This version of the form is not currently in use and is provided for reference only. Download this version of

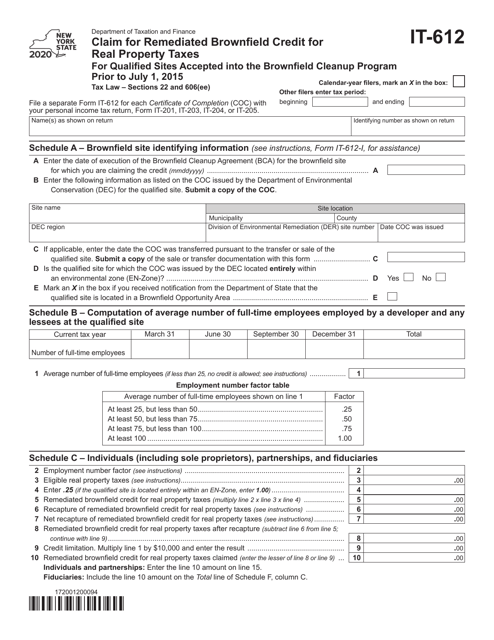

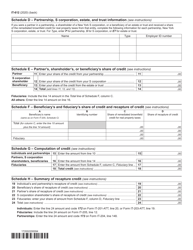

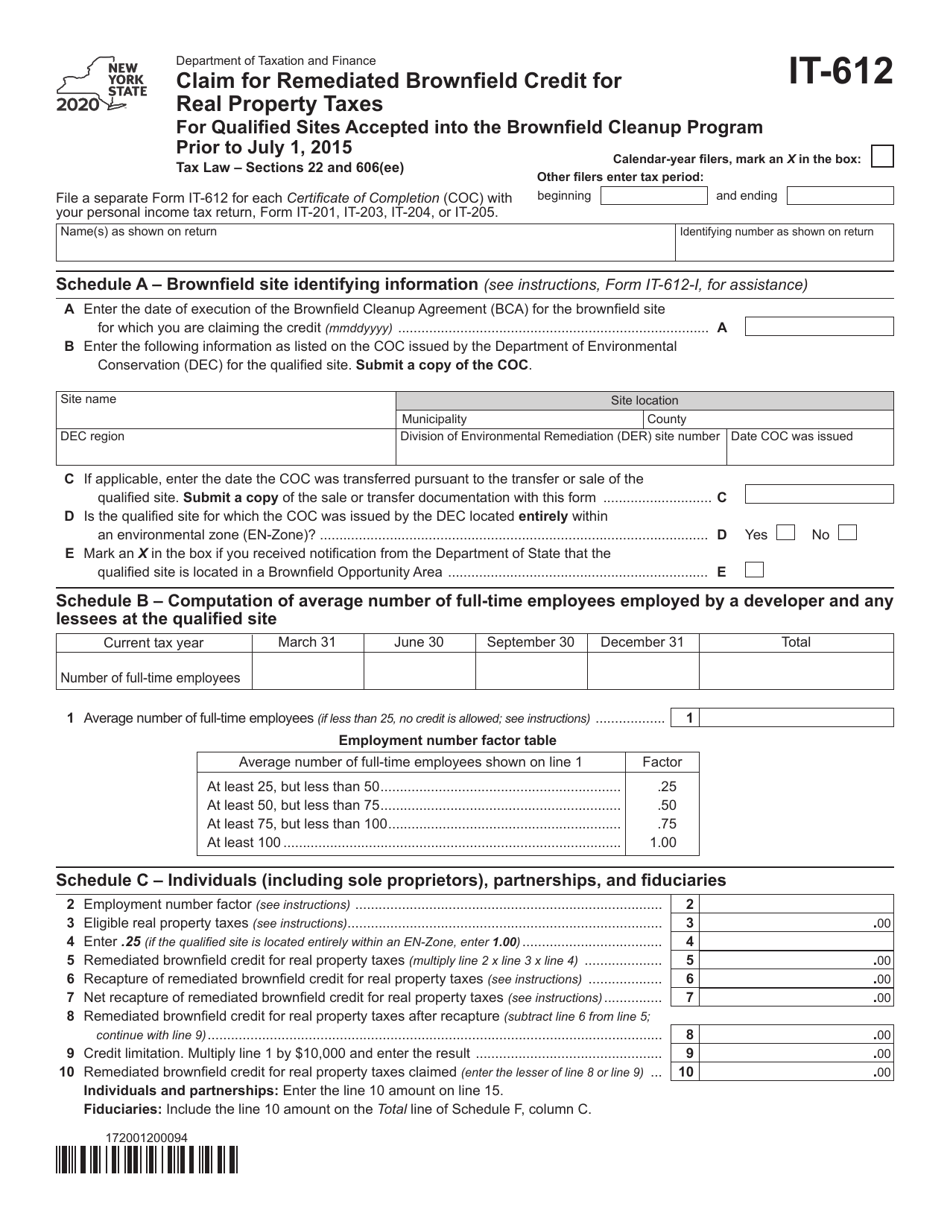

Form IT-612

for the current year.

Form IT-612 Claim for Remediated Brownfield Credit for Real Property Taxes for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form IT-612?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-612?

A: Form IT-612 is a form used to claim the Remediated Brownfield Credit for Real Property Taxes for Qualified Sites in New York.

Q: What is the Remediated Brownfield Credit?

A: The Remediated Brownfield Credit is a tax credit available to individuals or businesses that have successfully remediated contaminated properties in New York.

Q: Who can claim the Remediated Brownfield Credit?

A: Individuals or businesses who have enrolled their contaminated properties in the Brownfield Cleanup Program prior to July 1, 2015, can claim this credit.

Q: What is the purpose of the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program aims to encourage the cleanup and redevelopment of contaminated properties in New York.

Q: What expenses are eligible for the Remediated Brownfield Credit?

A: Eligible expenses may include the costs of investigation, cleanup, and site preparation related to the remediation of a brownfield site.

Q: What is the deadline for filing Form IT-612?

A: Form IT-612 must be filed within three years from the due date of the return or the date the return was filed, whichever is later.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-612 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.