This version of the form is not currently in use and is provided for reference only. Download this version of

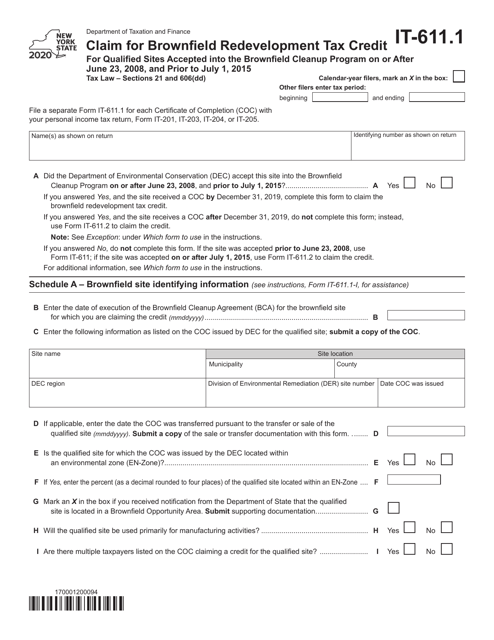

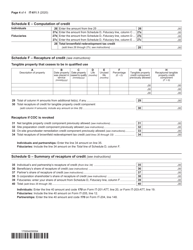

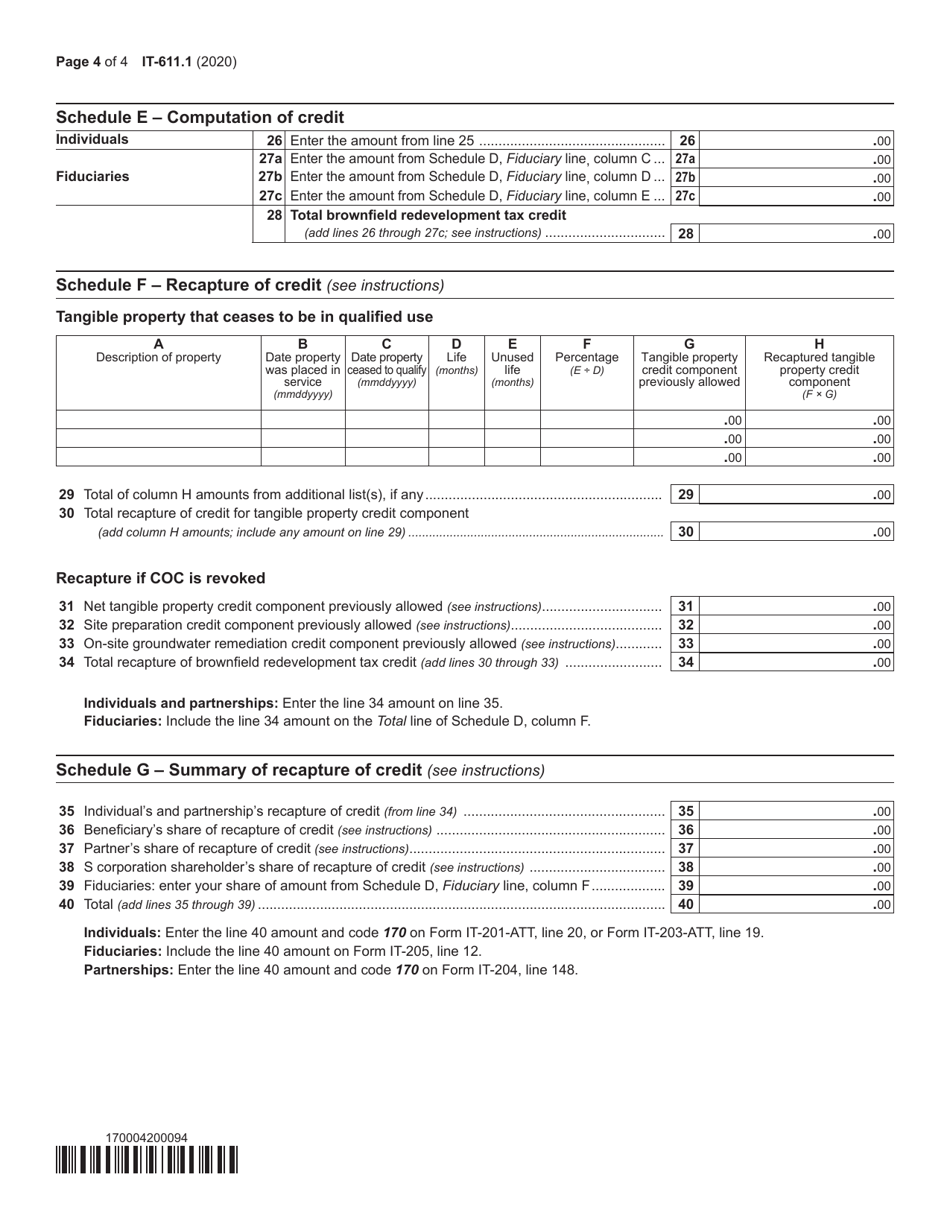

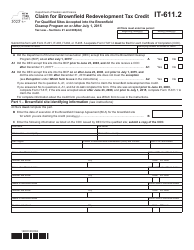

Form IT-611.1

for the current year.

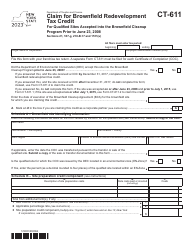

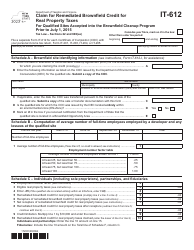

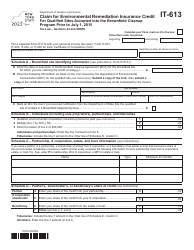

Form IT-611.1 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After June 23, 2008, and Prior to July 1, 2015 - New York

What Is Form IT-611.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-611.1?

A: Form IT-611.1 is a claim for Brownfield Redevelopment Tax Credit.

Q: What is the purpose of Form IT-611.1?

A: The purpose of Form IT-611.1 is to claim the Brownfield Redevelopment Tax Credit for qualified sites.

Q: Which sites are eligible for the Brownfield Redevelopment Tax Credit?

A: Sites accepted into the Brownfield Cleanup Program on or after June 23, 2008, and prior to July 1, 2015, are eligible.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York for the remediation and redevelopment of contaminated sites.

Q: When should Form IT-611.1 be filed?

A: Form IT-611.1 should be filed within three years from the date the certificate of completion is issued.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-611.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.