This version of the form is not currently in use and is provided for reference only. Download this version of

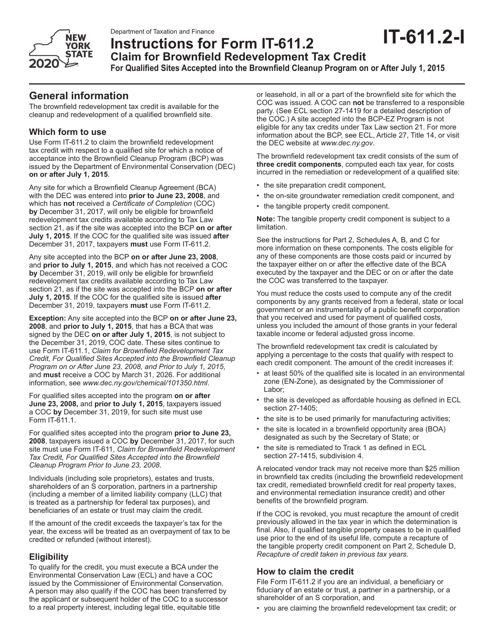

Instructions for Form IT-611.2

for the current year.

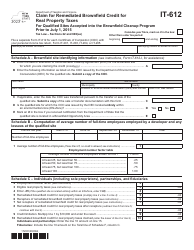

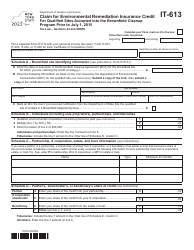

Instructions for Form IT-611.2 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 - New York

This document contains official instructions for Form IT-611.2 , Claim for Brownfield Cleanup Program on or After July 1, 2015 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-611.2 is available for download through this link.

FAQ

Q: What is Form IT-611.2?

A: Form IT-611.2 is a tax form used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a credit that provides financial incentives to encourage the cleanup and redevelopment of contaminated sites in New York.

Q: Who can claim the Brownfield Redevelopment Tax Credit?

A: Property owners, developers, and other eligible parties who have qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York can claim the tax credit.

Q: What is the purpose of the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is designed to facilitate the cleanup and redevelopment of contaminated sites in New York, promoting economic redevelopment and environmental improvement.

Q: When should Form IT-611.2 be filed?

A: Form IT-611.2 should be filed with the New York State Department of Taxation and Finance when claiming the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015.

Q: What documents are required to be attached to Form IT-611.2?

A: Various supporting documents are required to be attached to Form IT-611.2, including a copy of the Certificate of Completion issued by the New York State Department of Environmental Conservation.

Q: Is there a deadline for filing Form IT-611.2?

A: Yes, there is a deadline for filing Form IT-611.2. The specific deadline can vary, so it is advised to check the instructions or consult with the New York State Department of Taxation and Finance.

Q: How much is the Brownfield Redevelopment Tax Credit?

A: The amount of the Brownfield Redevelopment Tax Credit can vary depending on various factors, such as the eligible costs incurred for the cleanup and redevelopment of the qualified site.

Q: Can the Brownfield Redevelopment Tax Credit be transferred or sold?

A: Yes, the Brownfield Redevelopment Tax Credit can be transferred or sold to other taxpayers, subject to certain conditions and restrictions.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.