This version of the form is not currently in use and is provided for reference only. Download this version of

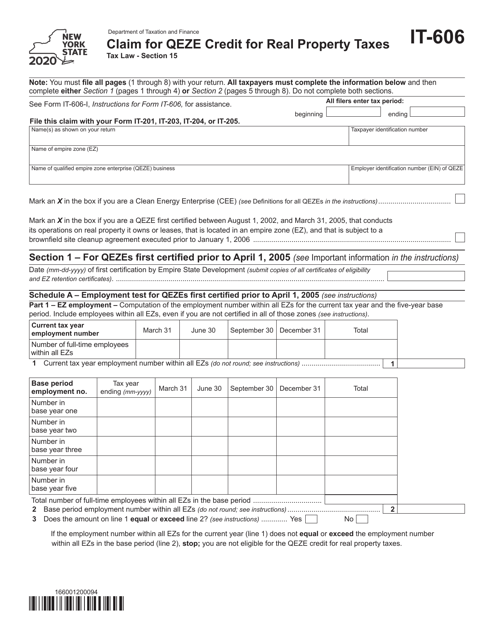

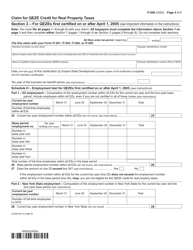

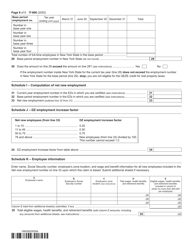

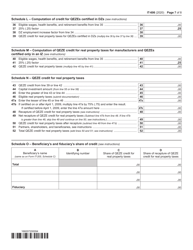

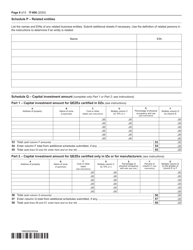

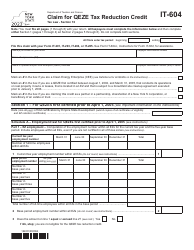

Form IT-606

for the current year.

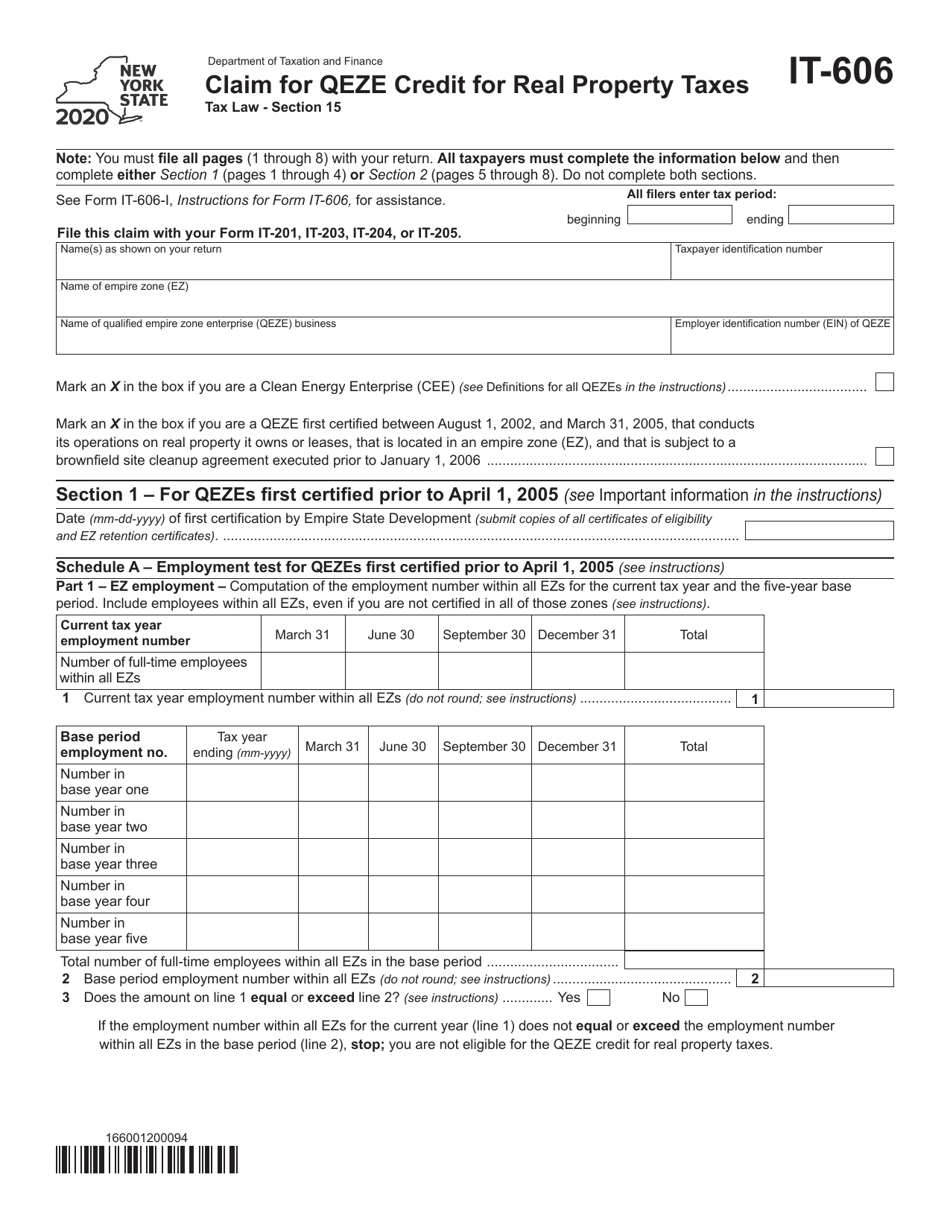

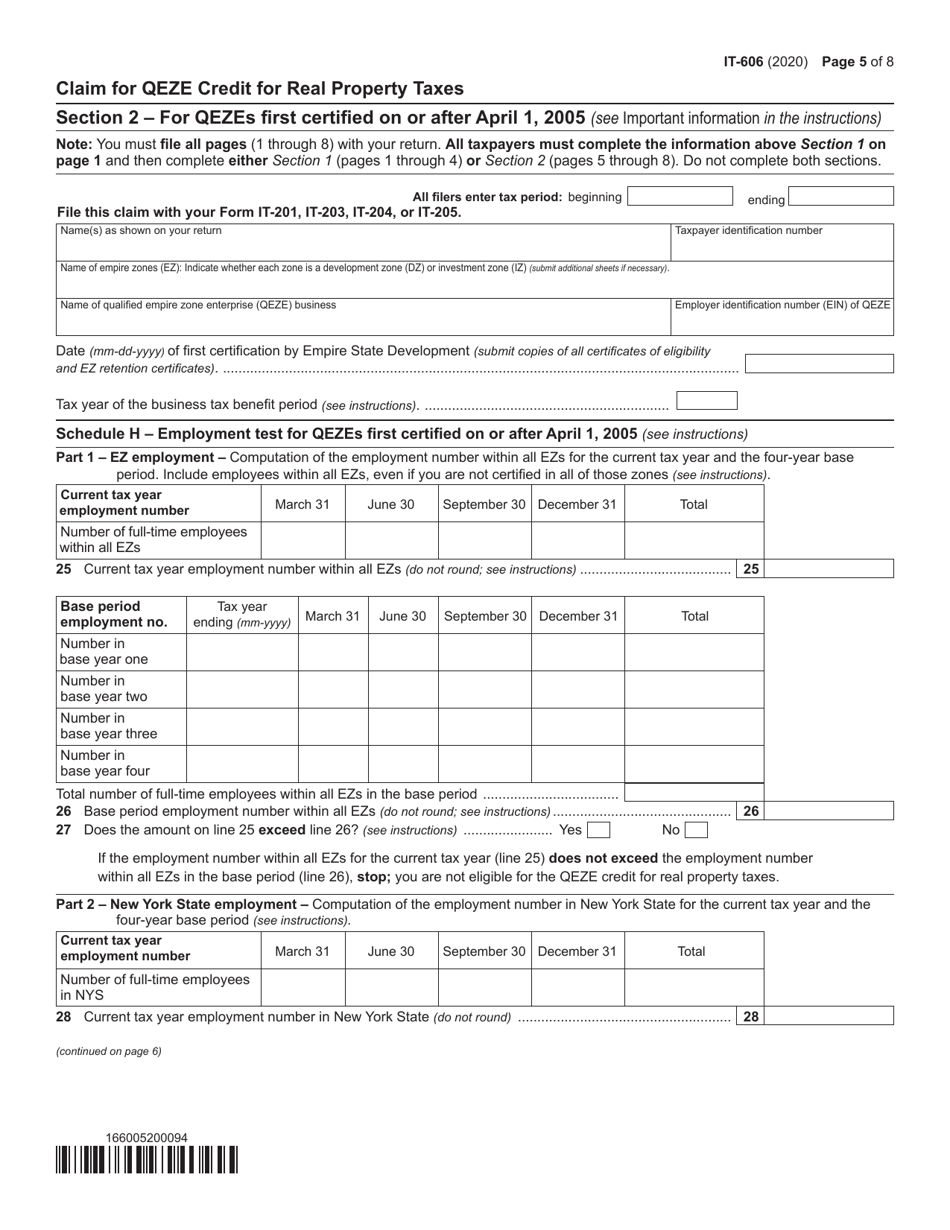

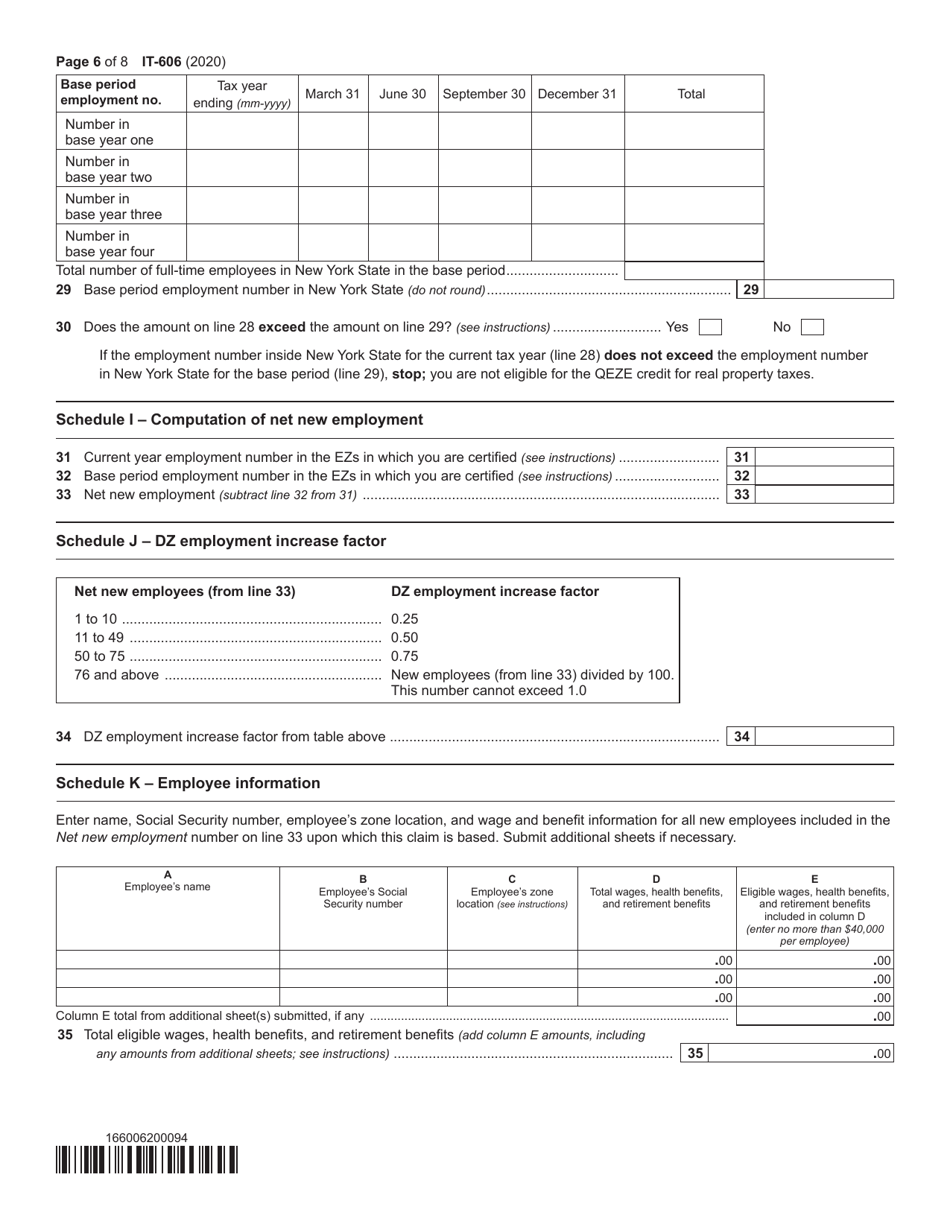

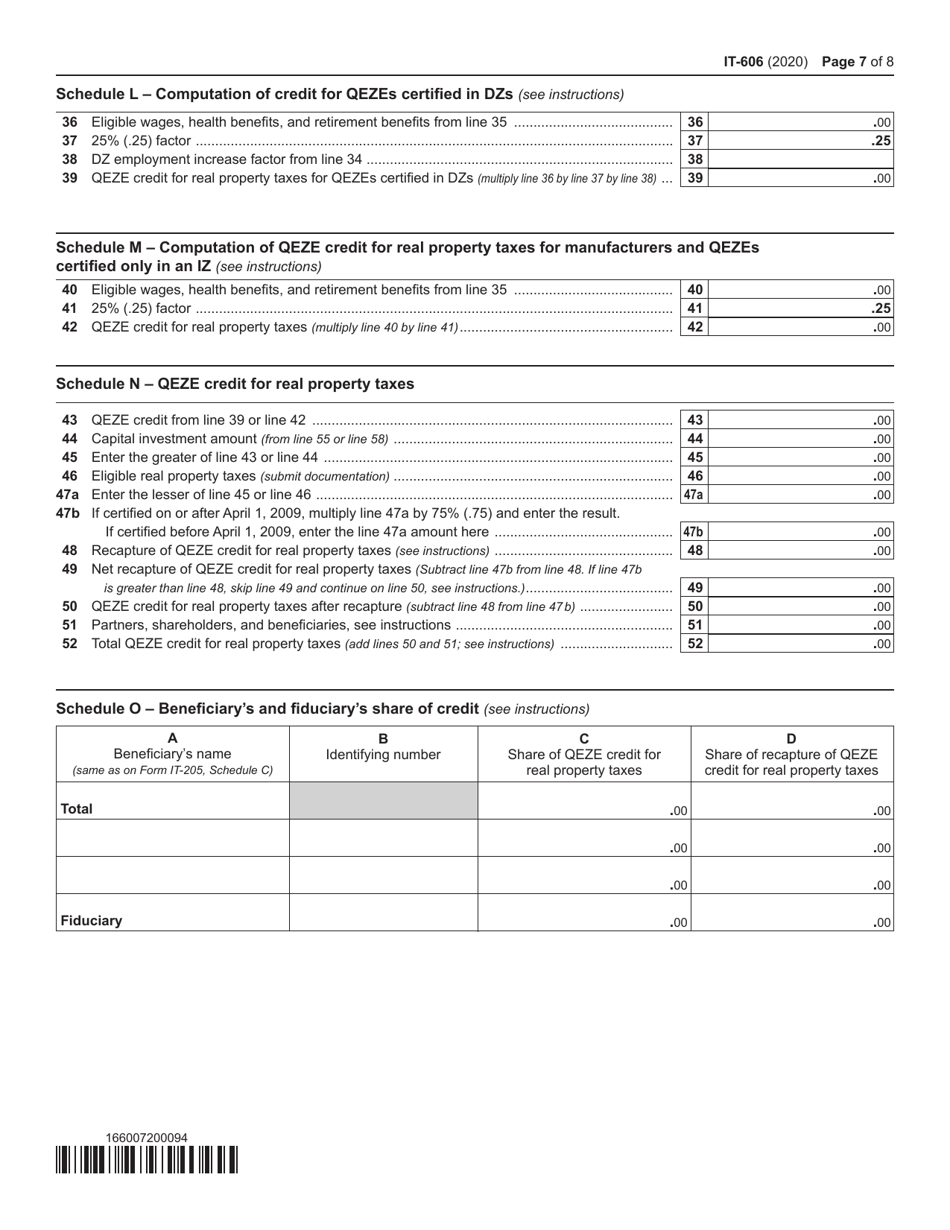

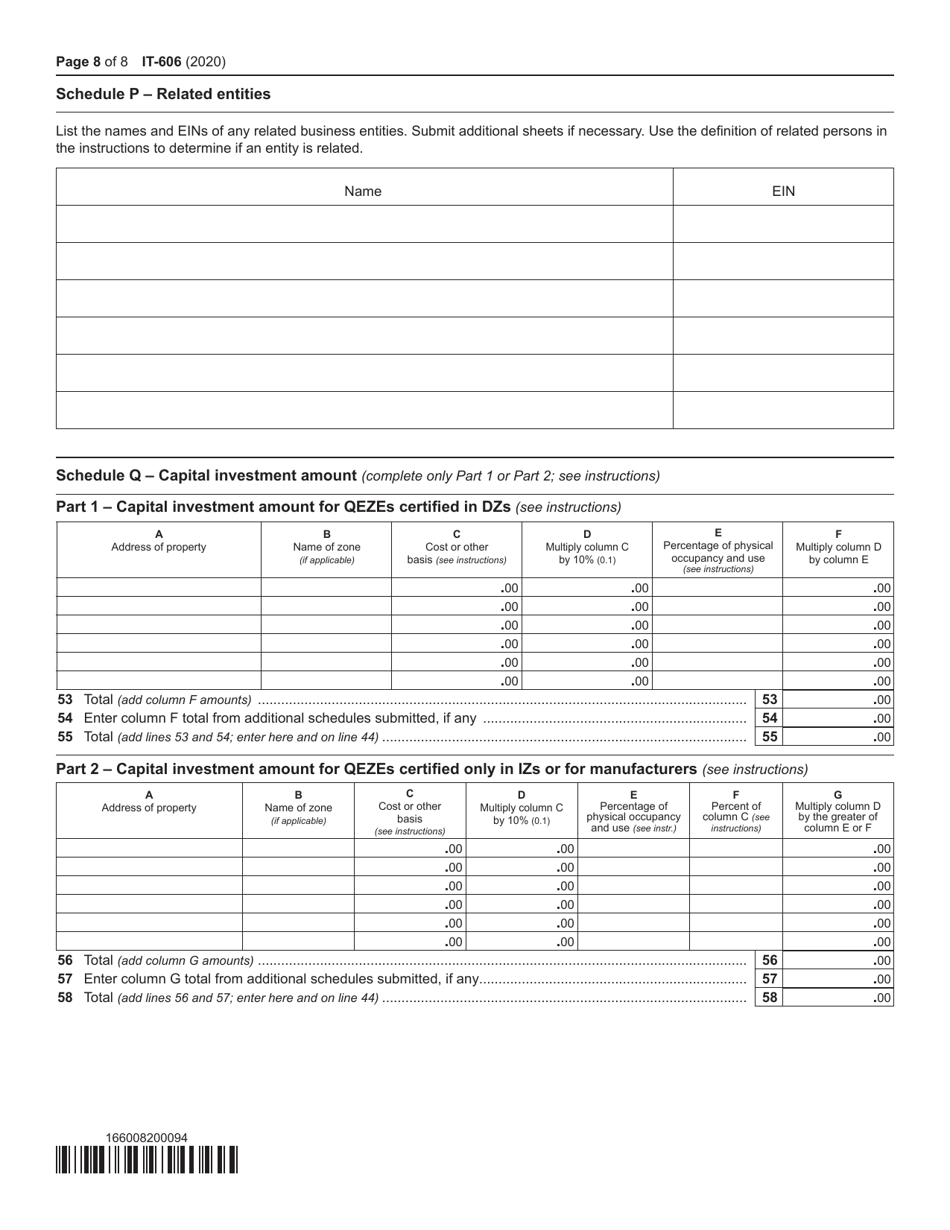

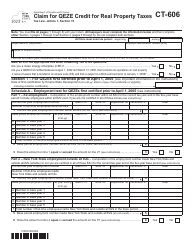

Form IT-606 Claim for Qeze Credit for Real Property Taxes - New York

What Is Form IT-606?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-606?

A: Form IT-606 is the Claim for QEZE (Qualified Empire Zone Enterprise) Credit for Real Property Taxes in New York.

Q: Who can use Form IT-606?

A: This form is used by eligible businesses in New York that are located in a Qualified Empire Zone.

Q: What is the QEZE Credit for Real Property Taxes?

A: The QEZE Credit for Real Property Taxes is a tax credit that eligible businesses can claim for qualifying real propertytaxes paid in a Qualified Empire Zone.

Q: How can I qualify for the QEZE Credit?

A: To qualify for the QEZE Credit, your business must be located in a Qualified Empire Zone and meet other eligibility requirements set by the New York State Department of Taxation and Finance.

Q: When should I file Form IT-606?

A: Form IT-606 should be filed annually with your New York State tax return by the due date.

Q: Can I claim the QEZE Credit if I rent a property in a Qualified Empire Zone?

A: No, the QEZE Credit is only available for qualifying real property owners and not for tenants.

Q: Is there a deadline for claiming the QEZE Credit?

A: Yes, you must claim the QEZE Credit within three years from the original due date of your tax return for the year in which the credit accrues.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-606 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.