This version of the form is not currently in use and is provided for reference only. Download this version of

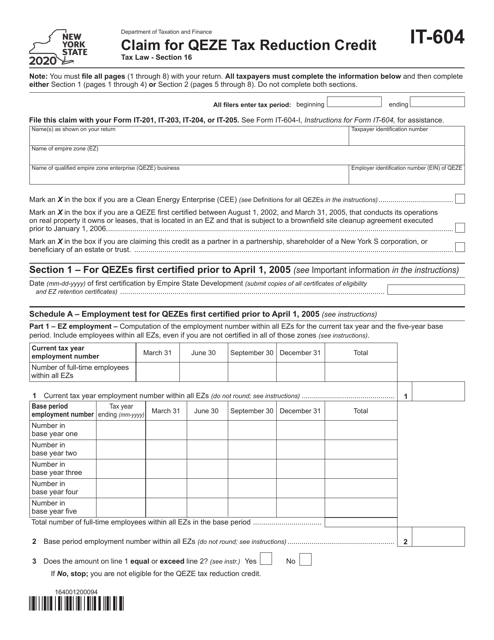

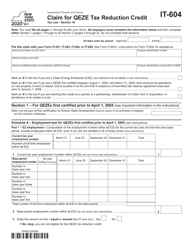

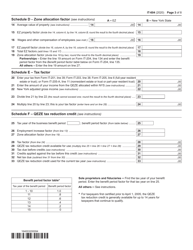

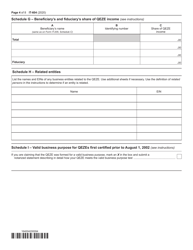

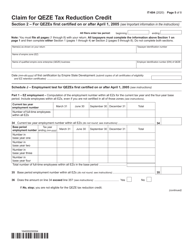

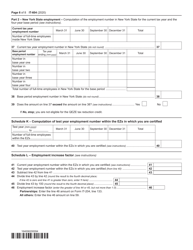

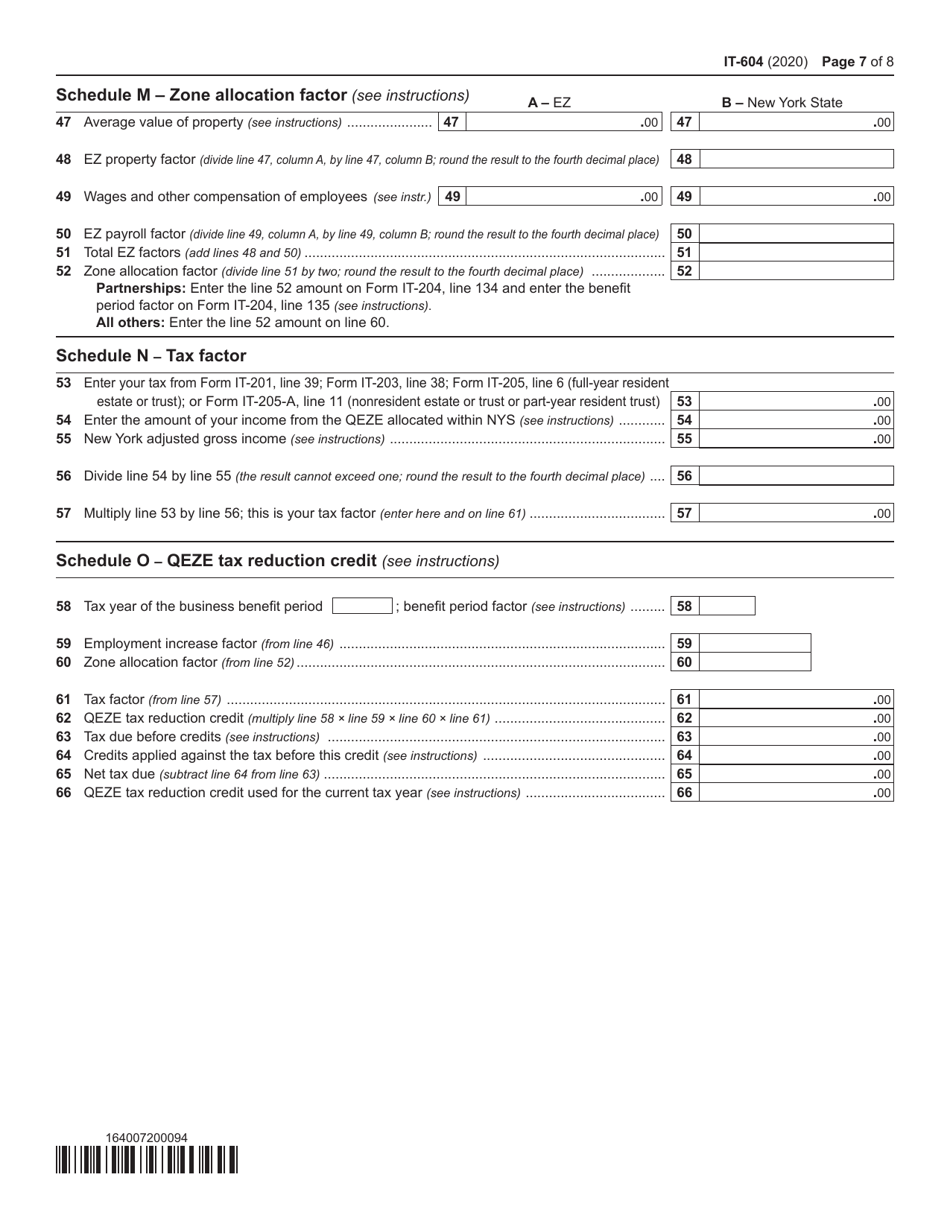

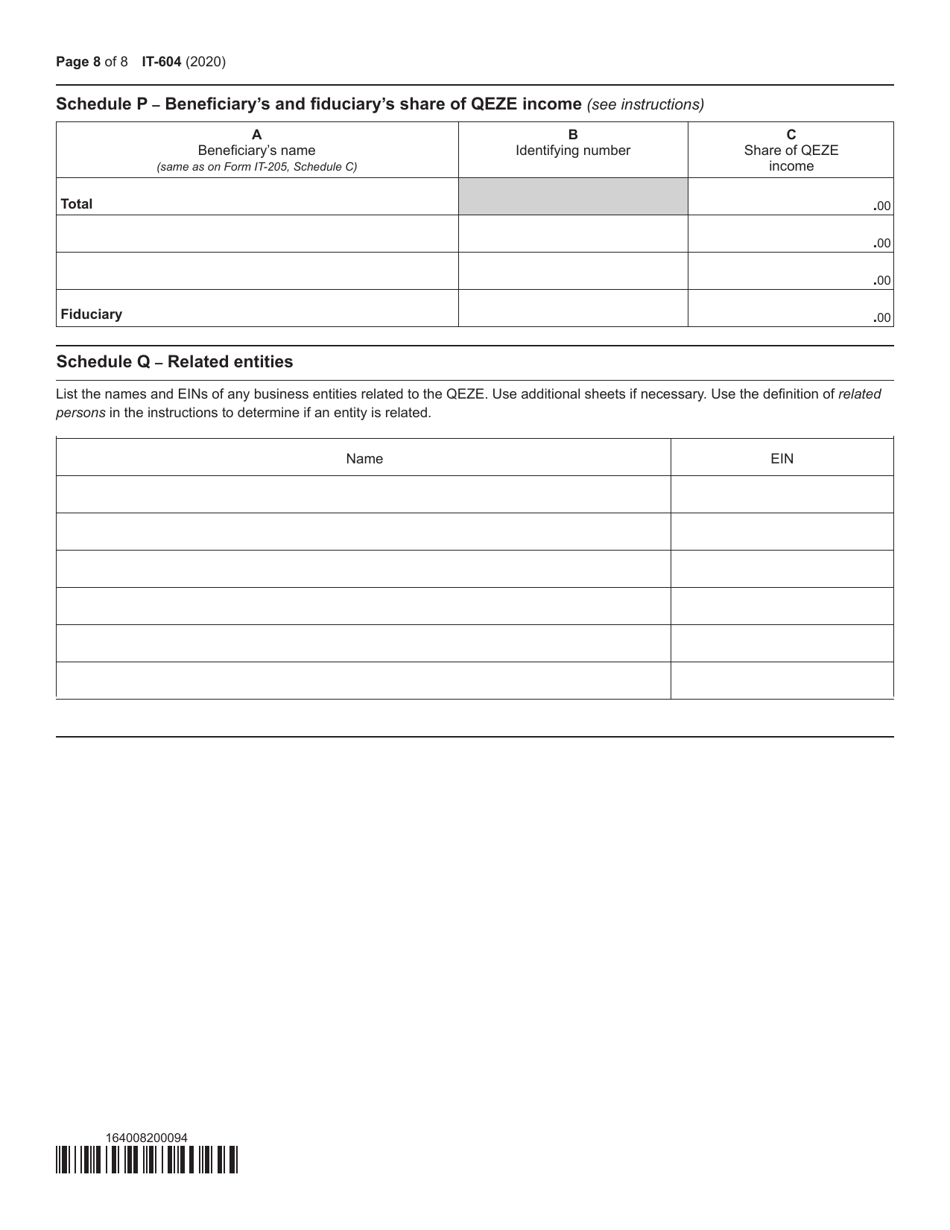

Form IT-604

for the current year.

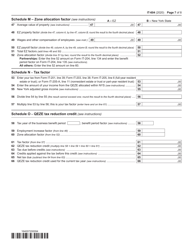

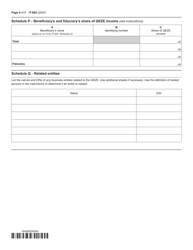

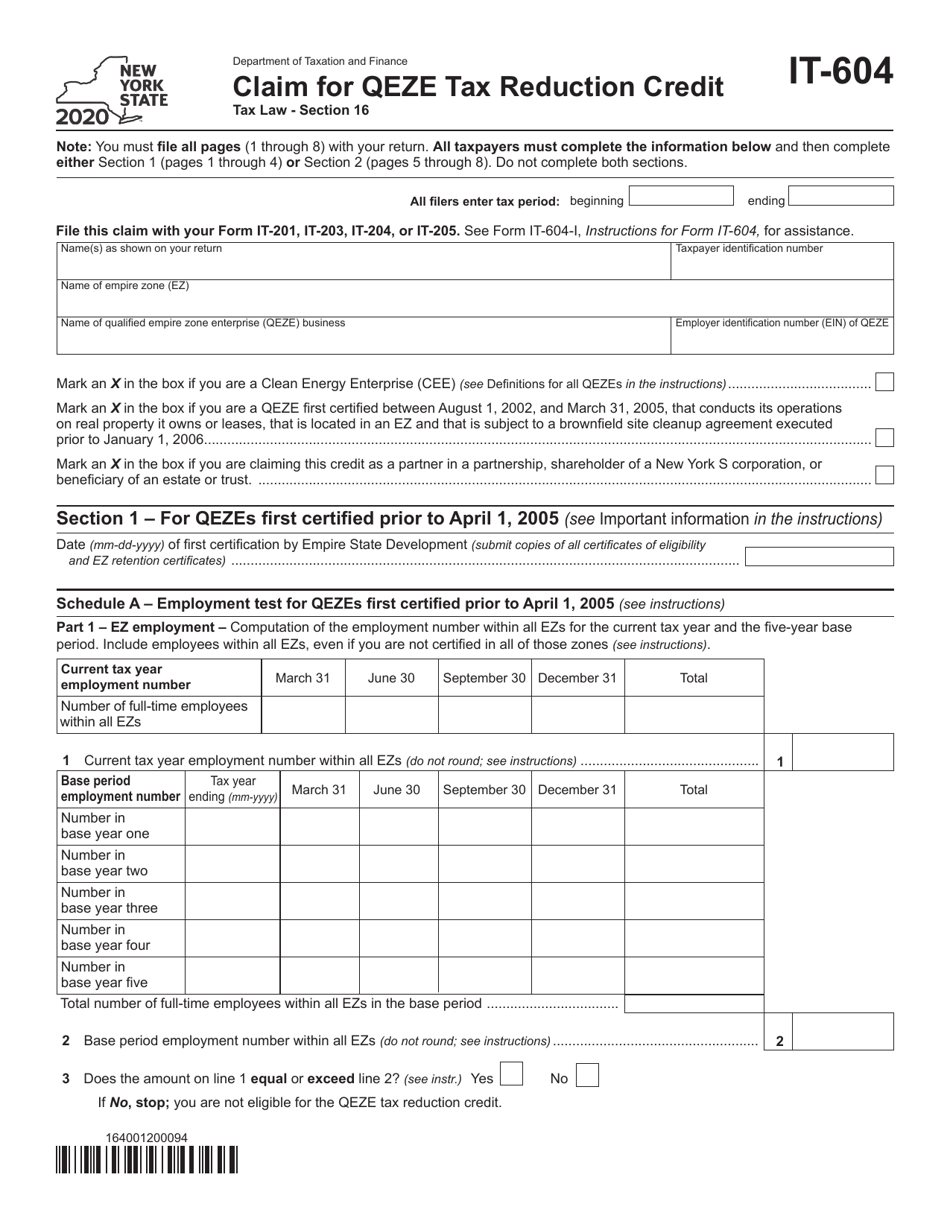

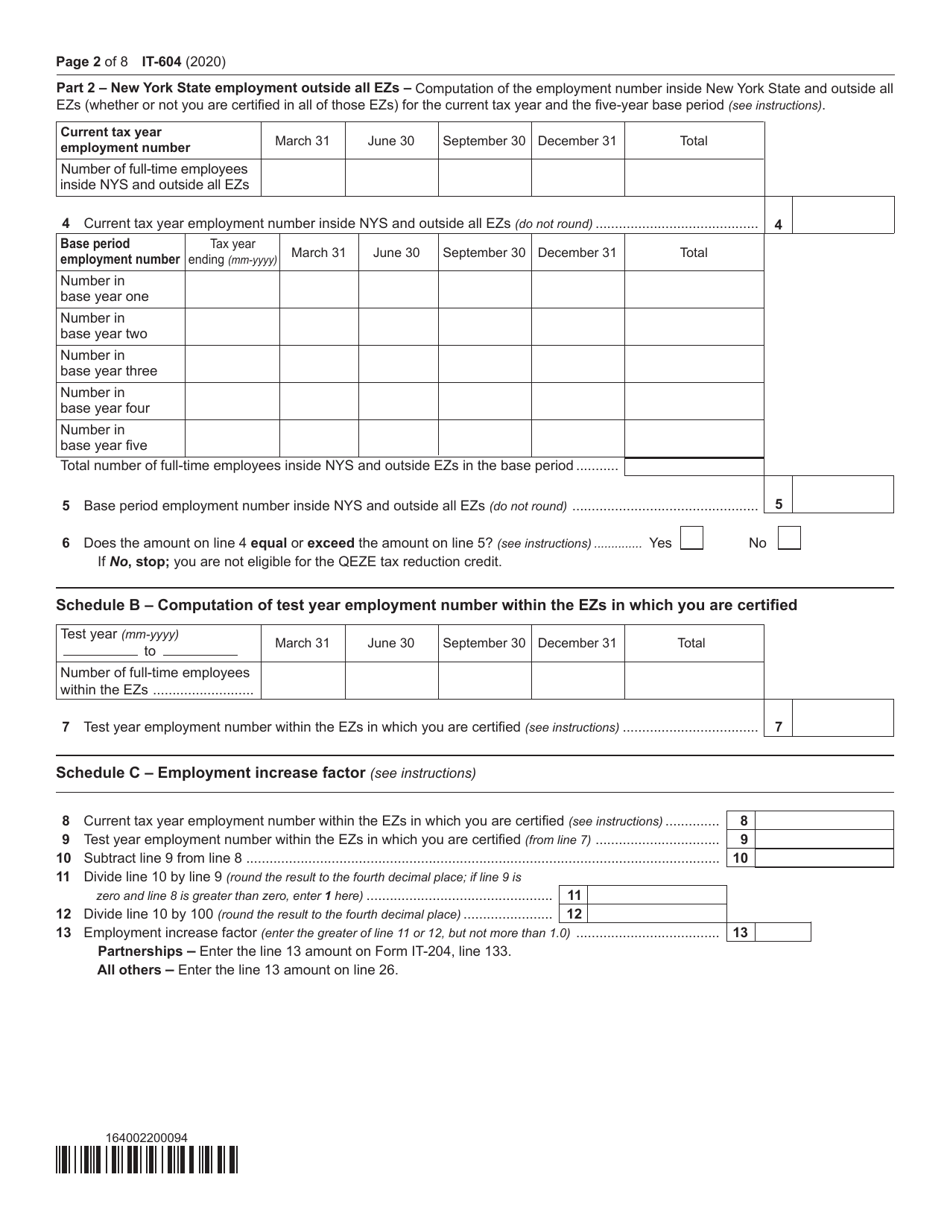

Form IT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form IT-604?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-604?

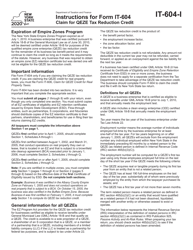

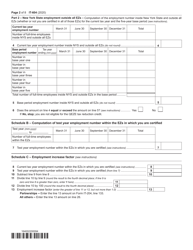

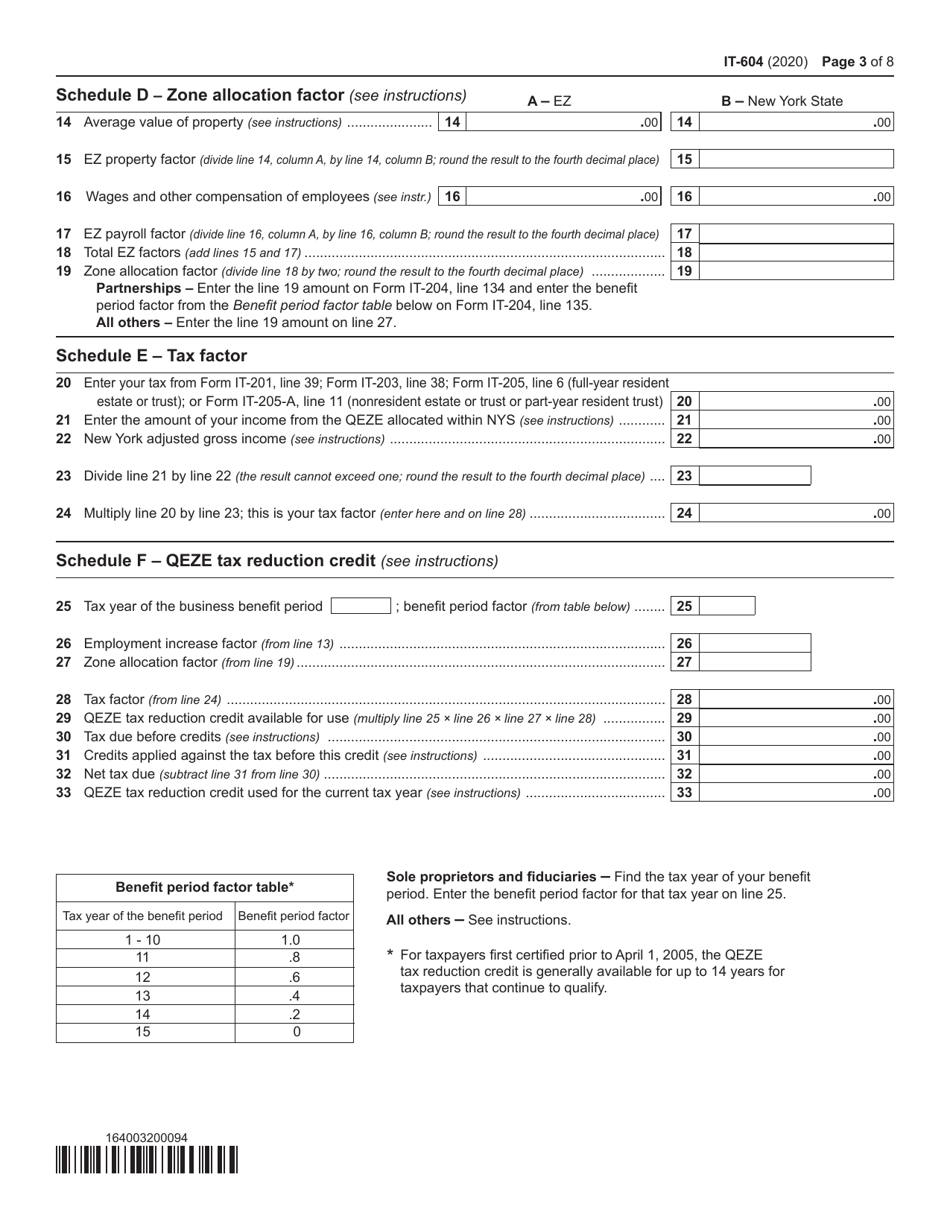

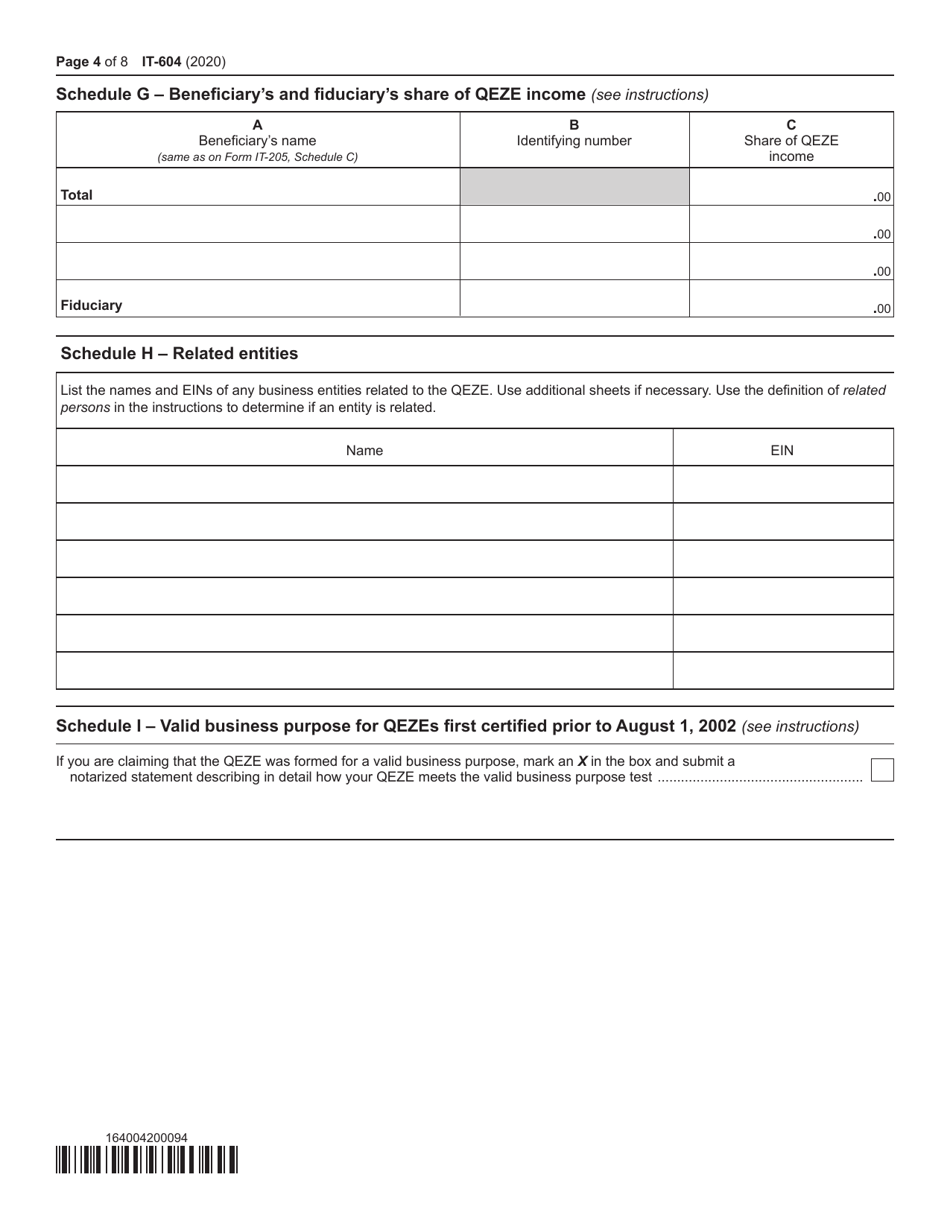

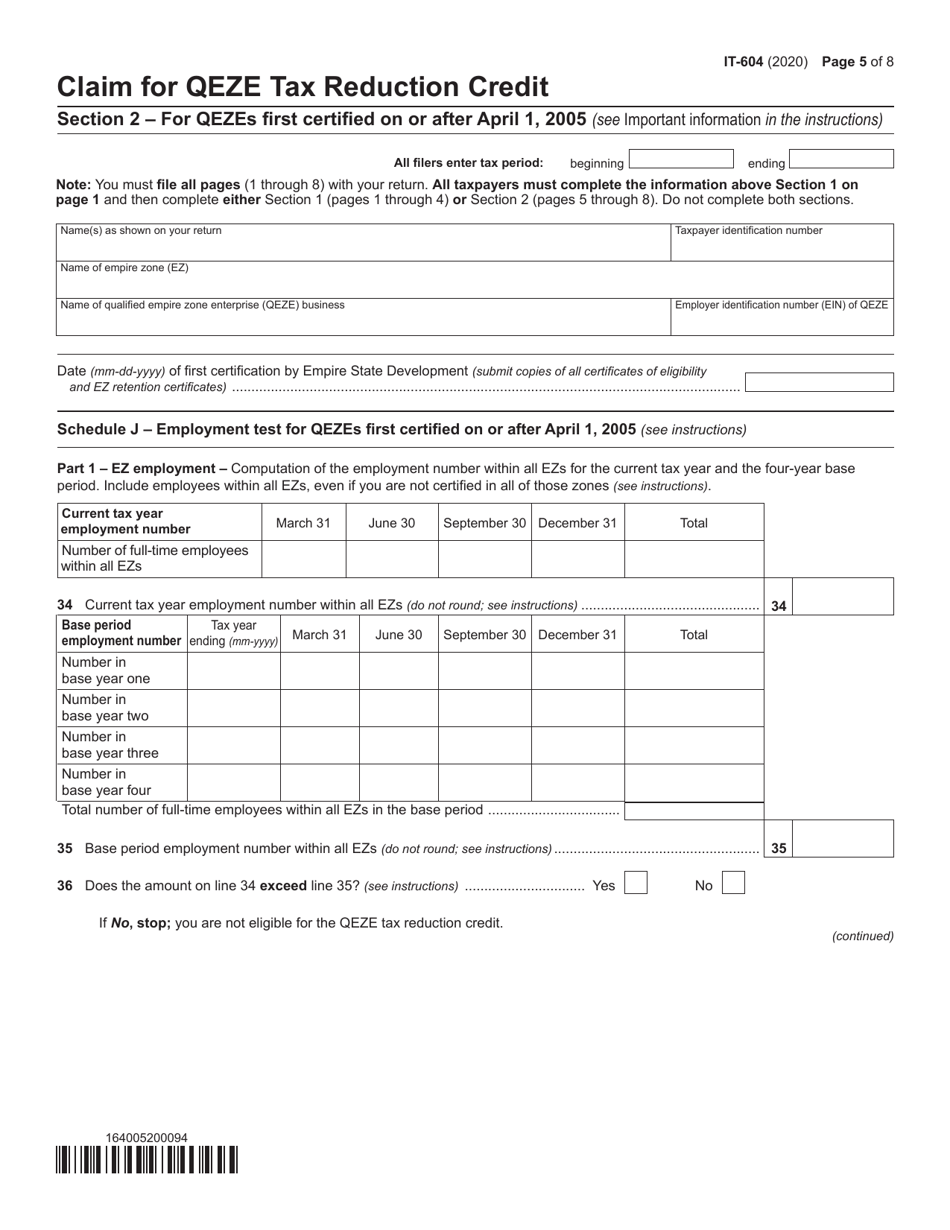

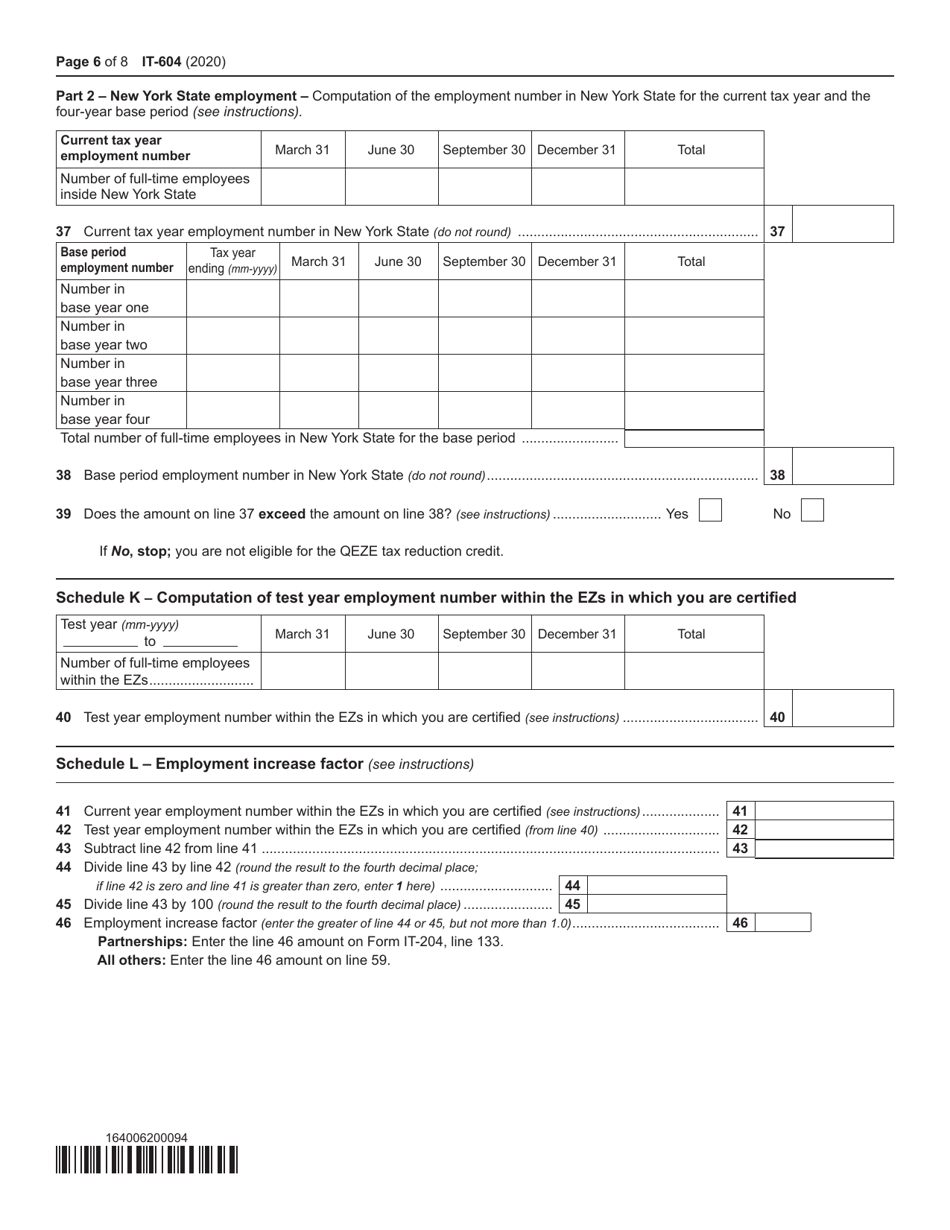

A: Form IT-604 is a tax form used in New York to claim the Qualified Empire Zone Enterprise (QEZE) Tax Reduction Credit.

Q: What is the Qualified Empire Zone Enterprise (QEZE) Tax Reduction Credit?

A: The QEZE Tax Reduction Credit is a tax credit available in New York to eligible businesses that operate within designated Empire Zones.

Q: Who is eligible to claim the QEZE Tax Reduction Credit?

A: Businesses that are certified as Qualified Empire Zone Enterprises (QEZE) and meet certain qualifications are eligible to claim the QEZE Tax Reduction Credit.

Q: What information do I need to complete Form IT-604?

A: You will need to provide information about your business, including its location within an Empire Zone and details about the qualified activities and investments.

Q: When is the deadline to file Form IT-604?

A: The deadline to file Form IT-604 is the same as the deadline for filing your New York State corporate or personal income tax return.

Q: Is there a limit to the amount of the QEZE Tax Reduction Credit that can be claimed?

A: Yes, there is a limit to the amount of the credit that can be claimed, depending on the size and type of business.

Q: Can the QEZE Tax Reduction Credit be carried forward or refunded?

A: Any unused portion of the QEZE Tax Reduction Credit may be carried forward for up to 15 years or refunded in certain circumstances.

Q: Are there any penalties for falsely claiming the QEZE Tax Reduction Credit?

A: Yes, there are penalties for falsely claiming the credit, including potential criminal charges and civil penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.