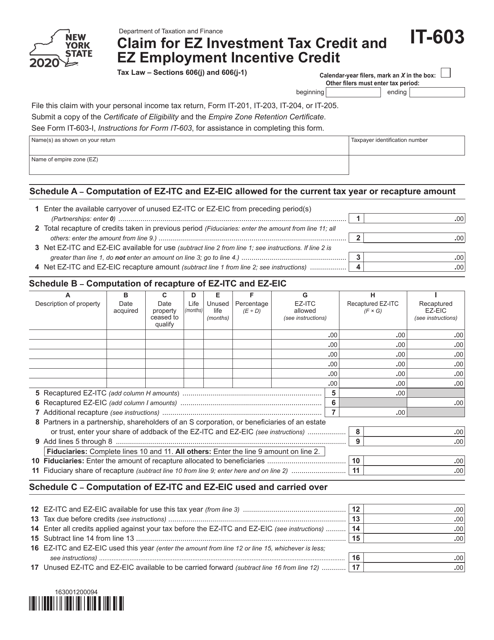

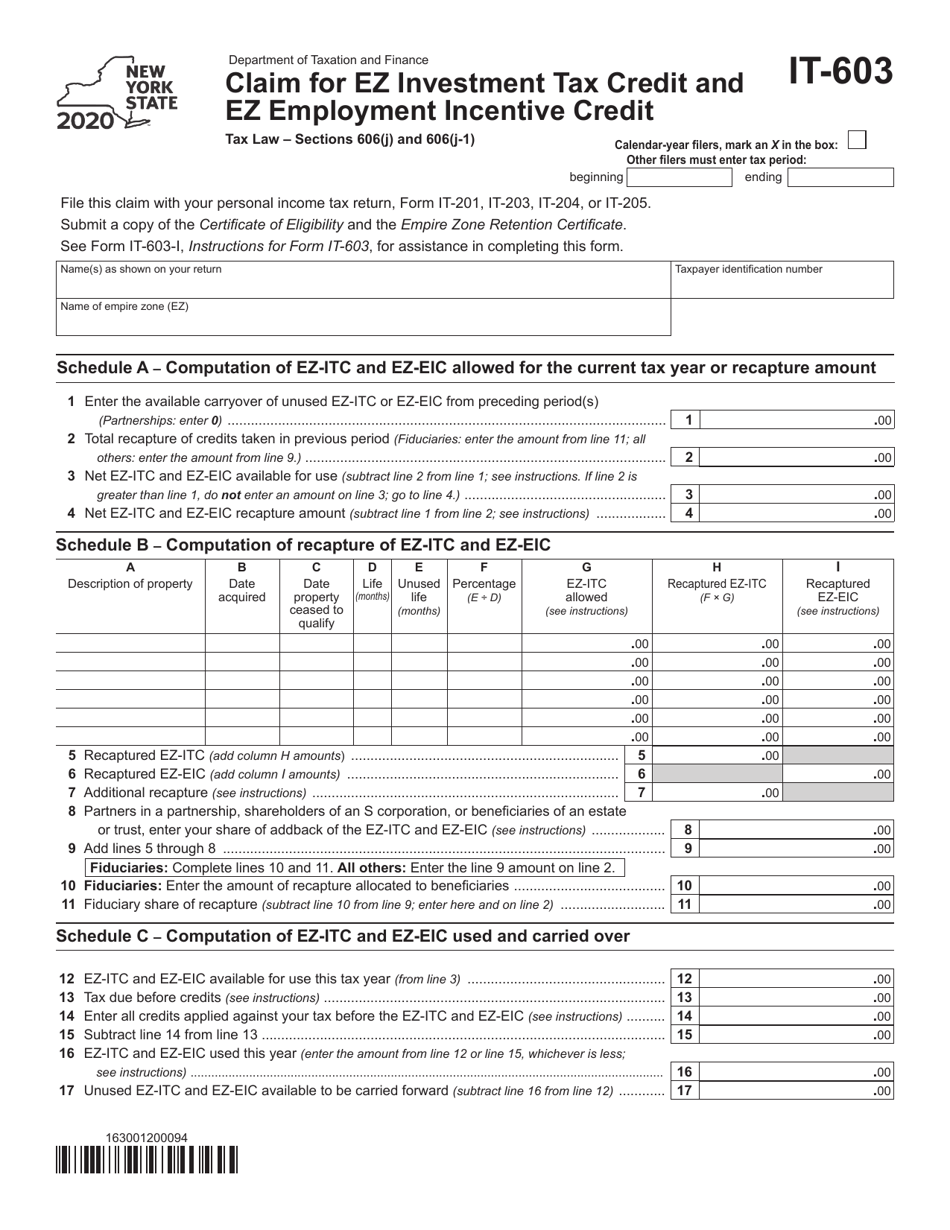

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-603

for the current year.

Form IT-603 Claim for Ez Investment Tax Credit and Ez Employment Incentive Credit - New York

What Is Form IT-603?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-603?

A: Form IT-603 is a claim form for the Ez Investment Tax Credit and Ez Employment Incentive Credit in New York.

Q: What is the Ez Investment Tax Credit?

A: The Ez Investment Tax Credit is a tax credit available to businesses that make qualified investments in certain areas of New York.

Q: What is the Ez Employment Incentive Credit?

A: The Ez Employment Incentive Credit is a tax credit available to businesses that create new jobs in certain areas of New York.

Q: Who is eligible to claim these credits?

A: Businesses that meet the requirements for the Ez Investment Tax Credit or the Ez Employment Incentive Credit in New York.

Q: How do I file Form IT-603?

A: Form IT-603 can be filed electronically or by mail. Instructions for filing are provided on the form.

Q: Are there any deadlines for filing this form?

A: The deadlines for filing Form IT-603 vary depending on the tax year. Check the form instructions for the specific deadlines.

Q: What documentation is required to support the claim?

A: Documentation such as investment or job creation records may be required to support the claim. Check the form instructions for the specific requirements.

Q: Can I claim both credits on the same form?

A: Yes, you can claim both the Ez Investment Tax Credit and the Ez Employment Incentive Credit on the same Form IT-603.

Q: Are there any limitations on the amount of credit that can be claimed?

A: Yes, there are limitations on the amount of credit that can be claimed. Refer to the form instructions for the specific limitations.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-603 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.