This version of the form is not currently in use and is provided for reference only. Download this version of

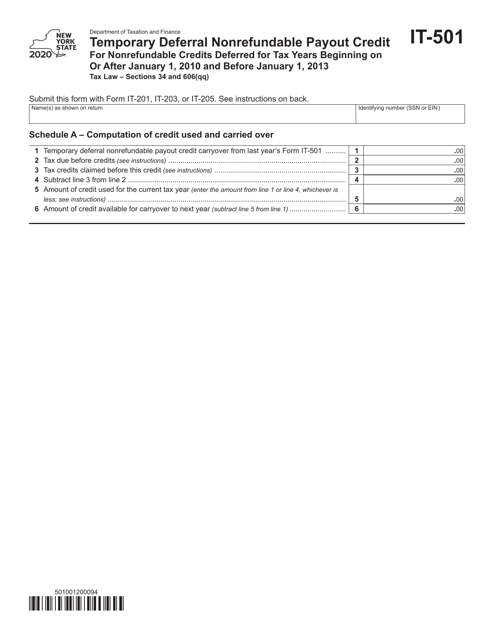

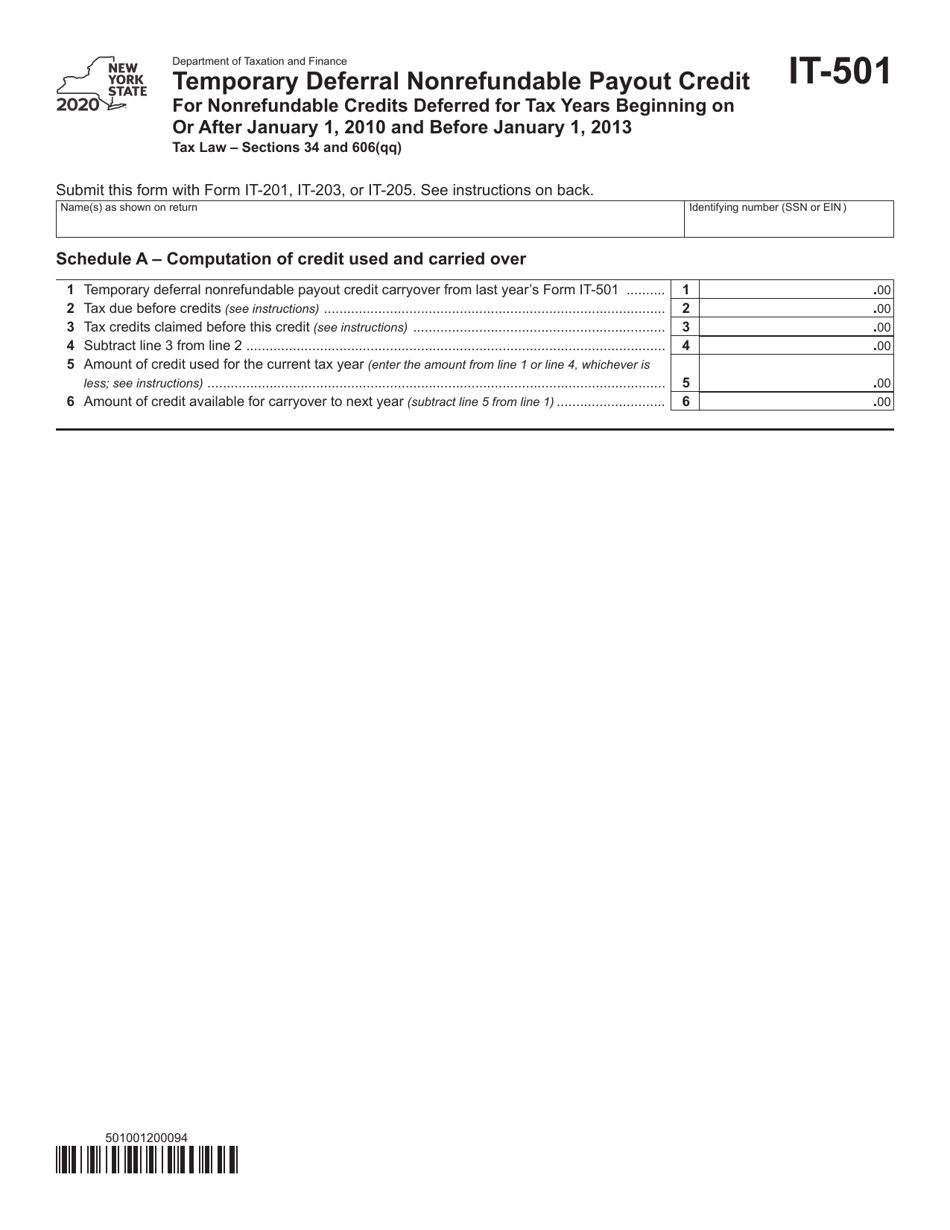

Form IT-501

for the current year.

Form IT-501 Temporary Deferral Nonrefundable Payout Credit - New York

What Is Form IT-501?

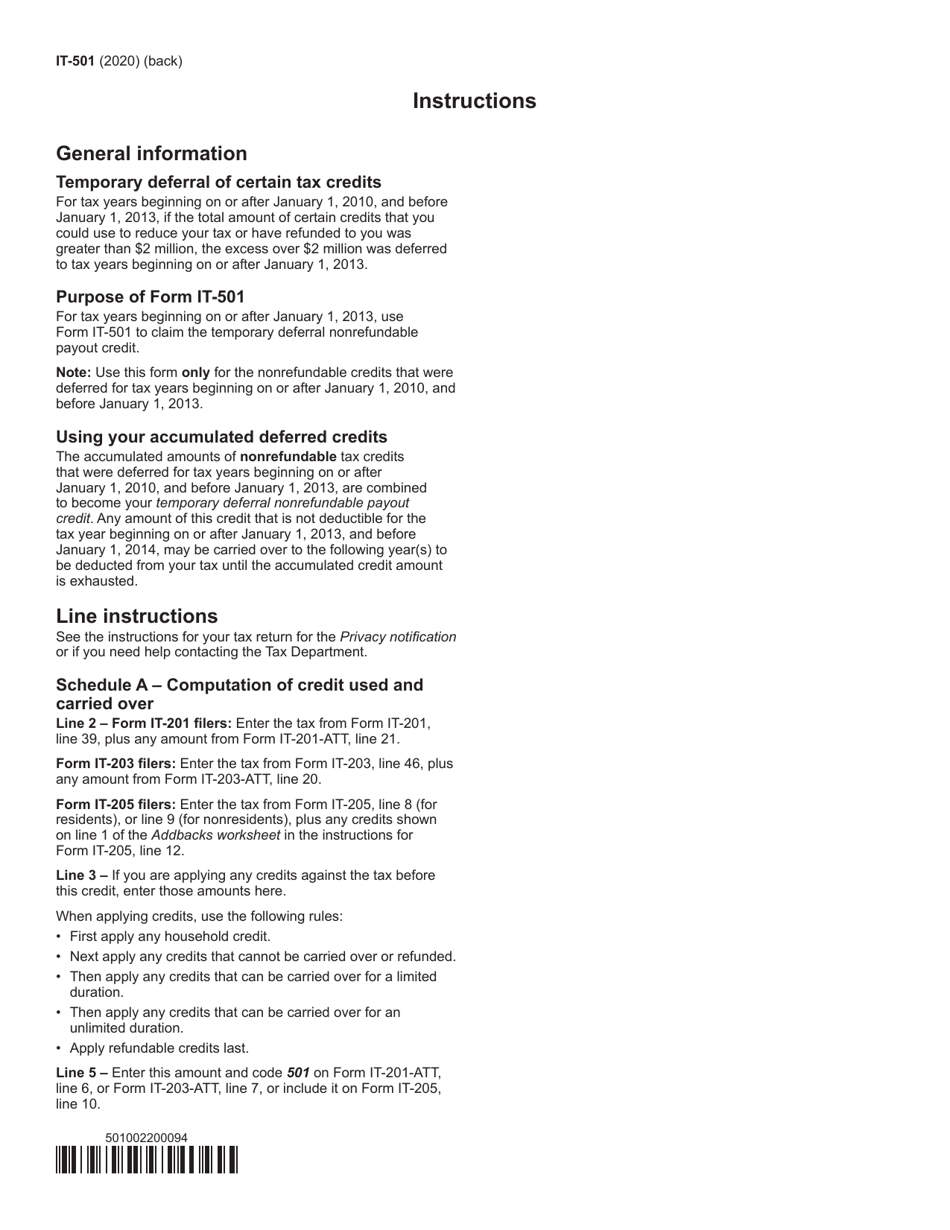

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-501?

A: Form IT-501 is a tax form used in New York to claim the Temporary Deferral Nonrefundable Payout Credit.

Q: What is the Temporary Deferral Nonrefundable Payout Credit?

A: The Temporary Deferral Nonrefundable Payout Credit is a tax credit in New York that allows for a deferral of certain income subject to a nonrefundable payout.

Q: Who is eligible to claim the credit?

A: Individuals who received income subject to a nonrefundable payout and meet certain criteria are eligible to claim the Temporary Deferral Nonrefundable Payout Credit.

Q: Why would someone need to use Form IT-501?

A: Form IT-501 is used to report and claim the Temporary Deferral Nonrefundable Payout Credit in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-501 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.