This version of the form is not currently in use and is provided for reference only. Download this version of

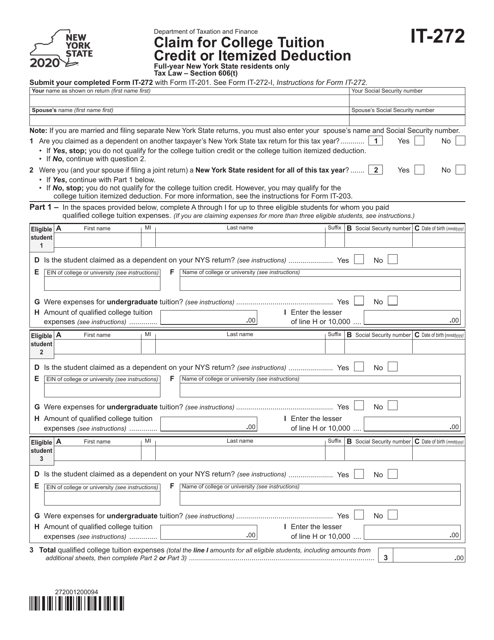

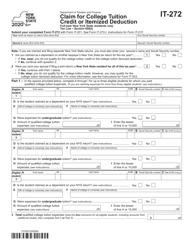

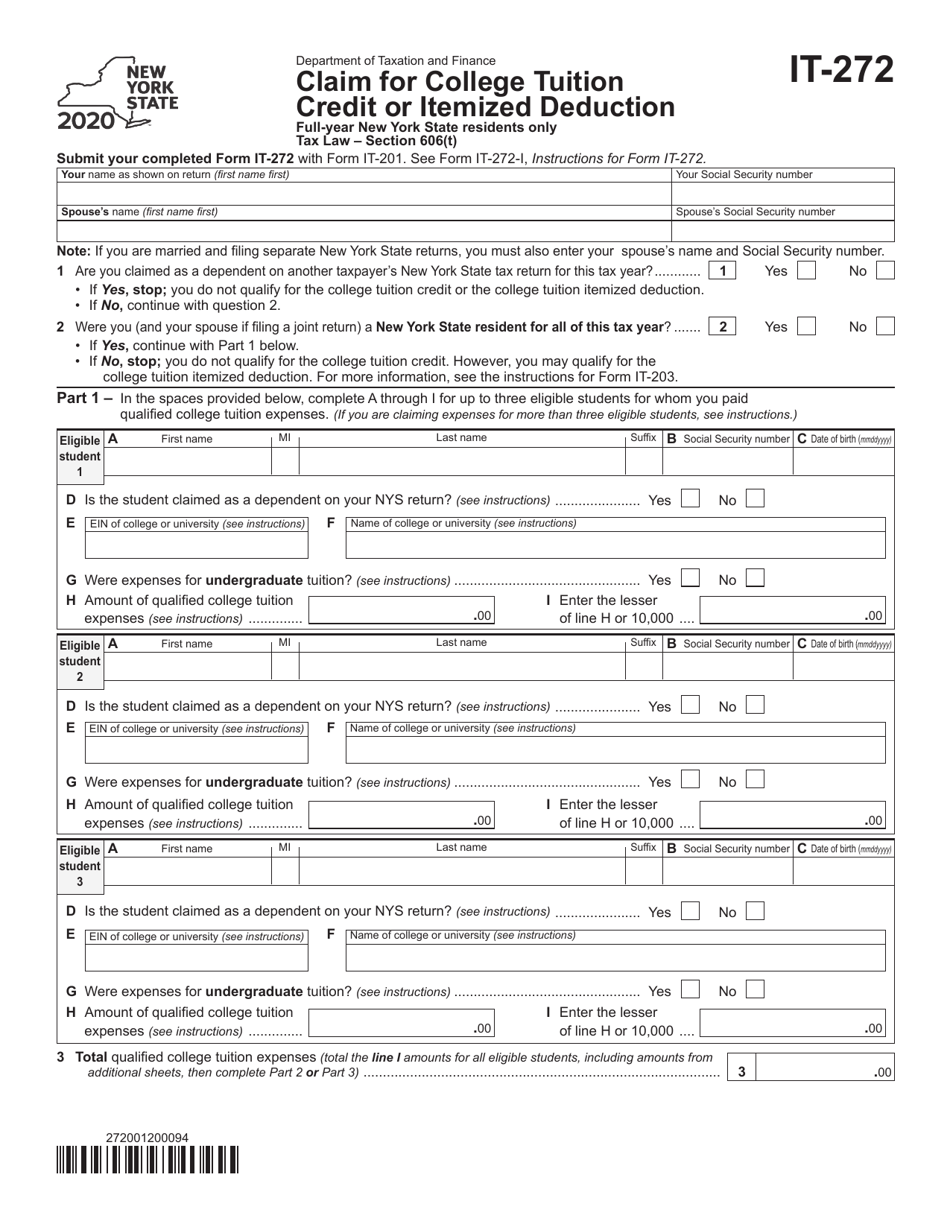

Form IT-272

for the current year.

Form IT-272 Claim for College Tuition Credit or Itemized Deduction - New York

What Is Form IT-272?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-272?

A: Form IT-272 is a tax form used in New York to claim the College Tuition Credit or Itemized Deduction.

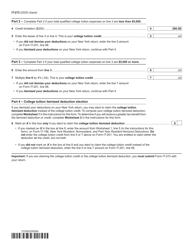

Q: What is the College Tuition Credit?

A: The College Tuition Credit is a tax credit that can be claimed by eligible New York residents who paid qualified college tuition expenses.

Q: What is the Itemized Deduction?

A: The Itemized Deduction is an alternative option to claim deductions for certain expenses, including college tuition, instead of taking the standard deduction.

Q: Who is eligible to claim the College Tuition Credit?

A: New York residents who paid eligible college tuition expenses for themselves, their spouse, or their dependents may be eligible to claim the College Tuition Credit.

Q: Who is eligible to claim the Itemized Deduction?

A: New York residents who choose to itemize their deductions and have eligible college tuition expenses may be eligible to claim the Itemized Deduction.

Q: What expenses can be claimed for the College Tuition Credit or Itemized Deduction?

A: Eligible expenses may include tuition, fees, and course-related expenses paid to an eligible educational institution.

Q: How do I claim the College Tuition Credit or Itemized Deduction?

A: To claim the College Tuition Credit or Itemized Deduction, you must complete, sign, and attach Form IT-272 to your New York state tax return.

Q: Are there any income limits for claiming these benefits?

A: Yes, there are income limits for both the College Tuition Credit and the Itemized Deduction. You should refer to the instructions for Form IT-272 or consult a tax professional for more information.

Q: When is the deadline to file Form IT-272?

A: The deadline to file Form IT-272 is generally the same as the deadline for filing your New York state tax return, which is usually April 15th. However, it's always best to check the current year's tax filing deadlines.

Q: Can I claim both the College Tuition Credit and the Itemized Deduction?

A: No, you can only claim either the College Tuition Credit or the Itemized Deduction for eligible college tuition expenses, not both.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-272 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.