This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-261

for the current year.

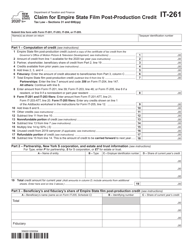

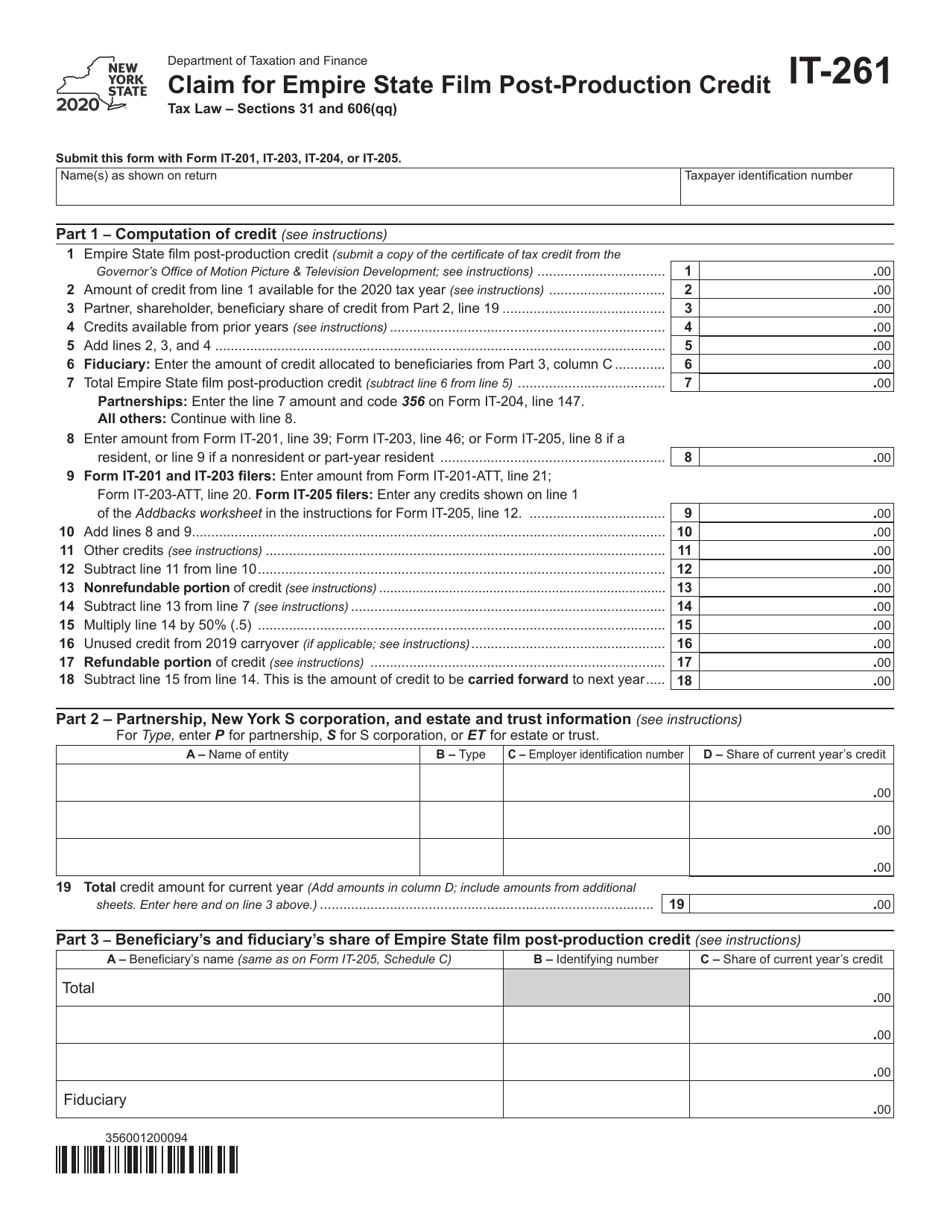

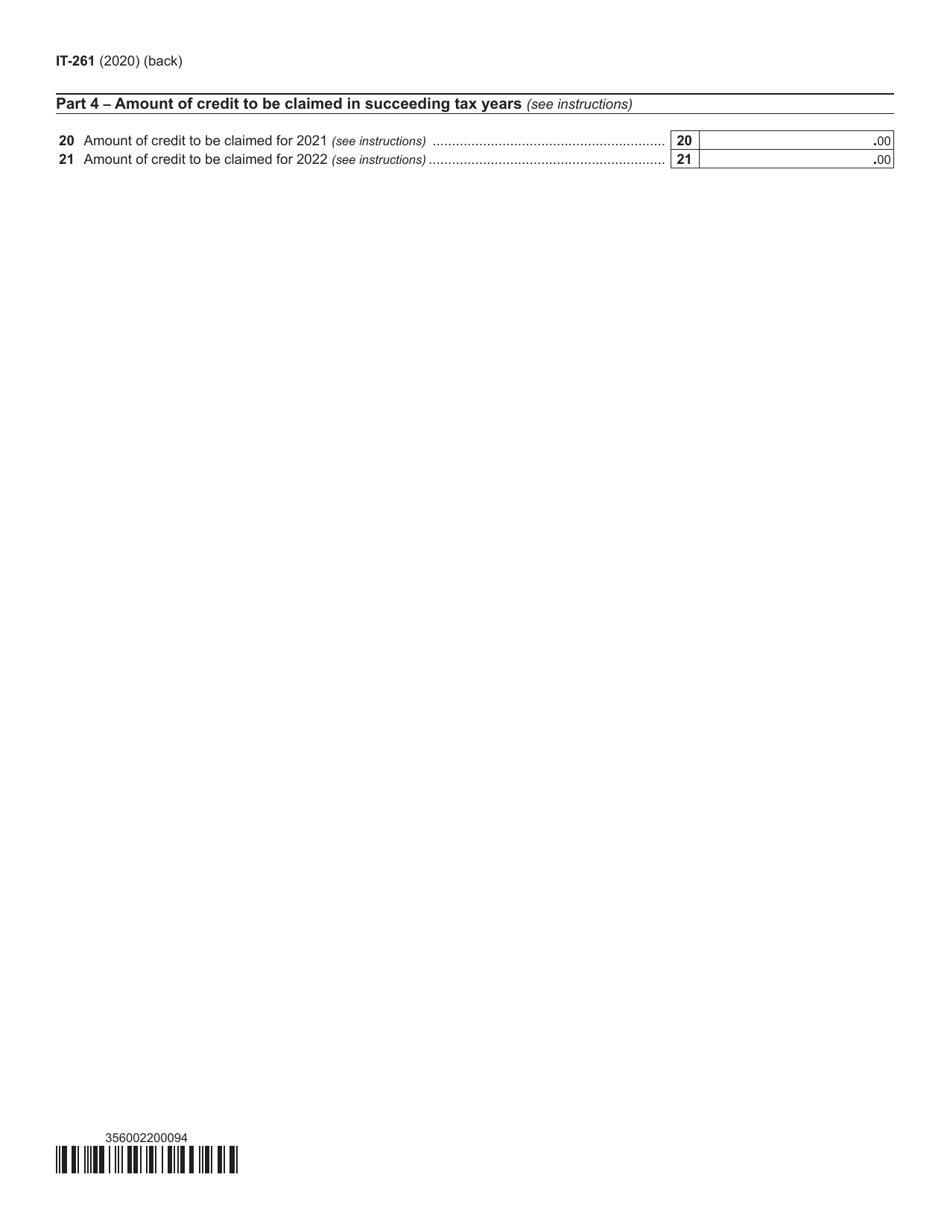

Form IT-261 Claim for Empire State Film Post-production Credit - New York

What Is Form IT-261?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-261?

A: Form IT-261 is a claim for Empire State Film Post-production Credit in the state of New York.

Q: Who can file Form IT-261?

A: Film production companies and post-production houses that have incurred qualifying post-production costs in New York can file Form IT-261.

Q: What is the purpose of Form IT-261?

A: The purpose of Form IT-261 is to claim the Empire State Film Post-production Credit, which provides a tax credit for qualifying post-production expenses incurred in the state of New York.

Q: What are qualifying post-production expenses?

A: Qualifying post-production expenses include costs related to the editing, sound mixing, special effects, and other post-production activities for eligible films produced in New York.

Q: How much is the Empire State Film Post-production Credit?

A: The credit amount is equal to 30% of the qualifying post-production expenses, with a maximum credit amount of $25 million per production.

Q: What are the eligibility requirements for the credit?

A: To be eligible for the Empire State Film Post-production Credit, the film production company or post-production house must meet certain criteria, including incurring at least $500,000 in qualifying post-production costs in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-261 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.