This version of the form is not currently in use and is provided for reference only. Download this version of

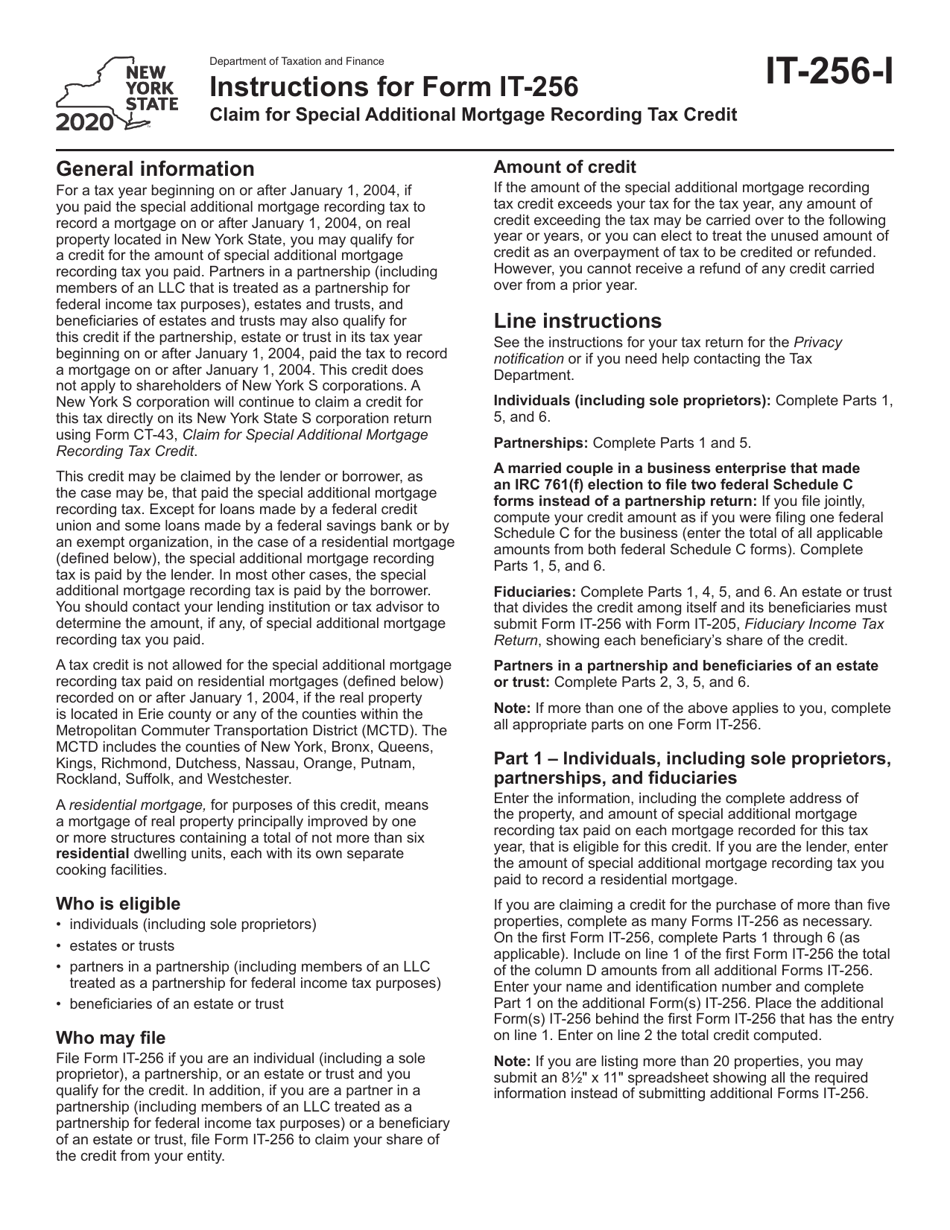

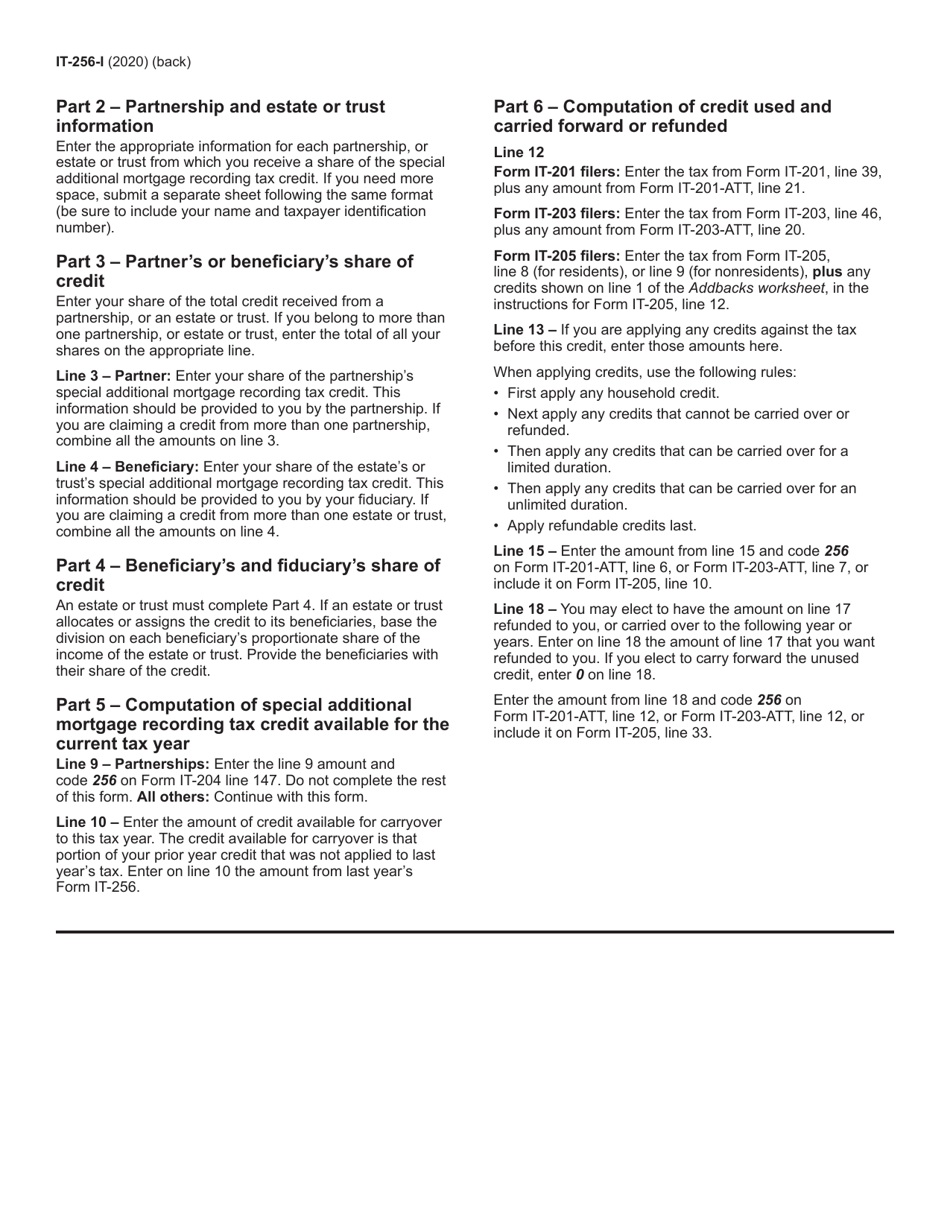

Instructions for Form IT-256

for the current year.

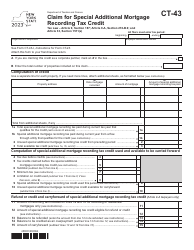

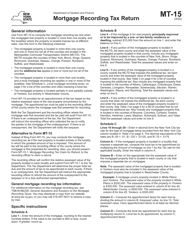

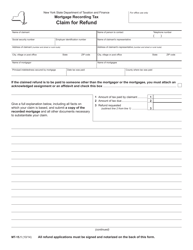

Instructions for Form IT-256 Claim for Special Additional Mortgage Recording Tax Credit - New York

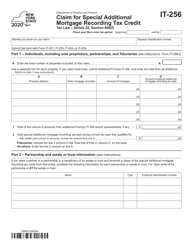

This document contains official instructions for Form IT-256 , Claim for Special Additional Mortgage Recording Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-256 is available for download through this link.

FAQ

Q: What is Form IT-256?

A: Form IT-256 is the official form used to claim the Special Additional Mortgage Recording Tax Credit in New York.

Q: What is the Special Additional Mortgage Recording Tax Credit?

A: The Special Additional Mortgage Recording Tax Credit is a tax credit available for certain homeowners in New York who meet certain criteria.

Q: Who is eligible to claim the Special Additional Mortgage Recording Tax Credit?

A: To be eligible, you must be a New York resident, have purchased a home in New York City on or after March 1, 2002, have paid the special additional mortgage recording tax, and meet certain income requirements.

Q: What are the income requirements for claiming the Special Additional Mortgage Recording Tax Credit?

A: For tax year 2021, the income limits are $75,000 or less for single filers, and $150,000 or less for married couples filing jointly.

Q: How much is the Special Additional Mortgage Recording Tax Credit?

A: The amount of the tax credit varies based on your eligible expenses, but it cannot exceed $350.

Q: How do I claim the Special Additional Mortgage Recording Tax Credit?

A: You must complete and submit Form IT-256 along with supporting documents to the New York State Department of Taxation and Finance.

Q: When is the deadline to file Form IT-256?

A: The deadline to file Form IT-256 is the same as the deadline for filing your New York State tax return, which is usually April 15th.

Q: Is the Special Additional Mortgage Recording Tax Credit refundable?

A: Yes, the tax credit is refundable, which means that if the amount of the credit exceeds your tax liability, you will receive a refund for the difference.

Q: Can I claim the Special Additional Mortgage Recording Tax Credit if I live outside of New York City?

A: No, the tax credit is only available for homeowners who have purchased a home in New York City.

Q: Are there any other requirements or restrictions for claiming the Special Additional Mortgage Recording Tax Credit?

A: Yes, there are additional requirements and restrictions. It is recommended to review the instructions and consult with a tax professional for specific guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.