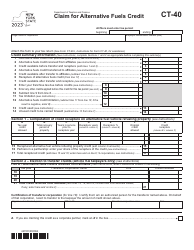

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-253

for the current year.

Form IT-253 Claim for Alternative Fuels Credit - New York

What Is Form IT-253?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

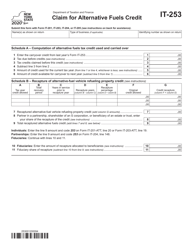

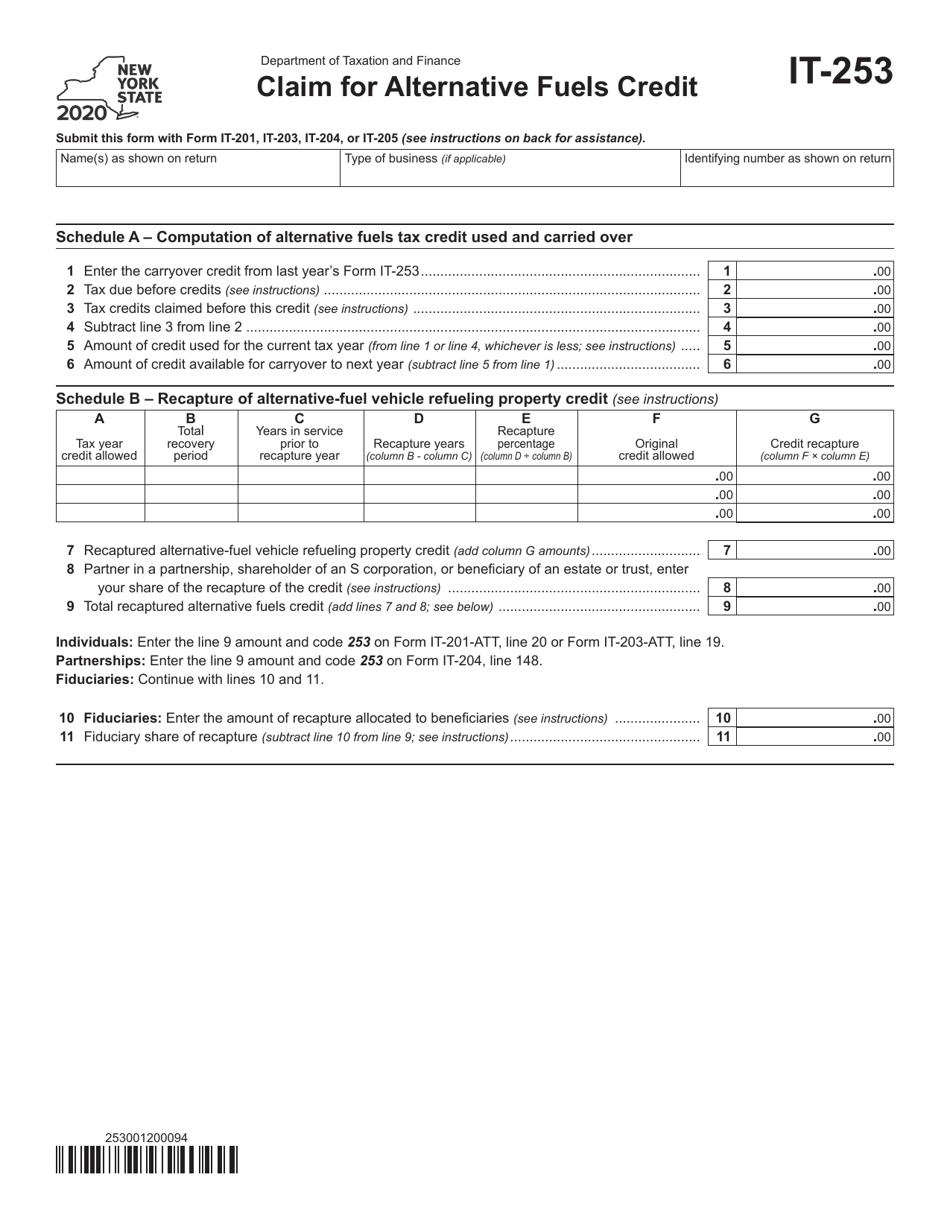

Q: What is IT-253?

A: IT-253 is a form used to claim the Alternative Fuels Credit in New York.

Q: What is the Alternative Fuels Credit?

A: The Alternative Fuels Credit is a tax credit available to businesses that use qualified alternative fuels in New York.

Q: Who is eligible to claim the Alternative Fuels Credit?

A: Businesses that use qualified alternative fuels in New York are eligible to claim the credit.

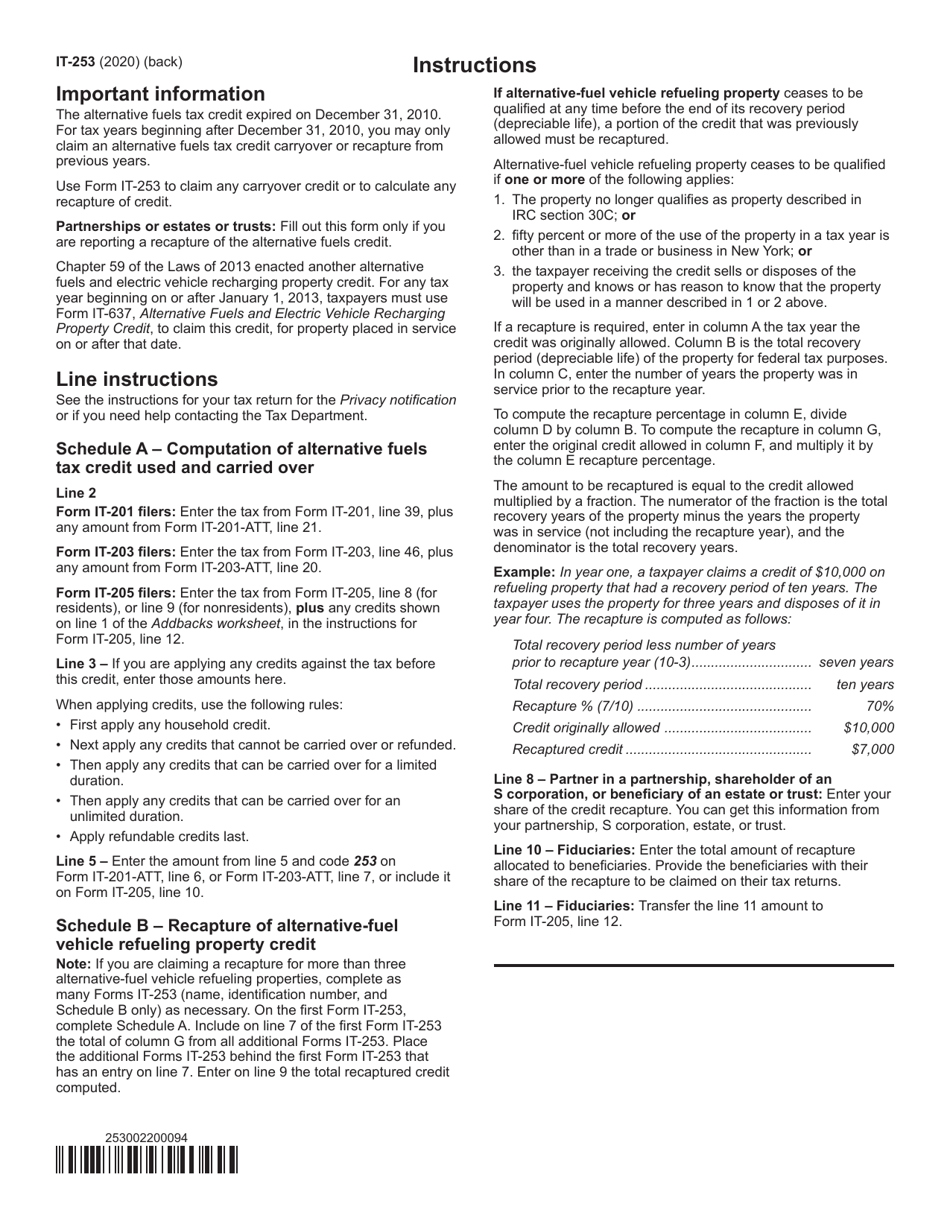

Q: How do I claim the Alternative Fuels Credit?

A: To claim the credit, you need to fill out Form IT-253 and include it with your New York state tax return.

Q: What information do I need to complete Form IT-253?

A: You will need to provide information about your business and the alternative fuels you used, as well as supporting documentation.

Q: Is there a deadline to file Form IT-253?

A: Yes, the deadline to file Form IT-253 is the same as the deadline for your New York state tax return, usually April 15th.

Q: How much is the Alternative Fuels Credit?

A: The amount of the credit depends on the type and amount of alternative fuels used, as well as other factors. It is best to consult the instructions on Form IT-253 for specific details.

Q: Can I carry forward any unused Alternative Fuels Credit?

A: Yes, any unused credit can be carried forward for up to five years.

Q: Can I claim the Alternative Fuels Credit for vehicles used for personal purposes?

A: No, the Alternative Fuels Credit is only available for vehicles used in your business or trade.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-253 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.