This version of the form is not currently in use and is provided for reference only. Download this version of

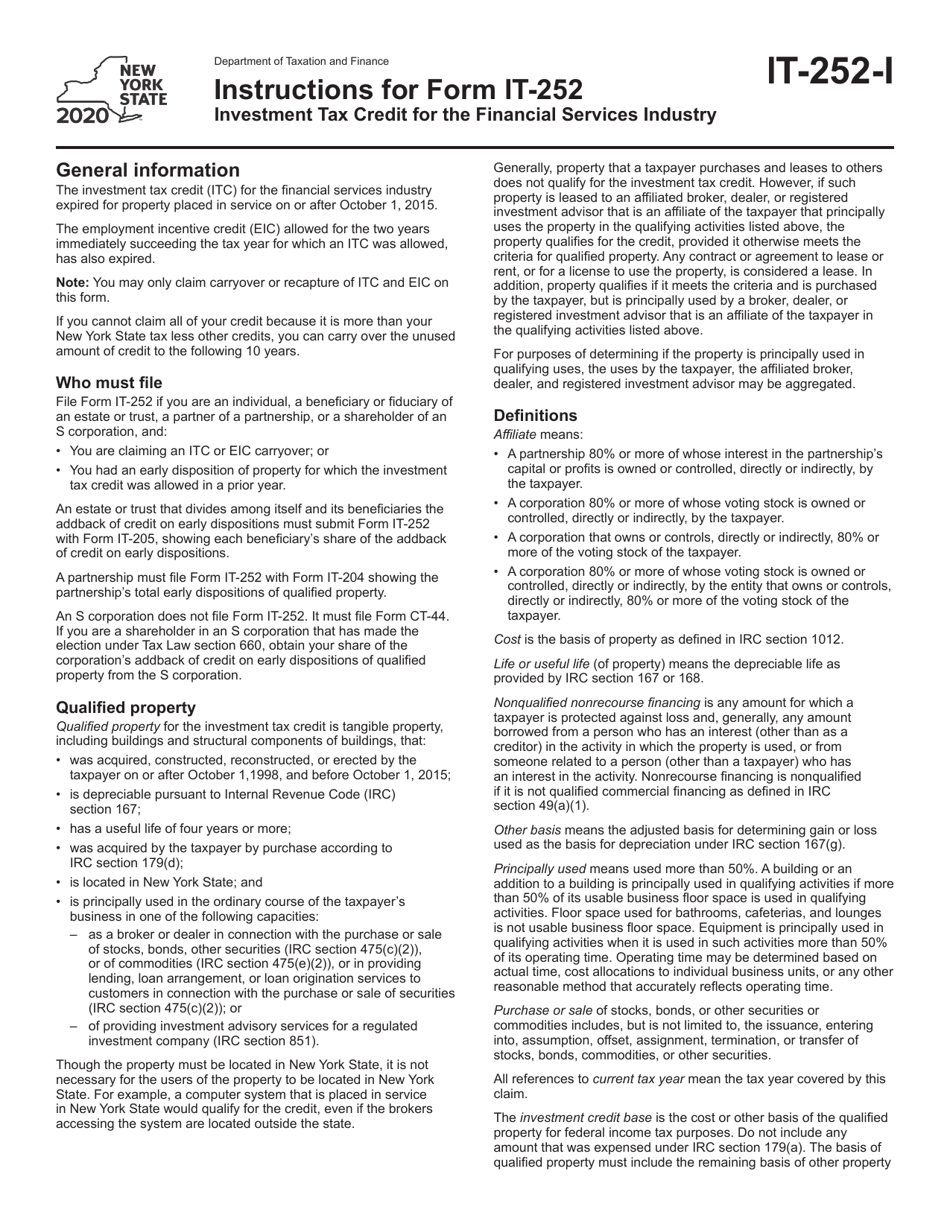

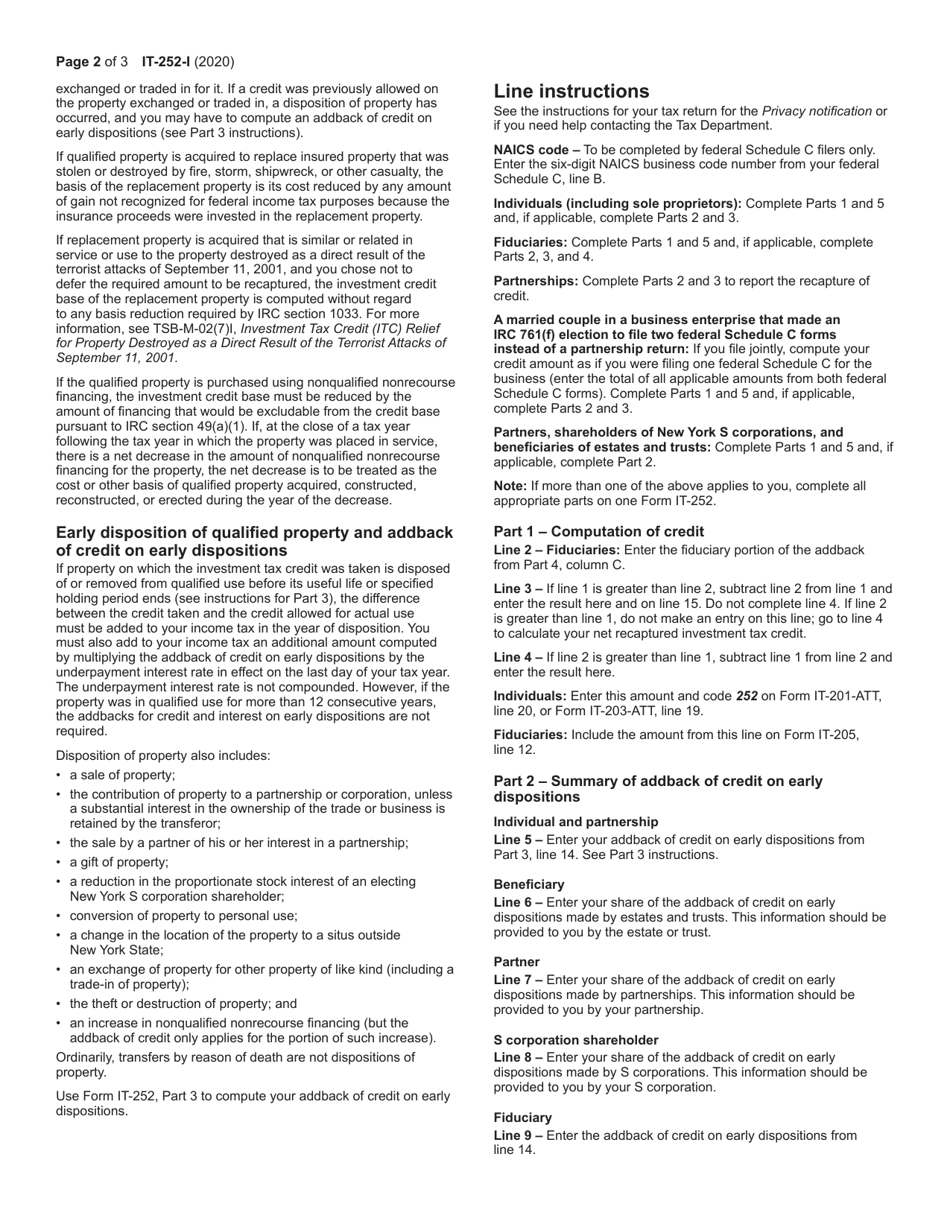

Instructions for Form IT-252

for the current year.

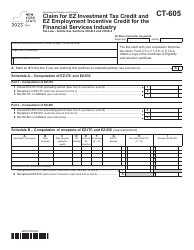

Instructions for Form IT-252 Investment Tax Credit for the Financial Services Industry - New York

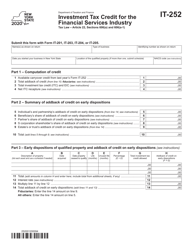

This document contains official instructions for Form IT-252 , Investment Tax Credit for the Financial Services Industry - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-252 is available for download through this link.

FAQ

Q: What is Form IT-252?

A: Form IT-252 is a tax form specific to the Financial Services Industry in New York.

Q: Who needs to file Form IT-252?

A: Businesses in the Financial Services Industry in New York who are claiming the Investment Tax Credit.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax incentive that allows businesses to reduce their tax liability based on their eligible investments.

Q: What is the Financial Services Industry?

A: The Financial Services Industry includes companies that provide financial services such as banking, insurance, securities, and investment management.

Q: What are eligible investments for the Investment Tax Credit?

A: Eligible investments for the Investment Tax Credit include qualified property, qualified research expenses, and certified film production costs.

Q: How do I calculate the Investment Tax Credit?

A: The Investment Tax Credit is calculated by multiplying the eligible investment by the prescribed credit rate.

Q: When is Form IT-252 due?

A: Form IT-252 is generally due by the fifteenth day of the fourth month following the close of the tax year.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.