This version of the form is not currently in use and is provided for reference only. Download this version of

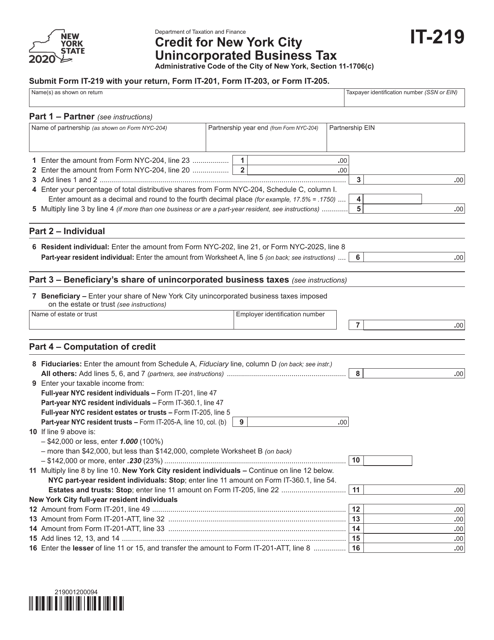

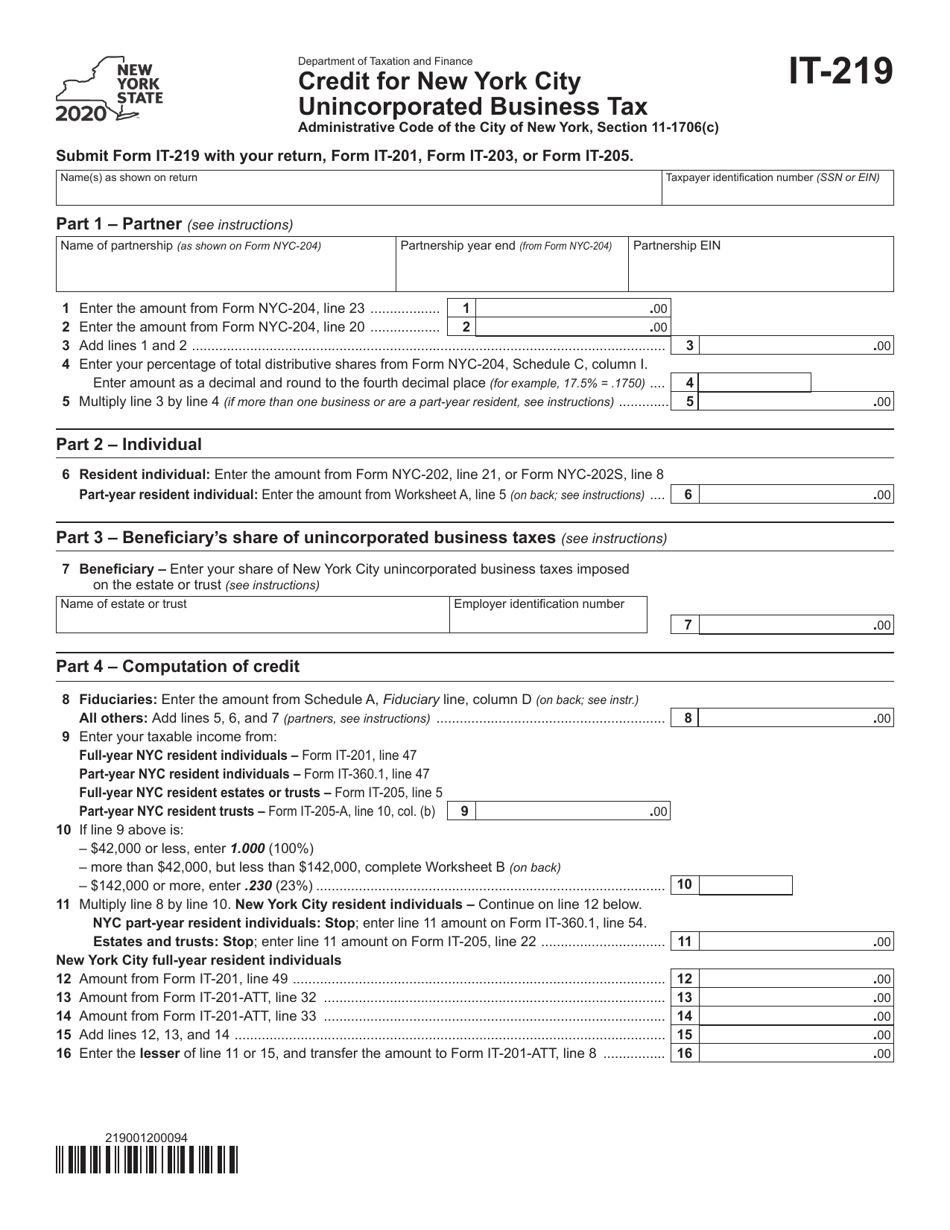

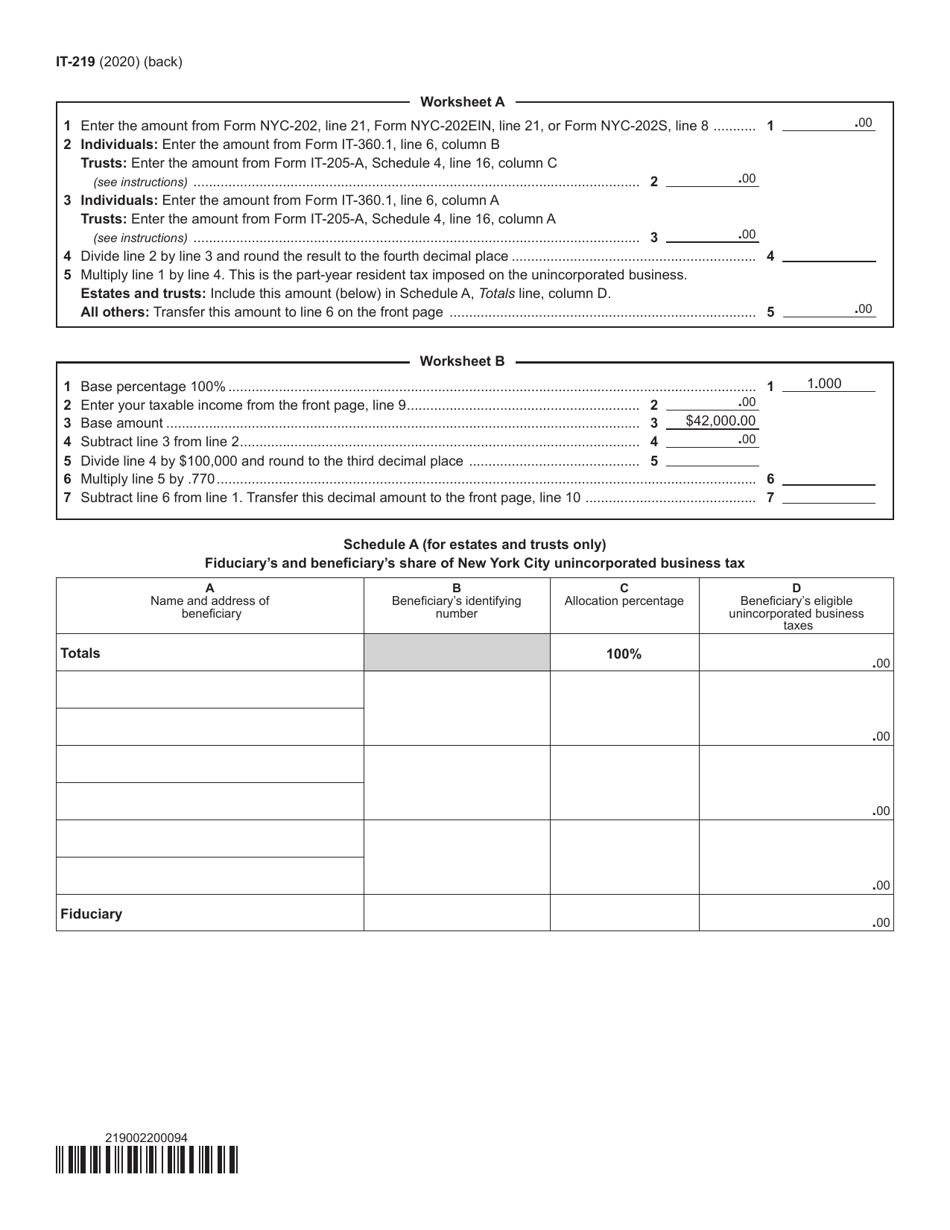

Form IT-219

for the current year.

Form IT-219 Credit for New York City Unincorporated Business Tax - New York

What Is Form IT-219?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-219?

A: Form IT-219 is a tax form used to claim the credit for New York City Unincorporated Business Tax.

Q: Who needs to file Form IT-219?

A: Anyone who is eligible for the credit for New York City Unincorporated Business Tax should file Form IT-219.

Q: What is the credit for New York City Unincorporated Business Tax?

A: The credit is a refundable tax credit that offsets the New York City Unincorporated Business Tax liability.

Q: How do I claim the credit?

A: You need to complete Form IT-219 and include it with your New York State income tax return.

Q: When is the deadline to file Form IT-219?

A: The deadline to file Form IT-219 is the same as the deadline to file your New York State income tax return, which is usually April 15th.

Q: What if I don't owe any New York City Unincorporated Business Tax?

A: If you don't owe any New York City Unincorporated Business Tax, you can still claim the credit and receive a refund.

Q: Can I e-file Form IT-219?

A: Yes, you can e-file Form IT-219 if you are filing your New York State income tax return electronically.

Q: Is the credit for New York City Unincorporated Business Tax available for individuals and businesses?

A: Yes, both individuals and businesses can claim the credit if they are eligible.

Q: Are there any limitations or requirements to claim the credit?

A: Yes, there are limitations and requirements to claim the credit. You should refer to the instructions for Form IT-219 for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-219 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.