This version of the form is not currently in use and is provided for reference only. Download this version of

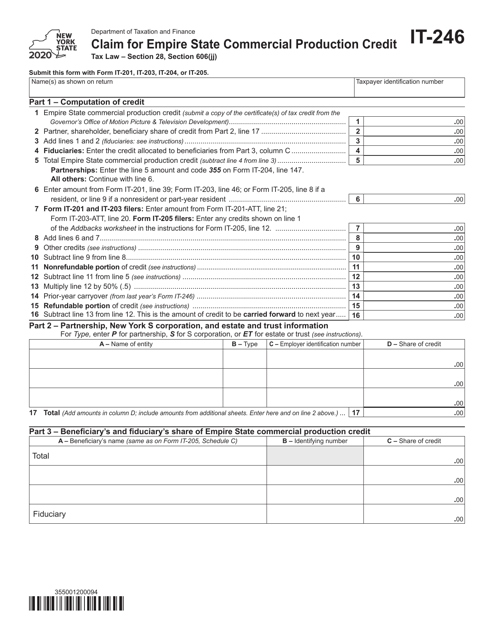

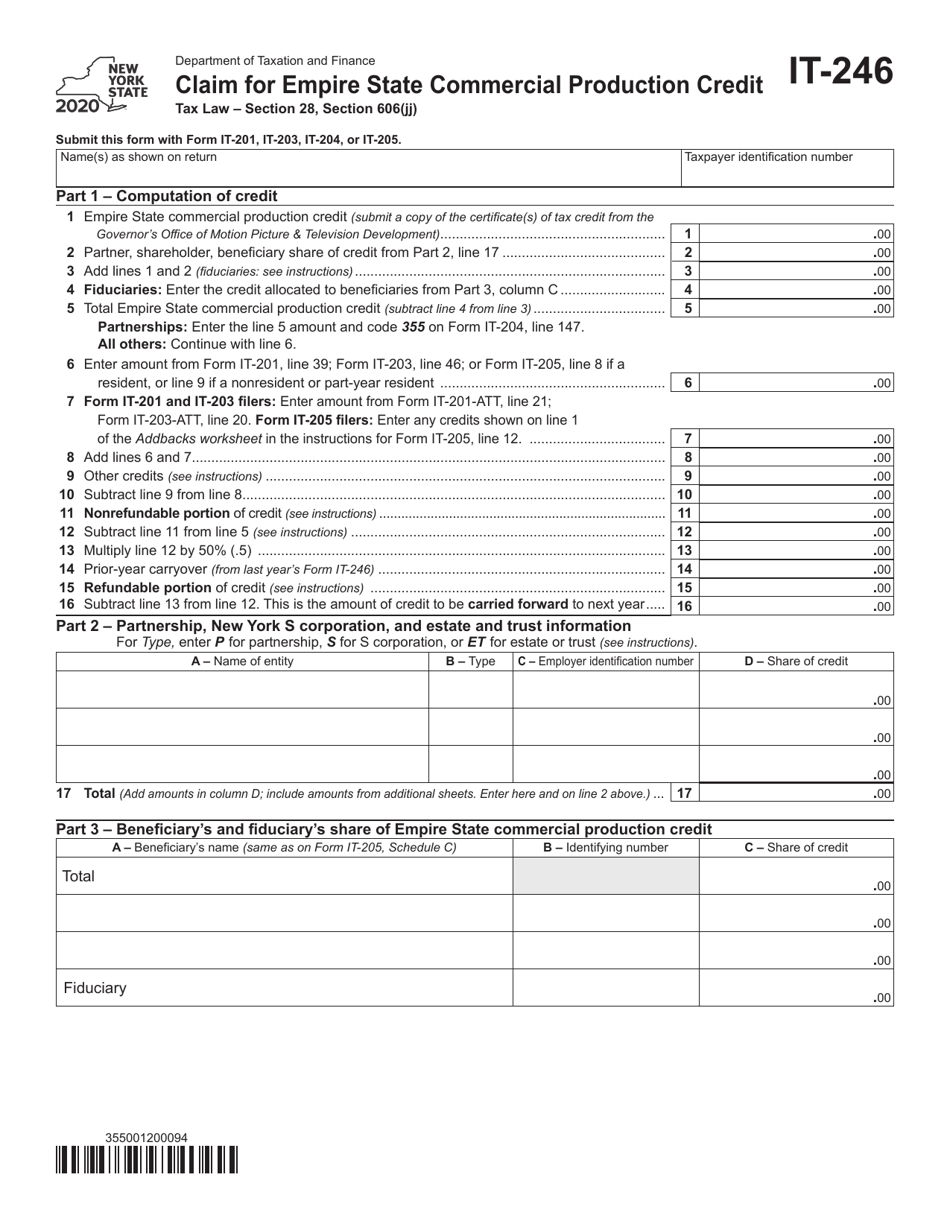

Form IT-246

for the current year.

Form IT-246 Claim for Empire State Commercial Production Credit - New York

What Is Form IT-246?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-246?

A: Form IT-246 is the Claim for Empire State Commercial Production Credit in New York.

Q: What is the Empire State Commercial Production Credit?

A: The Empire State Commercial Production Credit is a tax credit offered by the state of New York to encourage film and television production in the state.

Q: Who is eligible to claim the Empire State Commercial Production Credit?

A: Eligible entities include qualified film production companies, television companies, and commercial production companies that meet certain criteria.

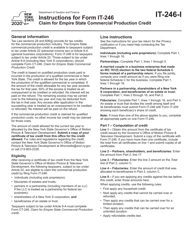

Q: What expenses are eligible for the credit?

A: Eligible expenses include qualified production costs incurred in New York State, such as wages, salaries, and certain tangible property expenses.

Q: How much is the credit?

A: The credit amount is generally 30% of qualified production costs, but it can be higher for certain qualified productions or in certain locations in New York.

Q: How do I claim the credit?

A: To claim the credit, you must complete Form IT-246 and attach it to your New York state income tax return.

Q: Are there any deadlines for claiming the credit?

A: Yes, the deadline to claim the credit is generally the same as the deadline for filing your New York state income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-246 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.