This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-239

for the current year.

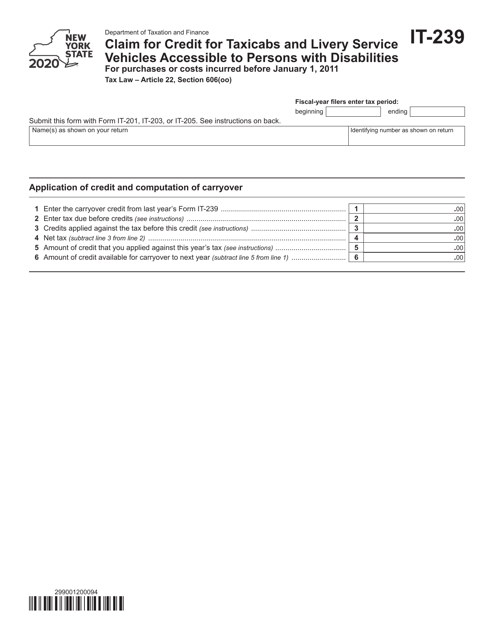

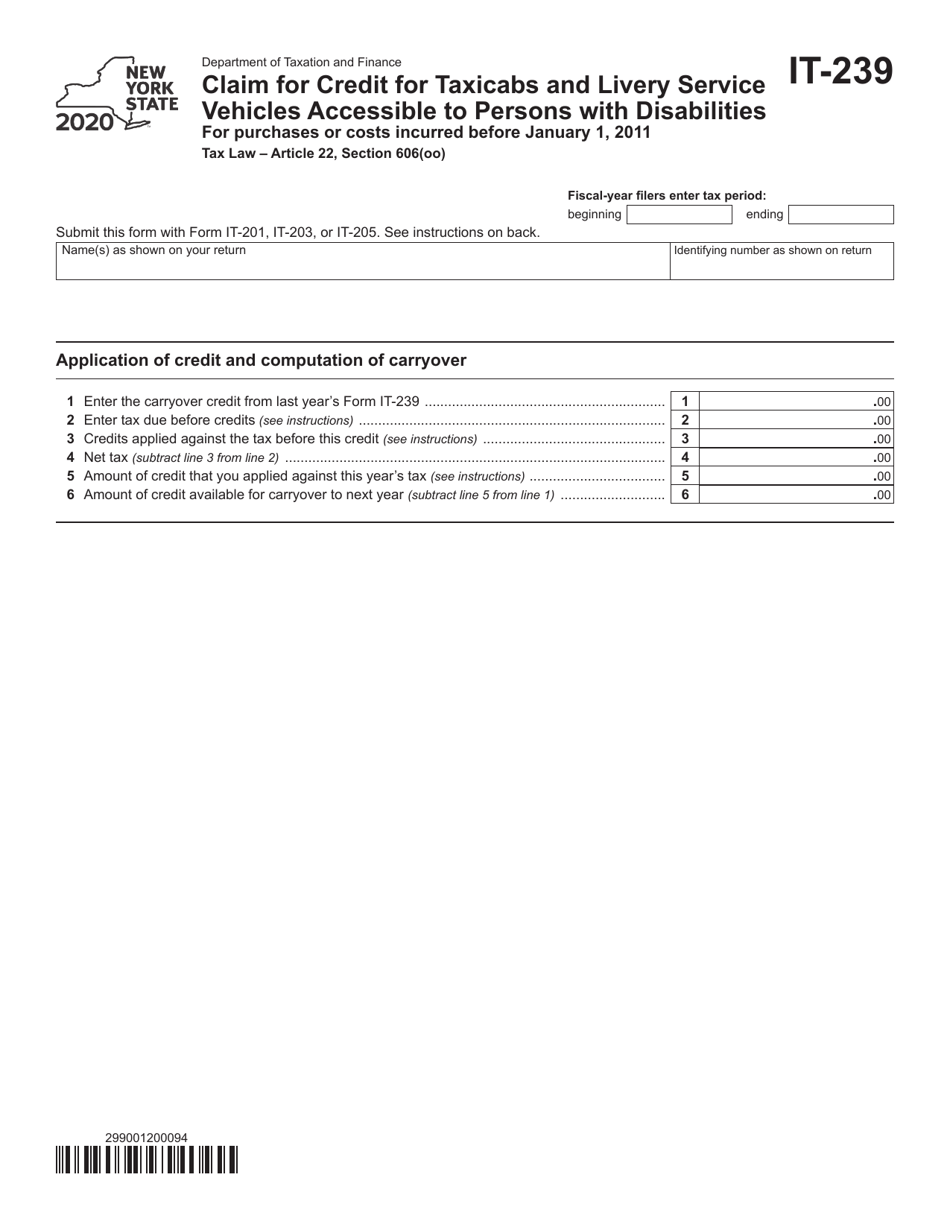

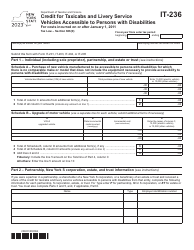

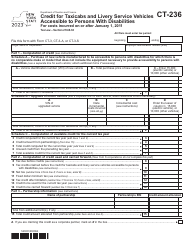

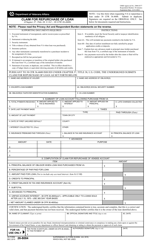

Form IT-239 Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities - New York

What Is Form IT-239?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-239?

A: Form IT-239 is the Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities.

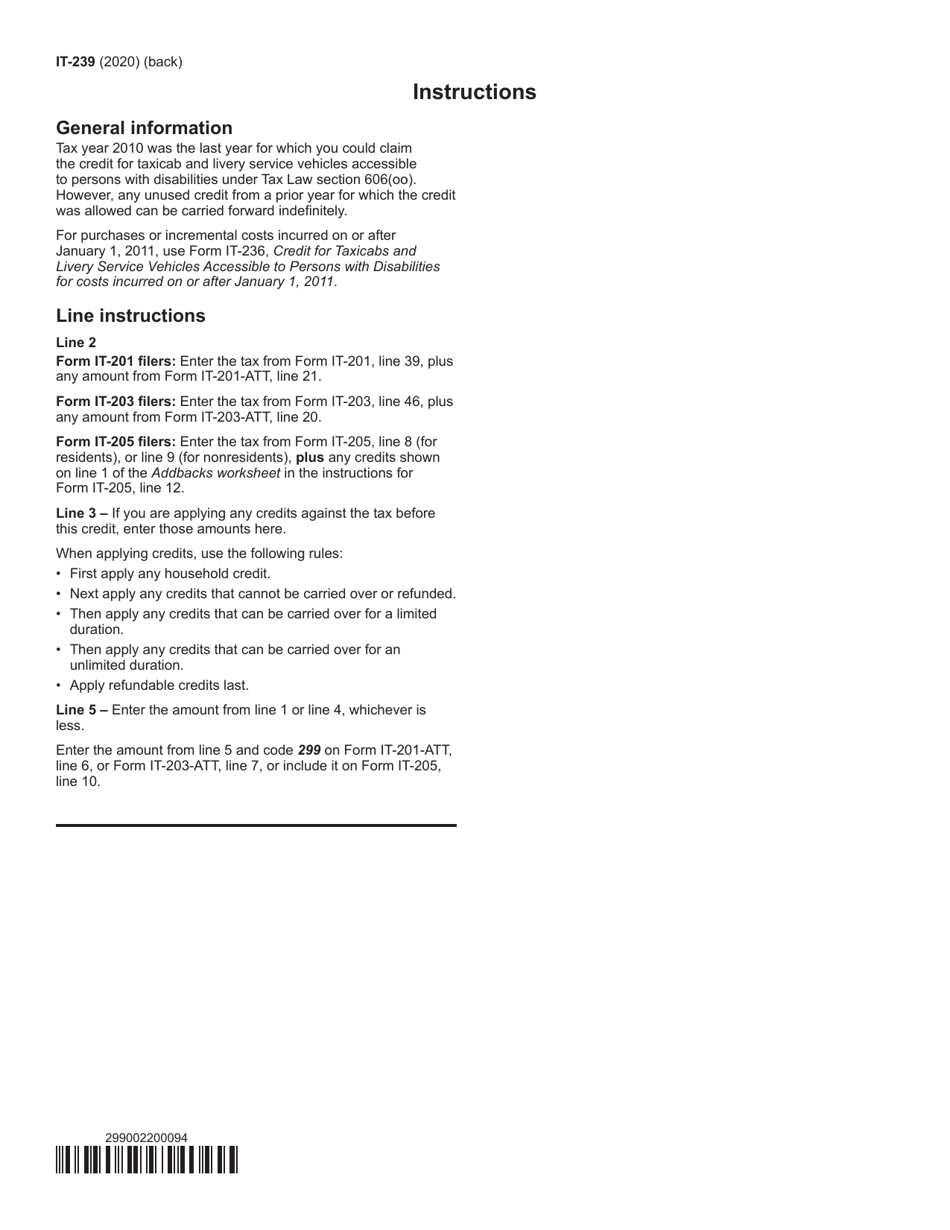

Q: What is the purpose of Form IT-239?

A: The purpose of Form IT-239 is to claim a tax credit for expenses related to providing accessible taxicabs and livery service vehicles for persons with disabilities.

Q: Who is eligible to file Form IT-239?

A: Taxicab and livery service owners or operators in New York who provide accessible vehicles to persons with disabilities are eligible to file Form IT-239.

Q: What expenses can be claimed on Form IT-239?

A: Expenses related to the purchase, lease, or modification of taxicabs and livery service vehicles to be accessible to persons with disabilities can be claimed on Form IT-239.

Q: How much is the tax credit for Form IT-239?

A: The tax credit amount is based on 50% of the eligible expenses, up to a maximum of $10,000 per vehicle.

Q: When is the deadline for filing Form IT-239?

A: Form IT-239 must be filed on or before April 15 of the year following the tax year in which the expenses were incurred.

Q: Are supporting documents required for Form IT-239?

A: Yes, supporting documents such as receipts and proofs of payment are required to be attached with Form IT-239.

Q: Can I e-file Form IT-239?

A: No, Form IT-239 can only be filed by mail and cannot be e-filed.

Q: Is Form IT-239 applicable in other states?

A: No, Form IT-239 is specific to New York and is not applicable in other states.

Q: Are there any penalties for filing Form IT-239 late?

A: Yes, late filing of Form IT-239 may result in penalties and interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-239 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.