This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-226

for the current year.

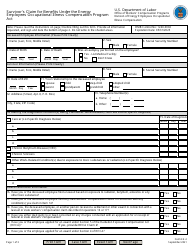

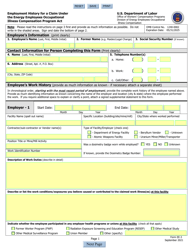

Form IT-226 Employer Compensation Expense Program Wage Credit - New York

What Is Form IT-226?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

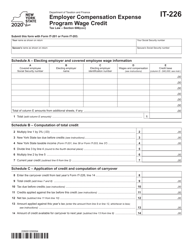

Q: What is the Form IT-226?

A: The Form IT-226 is an employer compensation expense program wage credit form.

Q: What is the Employer Compensation Expense Program?

A: The Employer Compensation Expense Program is a program in New York that provides a wage credit to certain businesses.

Q: Who is eligible for the wage credit?

A: Certain employers in New York may be eligible for the wage credit.

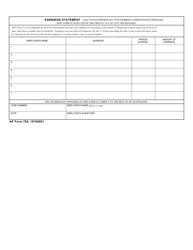

Q: How do I claim the wage credit?

A: To claim the wage credit, you need to complete and file the Form IT-226.

Q: Is there a deadline for filing the Form IT-226?

A: Yes, the deadline for filing the Form IT-226 is on or before April 30 of the following year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-226 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.