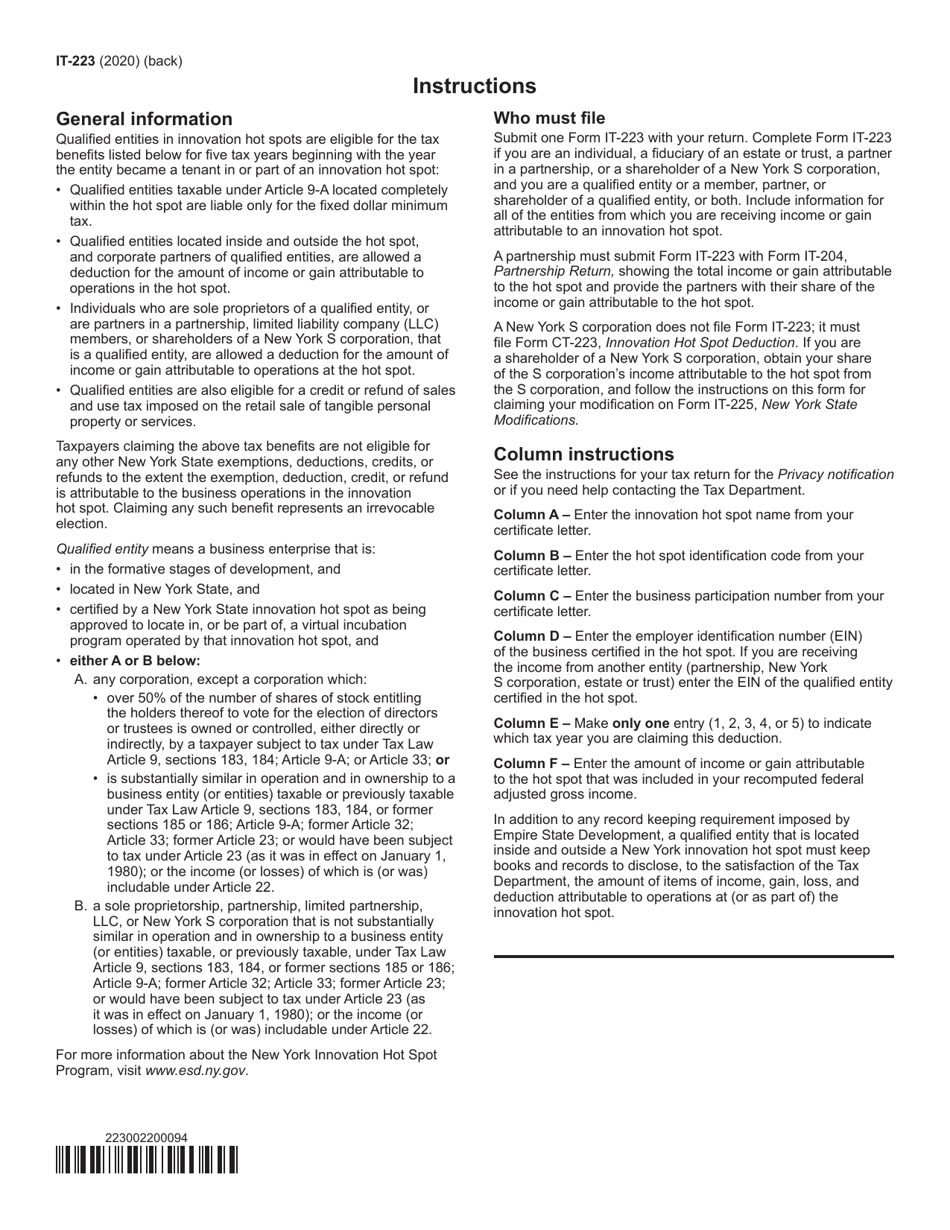

This version of the form is not currently in use and is provided for reference only. Download this version of

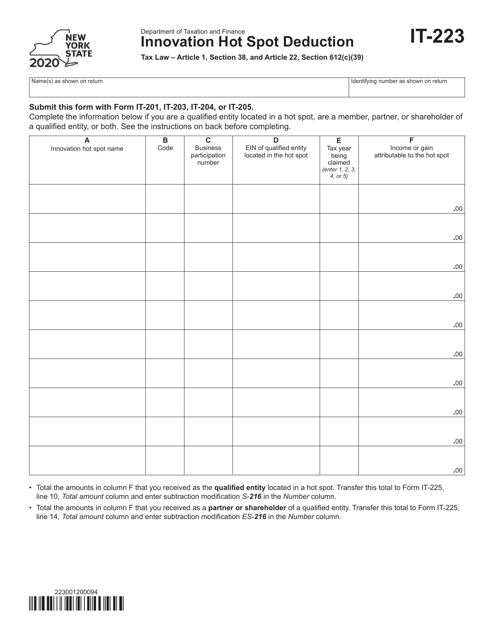

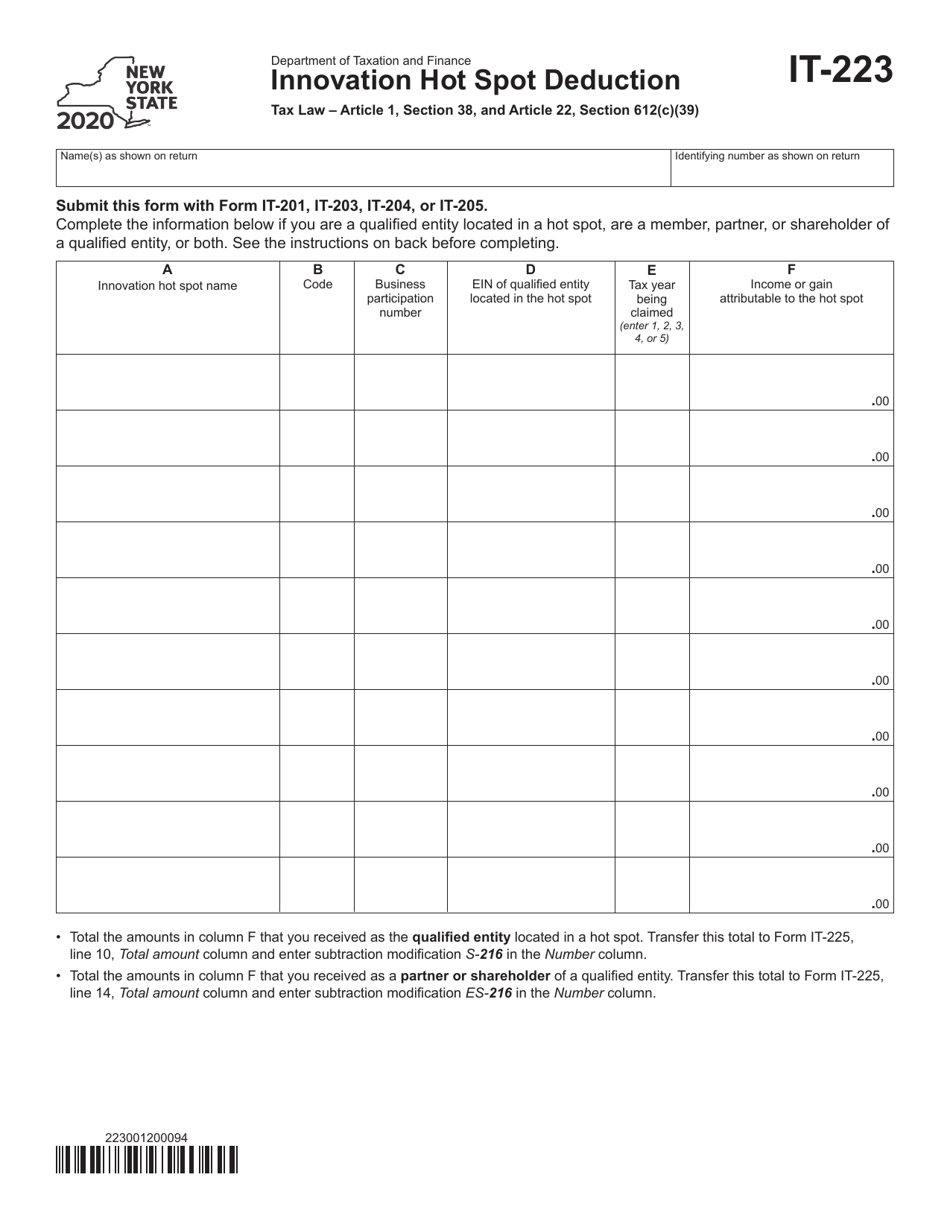

Form IT-223

for the current year.

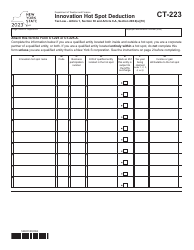

Form IT-223 Innovation Hot Spot Deduction - New York

What Is Form IT-223?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-223?

A: Form IT-223 is a tax form used in New York to claim the Innovation Hot Spot Deduction.

Q: What is the Innovation Hot Spot Deduction?

A: The Innovation Hot Spot Deduction is a tax deduction available to qualified businesses in New York.

Q: Who is eligible for the Innovation Hot Spot Deduction?

A: Qualified businesses that are located in designated innovation hot spots in New York are eligible for the deduction.

Q: What expenses can be deducted under the Innovation Hot Spot Deduction?

A: The deduction allows eligible businesses to deduct certain expenses related to qualified research and development activities.

Q: How do I claim the Innovation Hot Spot Deduction?

A: To claim the deduction, you need to fill out Form IT-223 and include it with your New York State tax return.

Q: Is there a deadline for claiming the Innovation Hot Spot Deduction?

A: Yes, the deduction must be claimed within the statute of limitations for your tax return filing.

Q: Are there any limitations or restrictions for the Innovation Hot Spot Deduction?

A: Yes, there are certain limitations and restrictions for the deduction. It is important to review the instructions for Form IT-223 for more details.

Q: What are the benefits of the Innovation Hot Spot Deduction?

A: The deduction can provide significant tax savings for qualified businesses and incentivize research and development activities in designated innovation hot spots.

Q: Can I claim the Innovation Hot Spot Deduction if my business is not located in an innovation hot spot?

A: No, the deduction is only available to businesses located in designated innovation hot spots in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-223 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.