This version of the form is not currently in use and is provided for reference only. Download this version of

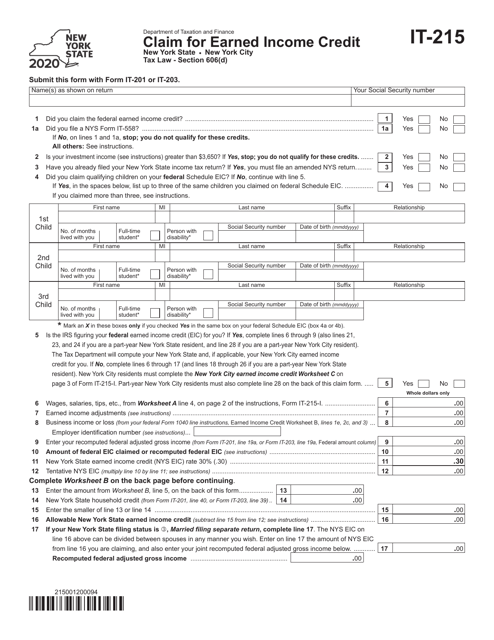

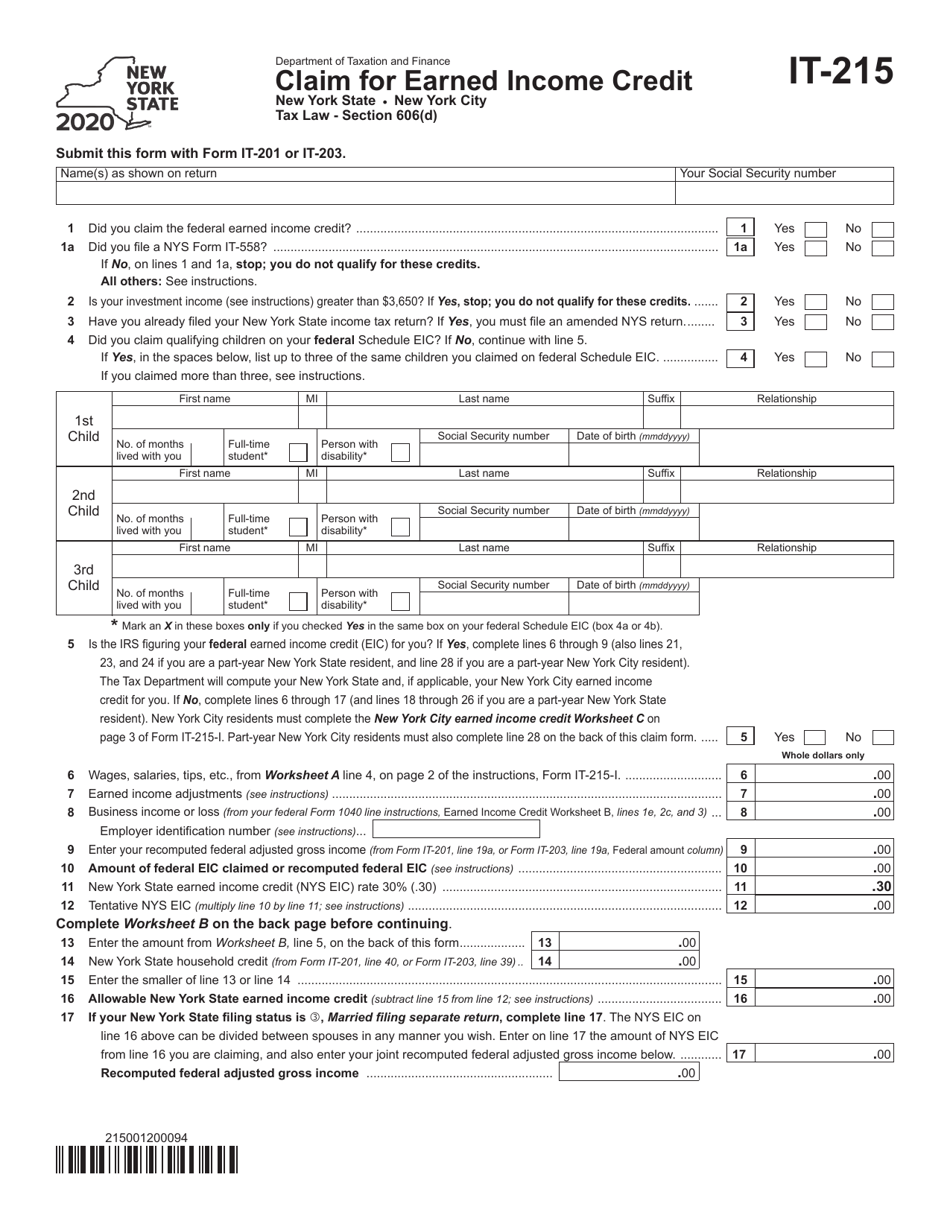

Form IT-215

for the current year.

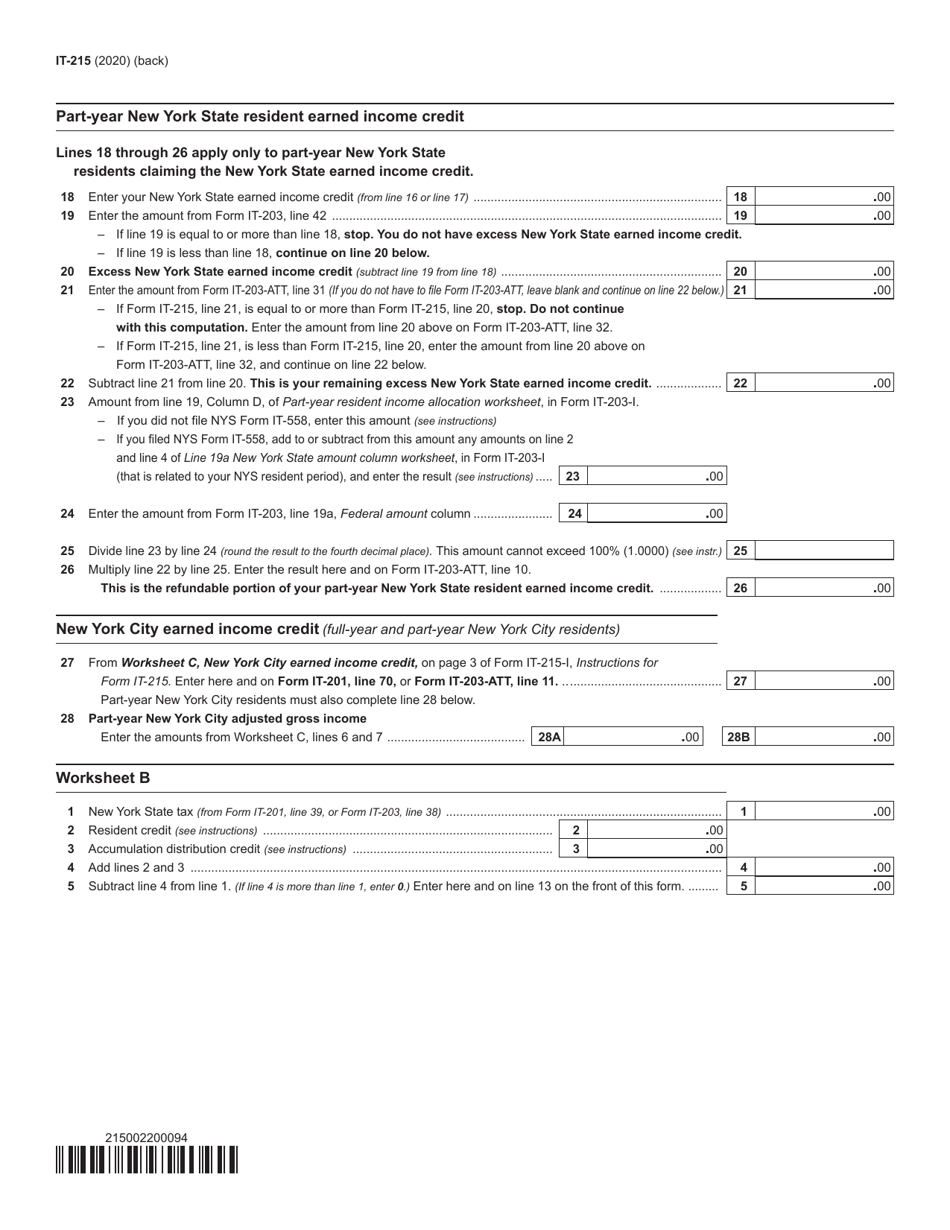

Form IT-215 Claim for Earned Income Credit - New York

What Is Form IT-215?

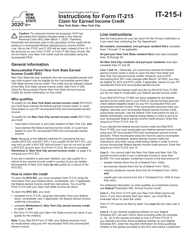

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-215?

A: Form IT-215 is a tax form used in New York to claim the Earned Income Credit.

Q: What is the Earned Income Credit?

A: The Earned Income Credit is a tax credit provided by the government to low-income individuals and families to help reduce their tax liability.

Q: Who can use Form IT-215?

A: Form IT-215 can be used by residents of New York who meet the eligibility criteria for the Earned Income Credit.

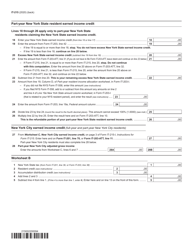

Q: What information do I need to complete Form IT-215?

A: You will need to provide your personal information, income details, and any applicable deductions and credits.

Q: When is the deadline to file Form IT-215?

A: The deadline to file Form IT-215 is the same as the deadline to file your New York state income tax return, which is usually April 15th.

Q: Can I file Form IT-215 electronically?

A: Yes, you can file Form IT-215 electronically if you are e-filing your New York state income tax return.

Q: What if I have questions or need help with Form IT-215?

A: If you have questions or need assistance with Form IT-215, you can contact the New York State Department of Taxation and Finance or seek help from a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-215 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.