This version of the form is not currently in use and is provided for reference only. Download this version of

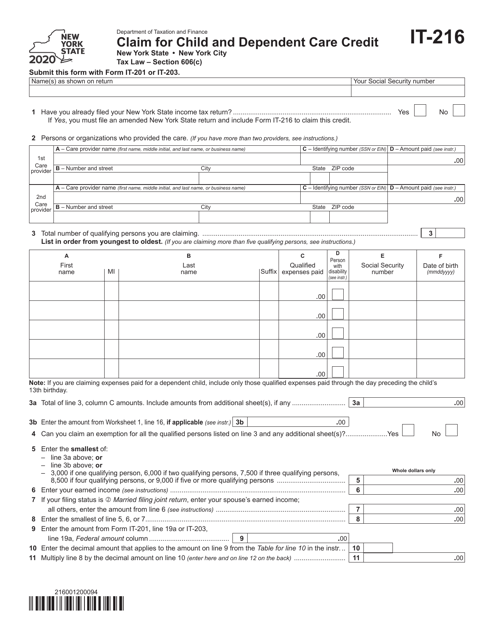

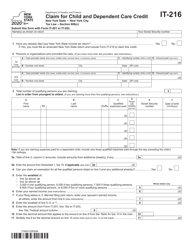

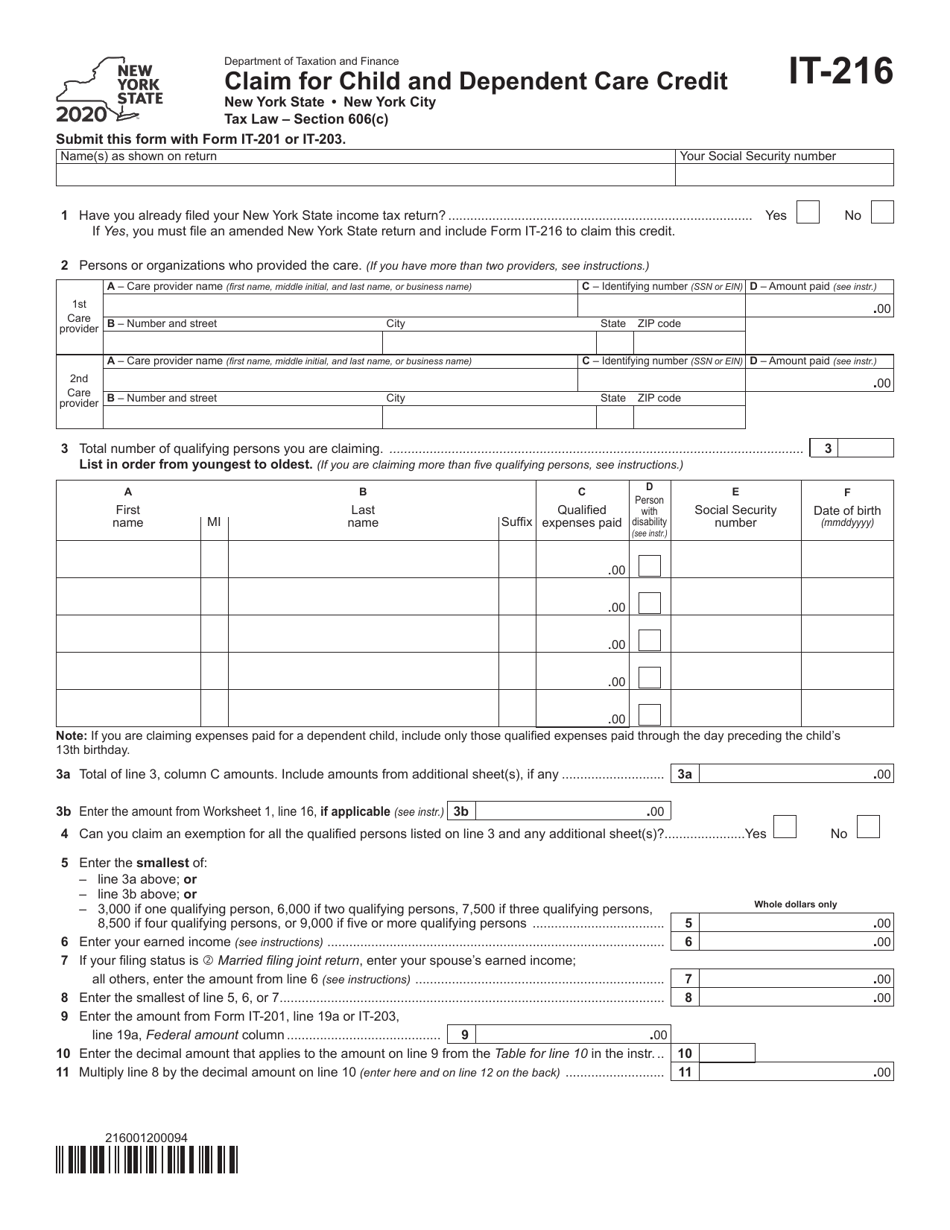

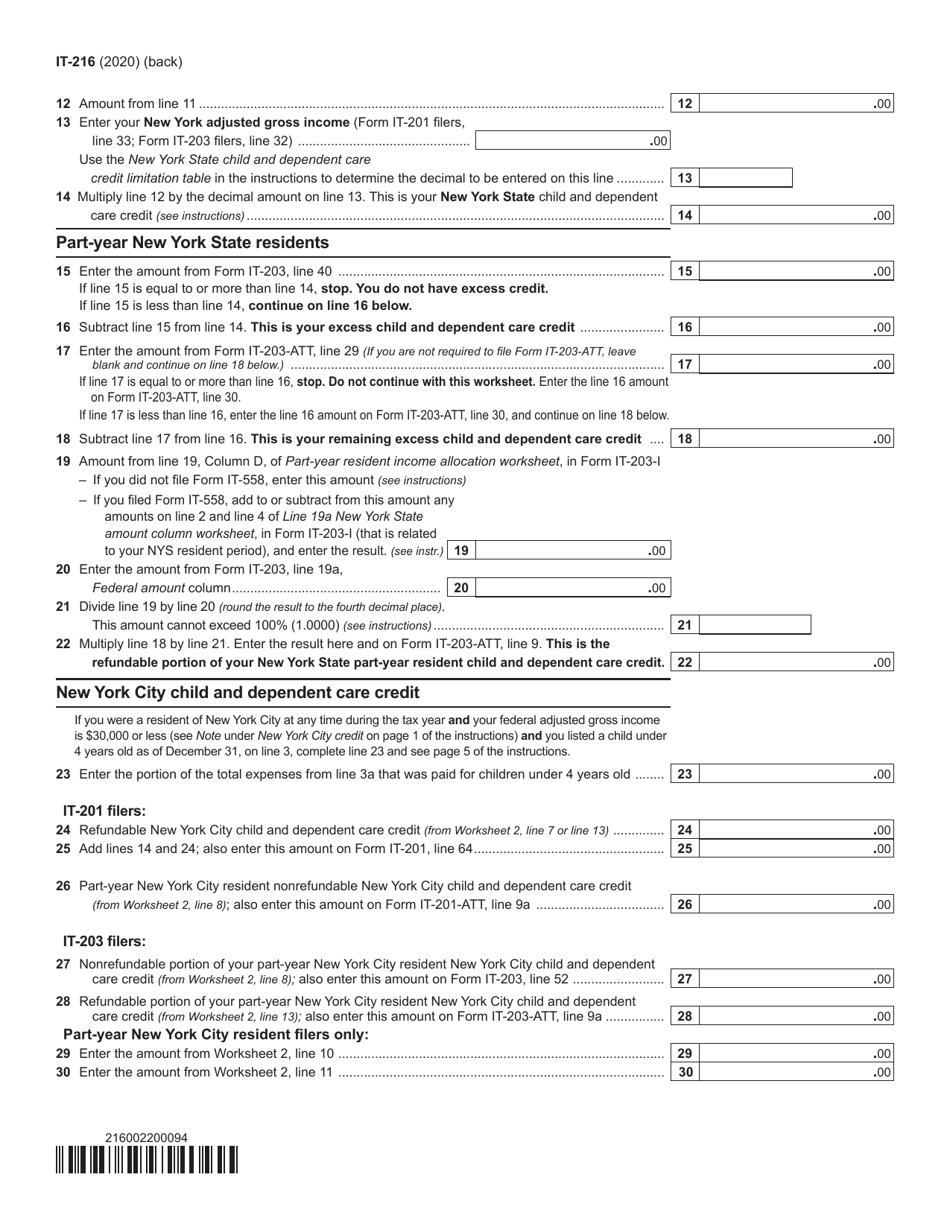

Form IT-216

for the current year.

Form IT-216 Claim for Child and Dependent Care Credit - New York

What Is Form IT-216?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-216?

A: Form IT-216 is a tax form used to claim the Child and Dependent Care Credit in New York.

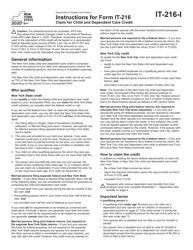

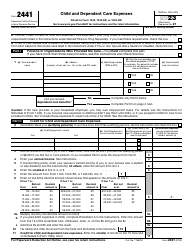

Q: What is the Child and Dependent Care Credit?

A: The Child and Dependent Care Credit is a tax credit that helps eligible individuals and families offset the cost of child and dependent care expenses.

Q: Who is eligible to claim the Child and Dependent Care Credit?

A: New York residents who paid for child or dependent care expenses in order to work or look for work may be eligible to claim this credit.

Q: What types of expenses qualify for the credit?

A: Expenses for the care of children under the age of 13, as well as expenses for the care of disabled dependents, may qualify for the credit.

Q: How do I claim the Child and Dependent Care Credit?

A: To claim the credit, you need to complete Form IT-216 and attach it to your New York state income tax return.

Q: Are there any limitations to the credit?

A: Yes, there are certain limitations and income thresholds that determine the amount of credit you may be eligible for.

Q: When is the deadline to file Form IT-216?

A: The deadline to file Form IT-216 is the same as the deadline to file your New York state income tax return, which is typically April 15th.

Q: Can I claim this credit if I have a child care subsidy?

A: Yes, you may still be eligible to claim the credit even if you receive a child care subsidy.

Q: Is this credit refundable?

A: No, the Child and Dependent Care Credit is not refundable, meaning it can only reduce your tax liability to zero and cannot result in a refund.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-216 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.