This version of the form is not currently in use and is provided for reference only. Download this version of

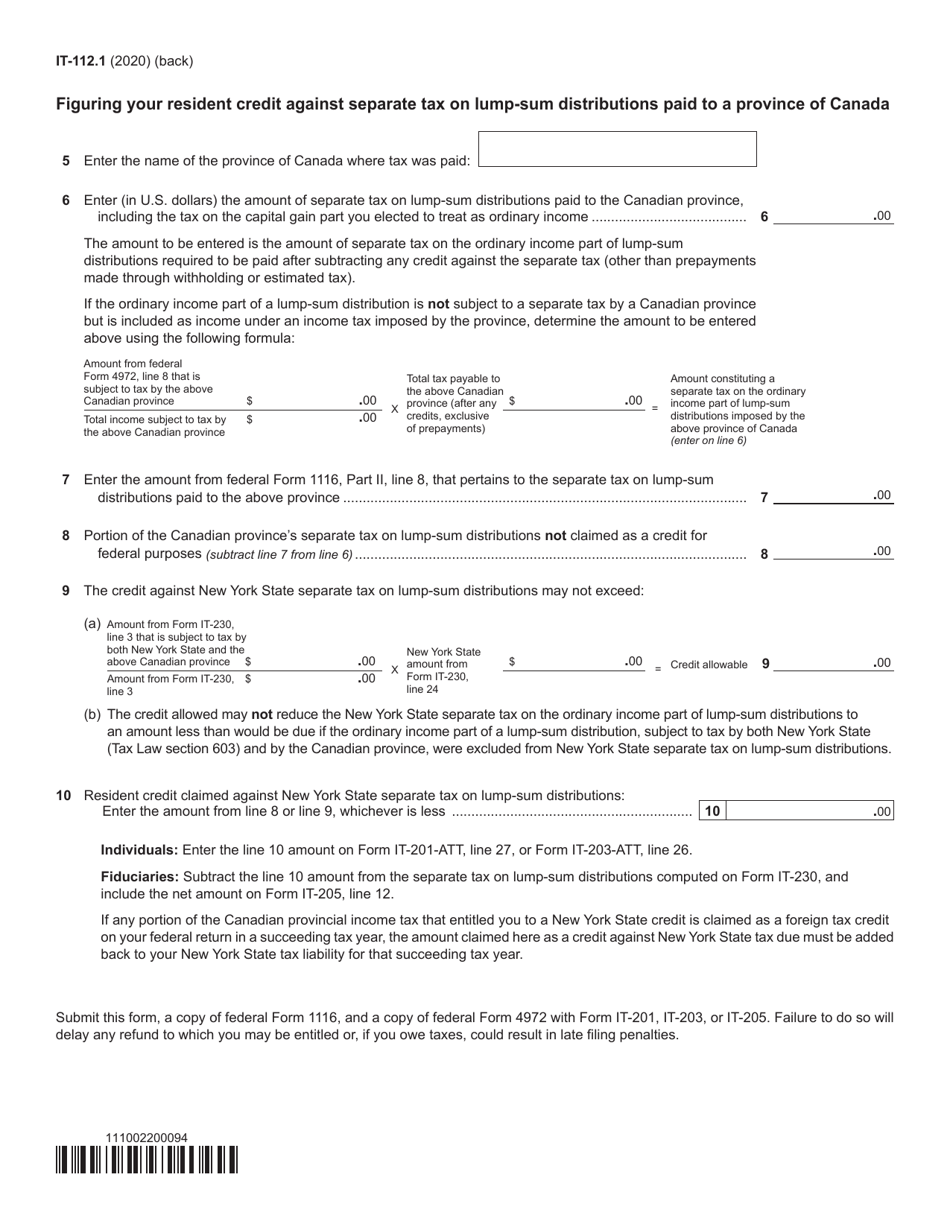

Form IT-112.1

for the current year.

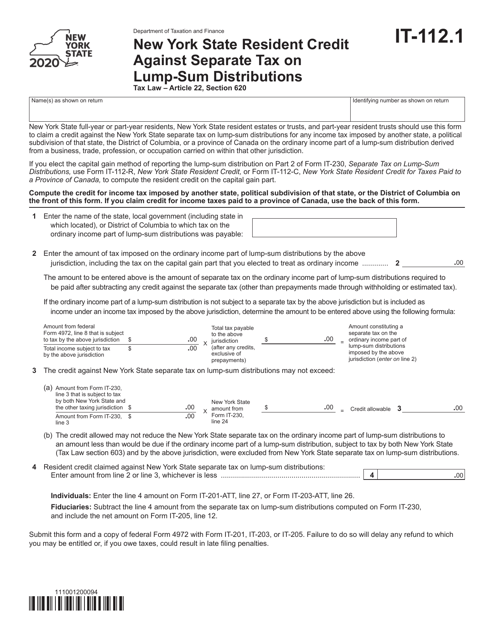

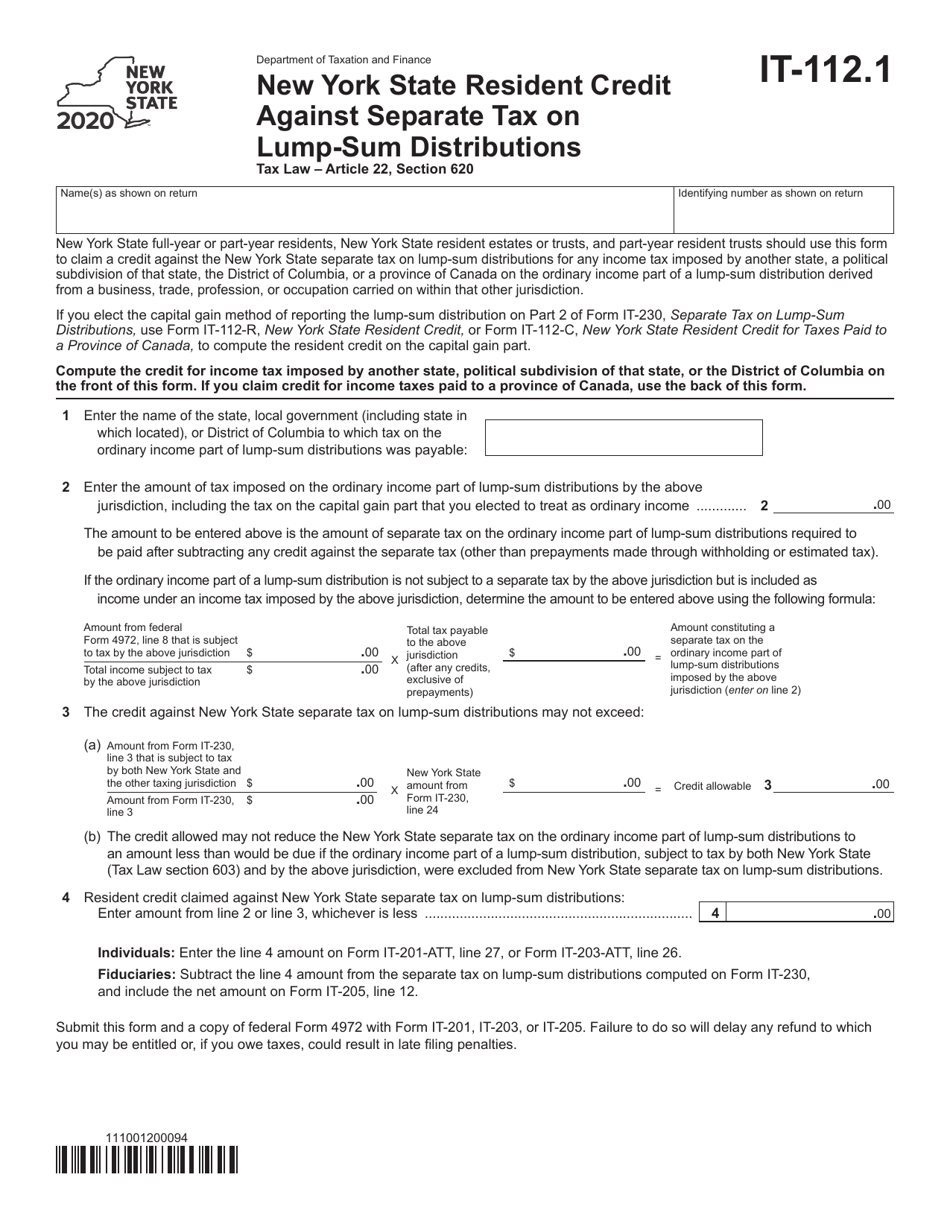

Form IT-112.1 New York State Resident Credit Against Separate Tax on Lump-Sum Distributions - New York

What Is Form IT-112.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-112.1?

A: Form IT-112.1 is a tax form for New York State residents.

Q: What is the purpose of Form IT-112.1?

A: Form IT-112.1 is used to claim a credit against the separate tax on lump-sum distributions.

Q: Who needs to file Form IT-112.1?

A: New York State residents who received a lump-sum distribution and are subject to separate tax on that distribution may need to file Form IT-112.1.

Q: What is a lump-sum distribution?

A: A lump-sum distribution is a one-time payment of your entire pension, profit-sharing, or retirement plan balance.

Q: What is the separate tax on lump-sum distributions?

A: The separate tax on lump-sum distributions is a special tax imposed by New York State on certain lump-sum distributions.

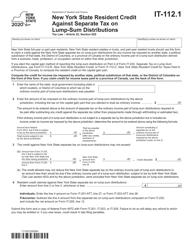

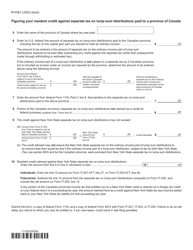

Q: How do I calculate the credit?

A: The credit is calculated based on the taxable portion of the lump-sum distribution and the New York tax rate for lump-sum distributions.

Q: When is the deadline to file Form IT-112.1?

A: The deadline to file Form IT-112.1 is typically the same as the deadline for filing your New York State income tax return, which is usually April 15th.

Q: Do I need to include any supporting documents with Form IT-112.1?

A: You may need to include a copy of your federal Form 1099-R and any other documents that support your claimed credit.

Q: Can I e-file Form IT-112.1?

A: Yes, you can e-file Form IT-112.1 if you are using approved tax software or a tax professional who offers e-filing services.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-112.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.