This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-209

for the current year.

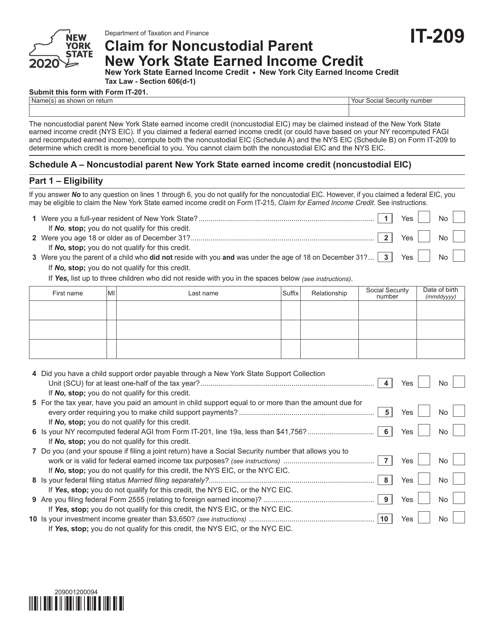

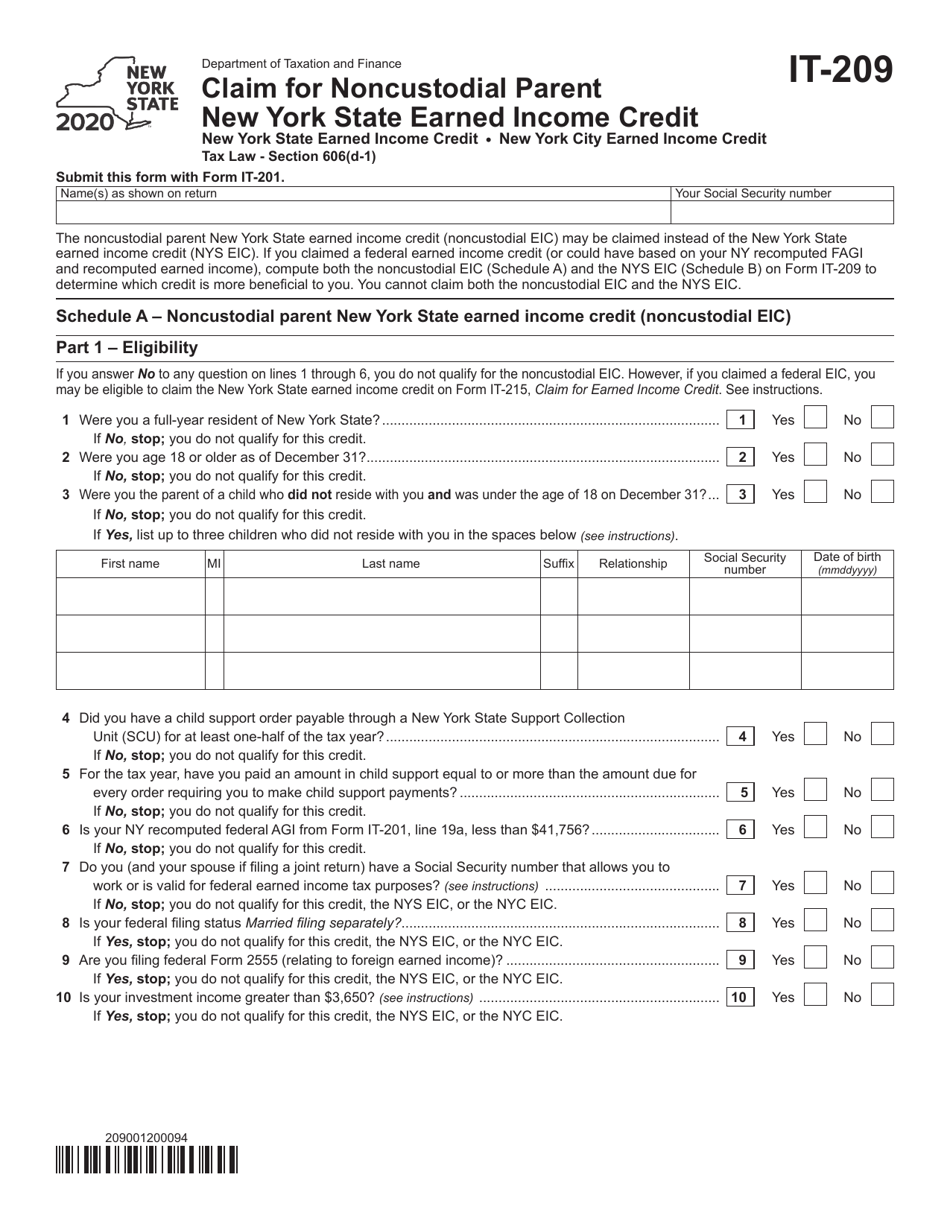

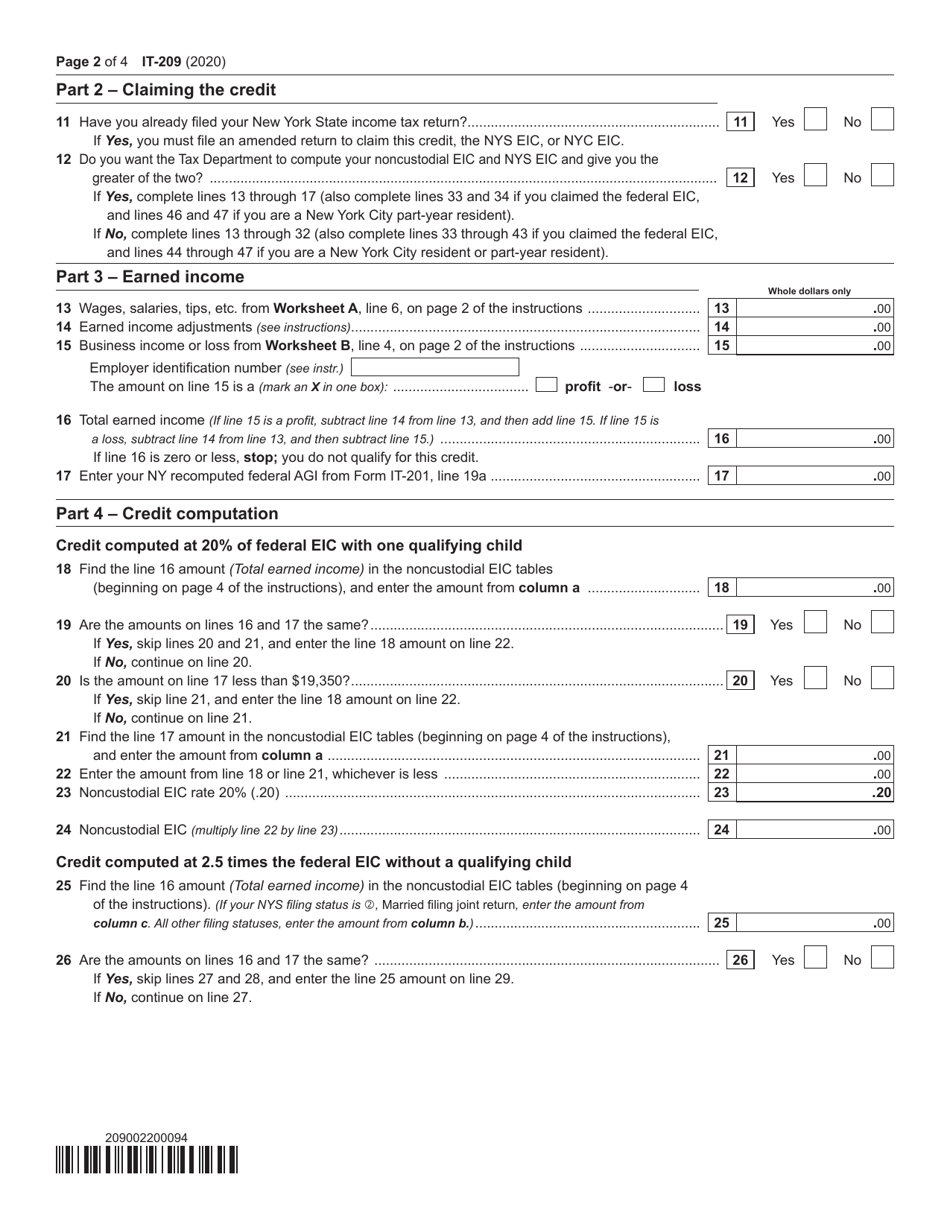

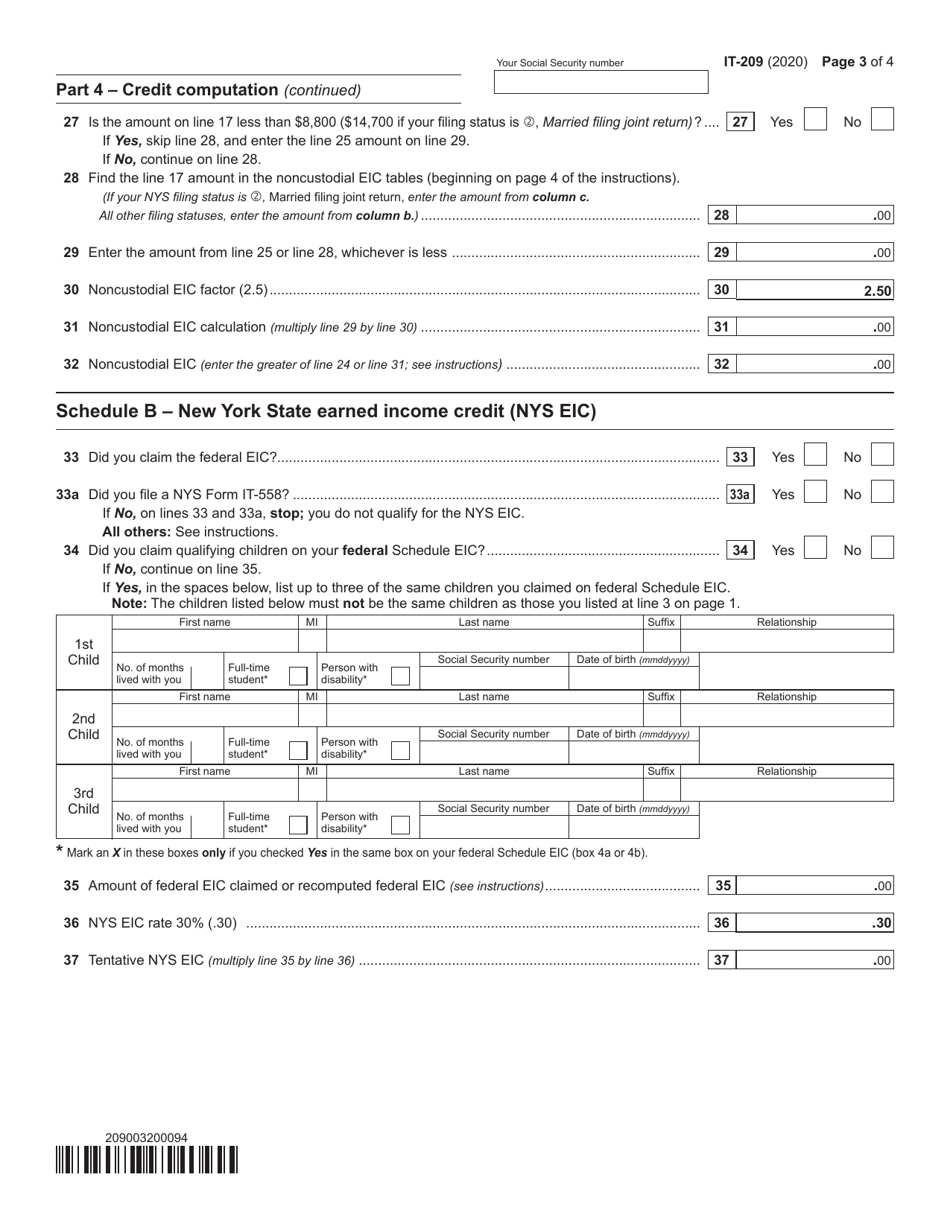

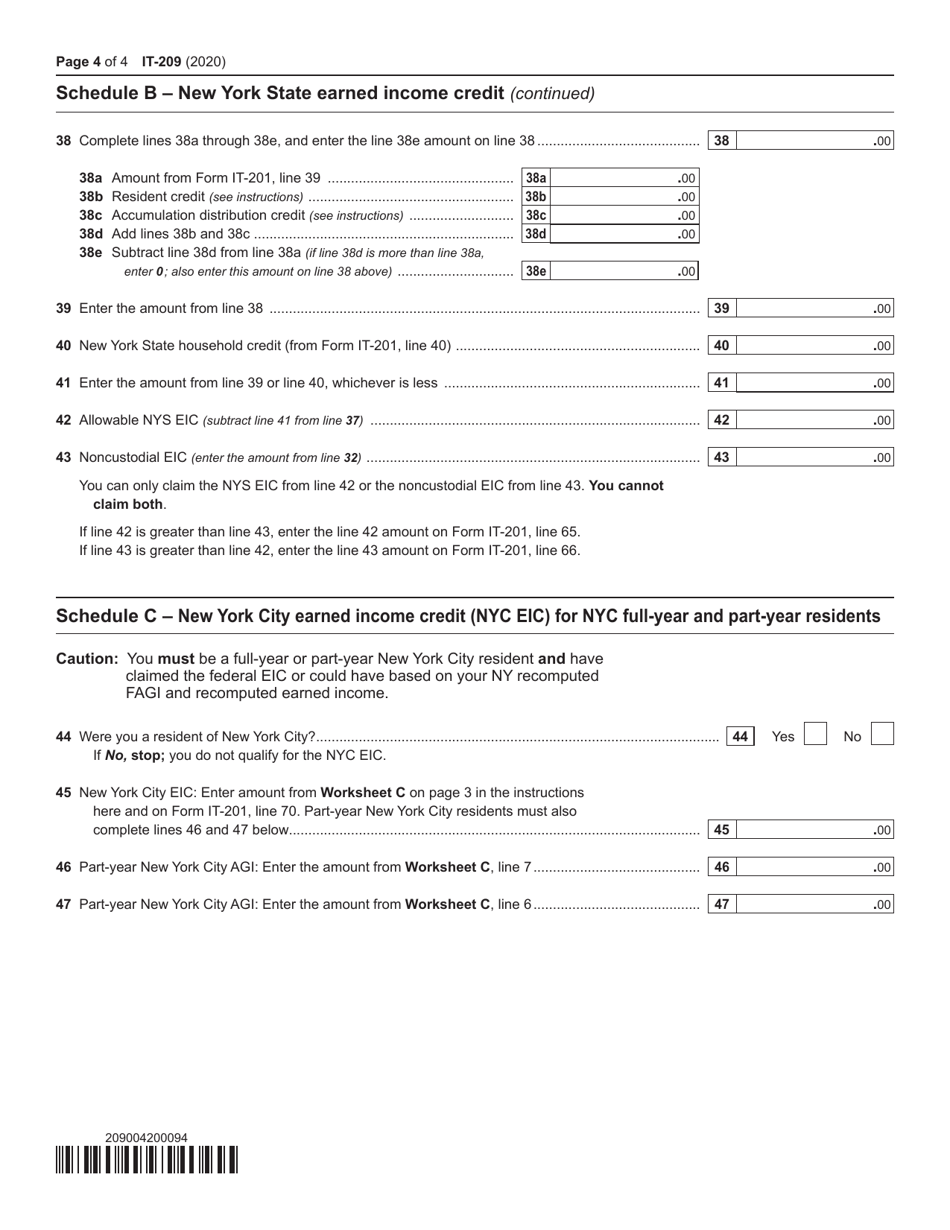

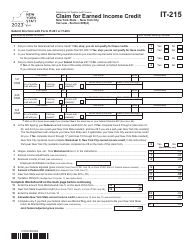

Form IT-209 Claim for Noncustodial Parent New York State Earned Income Credit - New York

What Is Form IT-209?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-209?

A: Form IT-209 is a form used to claim the New York State Earned Income Credit for noncustodial parents.

Q: Who can use Form IT-209?

A: Noncustodial parents who meet the requirements for the New York State Earned Income Credit can use Form IT-209.

Q: What is the New York State Earned Income Credit?

A: The New York State Earned Income Credit is a refundable tax credit for low-income working individuals and families.

Q: What are the requirements to claim the New York State Earned Income Credit?

A: To claim the New York State Earned Income Credit, you must meet certain income and filing status requirements.

Q: What documents do I need to complete Form IT-209?

A: You may need documents such as your W-2 forms, self-employment income records, and other income-related documents.

Q: Can I file Form IT-209 electronically?

A: Yes, you can file Form IT-209 electronically using tax preparation software or through the New York State e-file system.

Q: Is the New York State Earned Income Credit refundable?

A: Yes, the New York State Earned Income Credit is a refundable tax credit, which means you may receive a refund even if you don't owe any taxes.

Q: When is the deadline to file Form IT-209?

A: The deadline to file Form IT-209 is typically the same as the deadline to file your New York State tax return, which is April 15th.

Q: What if I made a mistake on my Form IT-209?

A: If you made a mistake on your Form IT-209, you can file an amended return using Form IT-209-X to correct the error.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-209 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.