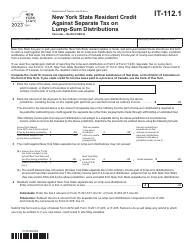

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-112-R

for the current year.

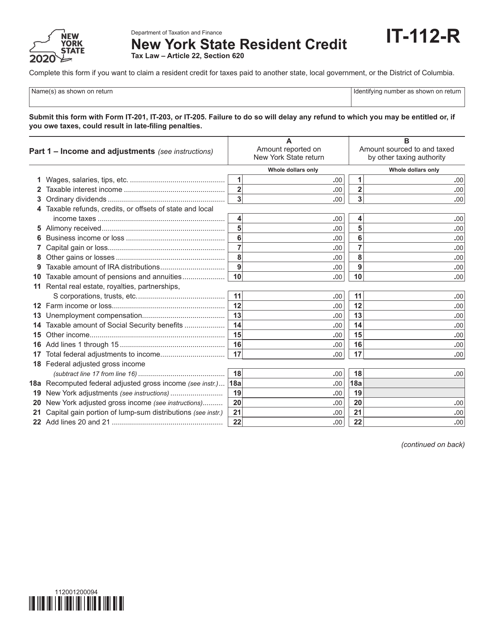

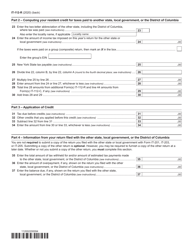

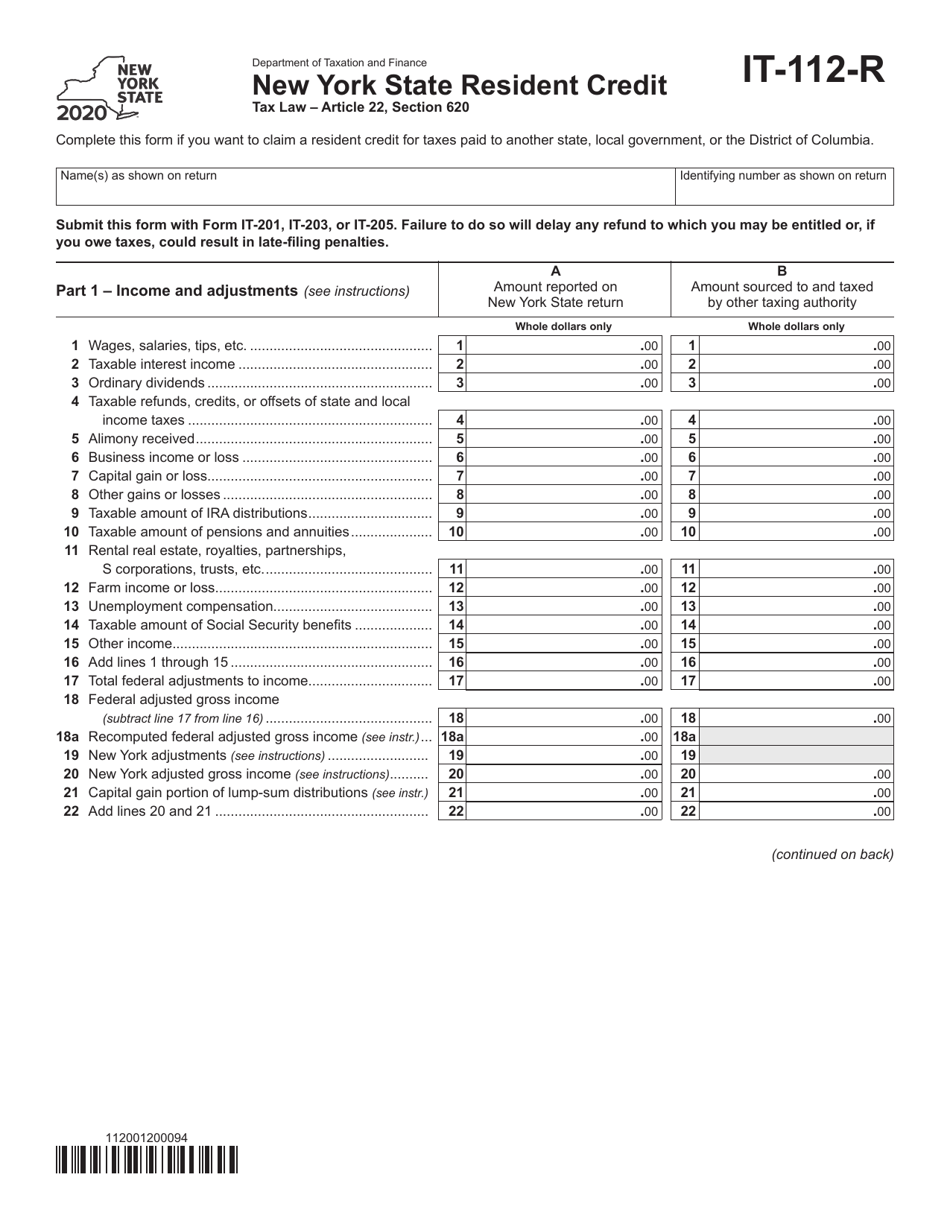

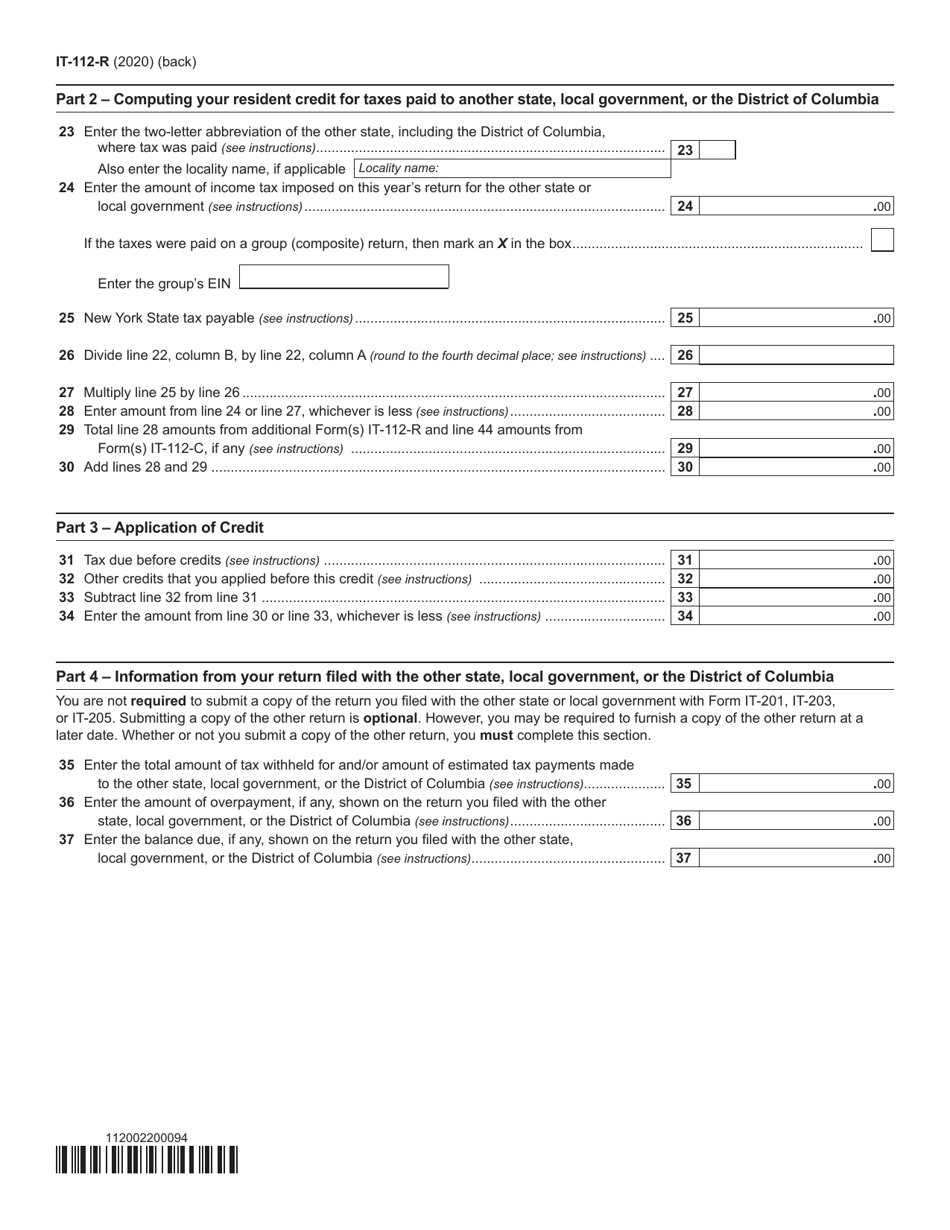

Form IT-112-R New York State Resident Credit - New York

What Is Form IT-112-R?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-112-R?

A: Form IT-112-R is a New York State tax form for claiming the New York State Resident Credit.

Q: Who can use Form IT-112-R?

A: Form IT-112-R can be used by New York residents who paid taxes to another state or local jurisdiction.

Q: What is the purpose of Form IT-112-R?

A: The purpose of Form IT-112-R is to calculate and claim a credit for taxes paid to another state or local jurisdiction.

Q: What information is required on Form IT-112-R?

A: You will need to provide information about your residency status, the taxes paid to another state or local jurisdiction, and any other relevant details.

Q: How do I file Form IT-112-R?

A: Form IT-112-R can be filed electronically or by mail. Instructions for filing are included with the form.

Q: When is the deadline for filing Form IT-112-R?

A: The deadline for filing Form IT-112-R is the same as the deadline for filing your New York State tax return.

Q: Is there a fee for filing Form IT-112-R?

A: No, there is no fee for filing Form IT-112-R.

Q: Can I claim the New York State Resident Credit if I didn't pay taxes to another state or local jurisdiction?

A: No, the New York State Resident Credit is only available if you paid taxes to another state or local jurisdiction.

Q: Can I file Form IT-112-R electronically?

A: Yes, you can file Form IT-112-R electronically if you choose to e-file your New York State tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-112-R by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.