This version of the form is not currently in use and is provided for reference only. Download this version of

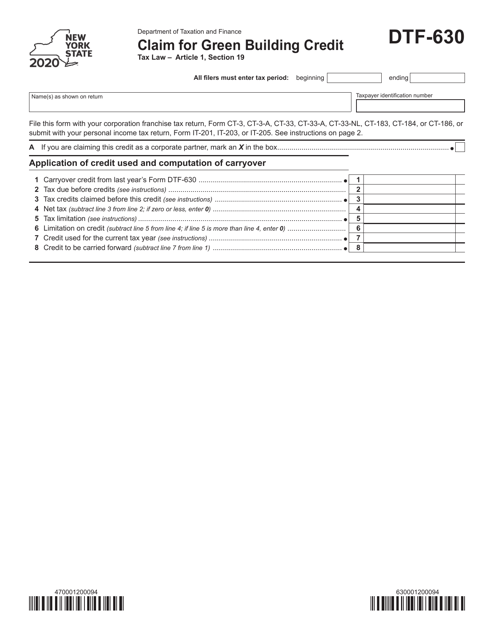

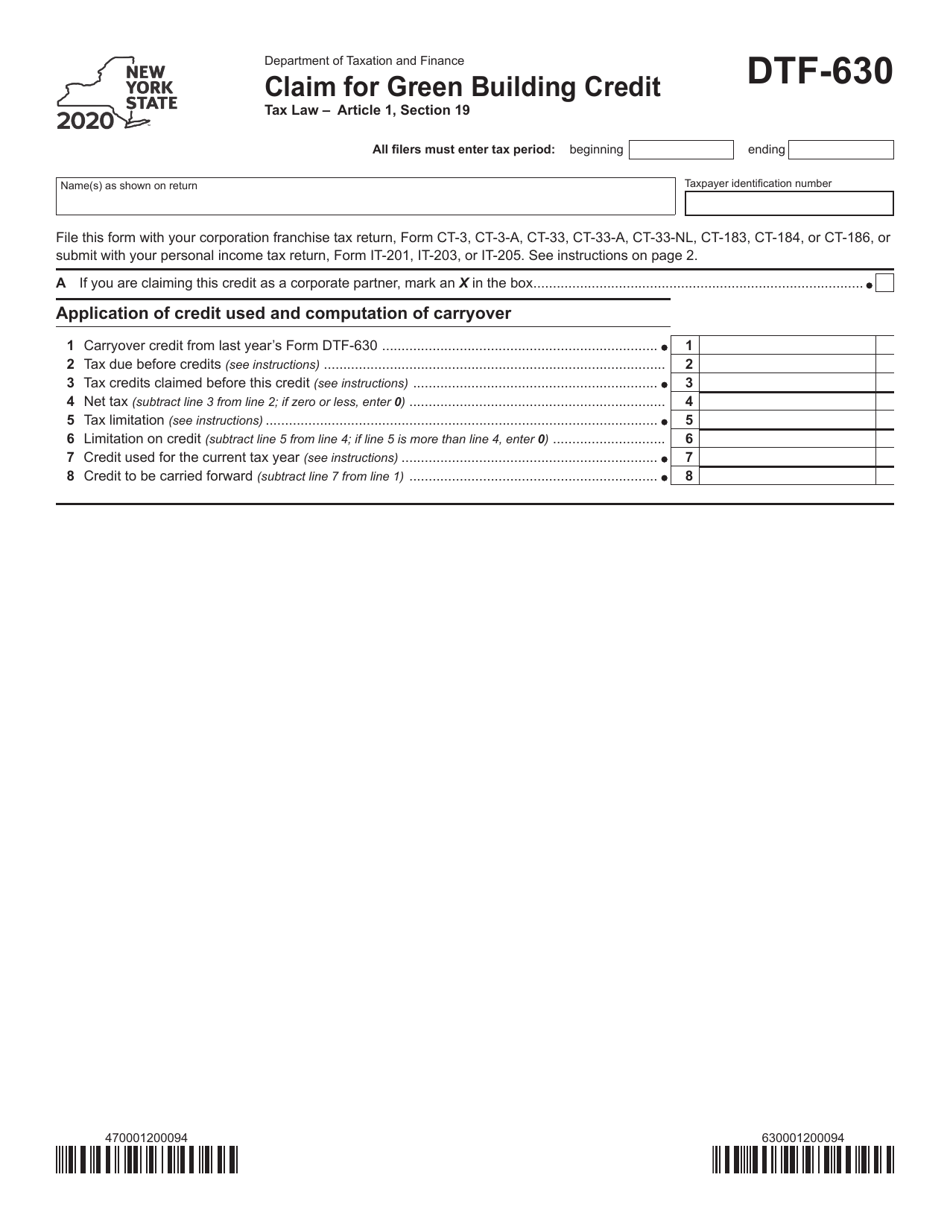

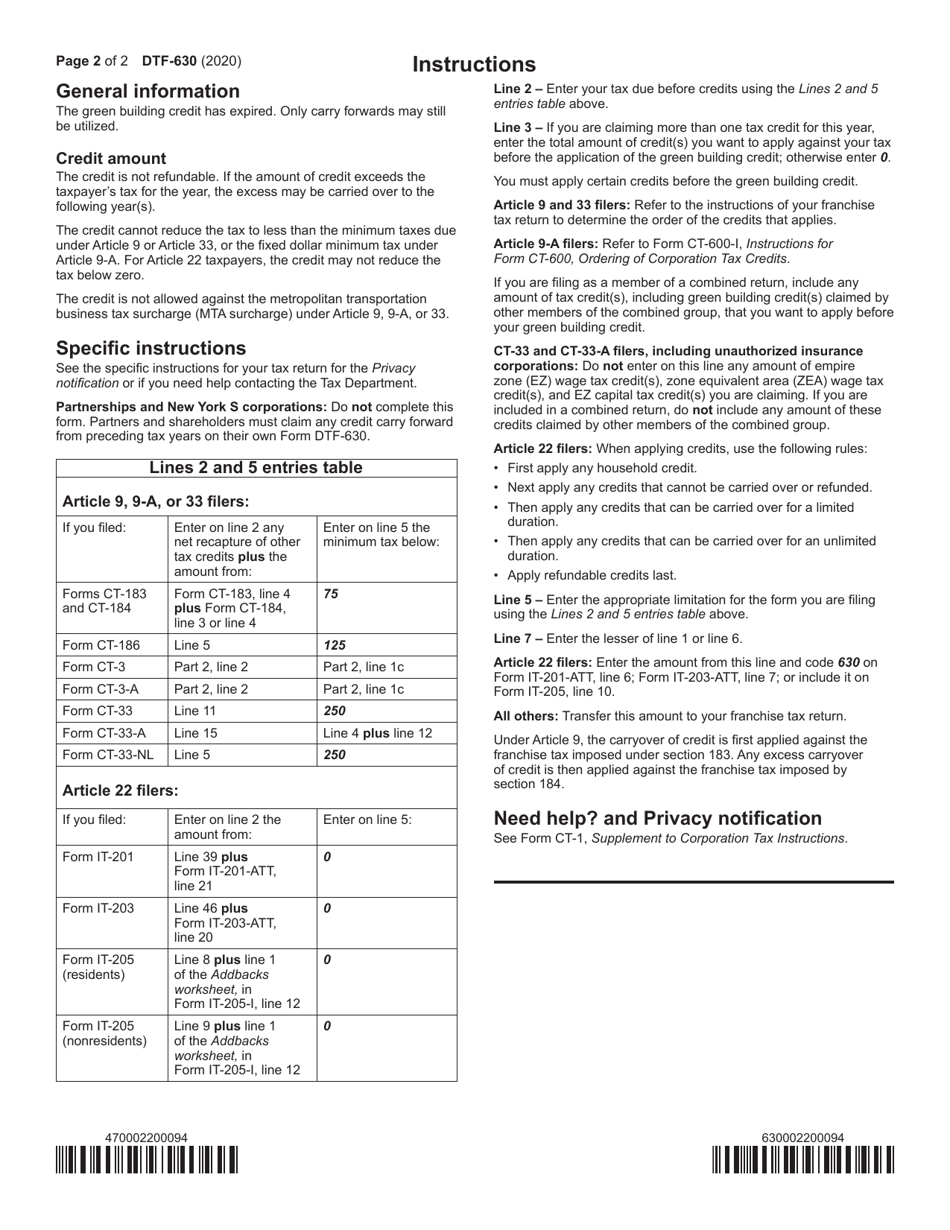

Form DTF-630

for the current year.

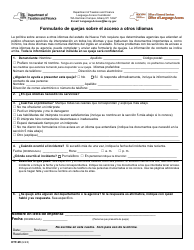

Form DTF-630 Claim for Green Building Credit - New York

What Is Form DTF-630?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-630?

A: Form DTF-630 is a claim form used to apply for the Green Building Credit in New York.

Q: What is the Green Building Credit?

A: The Green Building Credit is a tax credit offered in New York for qualifying energy-efficient construction.

Q: Who can file Form DTF-630?

A: Any taxpayer who has engaged in energy-efficient construction in New York can file Form DTF-630.

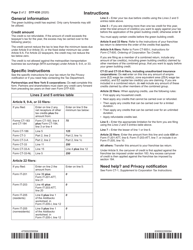

Q: What information is required on Form DTF-630?

A: Form DTF-630 requires information about the taxpayer, the project, and details about the energy-efficient construction.

Q: What is the deadline to file Form DTF-630?

A: The deadline to file Form DTF-630 is typically 30 days after the completion of the energy-efficient construction project.

Q: Are there any fees associated with filing Form DTF-630?

A: No, there are no fees associated with filing Form DTF-630.

Q: Is the Green Building Credit refundable?

A: No, the Green Building Credit is a non-refundable tax credit.

Q: Can the Green Building Credit be carried forward?

A: Yes, any unused portion of the Green Building Credit can be carried forward for five years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-630 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.