This version of the form is not currently in use and is provided for reference only. Download this version of

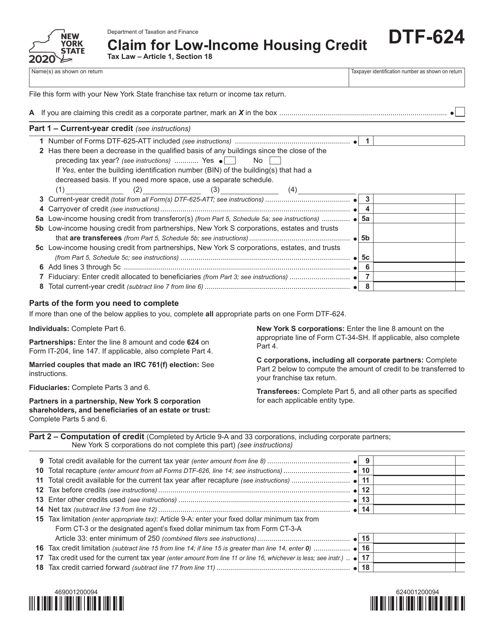

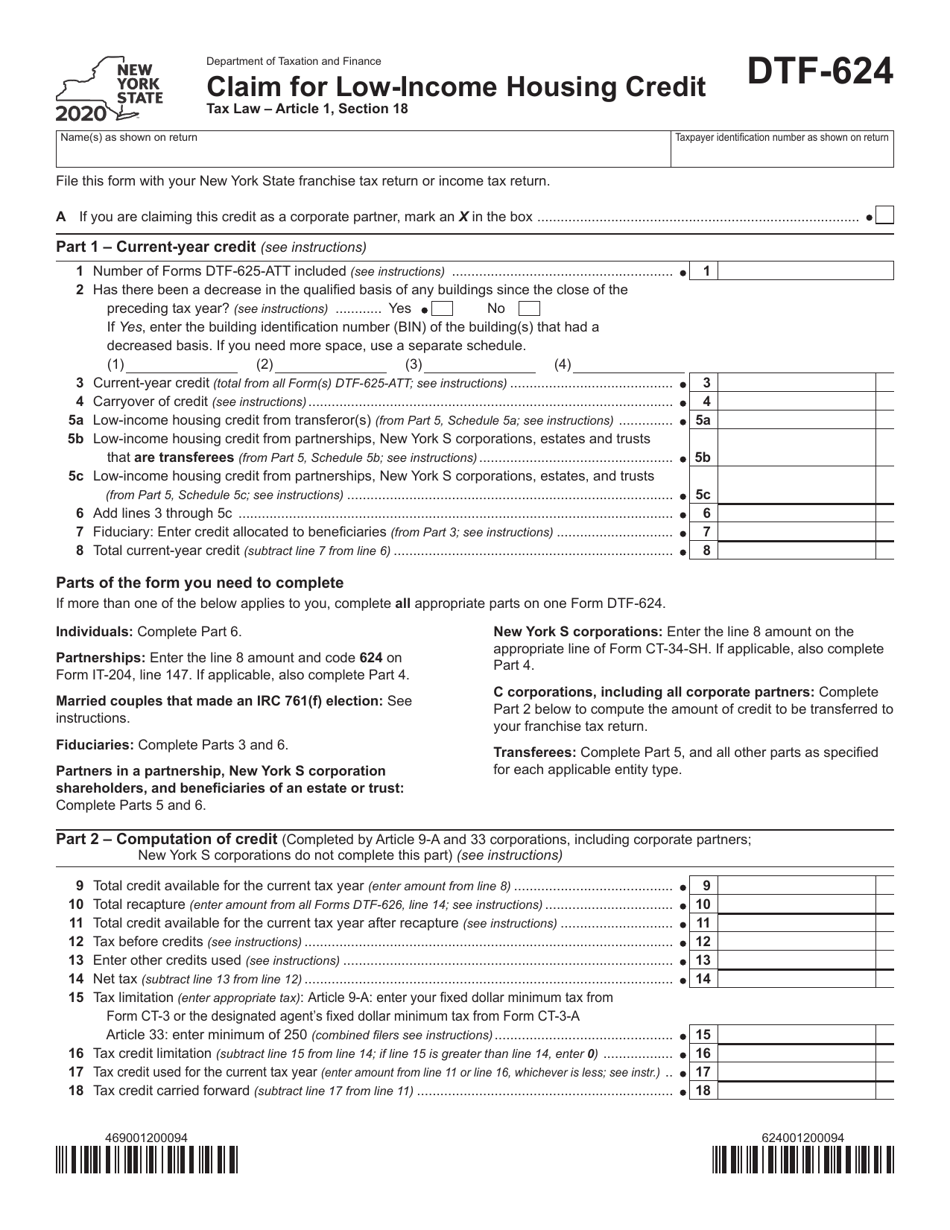

Form DTF-624

for the current year.

Form DTF-624 Claim for Low-Income Housing Credit - New York

What Is Form DTF-624?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-624?

A: Form DTF-624 is a claim for the Low-Income Housing Credit in New York.

Q: Who can use Form DTF-624?

A: Individuals and businesses involved in low-income housing projects in New York can use Form DTF-624.

Q: What is the purpose of the Low-Income Housing Credit?

A: The Low-Income Housing Credit is aimed at increasing the availability of affordable housing for low-income individuals and families.

Q: Are there any eligibility requirements to claim the Low-Income Housing Credit?

A: Yes, there are specific requirements regarding the location, rent, and income level of the tenants in the low-income housing project.

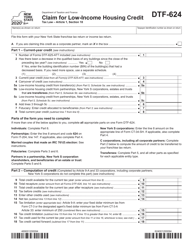

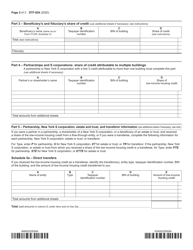

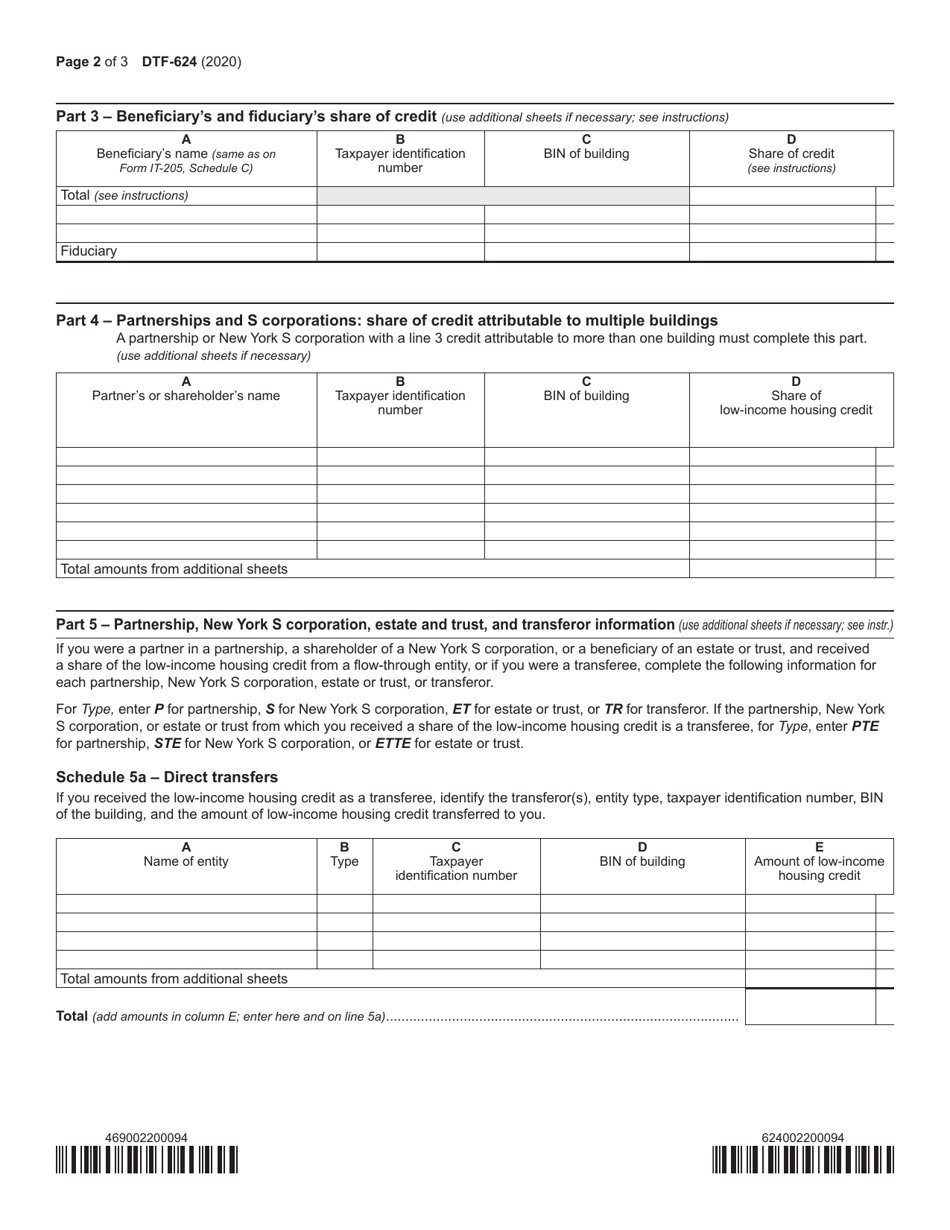

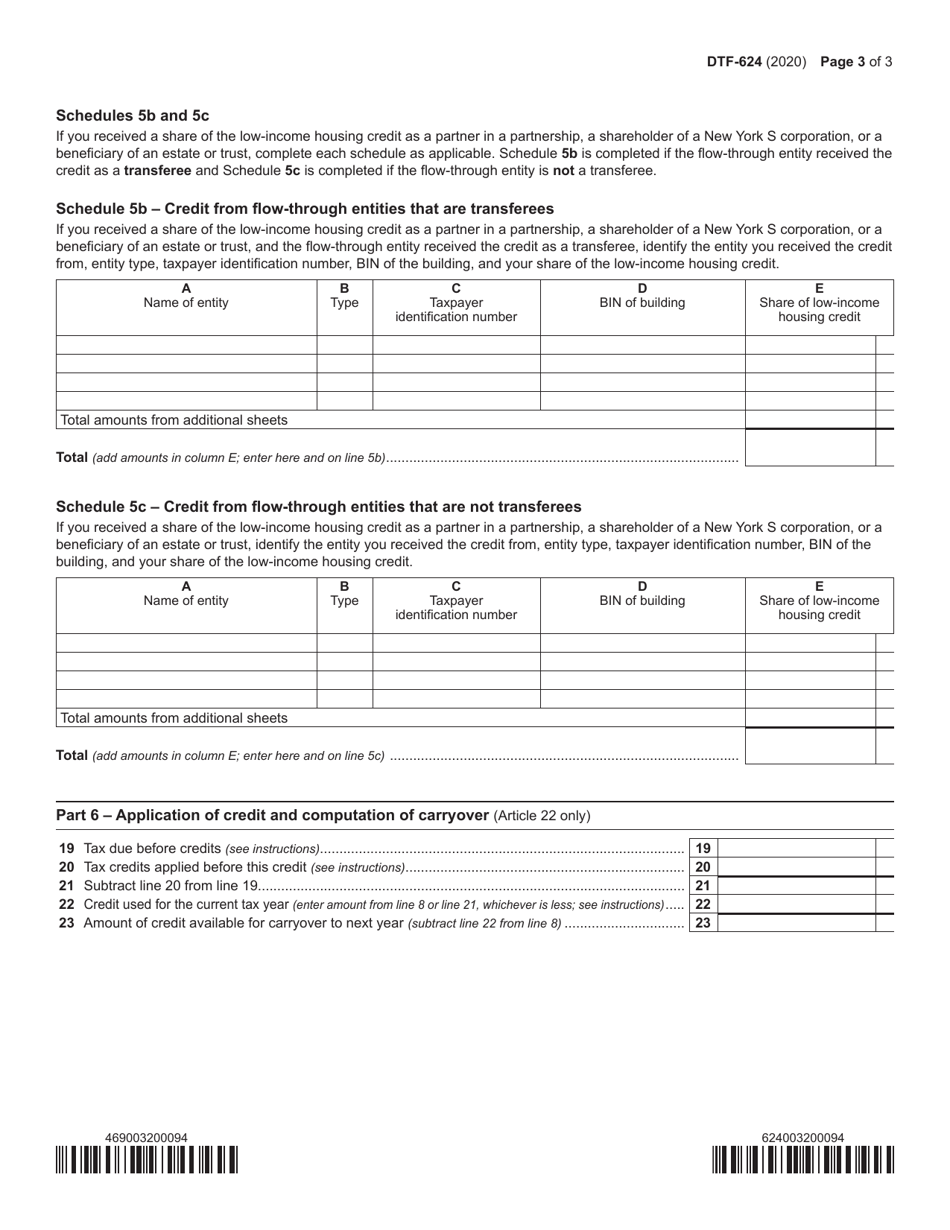

Q: What information is required on Form DTF-624?

A: Form DTF-624 requires information about the low-income housing project, the number of low-income units, and the calculation of the credit.

Q: When is Form DTF-624 due?

A: Form DTF-624 is typically due on the same date as your New York state tax return, which is usually April 15th.

Q: Can I e-file Form DTF-624?

A: Yes, you can e-file Form DTF-624 using approved software or a tax professional.

Q: Is there a fee to file Form DTF-624?

A: No, there is no fee to file Form DTF-624.

Q: Who should I contact for assistance with Form DTF-624?

A: You can contact the New York State Department of Taxation and Finance for assistance with Form DTF-624.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-624 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.