This version of the form is not currently in use and is provided for reference only. Download this version of

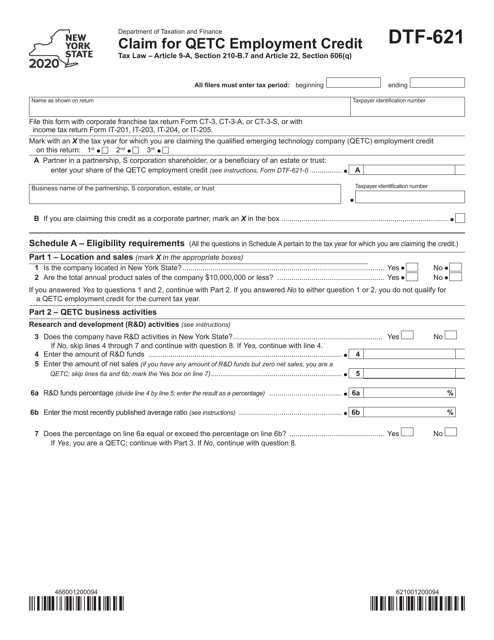

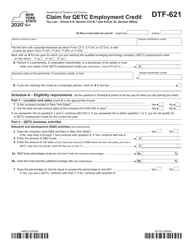

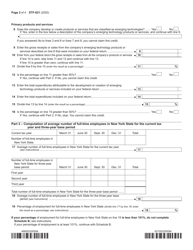

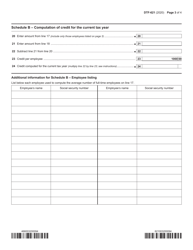

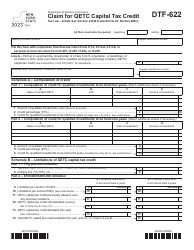

Form DTF-621

for the current year.

Form DTF-621 Claim for Qetc Employment Credit - New York

What Is Form DTF-621?

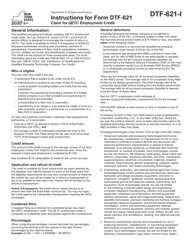

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-621?

A: Form DTF-621 is the claim form for claiming the QETC Employment Credit in New York.

Q: What is the QETC Employment Credit?

A: The QETC Employment Credit is a tax credit in New York for qualified emerging technology companies (QETCs) that create new jobs.

Q: Who can file Form DTF-621?

A: QETCs that meet the eligibility requirements can file Form DTF-621.

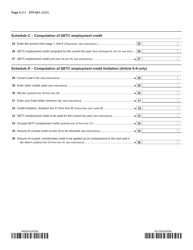

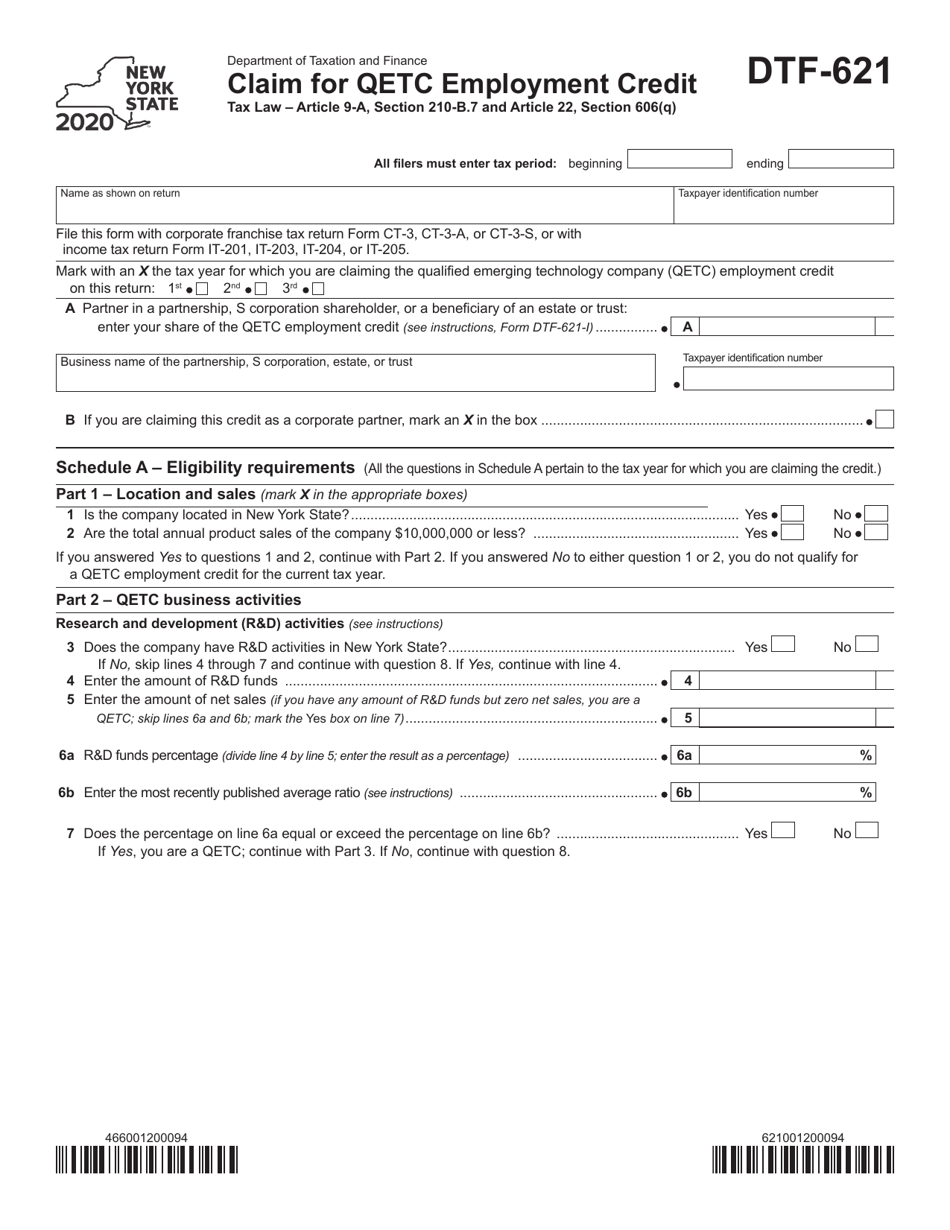

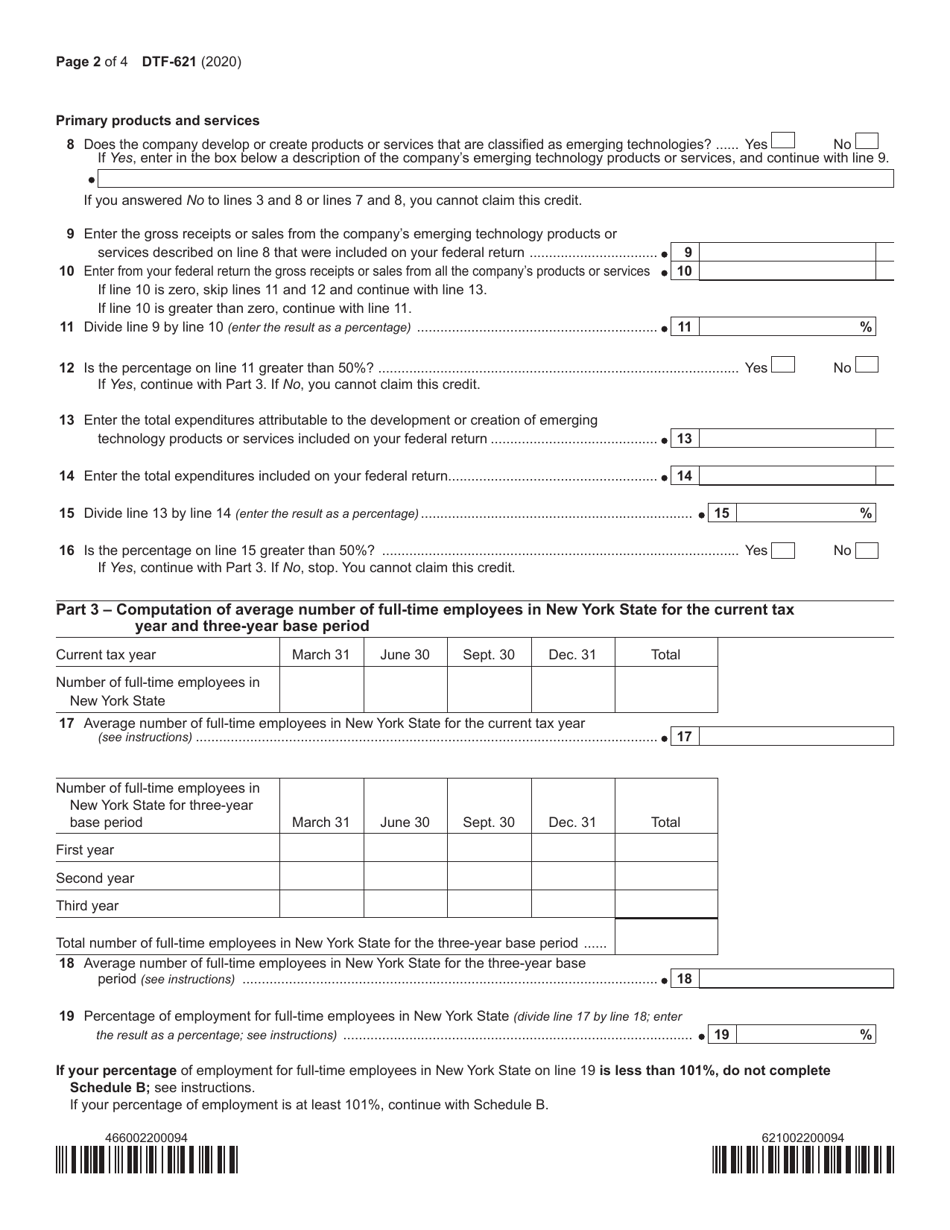

Q: What are the eligibility requirements for the QETC Employment Credit?

A: To be eligible for the QETC Employment Credit, a company must be certified as a QETC by Empire State Development and meet certain job creation and wage requirements.

Q: What are the benefits of claiming the QETC Employment Credit?

A: Claiming the QETC Employment Credit can result in reduced taxes for qualified QETCs and help stimulate job creation and economic growth.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-621 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.