This version of the form is not currently in use and is provided for reference only. Download this version of

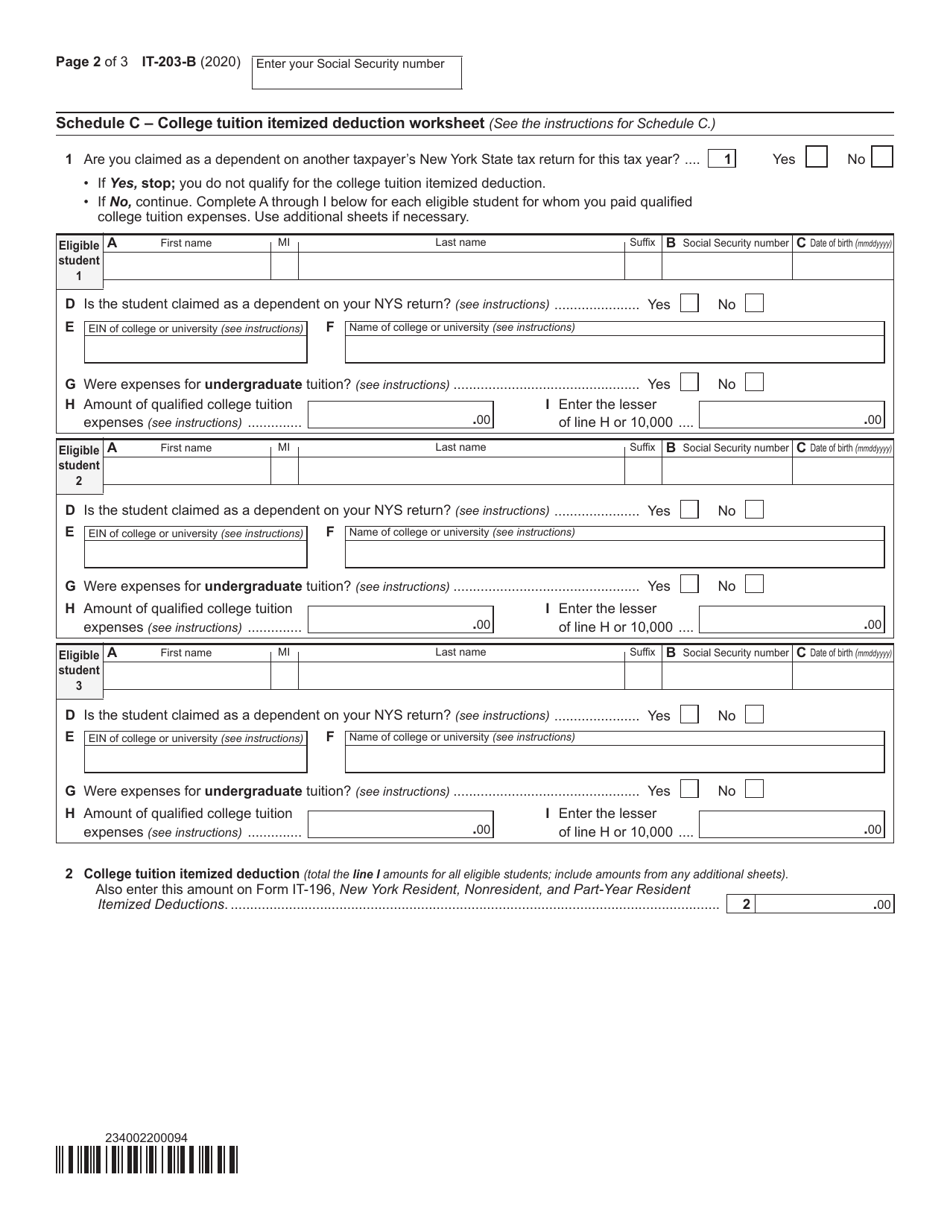

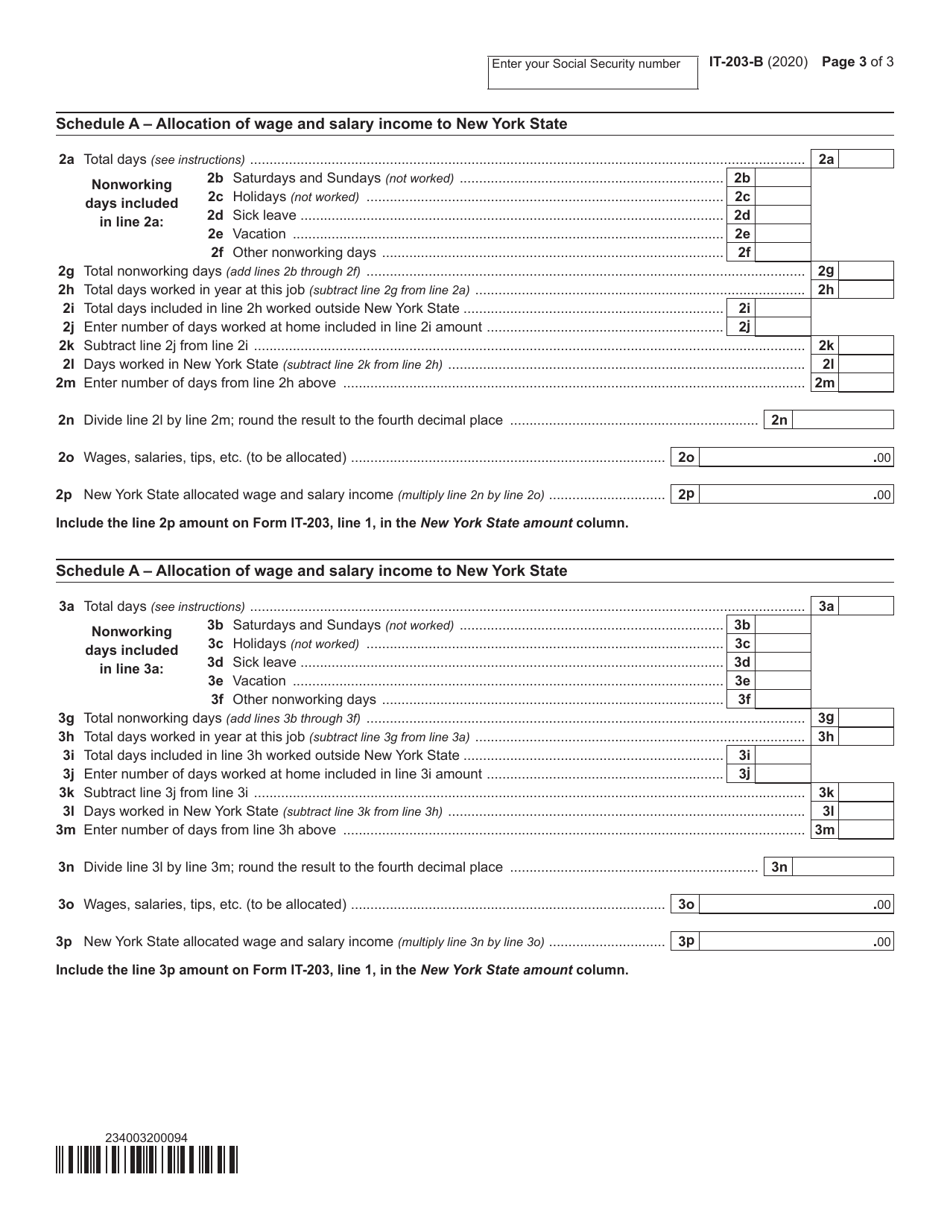

Form IT-203-B

for the current year.

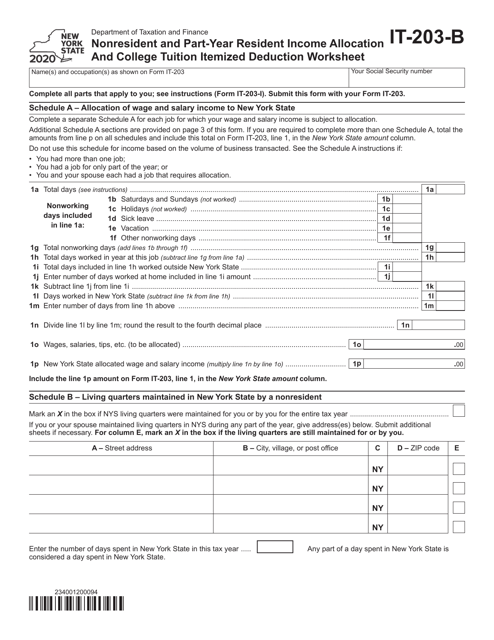

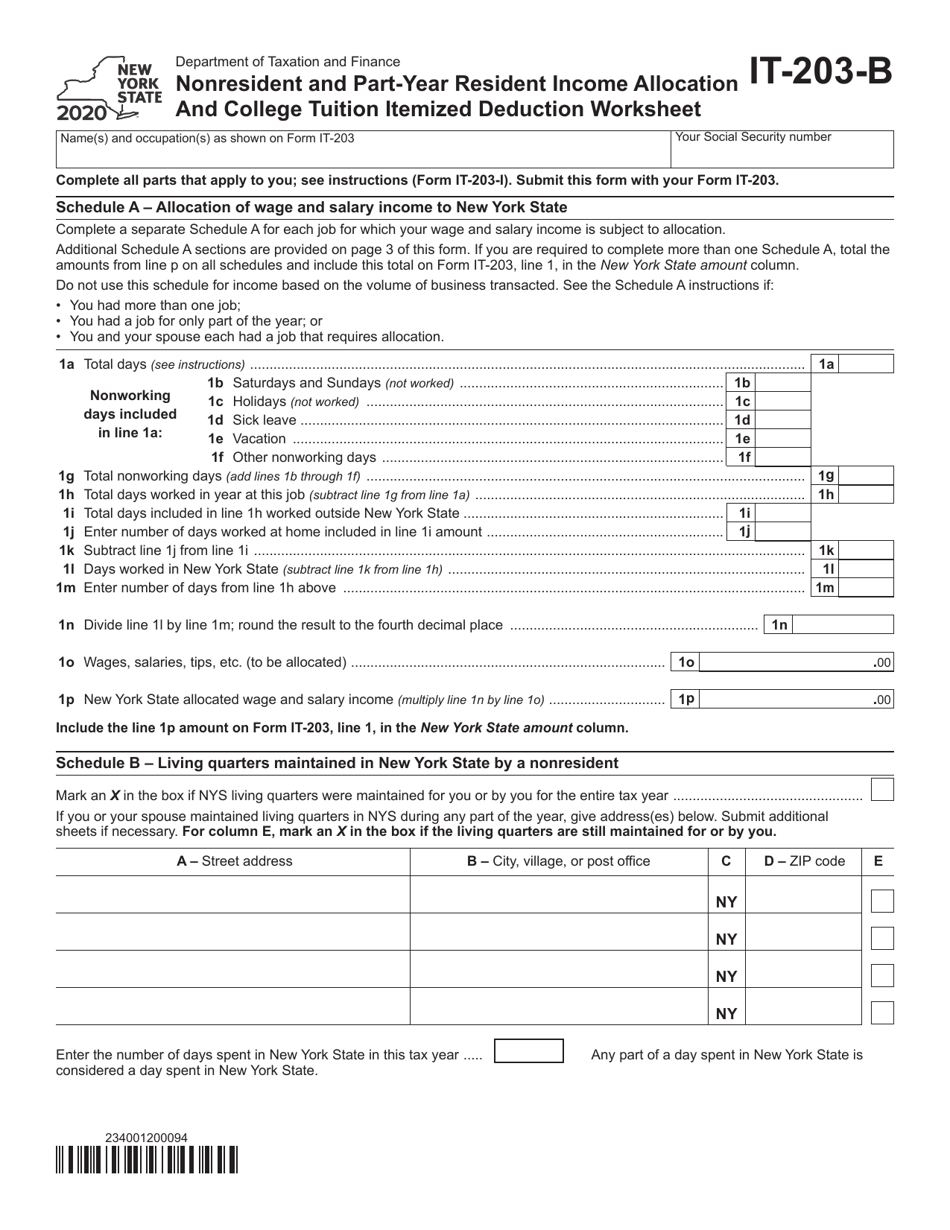

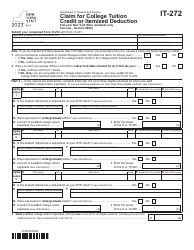

Form IT-203-B Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet - New York

What Is Form IT-203-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-B?

A: Form IT-203-B is the Nonresident and Part-Year Resident Income Allocation and College TuitionItemized Deduction Worksheet in New York.

Q: Who should use Form IT-203-B?

A: Form IT-203-B should be used by nonresidents and part-year residents of New York who need to allocate their income and claim college tuition itemized deductions.

Q: What is the purpose of Form IT-203-B?

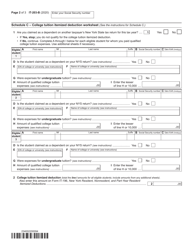

A: Form IT-203-B is used to calculate the allocation of income between New York State and other jurisdictions, as well as claim itemized deductions for college tuition expenses.

Q: What information is required on Form IT-203-B?

A: Form IT-203-B requires information about your New York State income, income from other jurisdictions, and college tuition expenses.

Q: Are there any eligibility requirements for using Form IT-203-B?

A: Yes, you must be a nonresident or part-year resident of New York to use Form IT-203-B.

Q: When is the deadline to file Form IT-203-B?

A: Form IT-203-B must be filed by the due date of your New York State tax return, which is usually April 15th.

Q: Can Form IT-203-B be filed electronically?

A: No, Form IT-203-B cannot be filed electronically. It must be mailed to the New York State Department of Taxation and Finance.

Q: What should I do if I have questions about Form IT-203-B?

A: If you have questions about Form IT-203-B, you should contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.