This version of the form is not currently in use and is provided for reference only. Download this version of

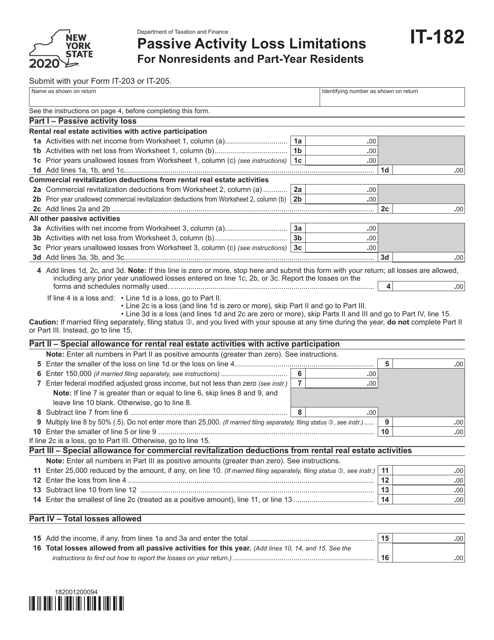

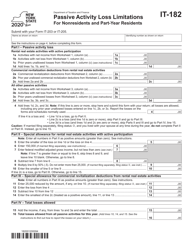

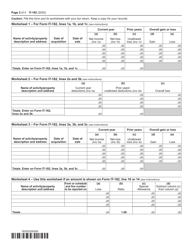

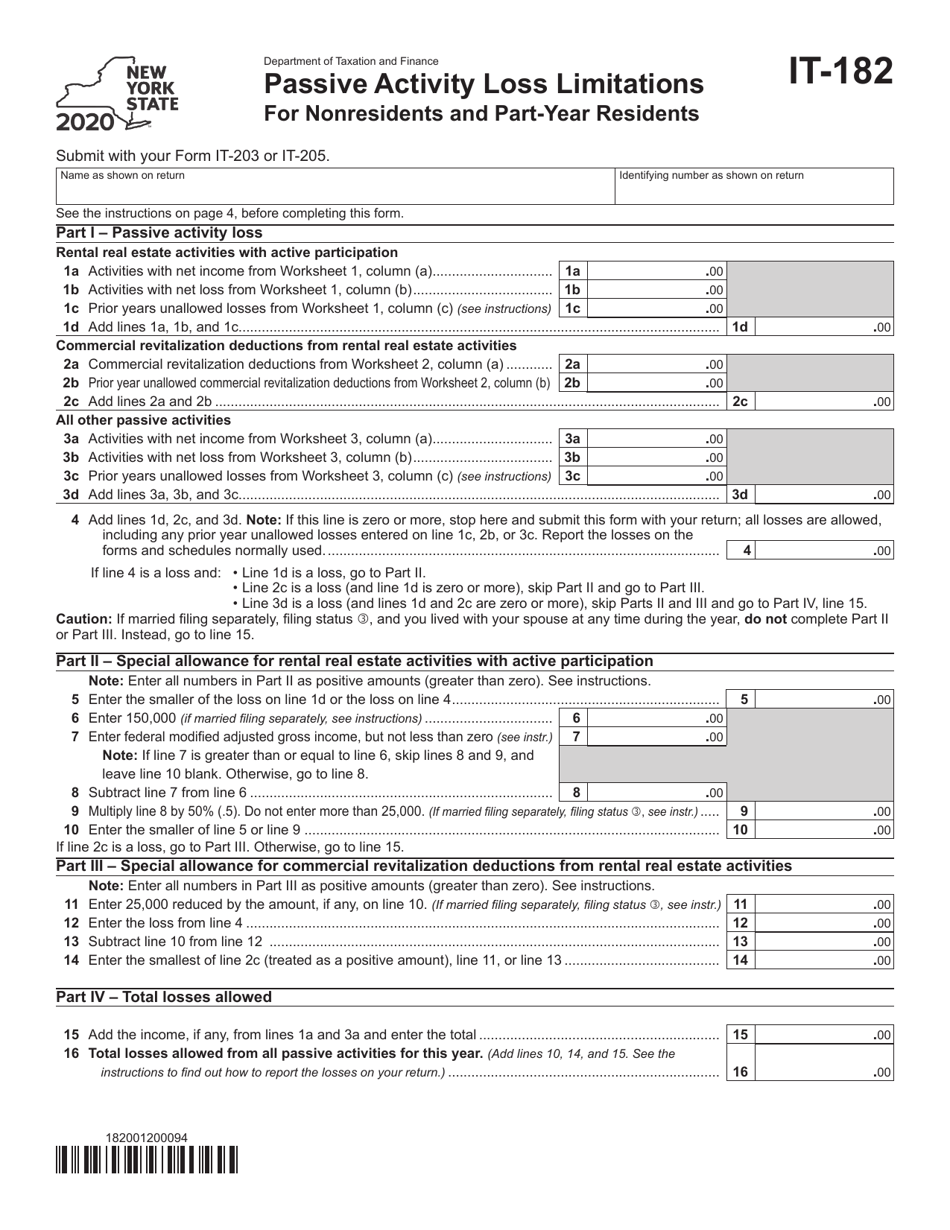

Form IT-182

for the current year.

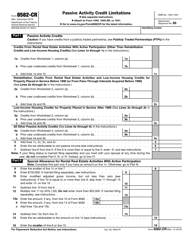

Form IT-182 Passive Activity Loss Limitations - New York

What Is Form IT-182?

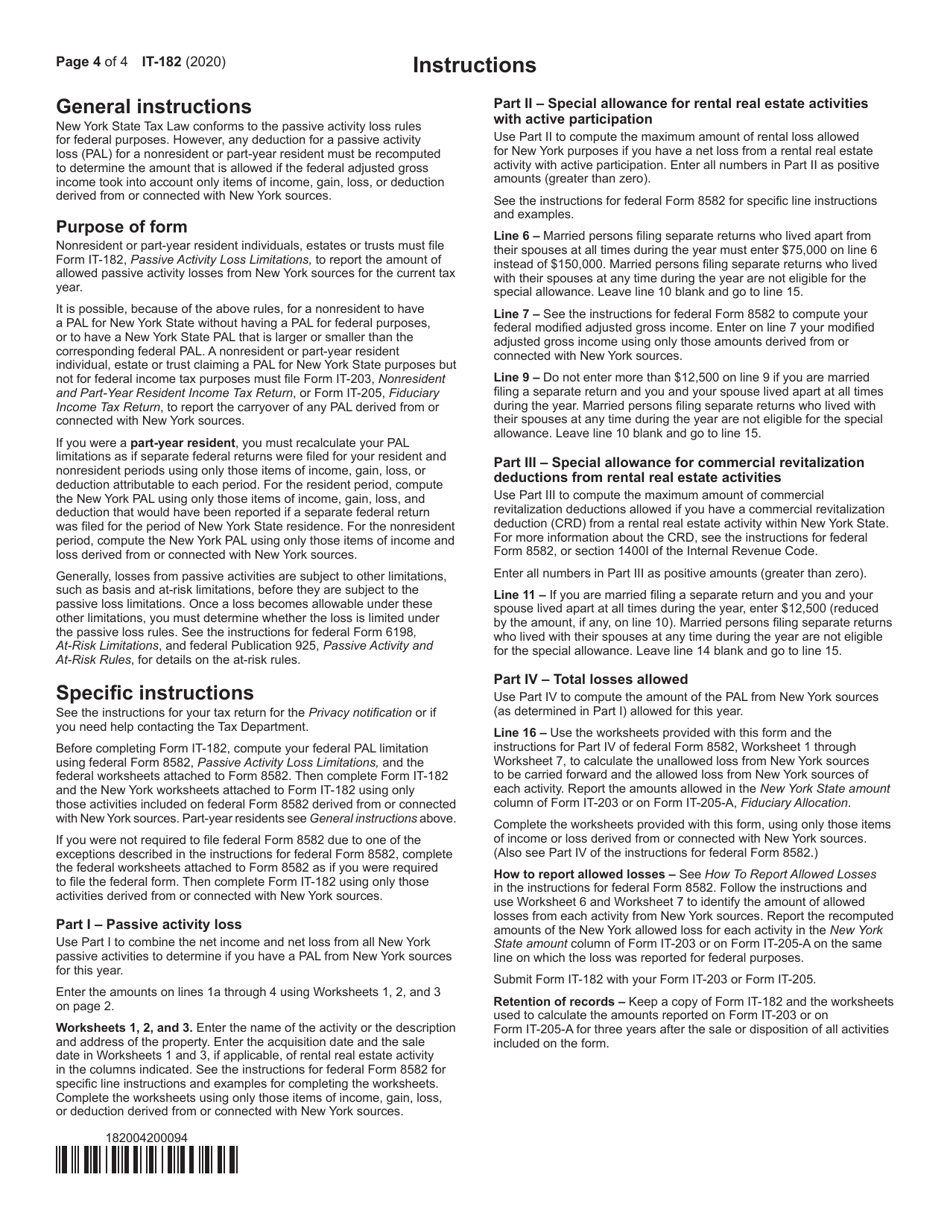

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-182?

A: Form IT-182 is a tax form used in New York to calculate passive activity loss limitations.

Q: What are passive activity loss limitations?

A: Passive activity loss limitations are rules that restrict the ability to deduct losses from passive activities, such as rental properties or investments.

Q: Who needs to file Form IT-182?

A: Taxpayers in New York who have passive activity losses or credits need to file Form IT-182.

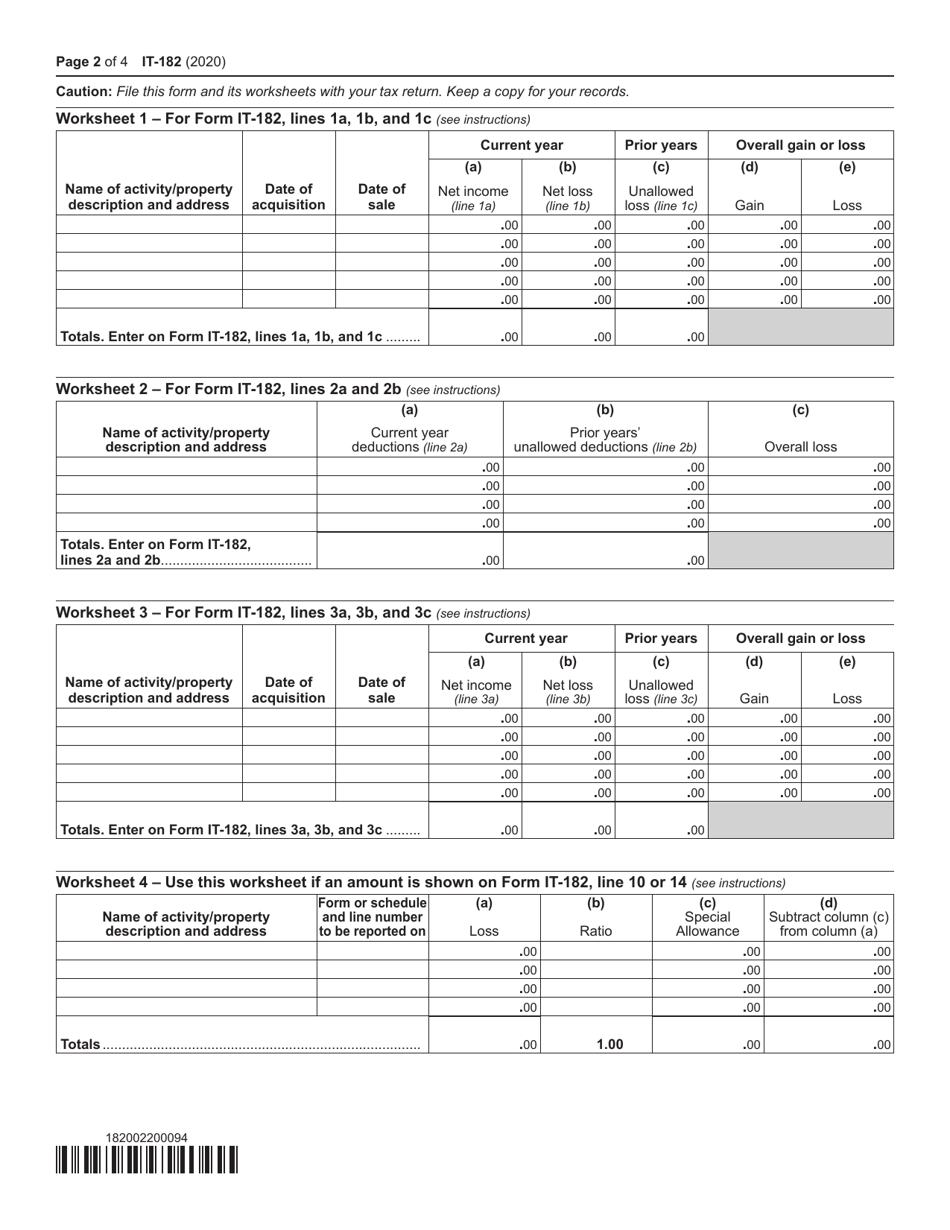

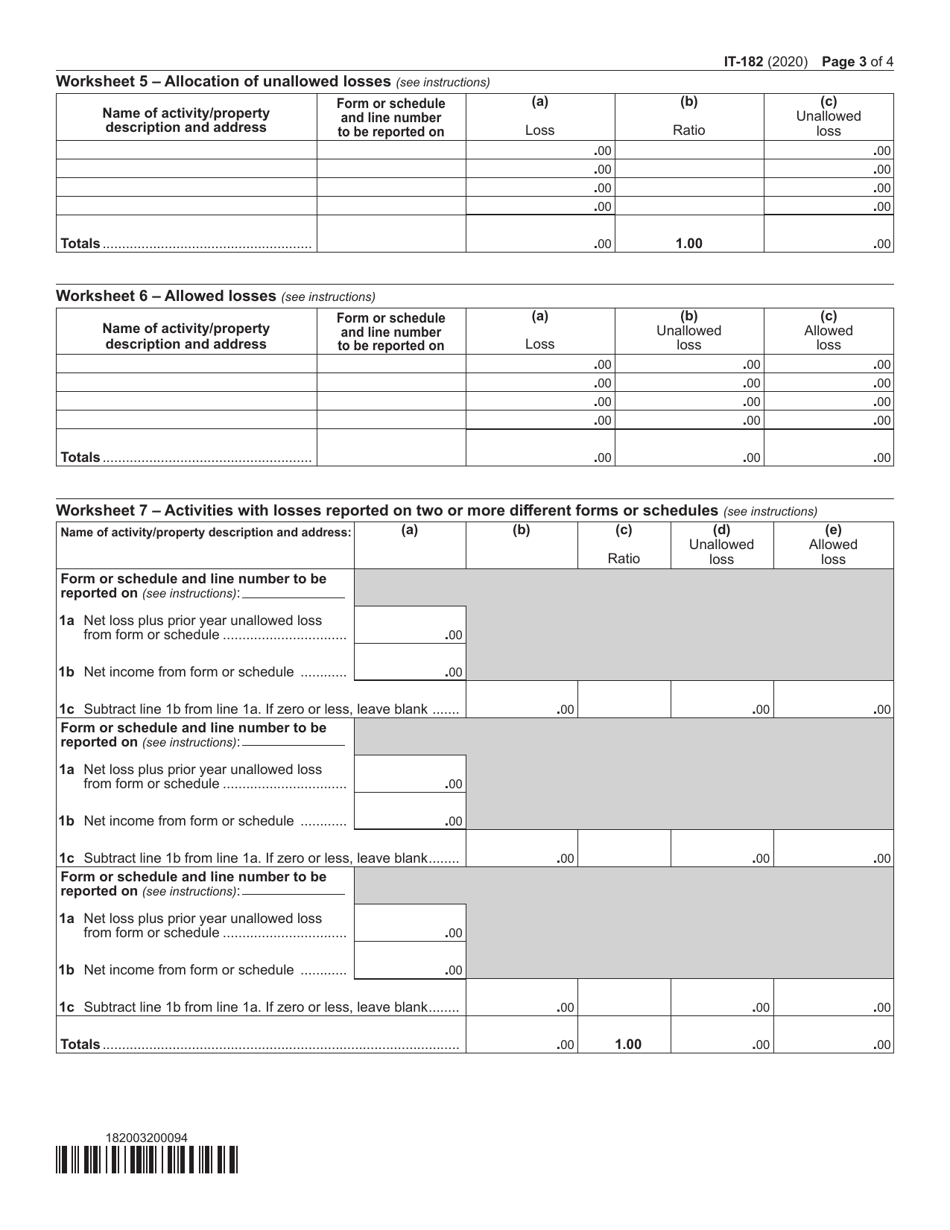

Q: How do I calculate passive activity loss limitations?

A: Passive activity loss limitations are based on your income and the amount of your passive losses or credits.

Q: When is the deadline to file Form IT-182?

A: The deadline to file Form IT-182 is the same as the deadline for filing your New York state tax return, which is usually April 15th.

Q: Can I e-file Form IT-182?

A: Yes, you can e-file Form IT-182 if you are filing your New York state tax return electronically.

Q: Are there any penalties for late filing?

A: Yes, if you file Form IT-182 late or fail to file it, you may be subject to penalties and interest.

Q: Is there any help available for filling out Form IT-182?

A: Yes, the New York State Department of Taxation and Finance provides instructions and assistance for filling out Form IT-182.

Q: Can I use Form IT-182 for federal tax purposes?

A: No, Form IT-182 is specific to New York state tax purposes and cannot be used for federal tax purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-182 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.