This version of the form is not currently in use and is provided for reference only. Download this version of

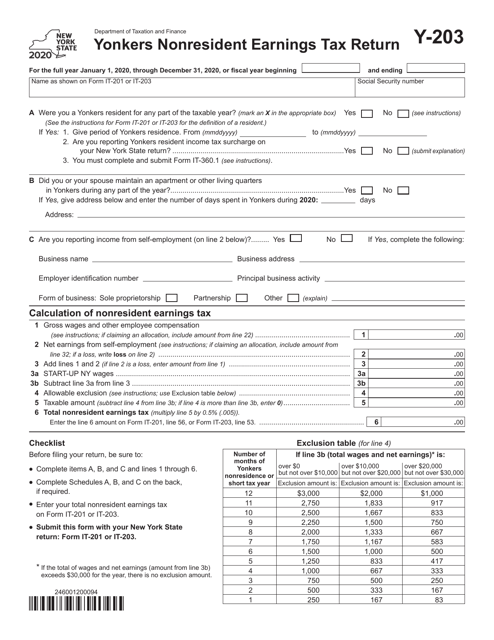

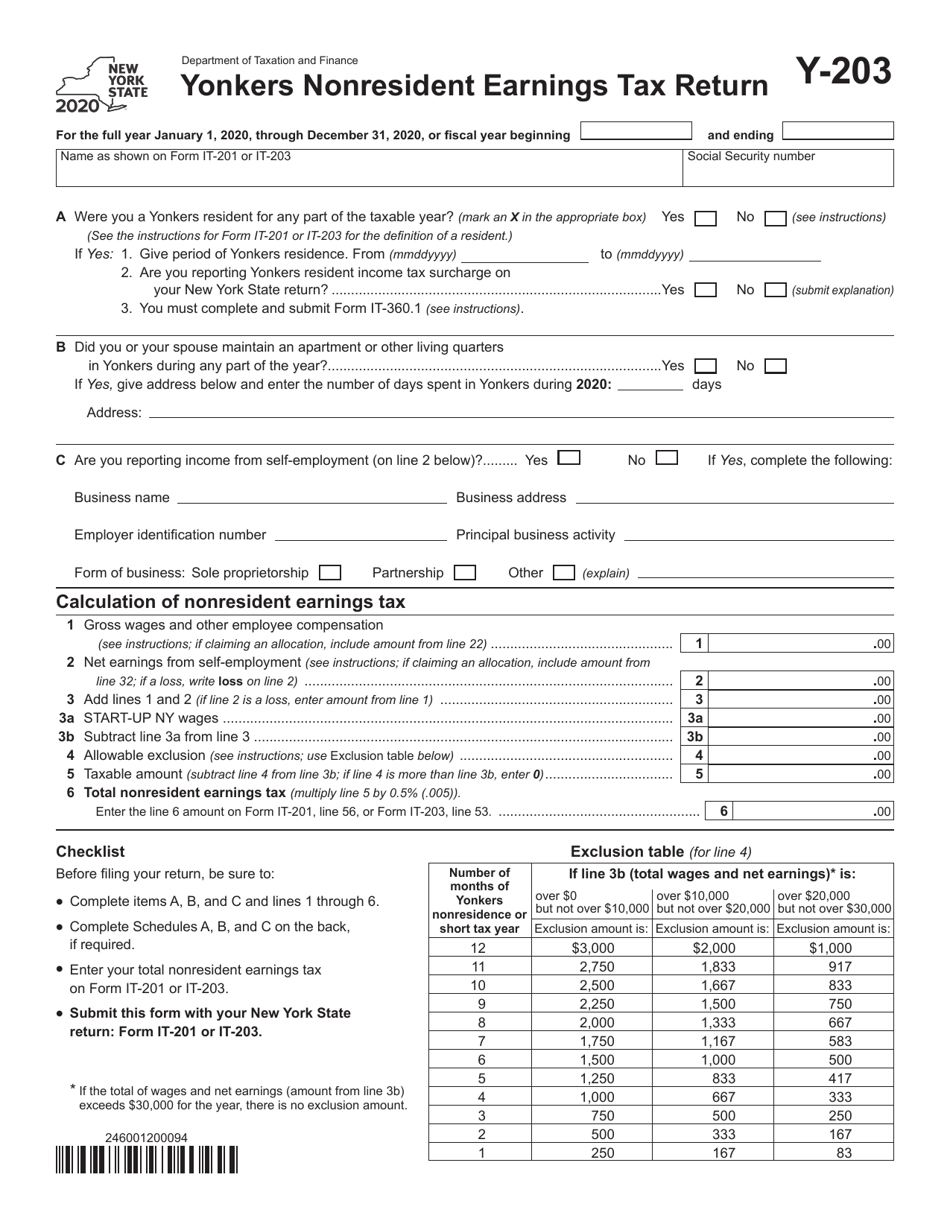

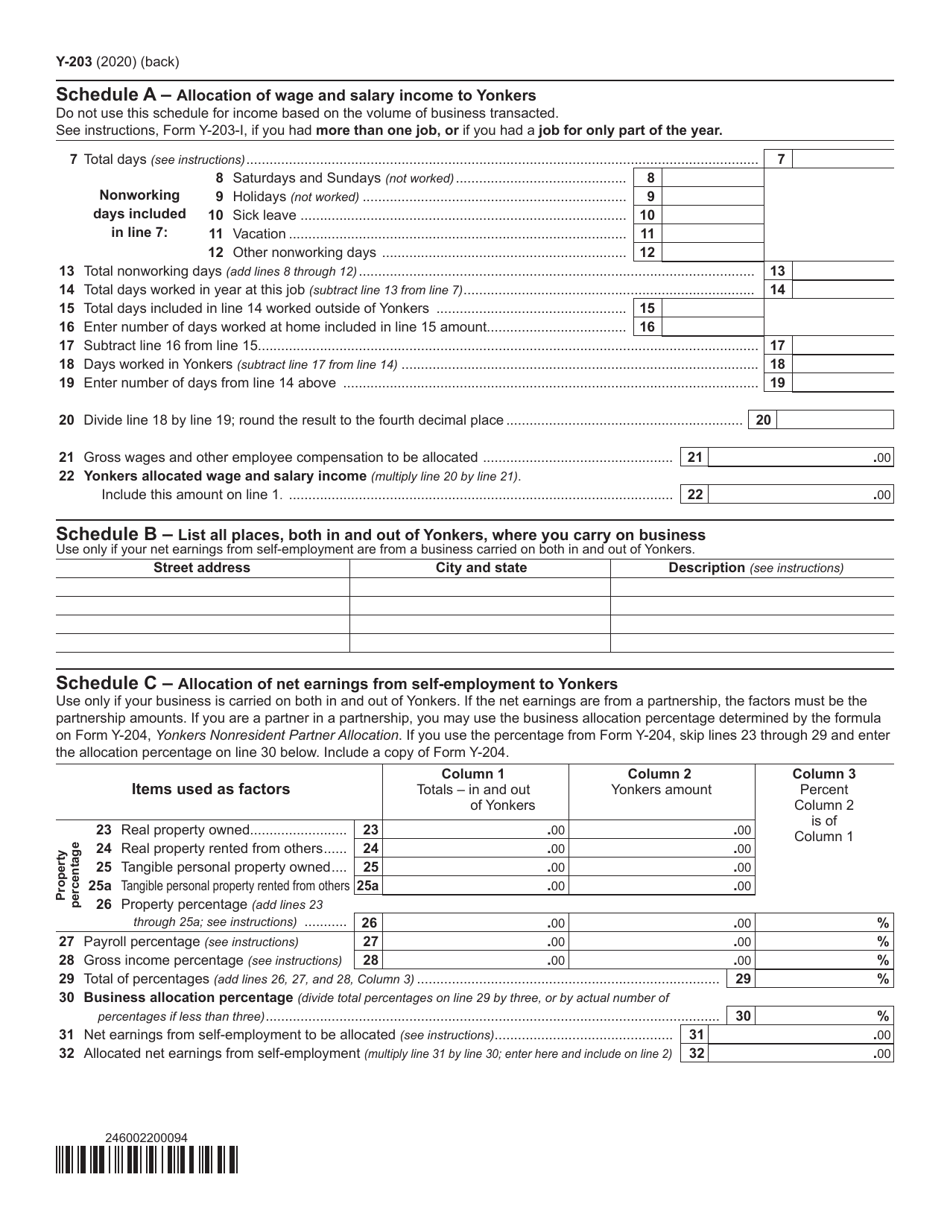

Form Y-203

for the current year.

Form Y-203 Yonkers Nonresident Earnings Tax Return - New York

What Is Form Y-203?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form Y-203?

A: Form Y-203 is the Yonkers Nonresident Earnings Tax Return for individuals who are not residents of Yonkers, New York.

Q: Who needs to file Form Y-203?

A: Nonresidents of Yonkers, New York who earned income in Yonkers during the tax year need to file Form Y-203.

Q: What is the purpose of Form Y-203?

A: The purpose of Form Y-203 is to report and pay the Yonkers nonresident earnings tax on income earned in Yonkers, New York.

Q: When is Form Y-203 due?

A: Form Y-203 is due on or before April 15th of each year.

Q: Is Form Y-203 only for individuals?

A: Yes, Form Y-203 is only for individuals who are nonresidents of Yonkers, New York.

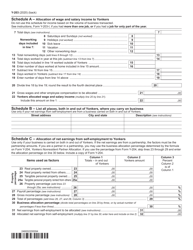

Q: Are there any exemptions or credits available on Form Y-203?

A: Yes, there are certain exemptions and credits available on Form Y-203. Eligibility depends on various factors, such as income level and filing status.

Q: What happens if I don't file Form Y-203?

A: If you are required to file Form Y-203 and fail to do so, you may face penalties and interest on any unpaid tax amounts.

Q: Do I need to file Form Y-203 if I had no income in Yonkers?

A: If you had no income in Yonkers, you do not need to file Form Y-203.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Y-203 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.