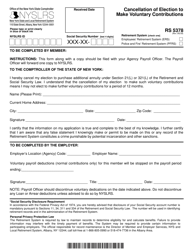

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-227

for the current year.

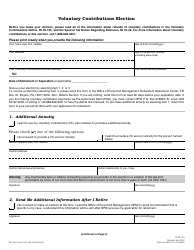

Form IT-227 New York State Voluntary Contributions - New York

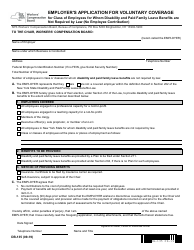

What Is Form IT-227?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-227?

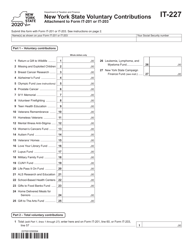

A: Form IT-227 is the New York State Voluntary Contributions form.

Q: What is the purpose of Form IT-227?

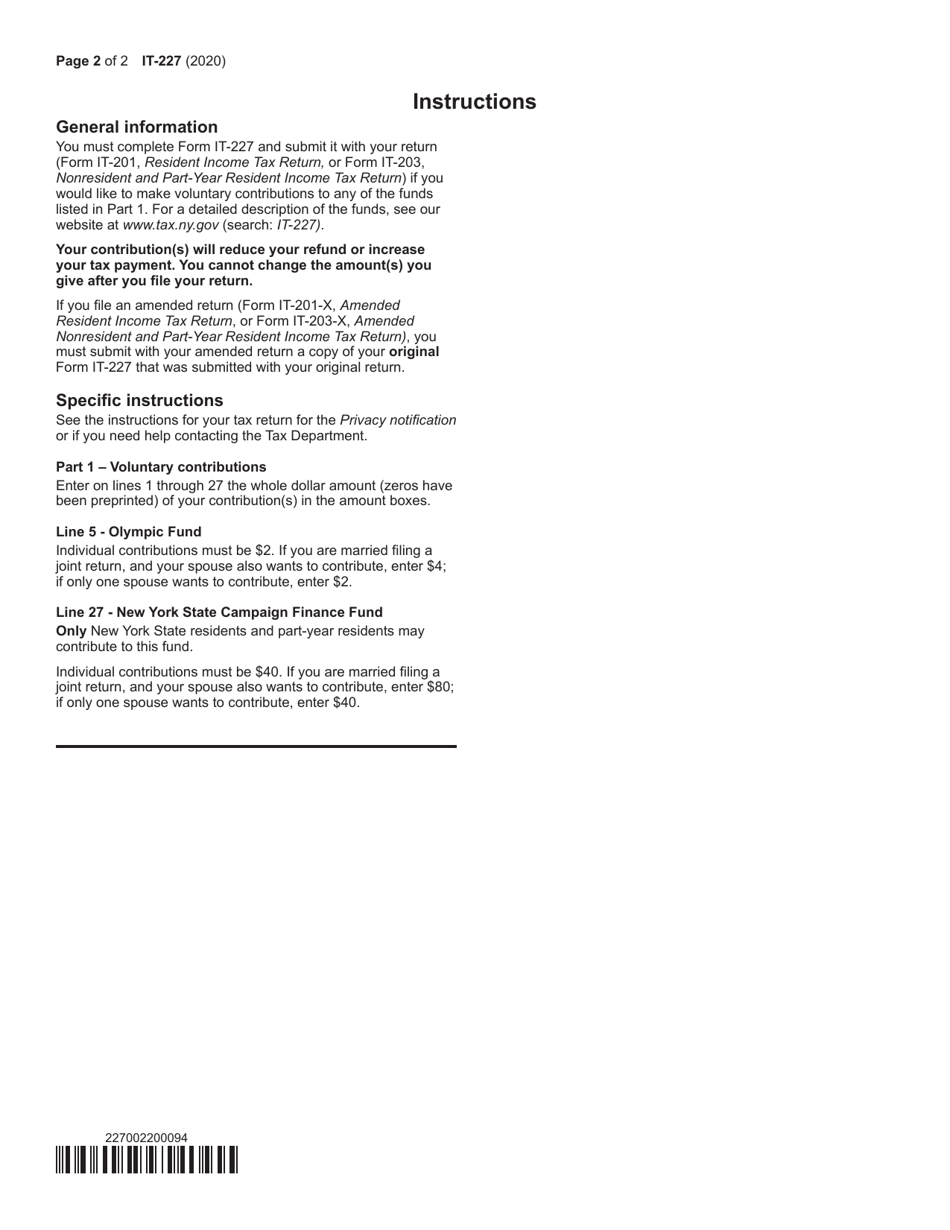

A: The purpose of Form IT-227 is to allow taxpayers to make voluntary contributions to specified charitable funds in New York State.

Q: Who can use Form IT-227?

A: Any individual or business taxpayer in New York State can use Form IT-227 to make voluntary contributions.

Q: What charitable funds can I contribute to using Form IT-227?

A: You can contribute to a variety of charitable funds listed on Form IT-227, such as the Cancer Research Fund, the Veterans' Memorial and Museum Fund, and the Alzheimer's Disease Fund, among others.

Q: How do I use Form IT-227?

A: To use Form IT-227, you must fill out the form, indicate the amount you want to contribute to each fund, and include it with your New York State tax return.

Q: Are contributions made through Form IT-227 tax-deductible?

A: Yes, contributions made through Form IT-227 are generally tax-deductible, subject to certain limitations.

Q: Is Form IT-227 mandatory?

A: No, Form IT-227 is voluntary, and you are not required to make contributions.

Q: Can I contribute to multiple funds using Form IT-227?

A: Yes, you can contribute to multiple funds by indicating the amount you want to contribute to each fund on the form.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-227 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.