This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-201-ATT

for the current year.

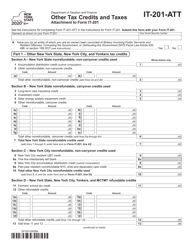

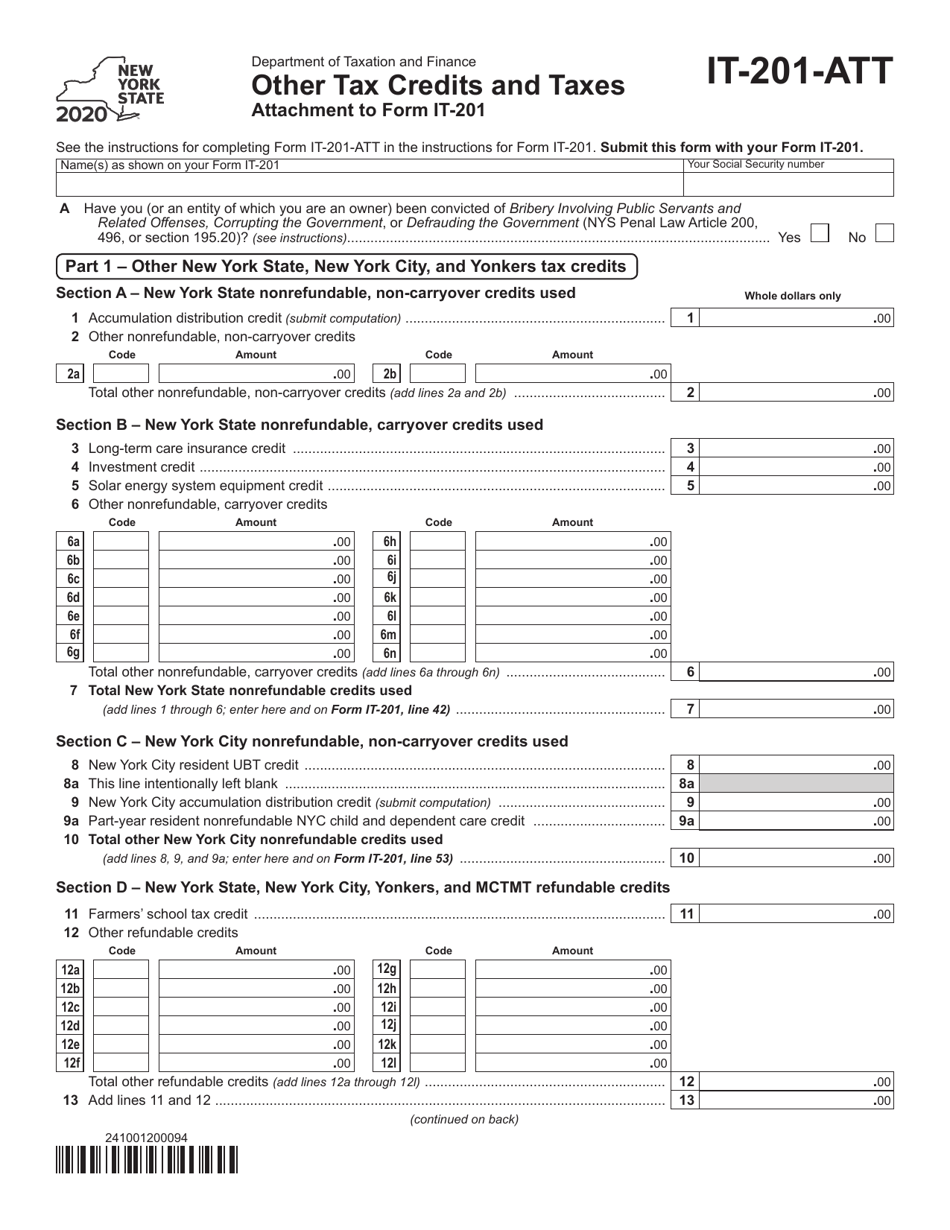

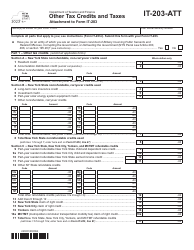

Form IT-201-ATT Other Tax Credits and Taxes - New York

What Is Form IT-201-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-201-ATT?

A: Form IT-201-ATT is a supplemental form used in New York to report other tax credits and taxes.

Q: What is the purpose of Form IT-201-ATT?

A: The purpose of Form IT-201-ATT is to calculate and report various tax credits and taxes that are not included on the main Form IT-201.

Q: What kinds of tax credits and taxes are reported on Form IT-201-ATT?

A: Form IT-201-ATT is used to report credits and taxes such as the solar energy system equipment credit, the wine production credit, the environmental remediationinsurance credit, and others.

Q: Is Form IT-201-ATT required for every taxpayer in New York?

A: No, Form IT-201-ATT is not required for every taxpayer. It is only necessary if you have certain tax credits or taxes to report.

Q: When is the deadline for filing Form IT-201-ATT?

A: The deadline for filing Form IT-201-ATT is the same as the deadline for filing the main Form IT-201, which is usually April 15th.

Q: Are there any additional forms that need to be filed with Form IT-201-ATT?

A: It depends on the specific credits and taxes being reported. Some credits may require additional documentation or forms.

Q: What should I do if I have questions about filling out Form IT-201-ATT?

A: If you have questions about filling out Form IT-201-ATT, you can contact the New York State Department of Taxation and Finance for assistance.

Q: Can I claim multiple tax credits on Form IT-201-ATT?

A: Yes, you can claim multiple tax credits on Form IT-201-ATT, as long as you meet the eligibility criteria for each credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-201-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.