This version of the form is not currently in use and is provided for reference only. Download this version of

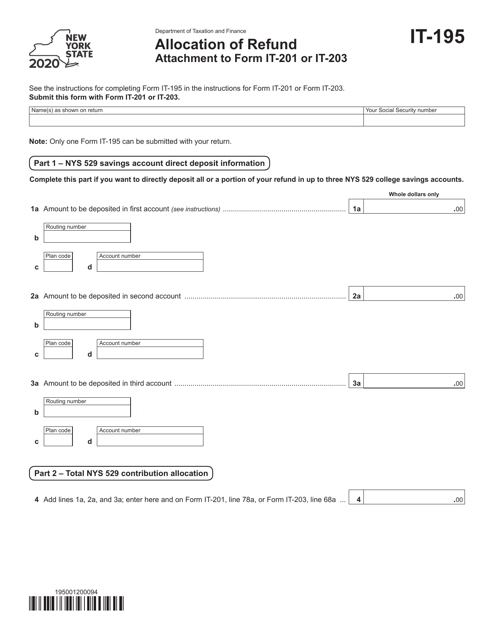

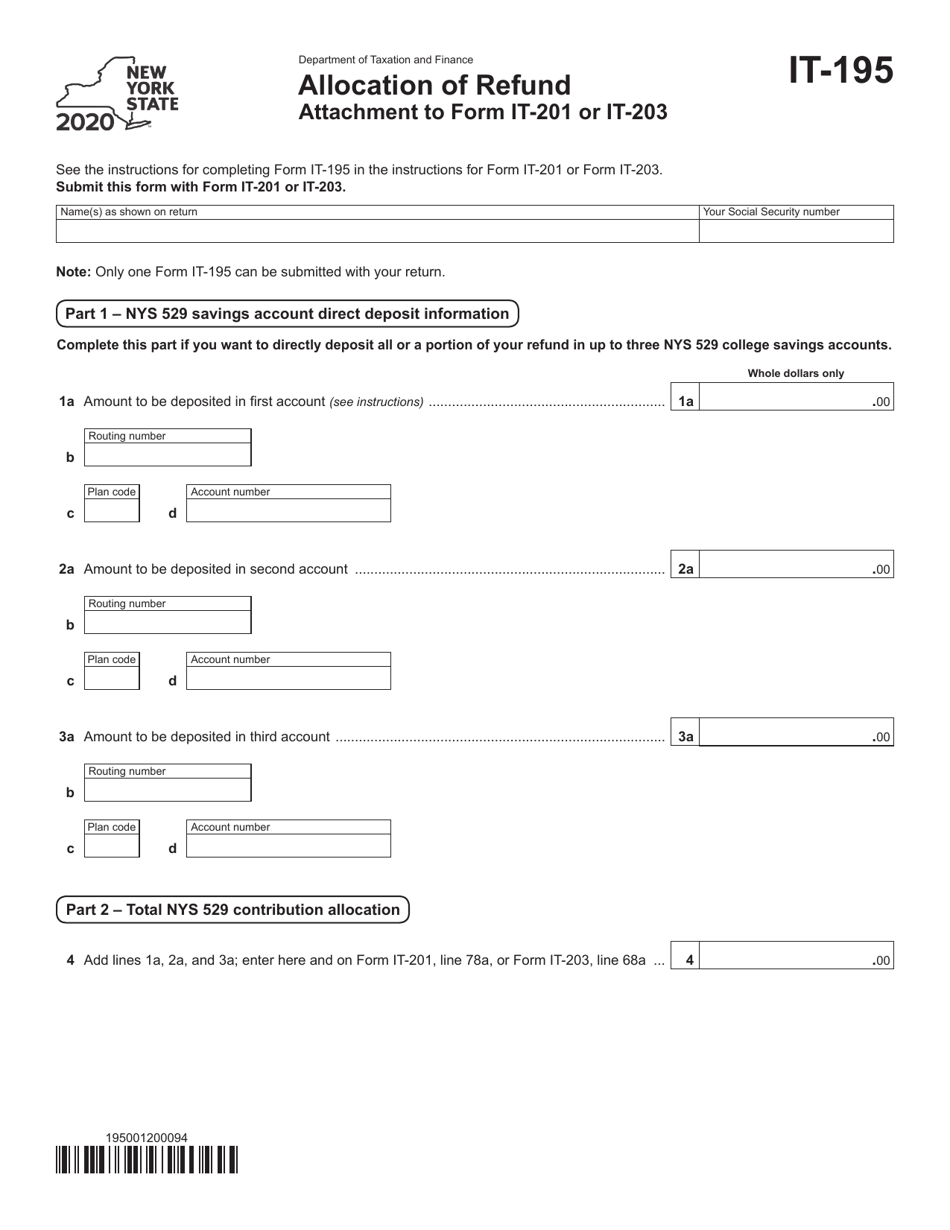

Form IT-195

for the current year.

Form IT-195 Allocation of Refund - New York

What Is Form IT-195?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-195?

A: Form IT-195 is the Allocation of Refund form used by residents of New York.

Q: Who needs to file Form IT-195?

A: Residents of New York who overpaid their state income taxes and want to allocate their refund to other tax liabilities or forms.

Q: What is the purpose of Form IT-195?

A: The purpose of Form IT-195 is to allow taxpayers to specify how their refund should be allocated, such as applying it towards future tax liabilities or requesting a refund on other specific forms.

Q: When is Form IT-195 due?

A: Form IT-195 is typically due at the same time as the New York state income tax return, which is generally April 15th.

Q: Are there any specific instructions for completing Form IT-195?

A: Yes, there are instructions provided with the form that guide taxpayers on how to correctly fill it out.

Q: What should I do if I need help completing Form IT-195?

A: If you need assistance with completing Form IT-195, you can contact the New York State Department of Taxation and Finance or seek help from a tax professional.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-195 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.