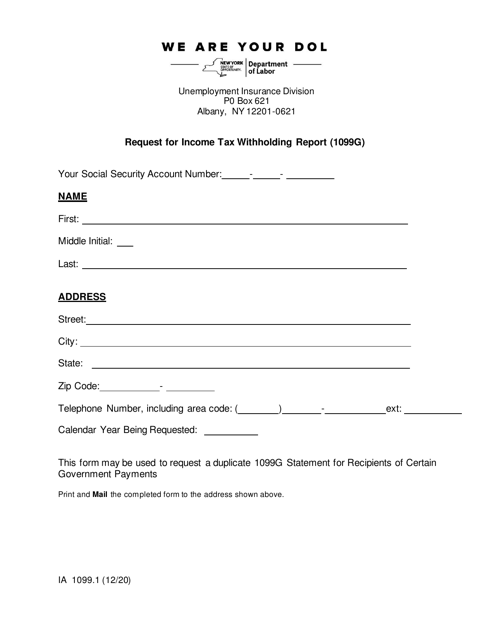

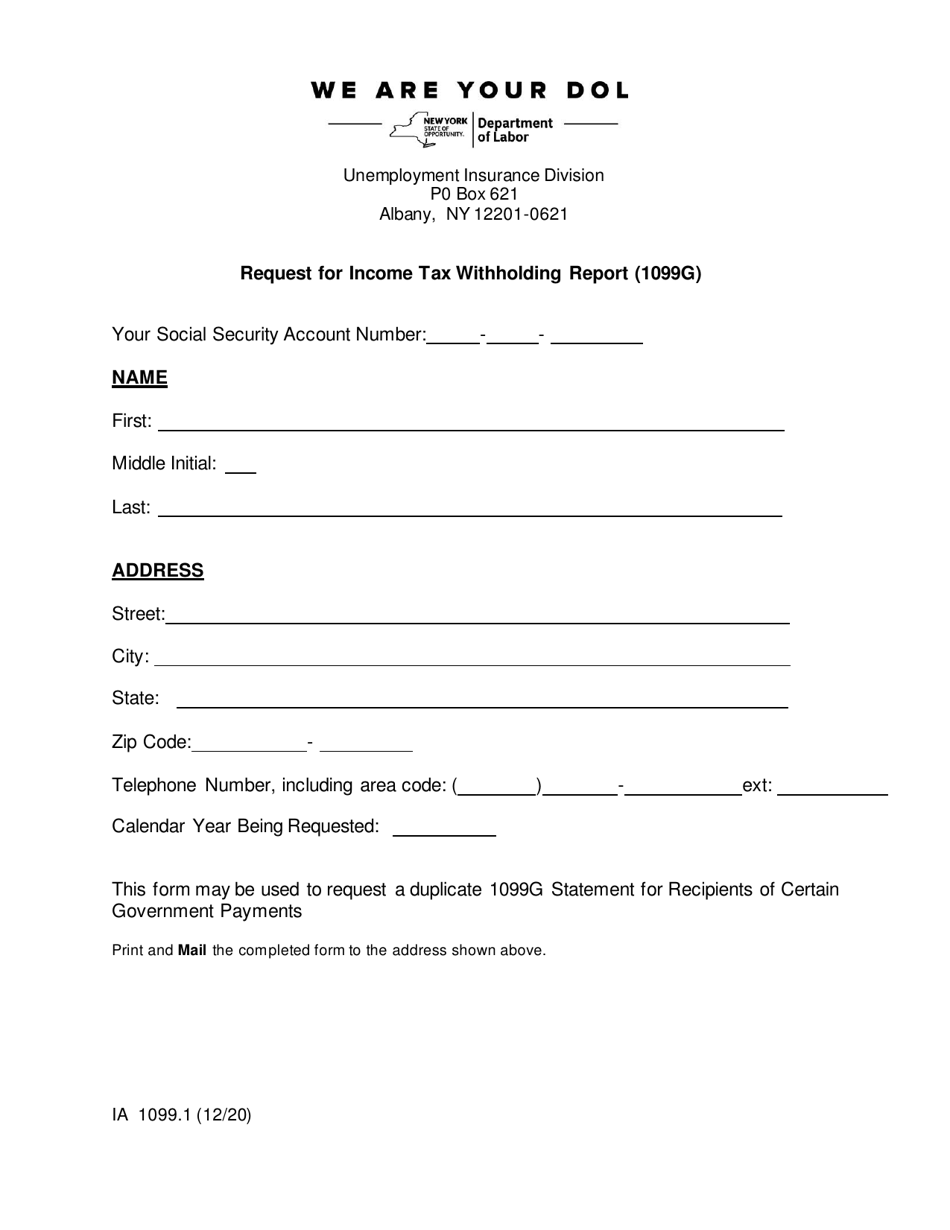

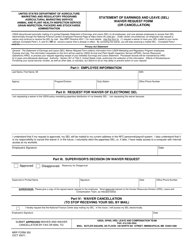

Form IA1099.1 Request for Income Tax Withholding Report (1099g) - New York

What Is Form IA1099.1?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA1099.1?

A: Form IA1099.1 is the Request forIncome Tax Withholding Report (1099g).

Q: Who uses Form IA1099.1?

A: Form IA1099.1 is used by individuals who have received income tax withholding information (1099g) from the state of New York.

Q: What is the purpose of Form IA1099.1?

A: The purpose of Form IA1099.1 is to request a copy of the income tax withholding report (1099g) for tax filing purposes.

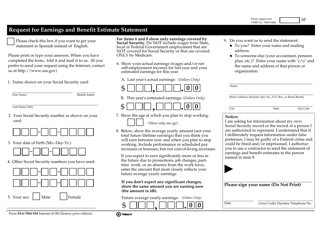

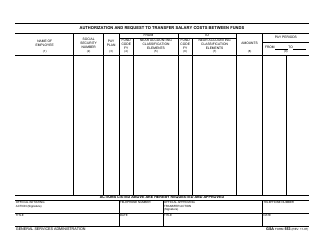

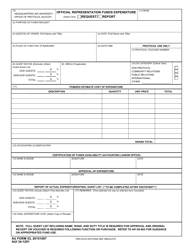

Q: How do I complete Form IA1099.1?

A: To complete Form IA1099.1, you need to provide your personal information and indicate the tax year for which you are requesting the income tax withholding report.

Q: Are there any fees for requesting Form IA1099.1?

A: No, there are no fees for requesting Form IA1099.1.

Q: When should I submit Form IA1099.1?

A: Form IA1099.1 should be submitted as soon as possible to ensure timely receipt of the income tax withholding report (1099g).

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA1099.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.