This version of the form is not currently in use and is provided for reference only. Download this version of

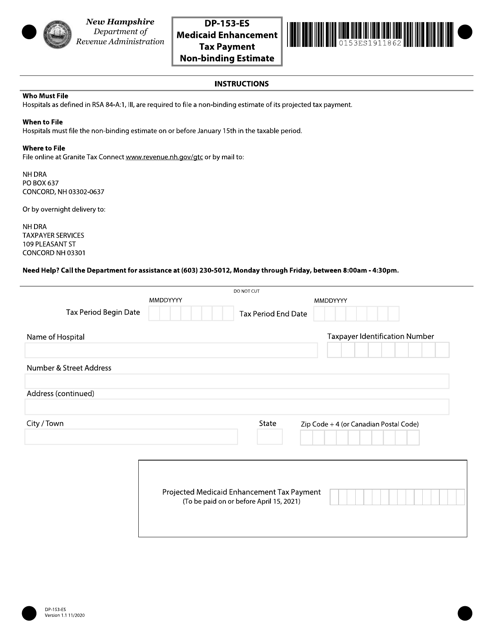

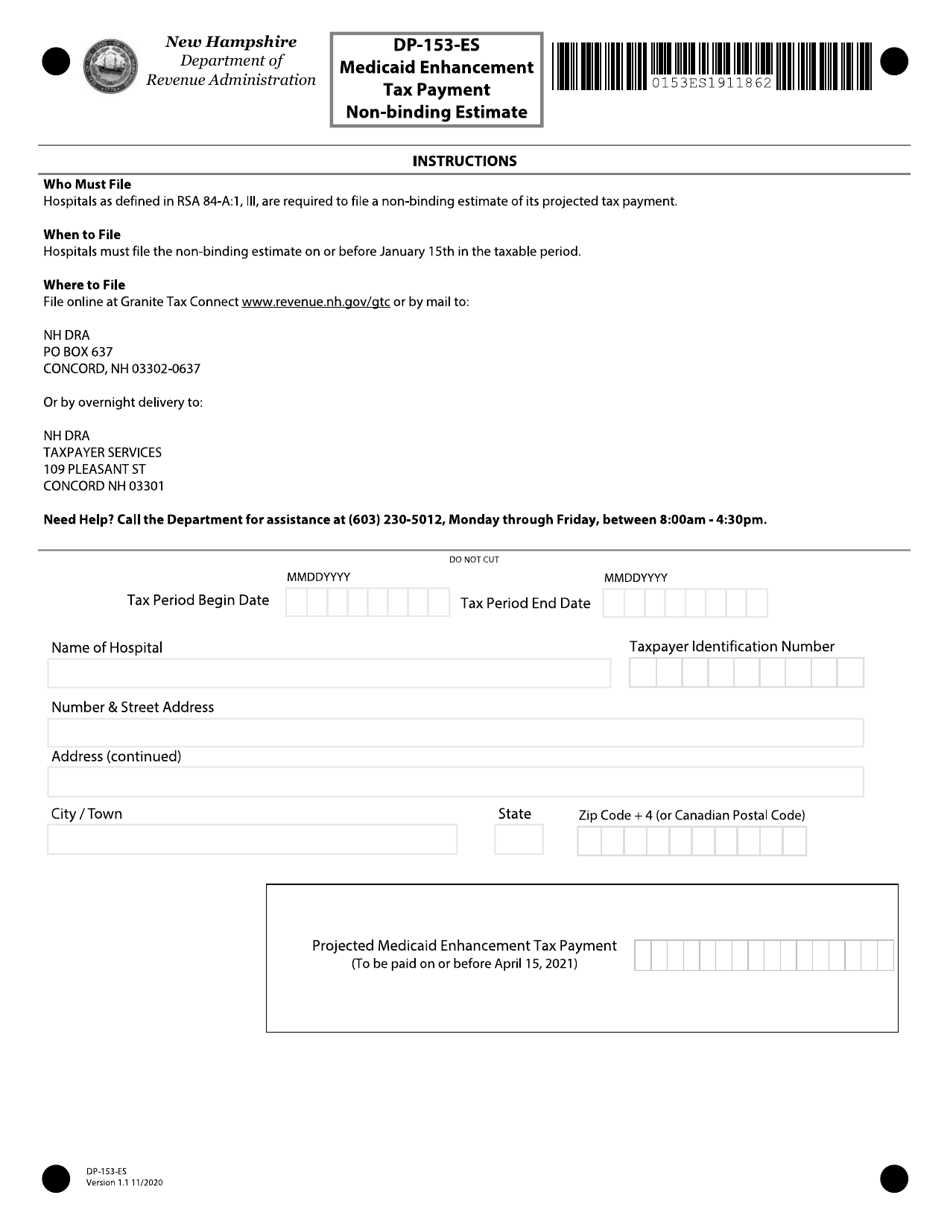

Form DP-153-ES

for the current year.

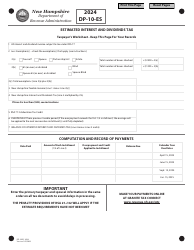

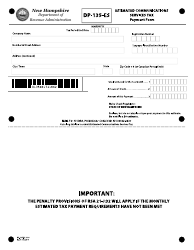

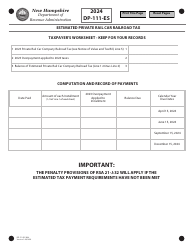

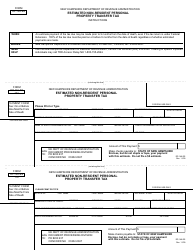

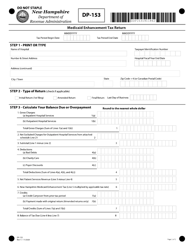

Form DP-153-ES Medicaid Enhancement Tax Payment Non-binding Estimate - New Hampshire

What Is Form DP-153-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-153-ES?

A: Form DP-153-ES is a Medicaid Enhancement Tax Payment Non-binding Estimate form.

Q: What is the purpose of Form DP-153-ES?

A: The purpose of Form DP-153-ES is to estimate Medicaid Enhancement Tax payments in New Hampshire.

Q: Who needs to fill out Form DP-153-ES?

A: This form must be filled out by entities subject to the Medicaid Enhancement Tax in New Hampshire.

Q: What is the Medicaid Enhancement Tax?

A: The Medicaid Enhancement Tax is a tax imposed on certain healthcare providers in New Hampshire to fund the state's Medicaid program.

Q: Is Form DP-153-ES a binding document?

A: No, Form DP-153-ES is a non-binding estimate and is used for informational purposes only.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-153-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.