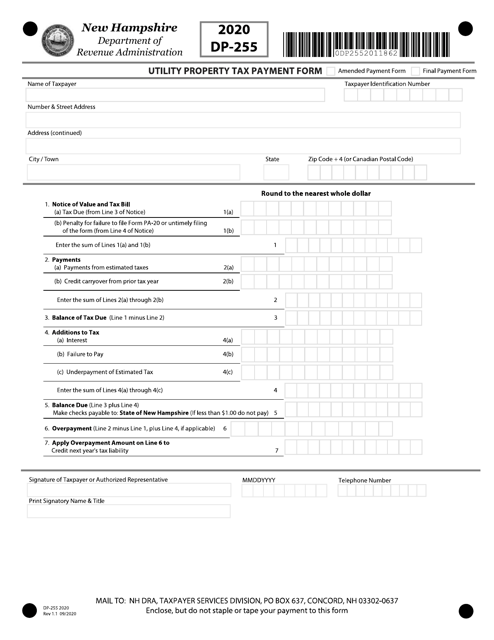

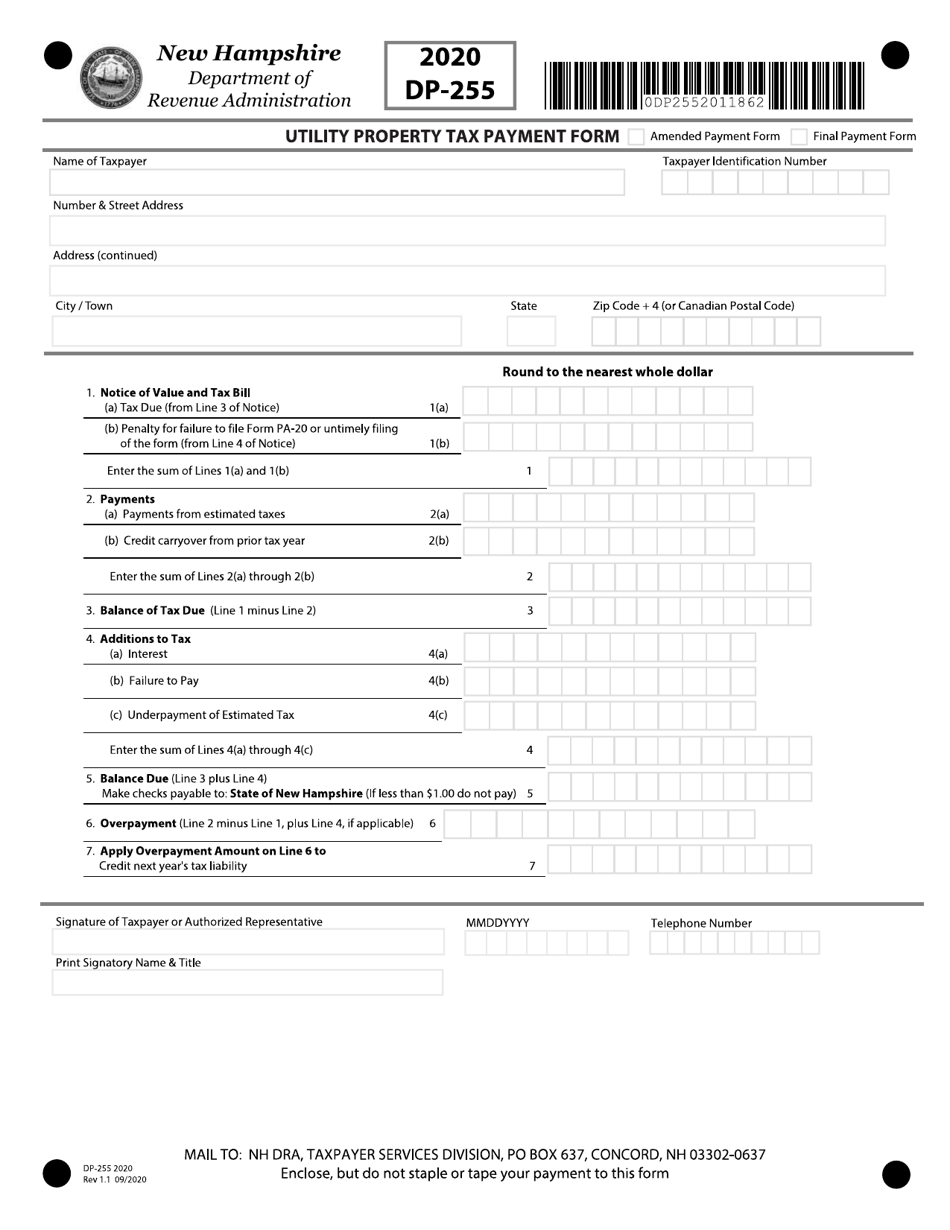

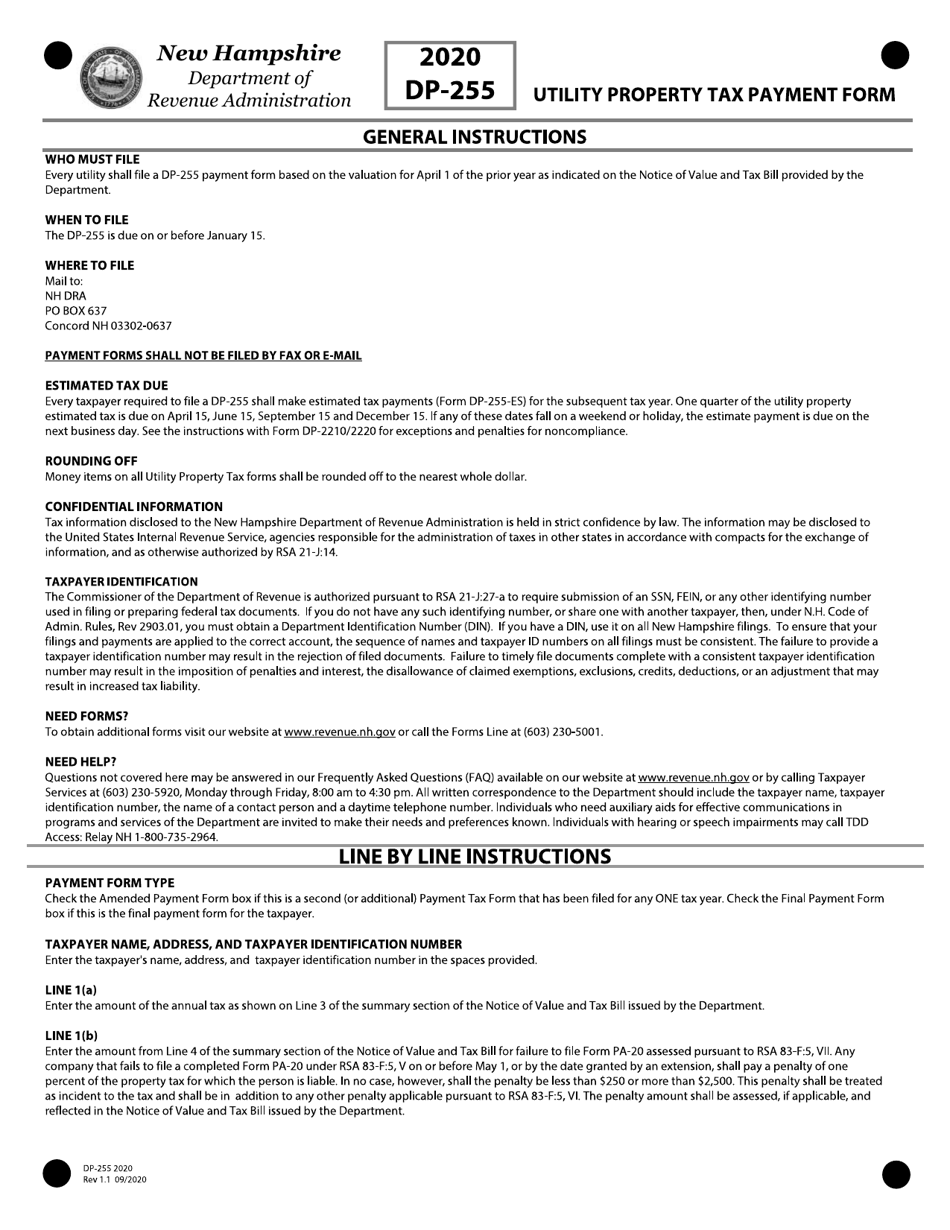

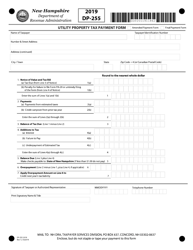

Form DP-255 Utility Property Tax Payment Form - New Hampshire

What Is Form DP-255?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-255?

A: Form DP-255 is the Utility Property Tax Payment Form for the state of New Hampshire.

Q: What is the purpose of Form DP-255?

A: The purpose of Form DP-255 is to make utility property tax payments.

Q: Who needs to fill out Form DP-255?

A: Anyone who owns or operates utility property in New Hampshire and is required to pay utility property taxes needs to fill out and submit Form DP-255.

Q: When is Form DP-255 due?

A: The due date for Form DP-255 varies, but it is typically due on or before the last day of April each year.

Q: What information is required on Form DP-255?

A: Form DP-255 requires information about your utility property, including the property identification number, mailing address, and the amount of utility property tax owed.

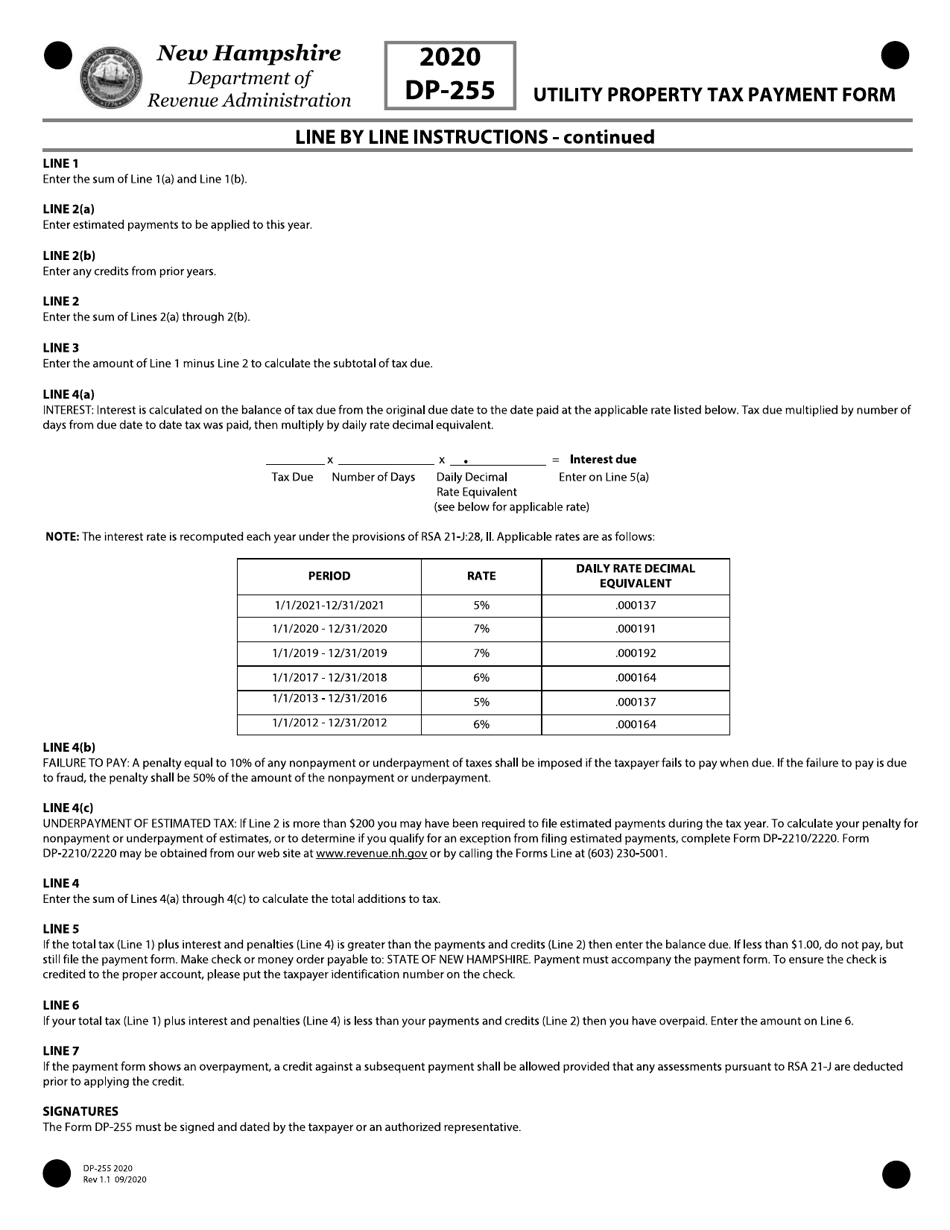

Q: Are there any penalties for late filing of Form DP-255?

A: Yes, there may be penalties for late filing of Form DP-255, including interest charges on the unpaid tax amount.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-255 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.