This version of the form is not currently in use and is provided for reference only. Download this version of

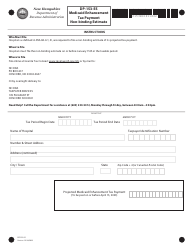

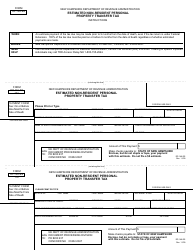

Form DP-110-ES

for the current year.

Form DP-110-ES Estimated Railroad Tax - New Hampshire

What Is Form DP-110-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

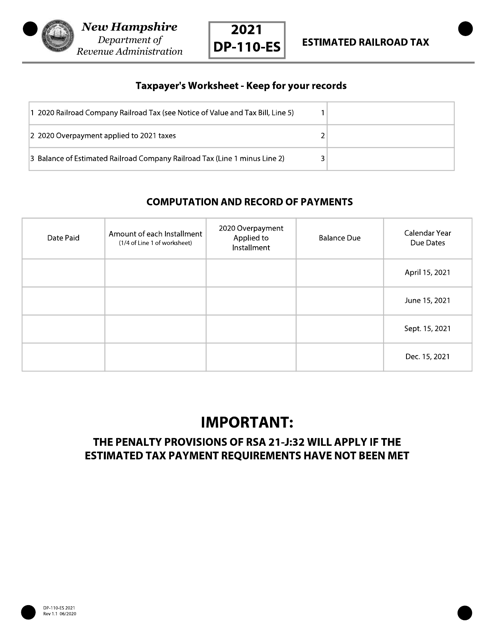

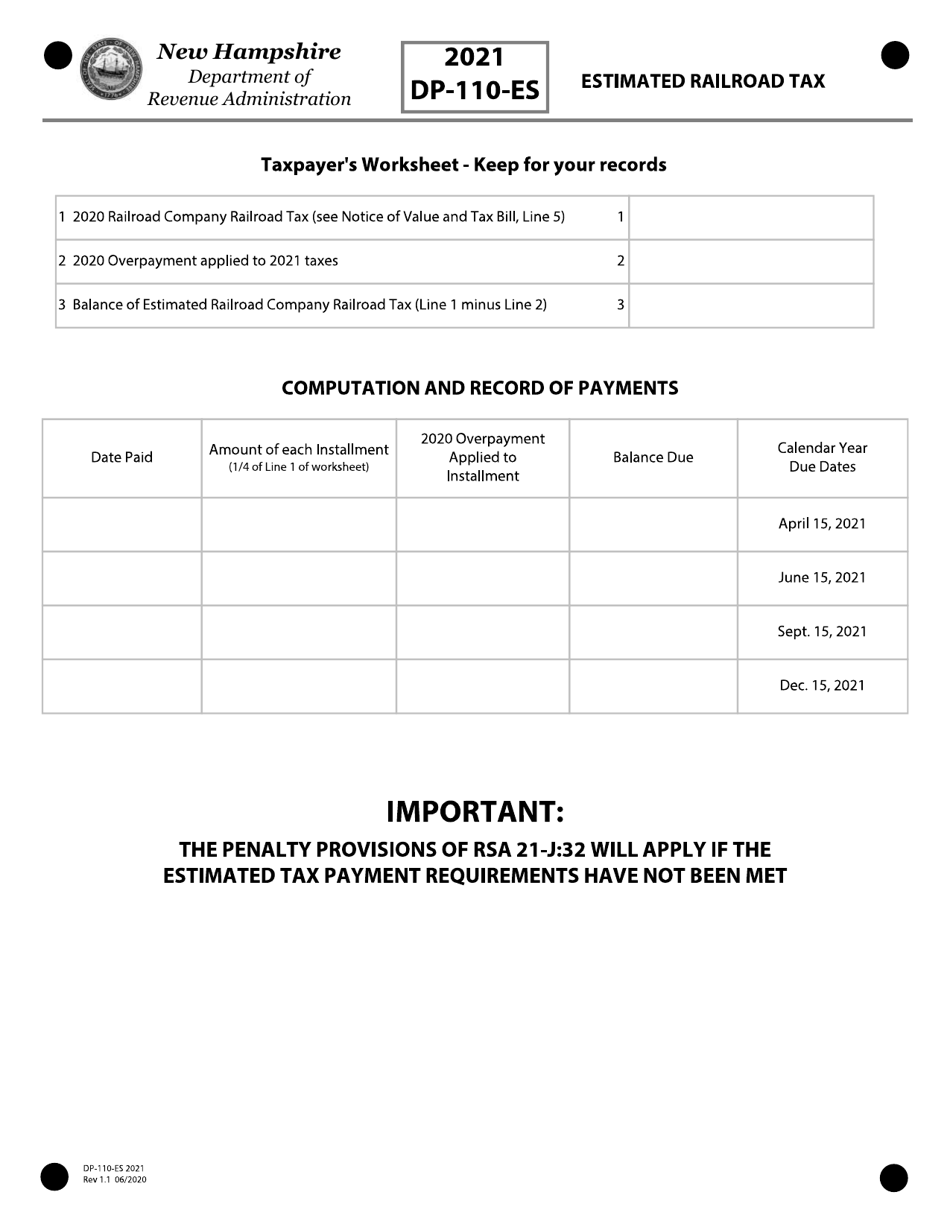

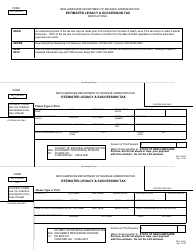

Q: What is Form DP-110-ES?

A: Form DP-110-ES is the Estimated Railroad Tax form for New Hampshire.

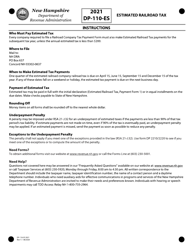

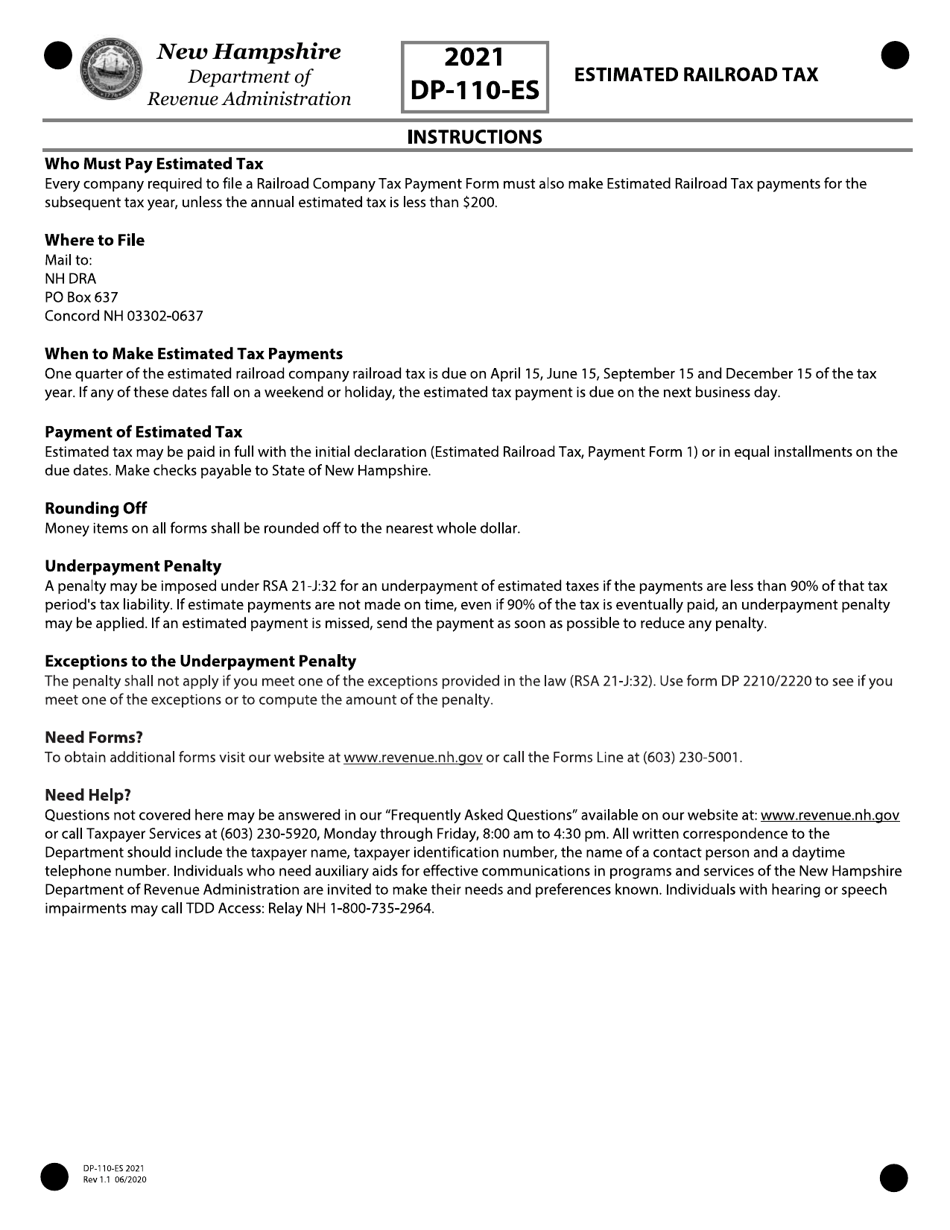

Q: Who needs to file Form DP-110-ES?

A: Railroad companies operating in New Hampshire need to file Form DP-110-ES to pay their estimated taxes.

Q: What is the purpose of Form DP-110-ES?

A: The purpose of Form DP-110-ES is to report and pay estimated taxes for railroad companies in New Hampshire.

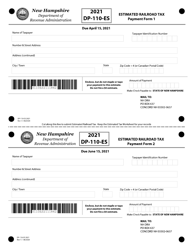

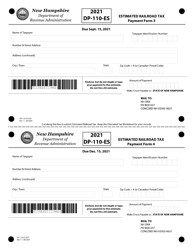

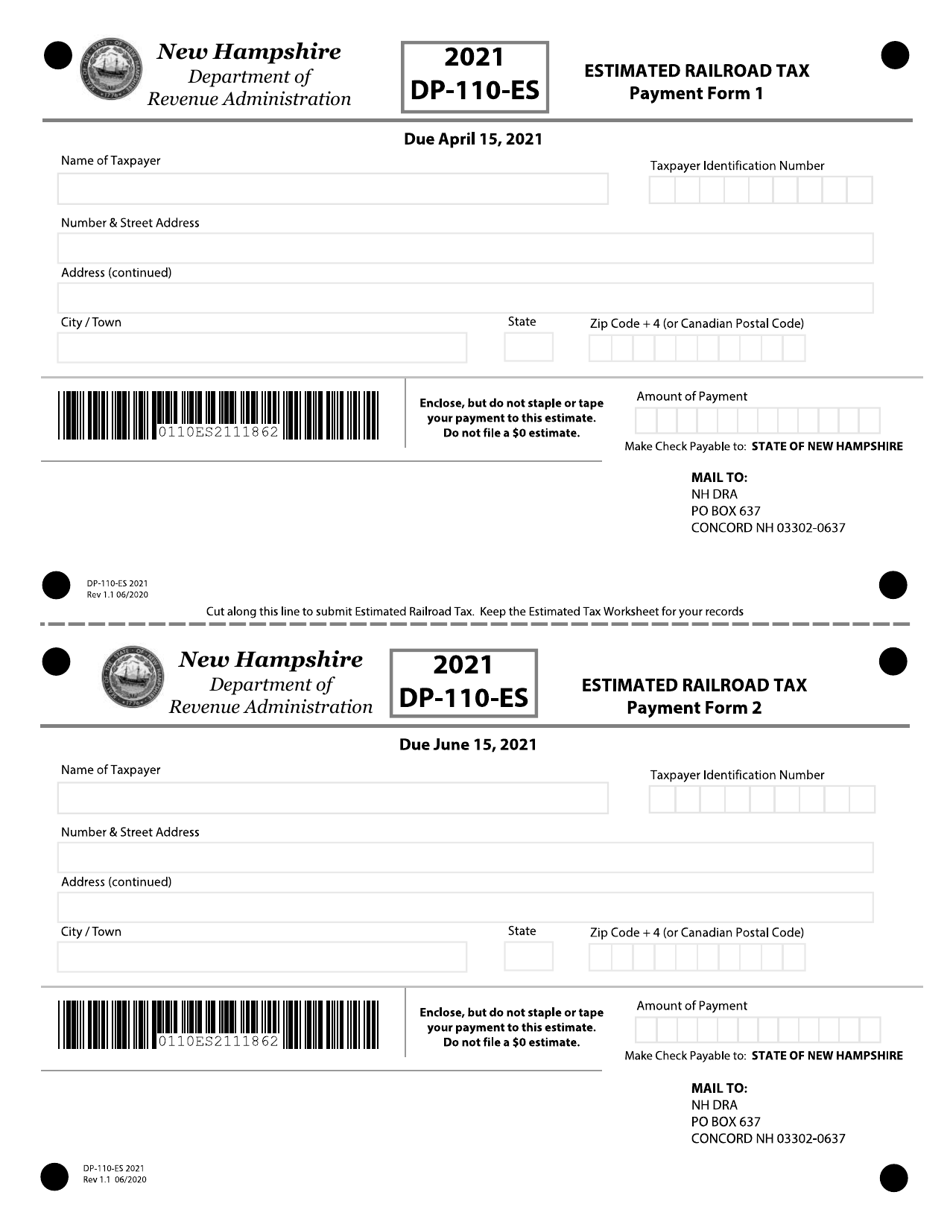

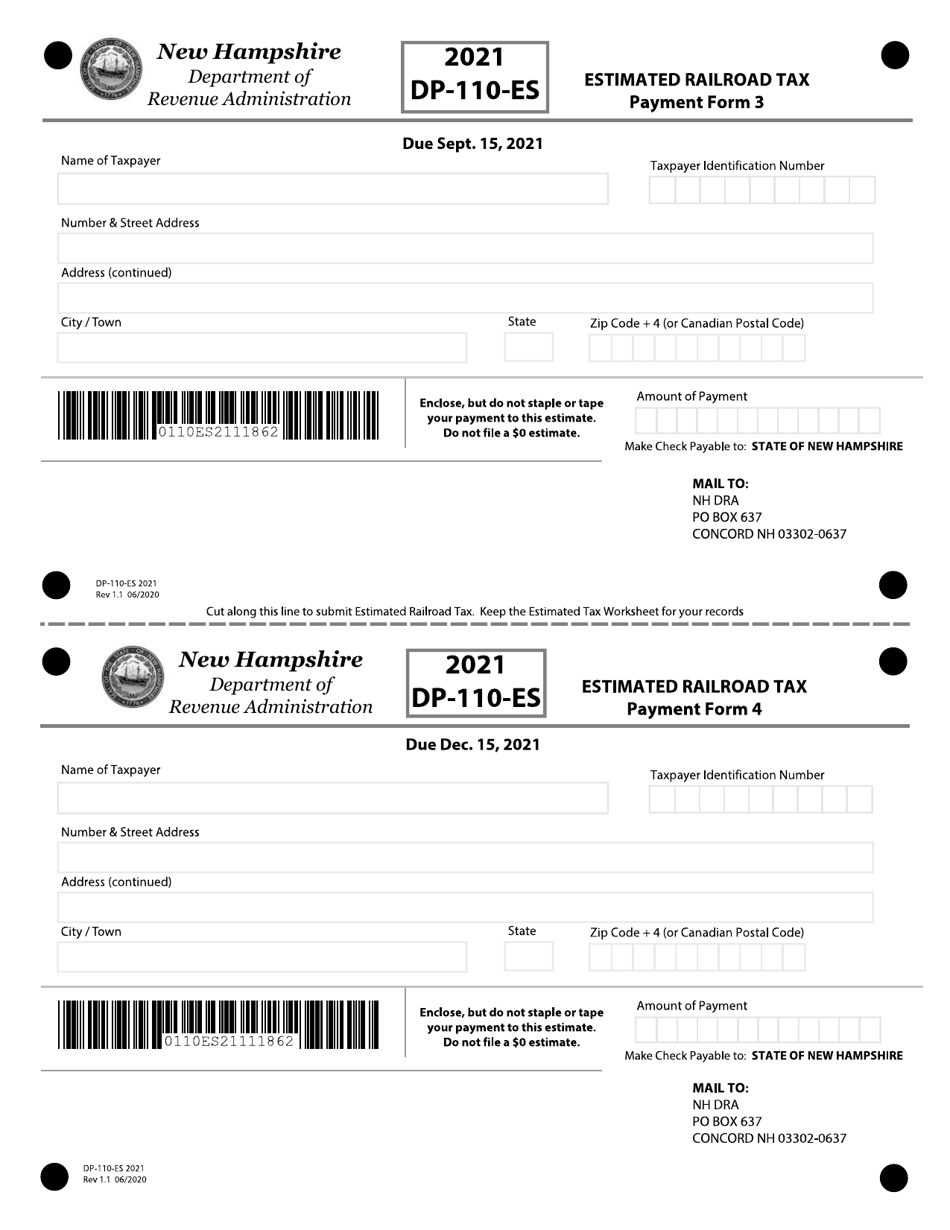

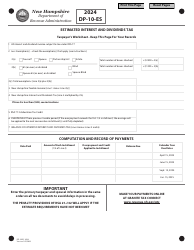

Q: When is Form DP-110-ES due?

A: Form DP-110-ES is due on a quarterly basis. The due dates are March 15, June 15, September 15, and December 15.

Q: Are there penalties for not filing Form DP-110-ES?

A: Yes, there are penalties for not filing Form DP-110-ES or paying the estimated taxes on time. It is important to comply with the filing and payment deadlines to avoid penalties.

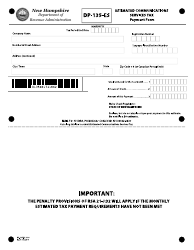

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-110-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.