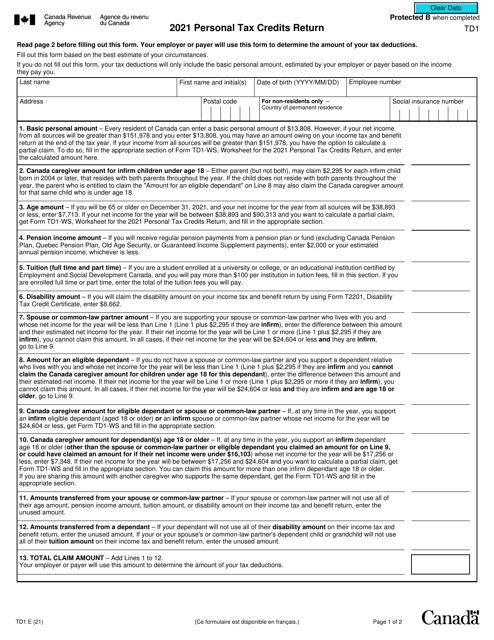

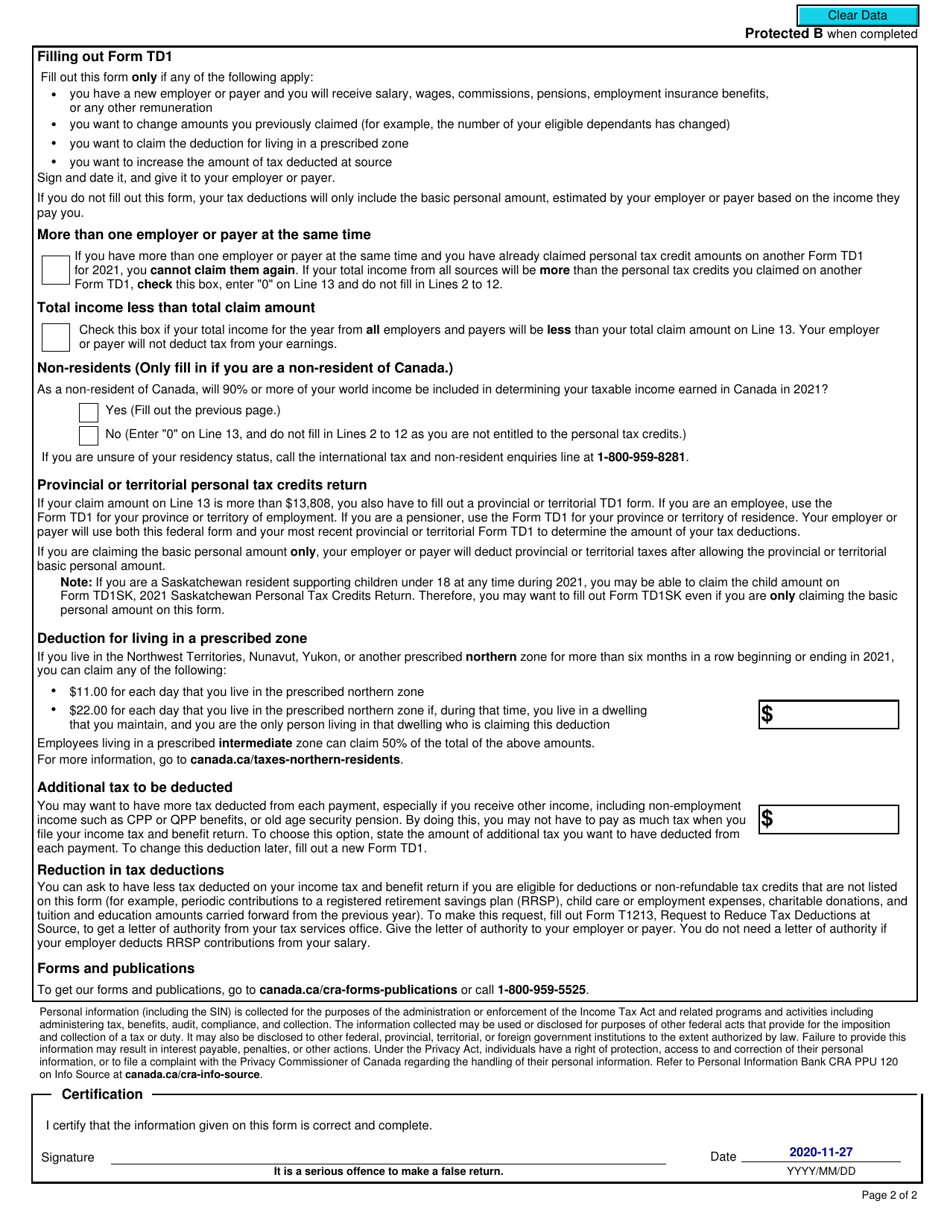

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1

for the current year.

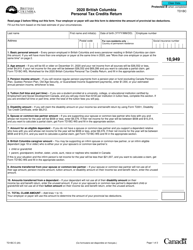

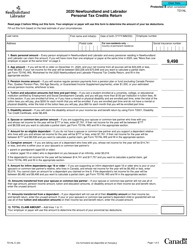

Form TD1 Personal Tax Credits Return - Canada

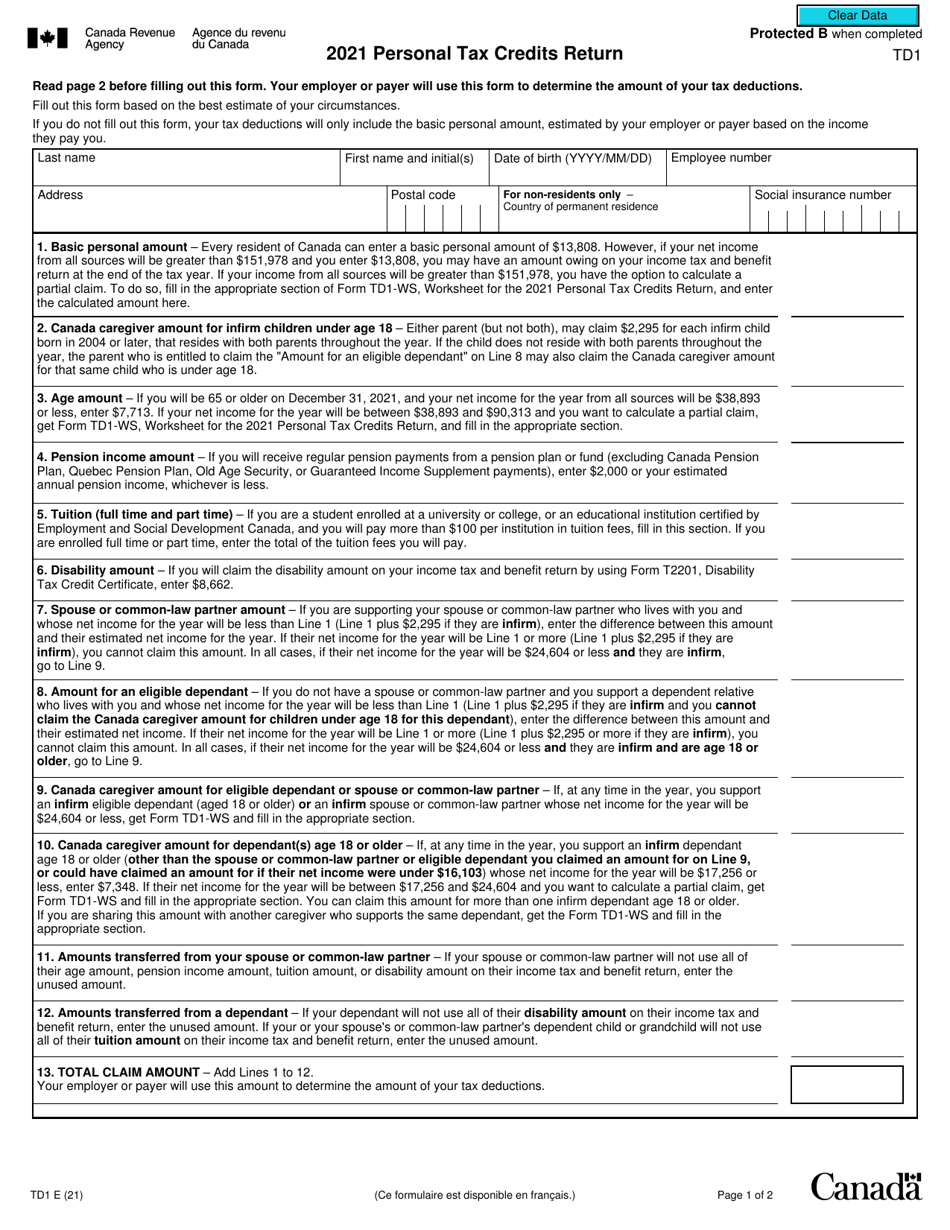

Form TD1 Personal Tax Credits Return - Canada is used by individuals to determine the amount of tax to be deducted from their employment income or other income, such as pension, for the year. It allows individuals to claim various personal tax credits and deductions they are eligible for, which can reduce the amount of tax they have to pay.

In Canada, individuals who want their employer to withhold less tax from their paycheck file the Form TD1 Personal Tax Credits Return. This form helps determine the amount of federal and provincial tax to be deducted from their income.

FAQ

Q: What is Form TD1 Personal Tax Credits Return?

A: Form TD1 Personal Tax Credits Return is a form used by individuals to let their employer know how much tax to deduct from their income.

Q: Who needs to fill out Form TD1?

A: Generally, all employees in Canada need to fill out Form TD1. However, if you are exempt from paying income tax, you do not need to submit this form.

Q: How often do I need to fill out Form TD1?

A: You need to fill out Form TD1 whenever there is a change in your personal circumstances that may affect the amount of tax you owe or the tax credits you are eligible for.

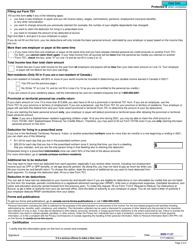

Q: What information do I need to provide on Form TD1?

A: You need to provide information such as your social insurance number, personal exemptions, spousal and child credits, and any other applicable tax credits or deductions.

Q: What happens after I fill out and submit Form TD1?

A: Your employer will use the information provided on Form TD1 to calculate the appropriate amount of tax to deduct from your income.