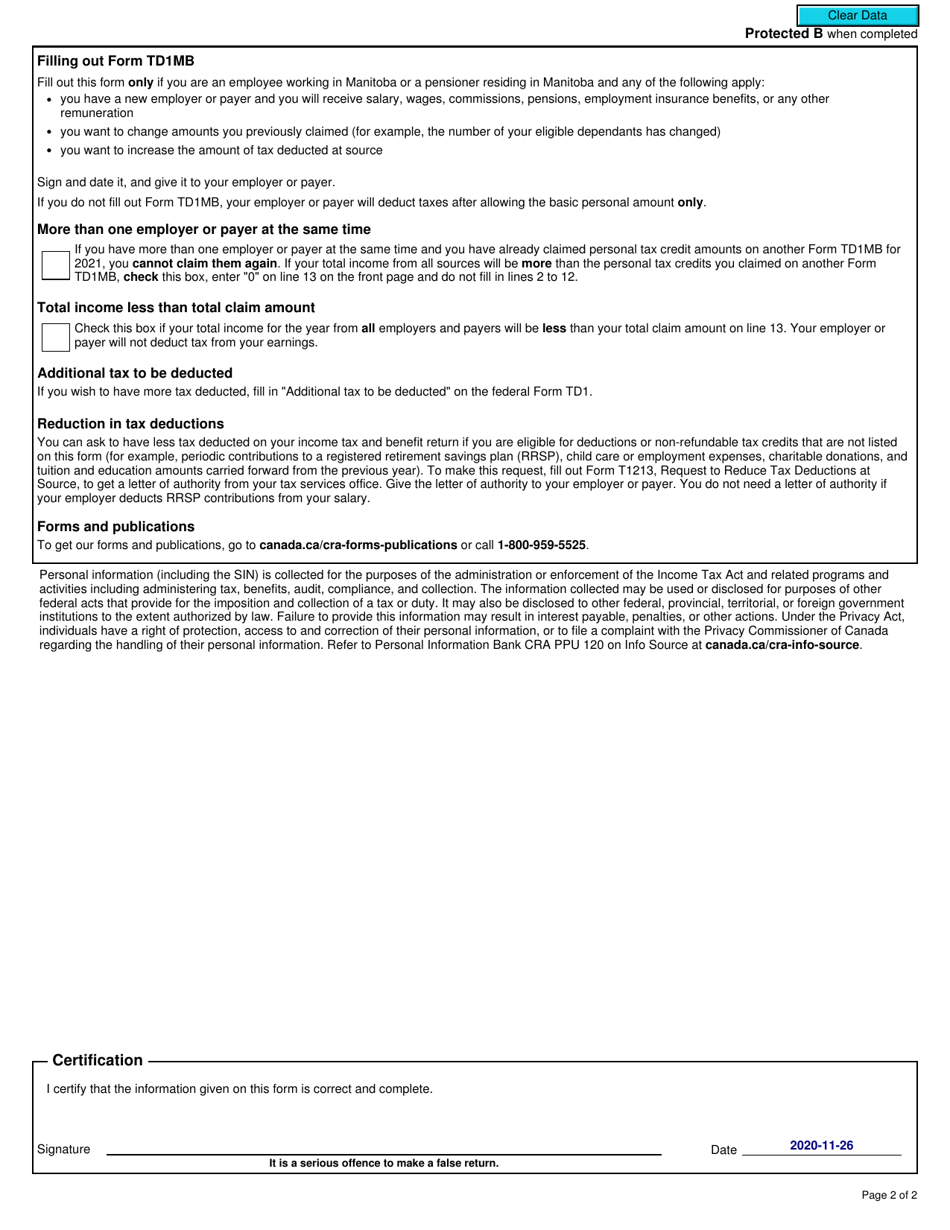

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1MB

for the current year.

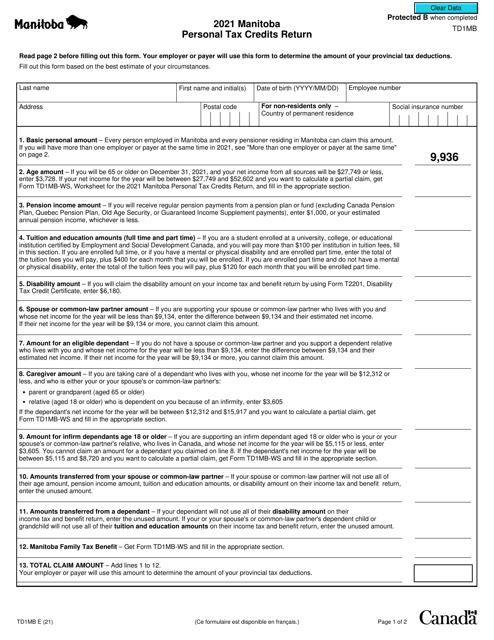

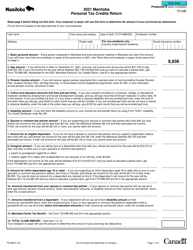

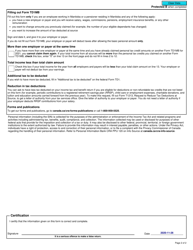

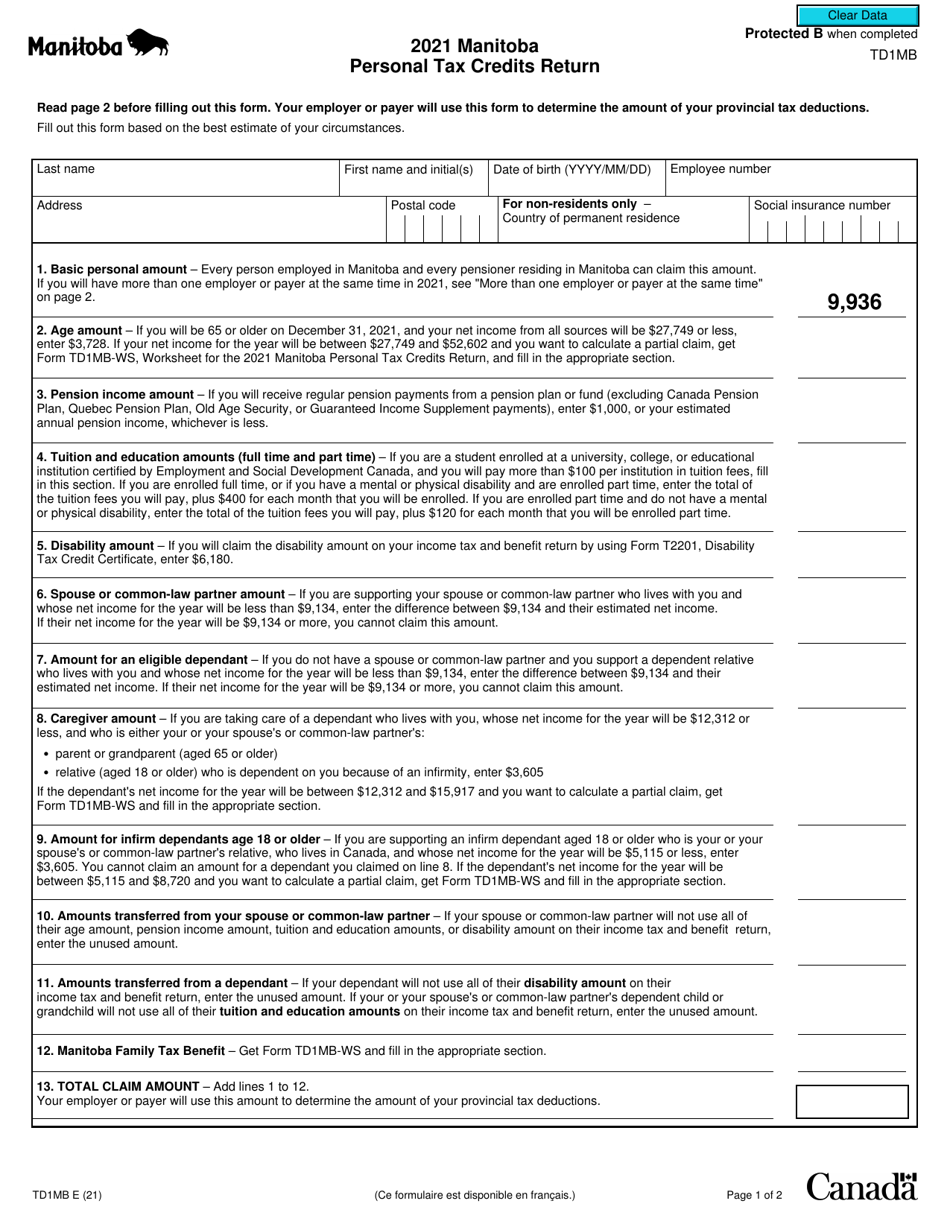

Form TD1MB Manitoba Personal Tax Credits Return - Canada

Form TD1MB, Manitoba Personal Tax Credits Return, is a form used by individuals residing in Manitoba, Canada, to claim various personal tax credits on their income tax return. It allows individuals to reduce the amount of income tax that is deducted from their paychecks throughout the year. The form is used to determine the amount of tax credits an individual is eligible for, such as the Basic Personal Amount, age amount, caregiver amount, and more.

The Form TD1MB Manitoba Personal Tax Credits Return is filed by individuals who are residents of Manitoba in Canada.

FAQ

Q: What is Form TD1MB?

A: Form TD1MB is the Manitoba Personal Tax Credits Return form.

Q: Who needs to fill out Form TD1MB?

A: Residents of Manitoba who want to claim personal tax credits on their income tax return need to fill out Form TD1MB.

Q: What is the purpose of Form TD1MB?

A: The purpose of Form TD1MB is to determine the amount of income tax to be deducted from an individual's pay, taking into account their eligible tax credits.

Q: When should Form TD1MB be filled out?

A: Form TD1MB should be filled out when starting a new job, when there are changes to your tax situation, or when you want to reduce the amount of tax deducted at source.