This version of the form is not currently in use and is provided for reference only. Download this version of

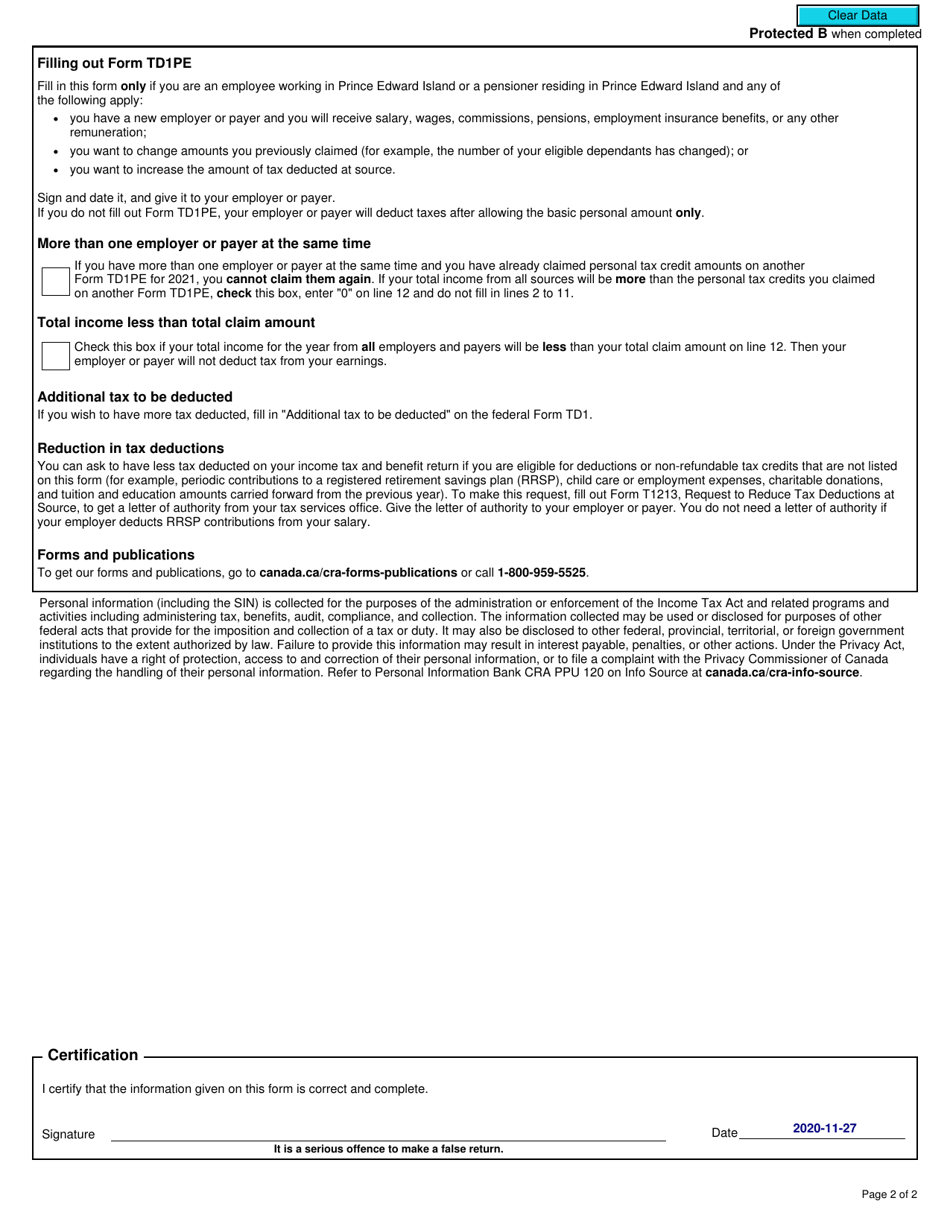

Form TD1PE

for the current year.

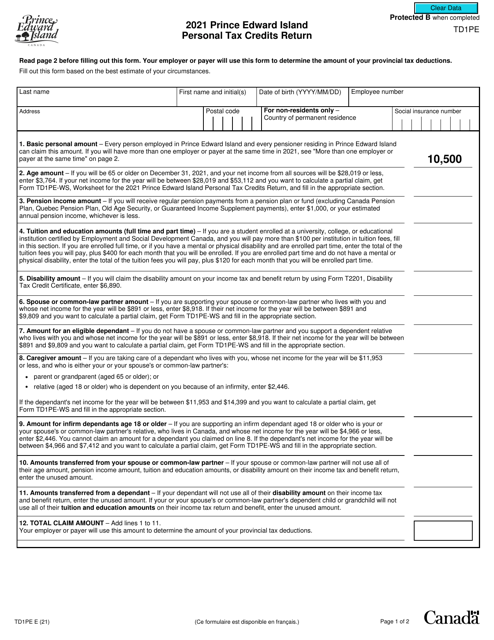

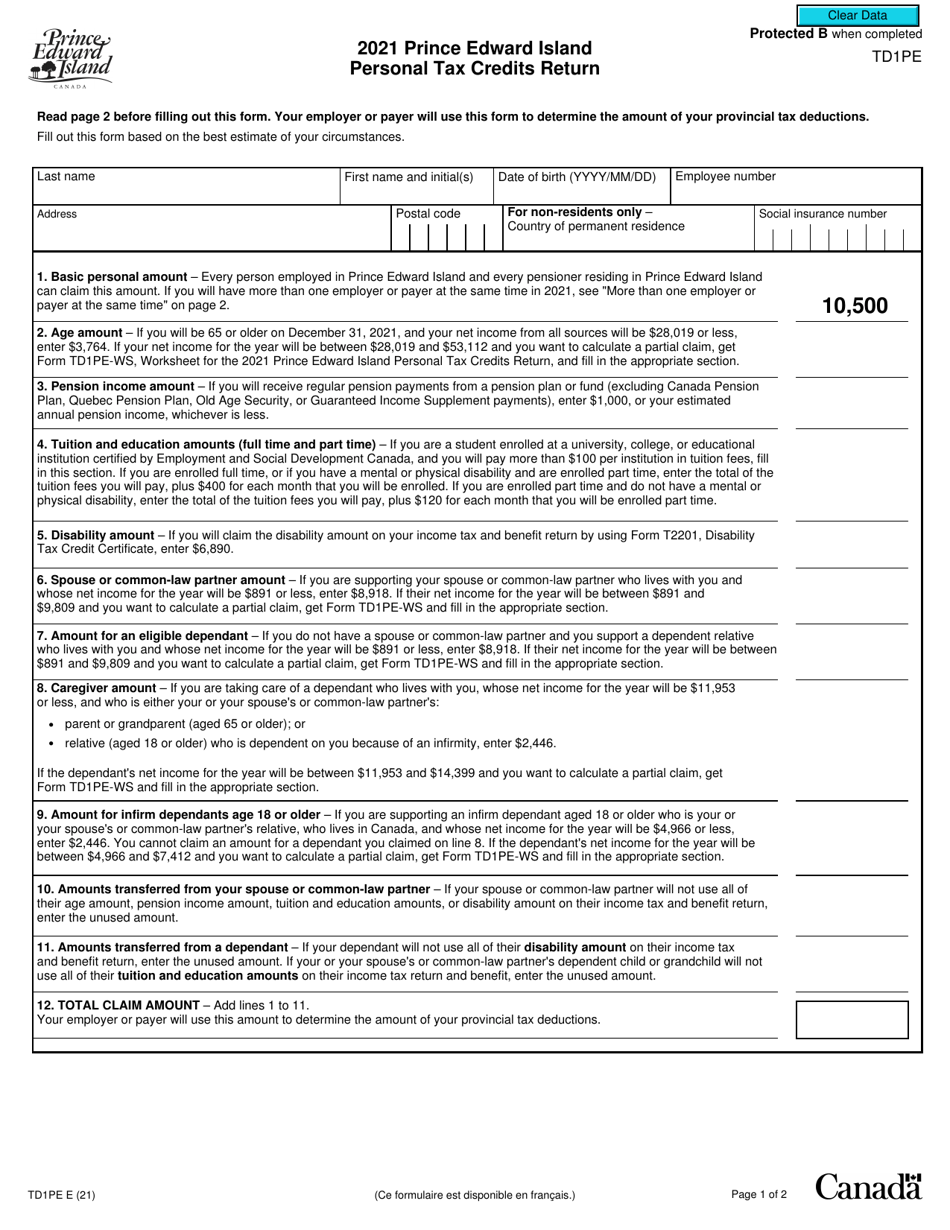

Form TD1PE Prince Edward Island Personal Tax Credits Return - Canada

Form TD1PE (Prince Edward Island Personal Tax Credits Return) is a form used in Canada by individuals who reside in the province of Prince Edward Island to indicate their personal tax credit amounts. By completing this form, individuals can claim various tax credits and deductions, which can help reduce their income tax liability. The form is used to determine the amount of income tax that should be withheld from their pay by their employer.

Individuals who are residents of Prince Edward Island and want to claim specific tax credits for that province should file the Form TD1PE (Prince Edward Island Personal Tax Credits Return).

FAQ

Q: What is Form TD1PE?

A: Form TD1PE is the Prince Edward Island Personal Tax Credits Return.

Q: Who should fill out Form TD1PE?

A: Residents of Prince Edward Island who want to claim tax credits.

Q: What is the purpose of Form TD1PE?

A: The purpose of Form TD1PE is to calculate and claim personal tax credits specific to Prince Edward Island.

Q: Do I need to fill out Form TD1PE every year?

A: Yes, if you are a resident of Prince Edward Island, you must fill out Form TD1PE every year to claim tax credits.

Q: Can I submit Form TD1PE electronically?

A: No, you must submit a paper copy of Form TD1PE to the CRA.

Q: Are there any other requirements for claiming tax credits in Prince Edward Island?

A: Yes, you must have a valid Social Insurance Number (SIN) and meet the residency requirements set by the CRA.

Q: What should I do if my personal circumstances change during the year?

A: If your personal circumstances change, such as getting married or having a child, you should update your information on Form TD1PE and submit a new copy to the CRA.