This version of the form is not currently in use and is provided for reference only. Download this version of

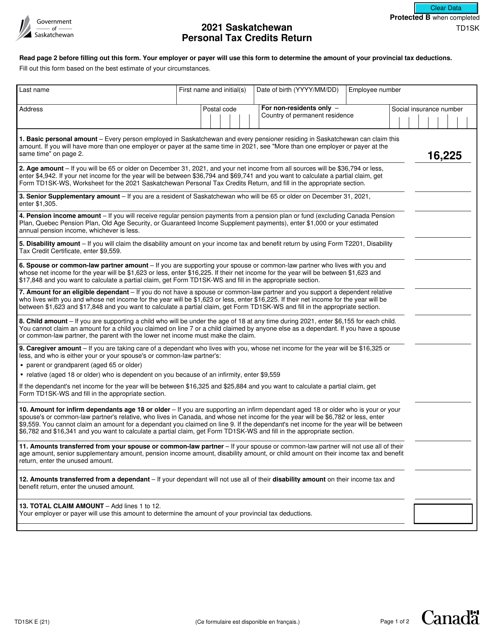

Form TD1SK

for the current year.

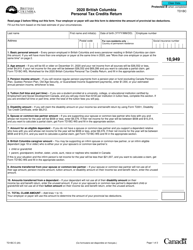

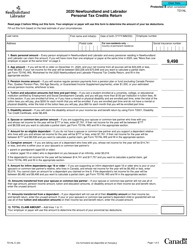

Form TD1SK Saskatchewan Personal Tax Credits Return - Canada

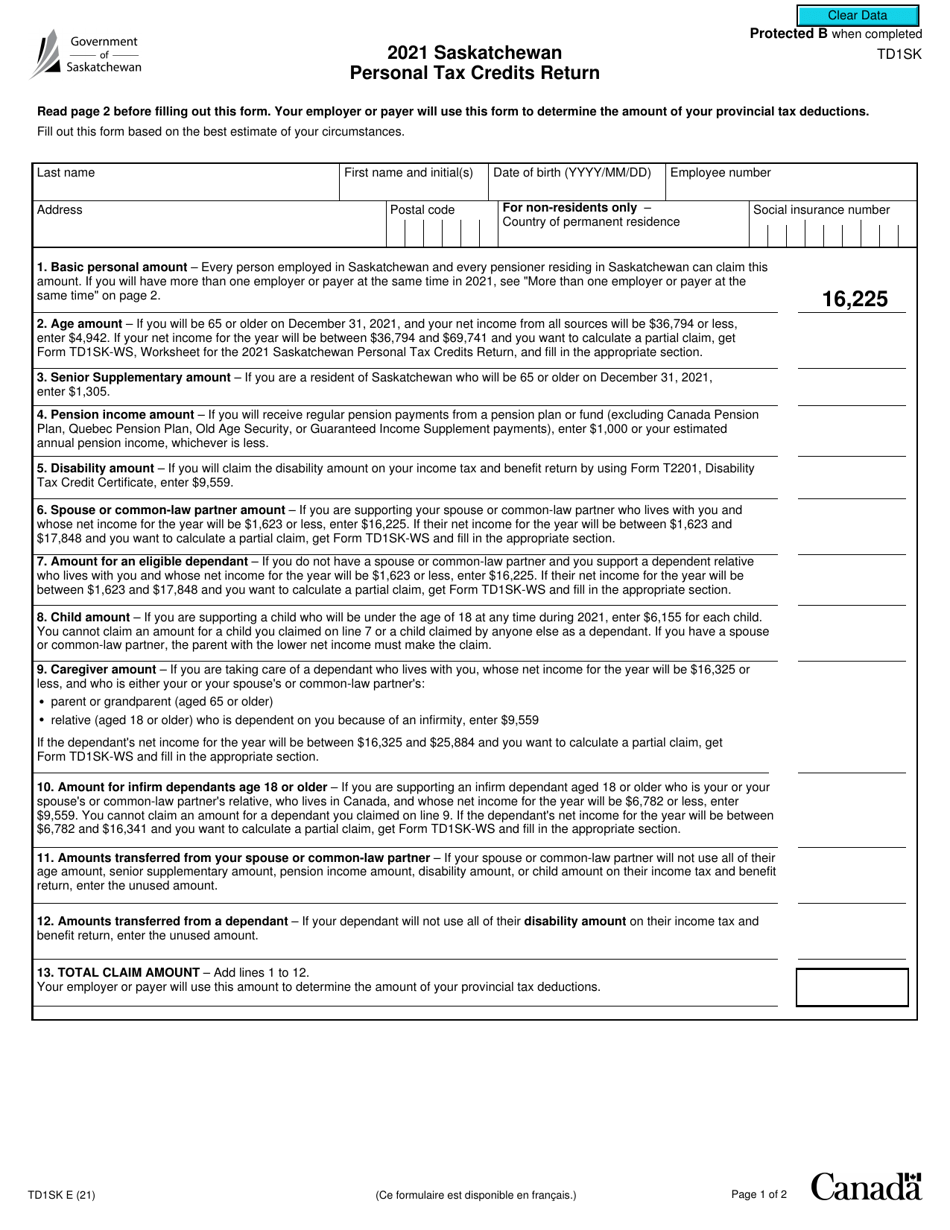

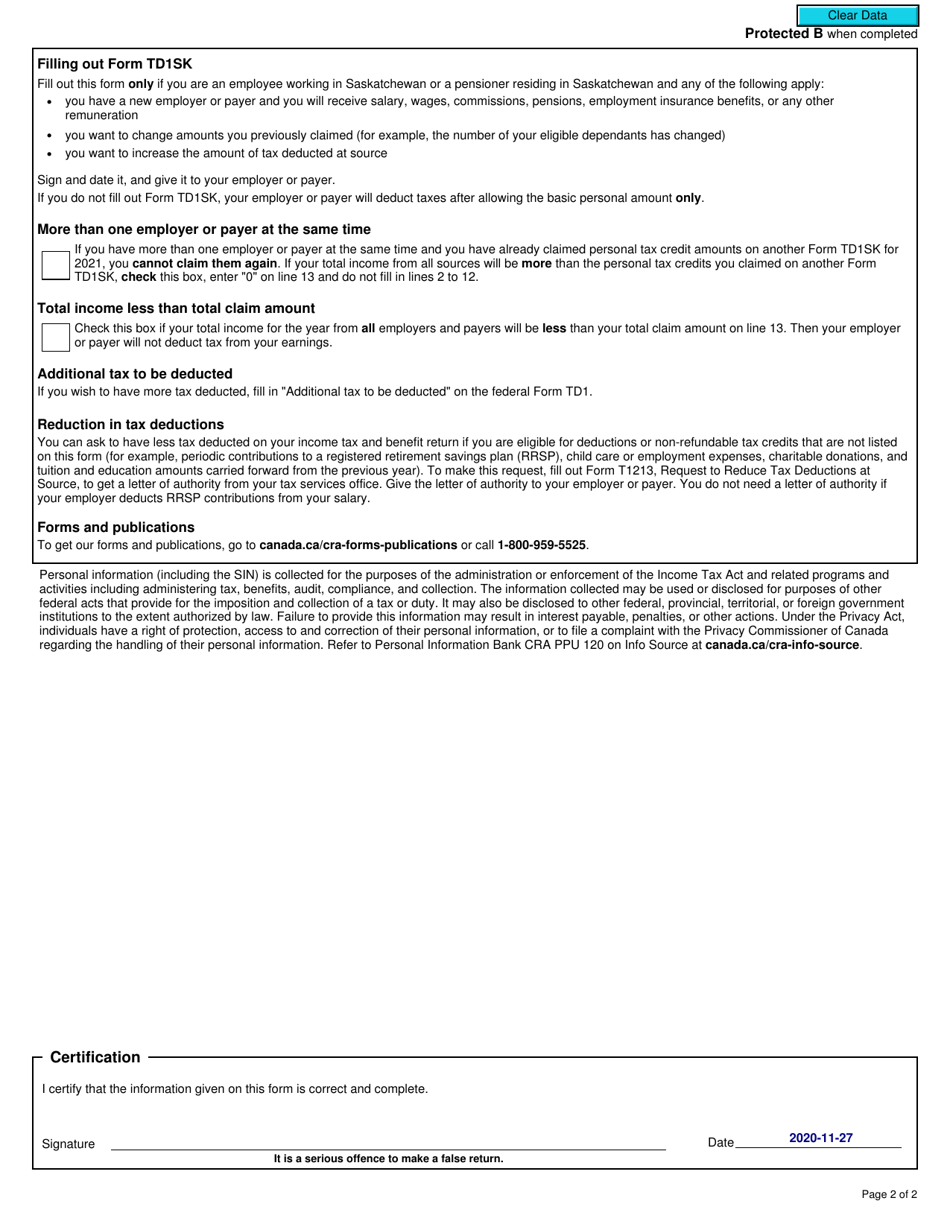

Form TD1SK Saskatchewan Personal Tax Credits Return is used by individuals who reside in the province of Saskatchewan, Canada. It allows individuals to claim various tax credits and deductions specific to the province when calculating their income tax withholdings. This form helps ensure that the correct amount of income tax is deducted from your pay throughout the year.

The Form TD1SK is filed by individuals who are residents of Saskatchewan and want to claim personal tax credits on their income tax return.

FAQ

Q: What is Form TD1SK?

A: Form TD1SK is a personal tax credits return specific to Saskatchewan residents in Canada.

Q: Who needs to fill out Form TD1SK?

A: Saskatchewan residents who want their employer to withhold the correct amount of income tax from their pay need to fill out Form TD1SK.

Q: What is the purpose of Form TD1SK?

A: The purpose of Form TD1SK is to claim personal tax credits and deductions that will affect the amount of income tax withheld from your pay.

Q: Do I need to fill out Form TD1SK every year?

A: You should review and update your Form TD1SK every year to ensure your employer withholds the correct amount of income tax.

Q: What happens if I don't fill out Form TD1SK?

A: If you don't fill out Form TD1SK, your employer will default to withholding taxes based on the basic personal amount, which may result in over or underpayment of taxes.

Q: Can I claim tax credits on Form TD1SK?

A: Yes, you can claim various tax credits on Form TD1SK, such as the tuition tax credit, the disability amount, and the caregiver amount.

Q: Is Form TD1SK the same as the federal TD1 form?

A: No, Form TD1SK is specific to Saskatchewan residents, while the federal TD1 form is applicable to residents of all provinces and territories in Canada.