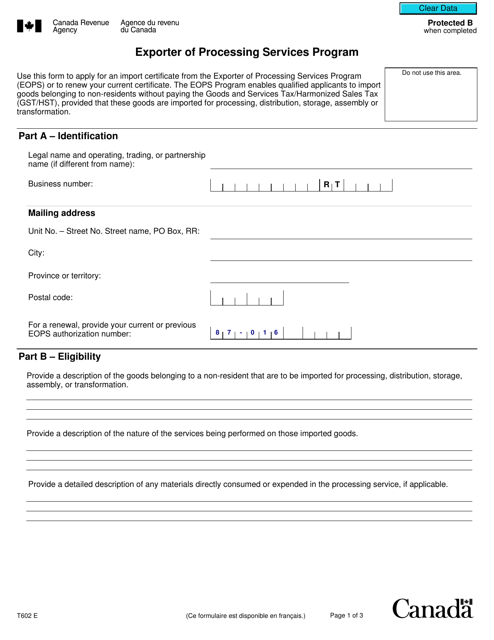

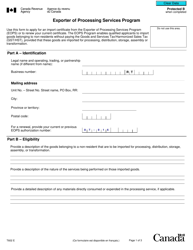

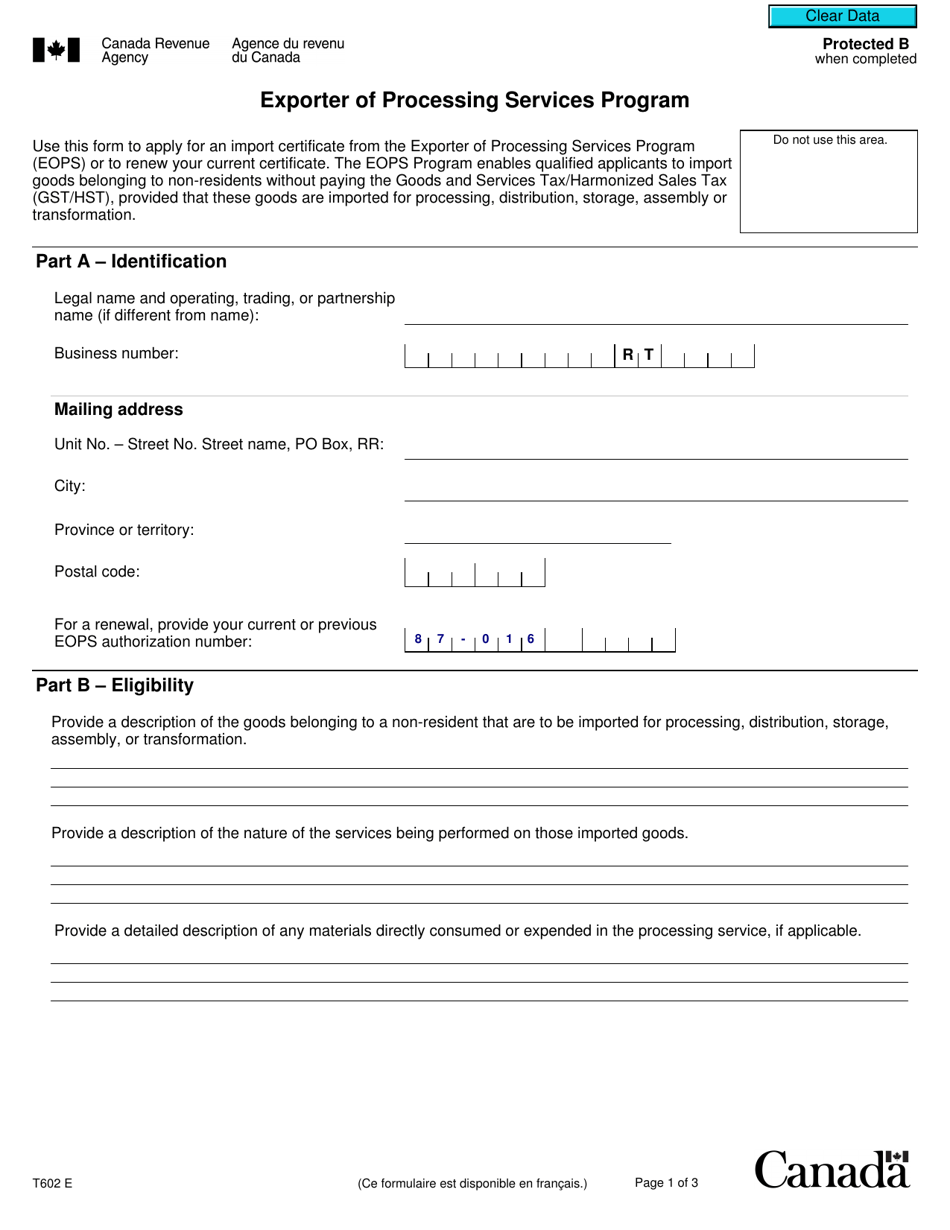

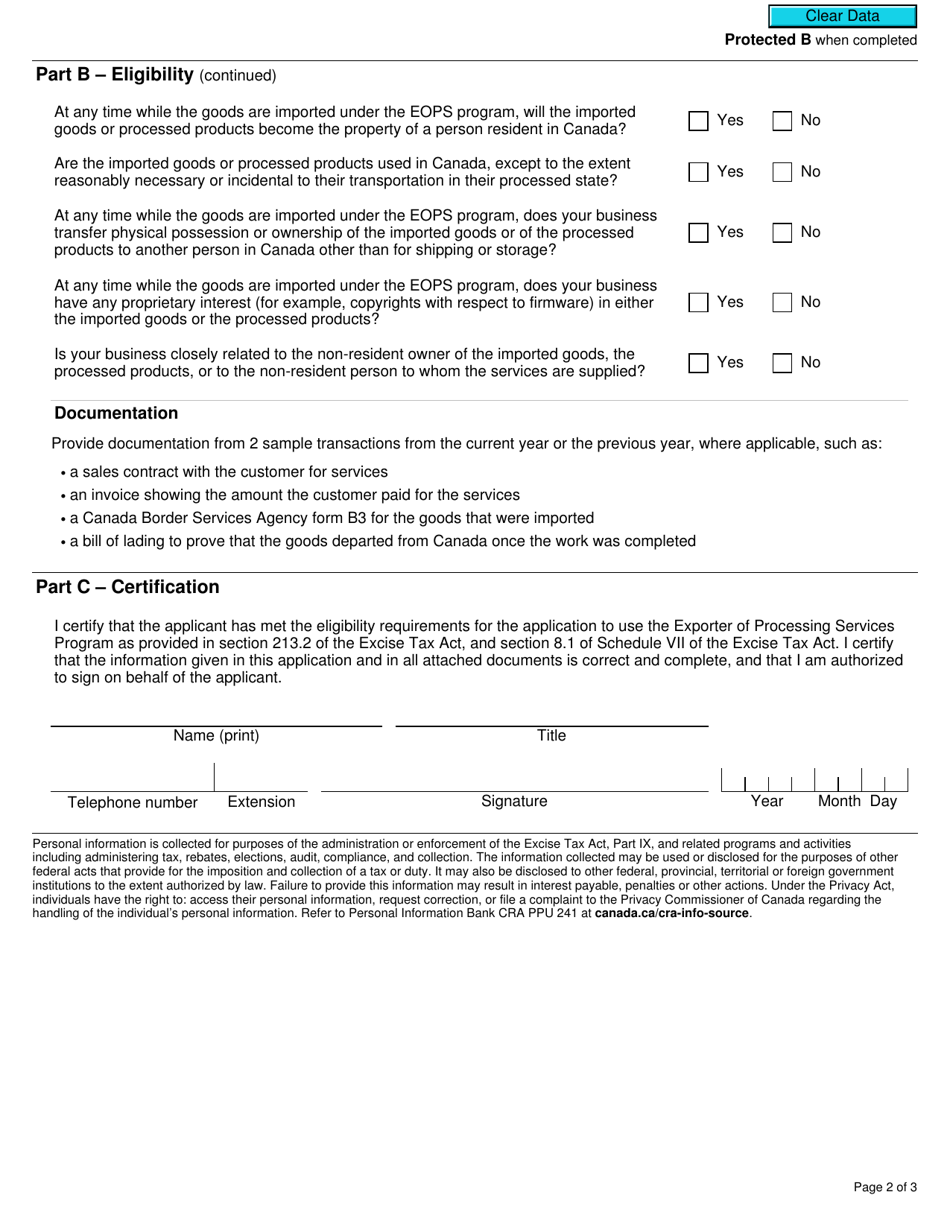

Form T602 Exporter of Processing Services Program - Canada

Form T602 Exporter of Processing Services Program - Canada is a form used by businesses in Canada to apply for participation in the Exporter of Processing Services (EOPS) program. This program allows eligible exporters to claim a refund of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on certain processing services.

The exporter of processing services program in Canada requires the form T602 to be filed by the exporter of the processing services.

FAQ

Q: What is Form T602?

A: Form T602 is a form used for the Exporter of Processing Services Program in Canada.

Q: What is the Exporter of Processing Services Program?

A: The Exporter of Processing Services Program is a program in Canada that allows exporters to claim a refund of GST/HST paid on eligible processing services.

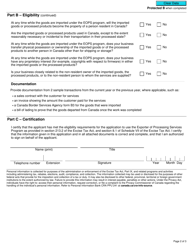

Q: Who is eligible for the Exporter of Processing Services Program?

A: Exporters who have paid GST/HST on eligible processing services in Canada are eligible for the program.

Q: What are eligible processing services?

A: Eligible processing services include services provided in Canada that result in the production, manufacture, or processing of goods for export.

Q: How can I apply for the Exporter of Processing Services Program?

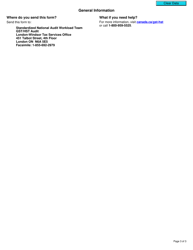

A: You can apply for the program by completing Form T602 and submitting it to the Canada Revenue Agency.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted within four years from the end of the reporting period in which the GST/HST was paid on the processing services.

Q: What documents do I need to submit with the application?

A: You will need to submit supporting documentation such as invoices, proof of export, and any other relevant documents.

Q: How long does it take to process the application?

A: The processing time can vary, but it usually takes several weeks to a few months to receive a response on your application.

Q: Can I claim a refund for processing services provided outside of Canada?

A: No, the program only applies to eligible processing services provided within Canada.

Q: Can I claim a refund for GST/HST paid on goods purchased for processing?

A: No, the program only applies to GST/HST paid on eligible processing services, not on the purchase of goods.