This version of the form is not currently in use and is provided for reference only. Download this version of

Form TL11A

for the current year.

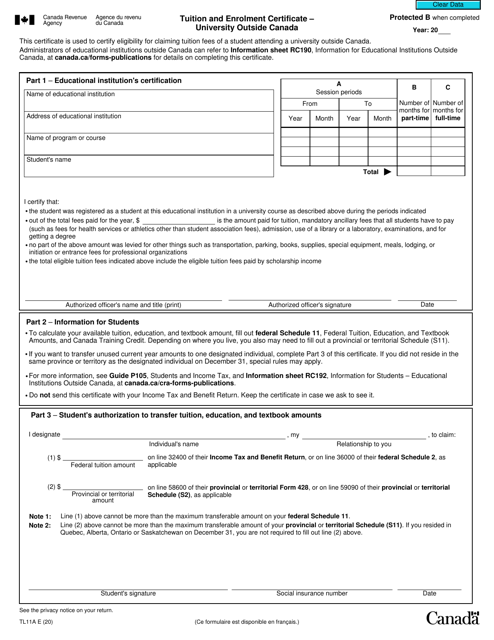

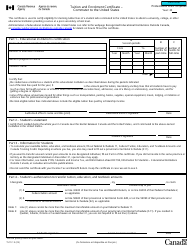

Form TL11A Tuition and Enrolment Certificate - University Outside Canada - Canada

Form TL11A Tuition and Enrolment Certificate is used by individuals who are attending a university outside of Canada. This form is used to certify their enrolment, the amount of tuition paid, and any eligible education fees for the purpose of claiming education-related tax credits when filing their Canadian income tax returns.

The student who attended a university outside Canada files the Form TL11A Tuition and Enrolment Certificate in Canada.

FAQ

Q: What is the TL11A form?

A: The TL11A form is the Tuition and Enrolment Certificate for students studying at a university outside Canada.

Q: Who needs to use the TL11A form?

A: Students who are studying at a university outside Canada and want to claim a tuition tax credit on their Canadian taxes need to use the TL11A form.

Q: What information does the TL11A form provide?

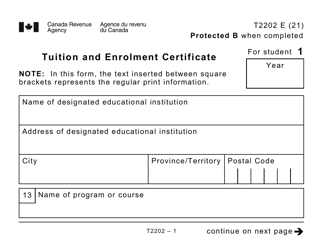

A: The TL11A form provides information about the amount of eligible tuition fees paid by the student, the number of months of full-time or part-time studies, and the name and address of the educational institution.

Q: How can I obtain the TL11A form?

A: You can usually obtain the TL11A form from the educational institution you are studying at. They will provide you with the completed form.