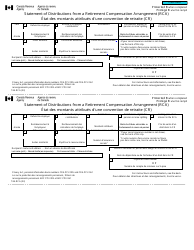

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T4A-RCA

for the current year.

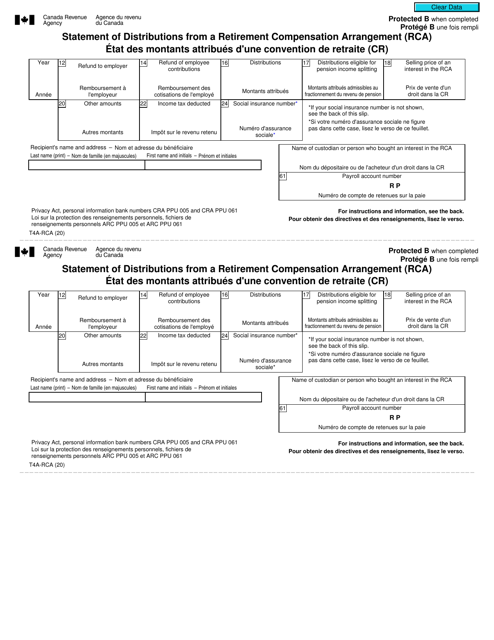

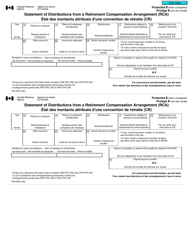

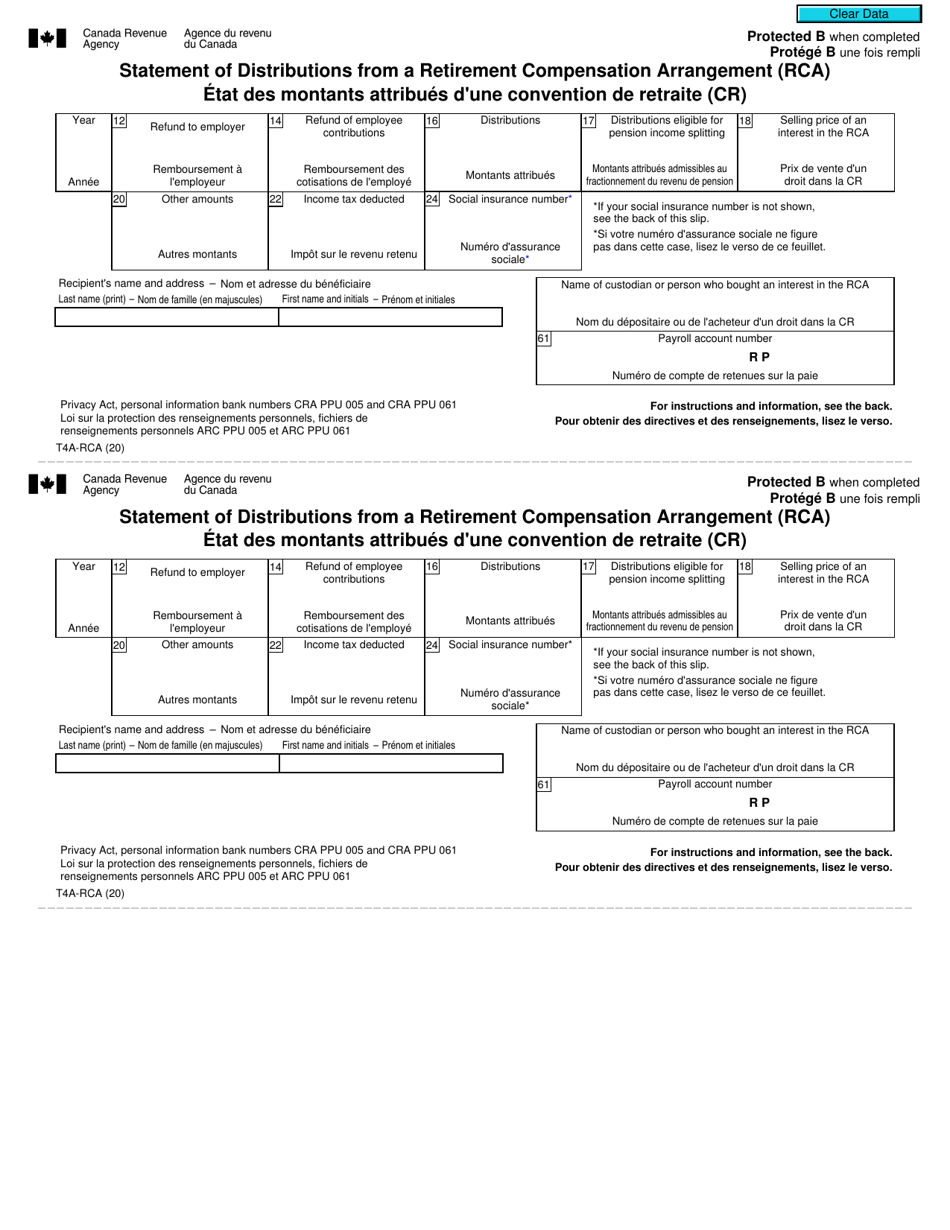

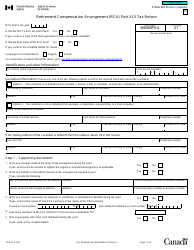

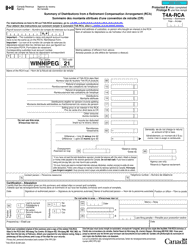

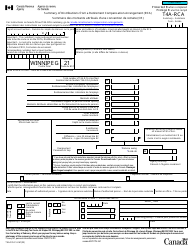

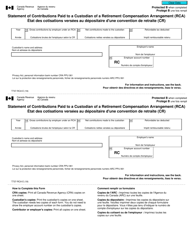

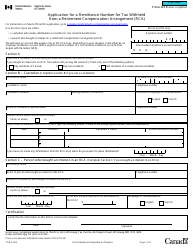

Form T4A-RCA Statement of Distributions From a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T4A-RCA is a statement of distributions from a Retirement Compensation Arrangement (RCA) in Canada. It is used to report the amount of eligible retiring allowances and other amounts that have been paid out of an RCA.

The Form T4A-RCA is filed by the payer of the retirement compensation arrangement (RCA) in Canada, both in English and French.

FAQ

Q: What is Form T4A-RCA?

A: Form T4A-RCA is a tax form used to report distributions from a Retirement Compensation Arrangement (RCA) in Canada.

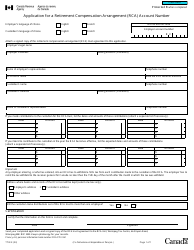

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of pension plan that provides benefits to high-income earners.

Q: Who needs to file Form T4A-RCA?

A: Employers who make distributions from an RCA must file Form T4A-RCA to report those distributions.

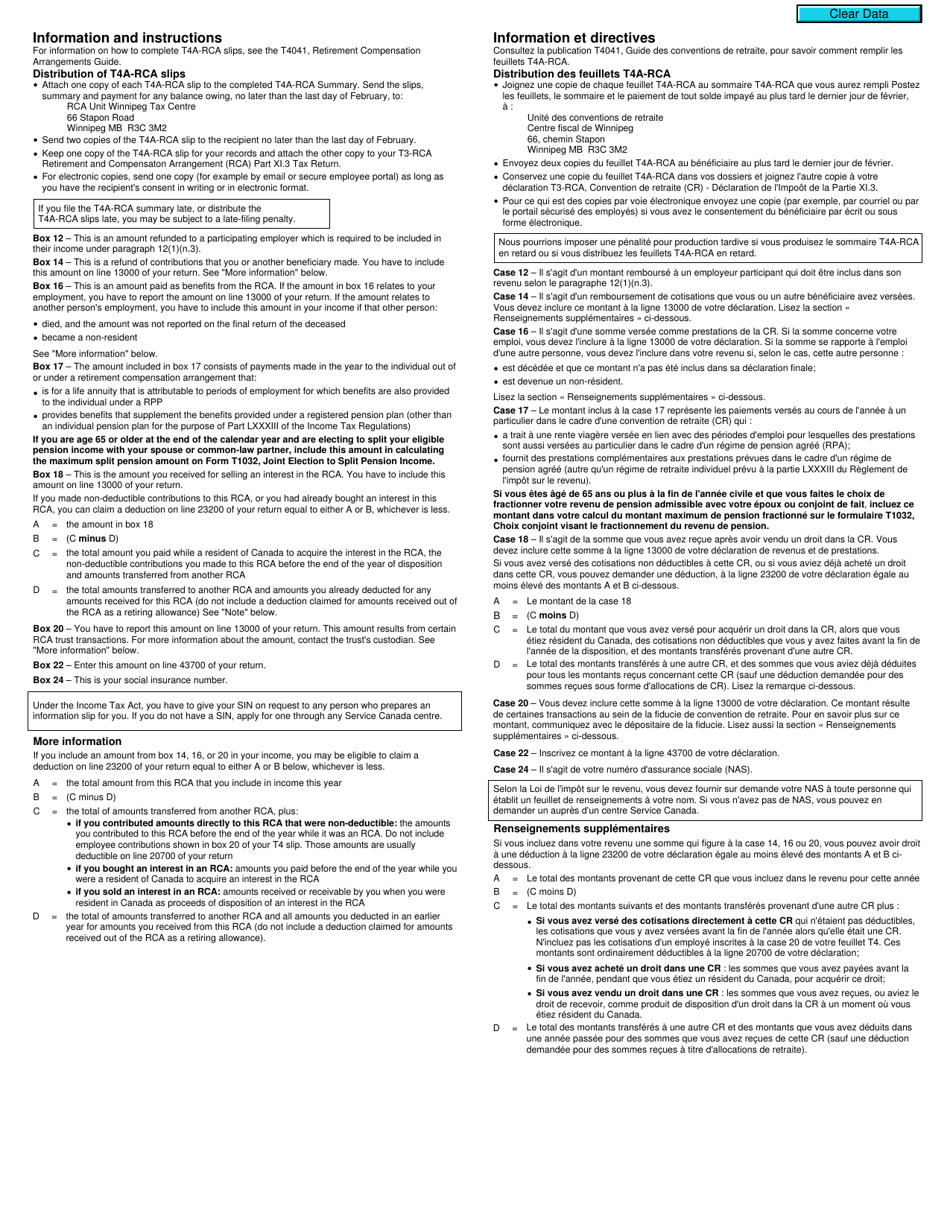

Q: When is Form T4A-RCA due?

A: Form T4A-RCA must be filed by the last day of February following the calendar year in which the distributions were made.

Q: Are there different versions of Form T4A-RCA for English and French?

A: Yes, there are separate versions of Form T4A-RCA available in both English and French.

Q: Are distributions from an RCA taxable?

A: Yes, distributions from an RCA are generally taxable as income.

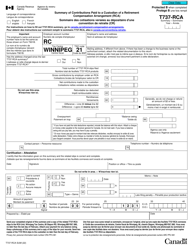

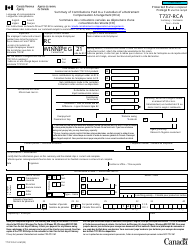

Q: What information is required on Form T4A-RCA?

A: Form T4A-RCA requires information such as the recipient's name, address, social insurance number, and the amount of distributions made.

Q: Is Form T4A-RCA the same as T4A?

A: No, Form T4A-RCA is specifically for reporting distributions from an RCA, while Form T4A is used for other types of income.

Q: What should I do if I make a mistake on Form T4A-RCA?

A: If you make a mistake on Form T4A-RCA, you should contact the CRA to report the error and request guidance on how to correct it.