This version of the form is not currently in use and is provided for reference only. Download this version of

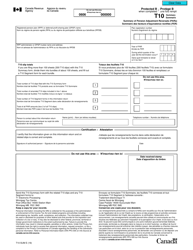

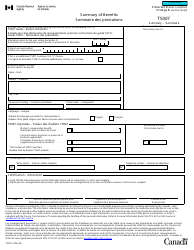

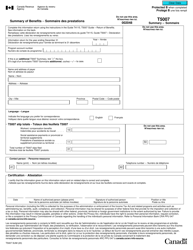

Form T3 SUM

for the current year.

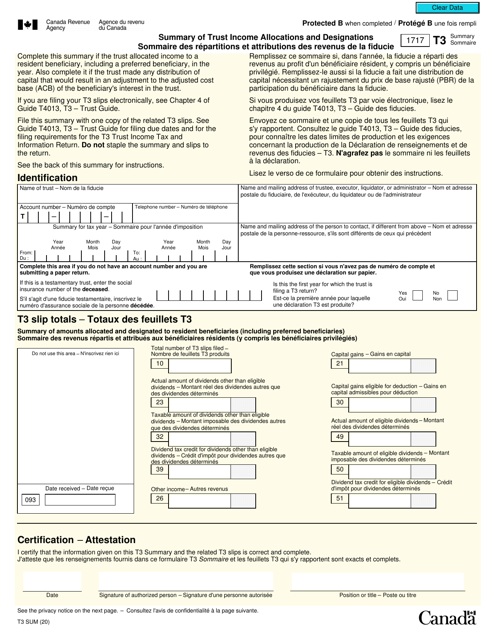

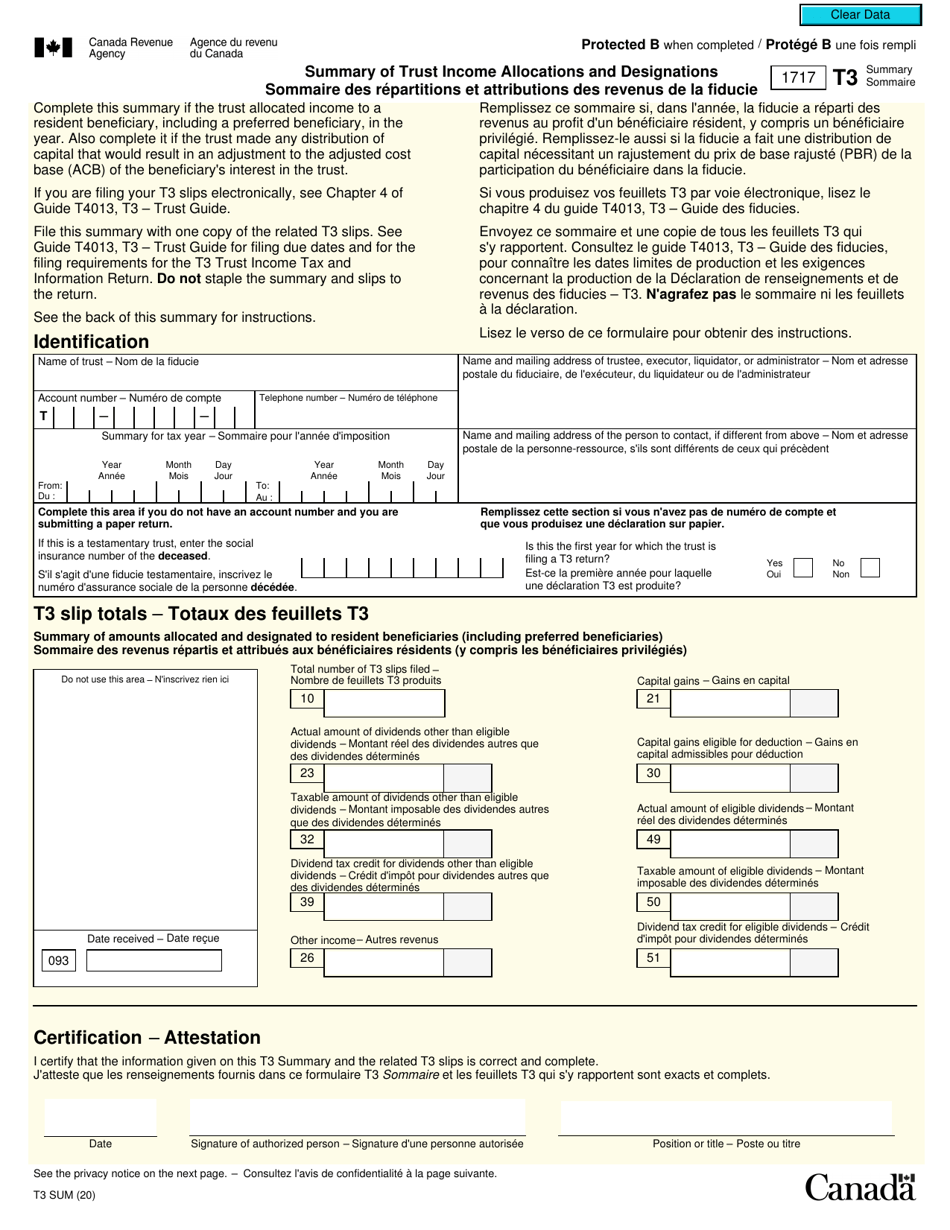

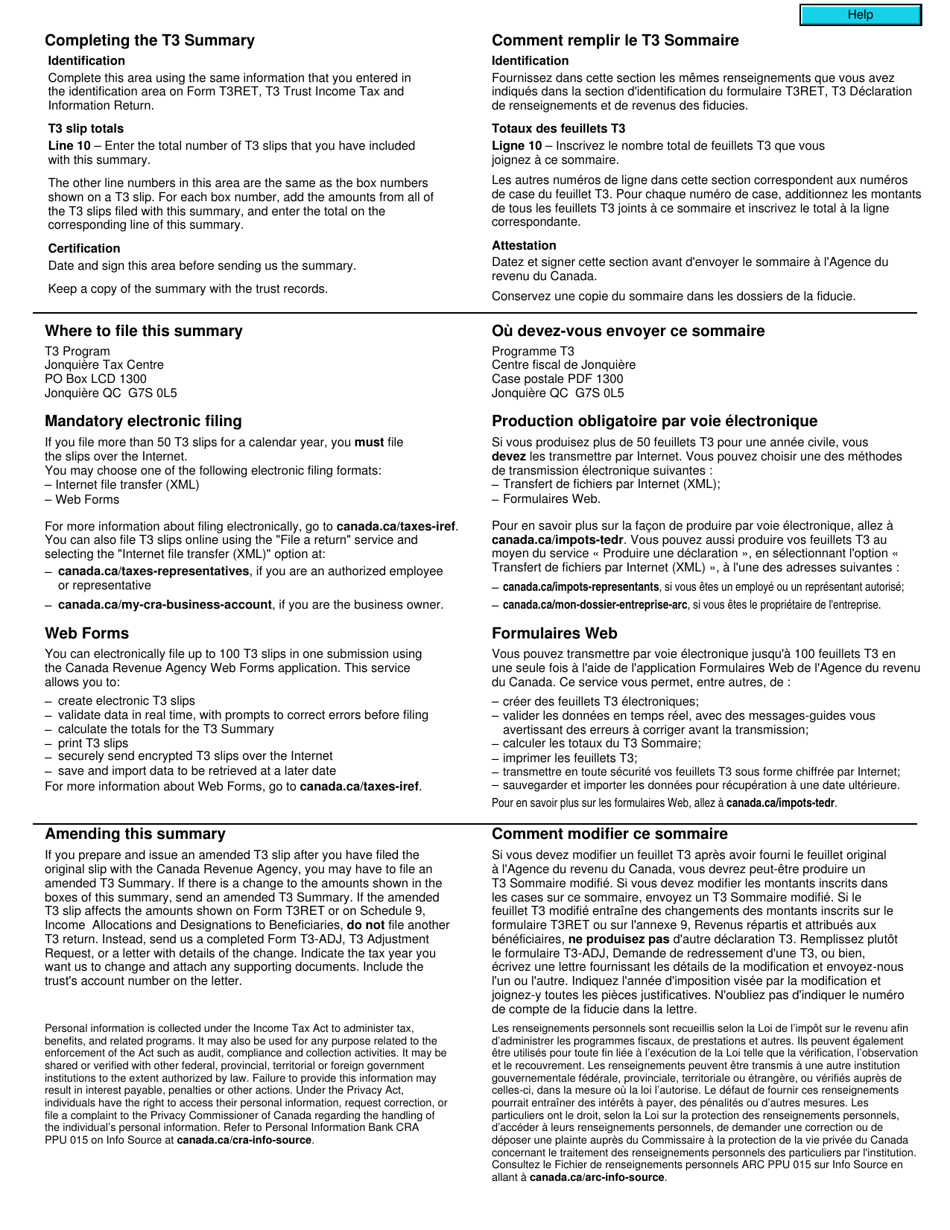

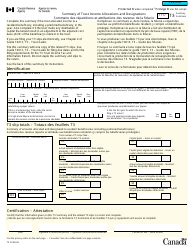

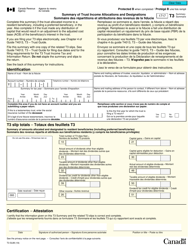

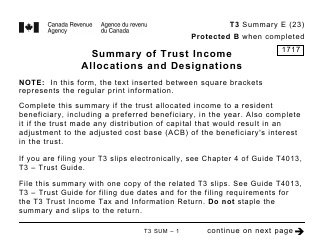

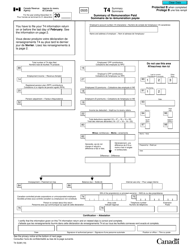

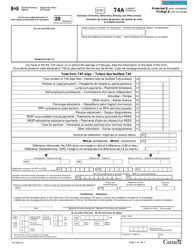

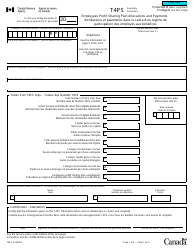

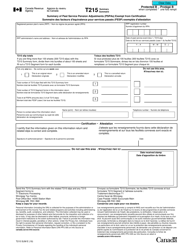

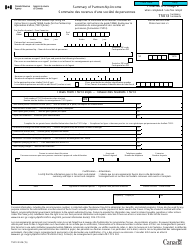

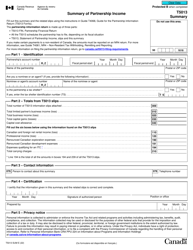

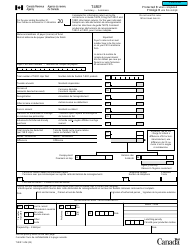

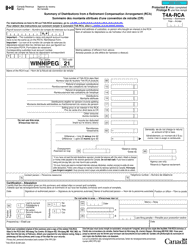

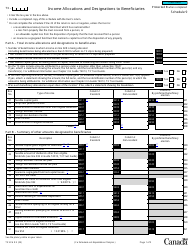

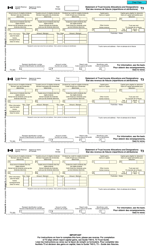

Form T3 SUM Summary of Trust Income Allocations and Designations - Canada (English / French)

Form T3 SUM is a summary of trust income allocations and designations used in Canada. It is used to report the income, deductions, credits, and other tax information for a trust. This form helps the Canada Revenue Agency (CRA) to determine the trust's taxable income and ensures proper tax compliance. The form is available in both English and French languages.

The Form T3SUM Summary of Trust Income Allocations and Designations is filed by the trustee of the trust in Canada.

FAQ

Q: What is Form T3 SUM?

A: Form T3 SUM is a summary of trust income allocations and designations in Canada.

Q: Who needs to fill out Form T3 SUM?

A: Trusts in Canada that have allocated or designated income to various beneficiaries need to fill out Form T3 SUM.

Q: What information is required on Form T3 SUM?

A: Form T3 SUM requires information about the trust, the allocated income, the beneficiaries, and the designations made.

Q: Is Form T3 SUM available in both English and French?

A: Yes, Form T3 SUM is available in both English and French.