This version of the form is not currently in use and is provided for reference only. Download this version of

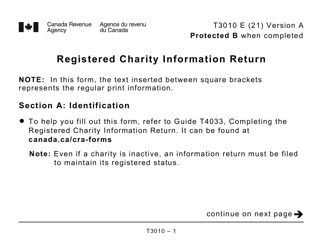

Form T3010

for the current year.

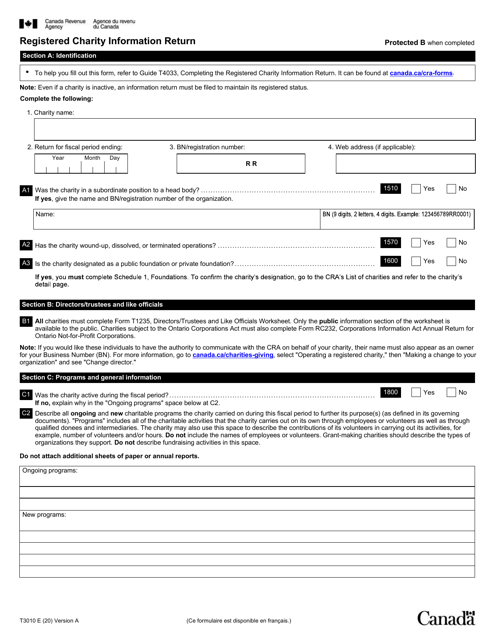

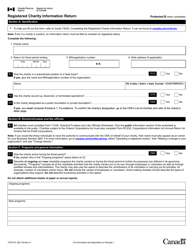

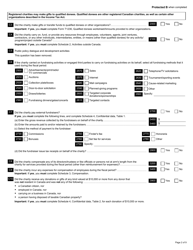

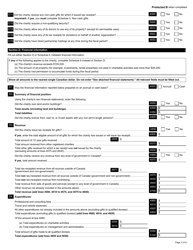

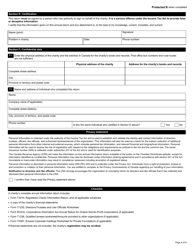

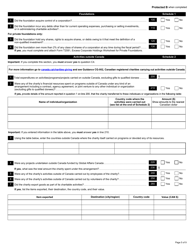

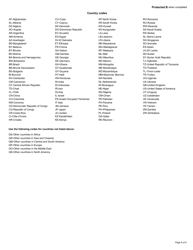

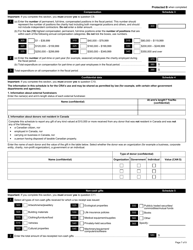

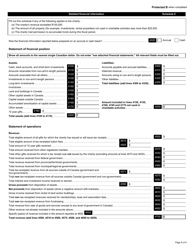

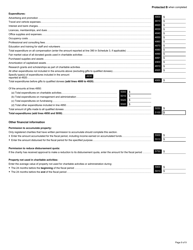

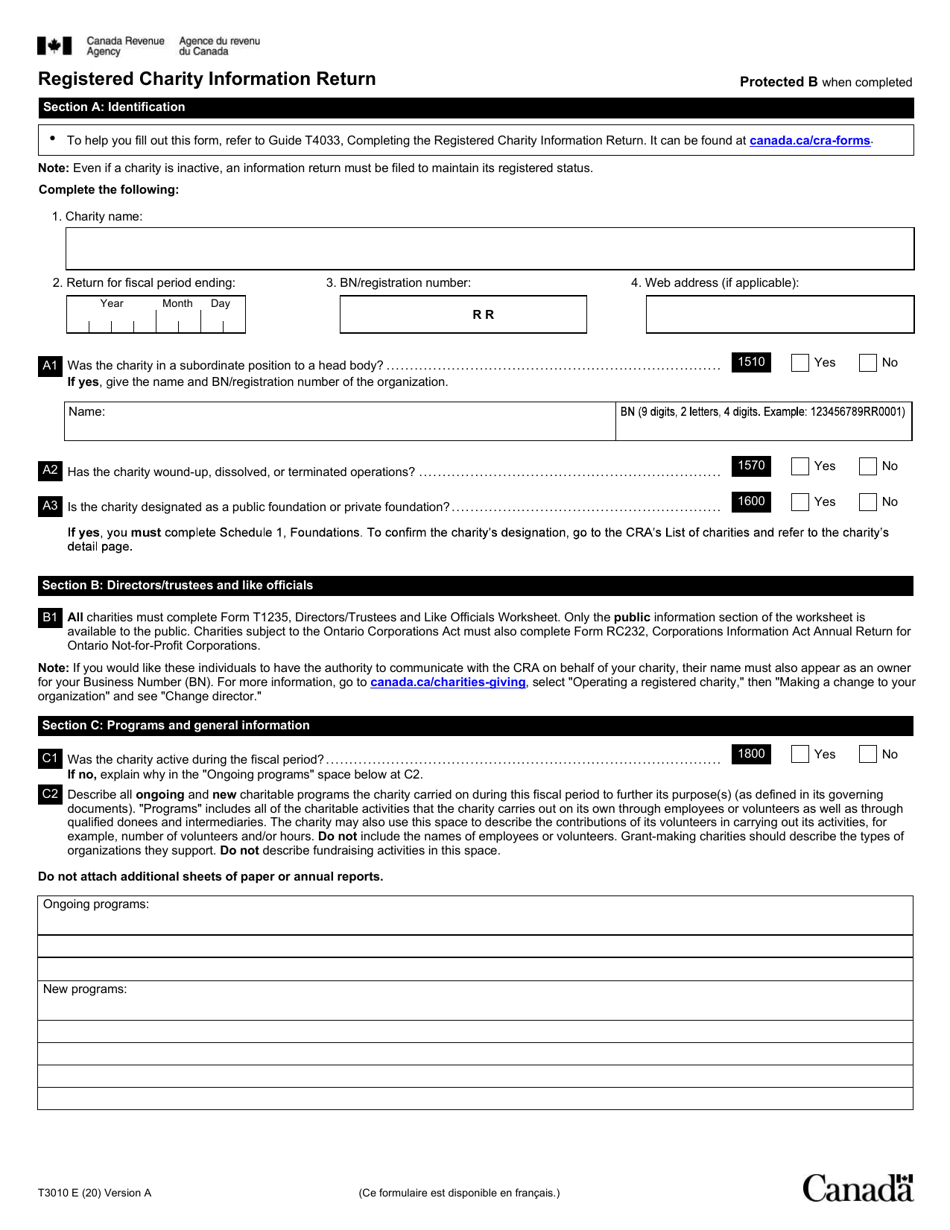

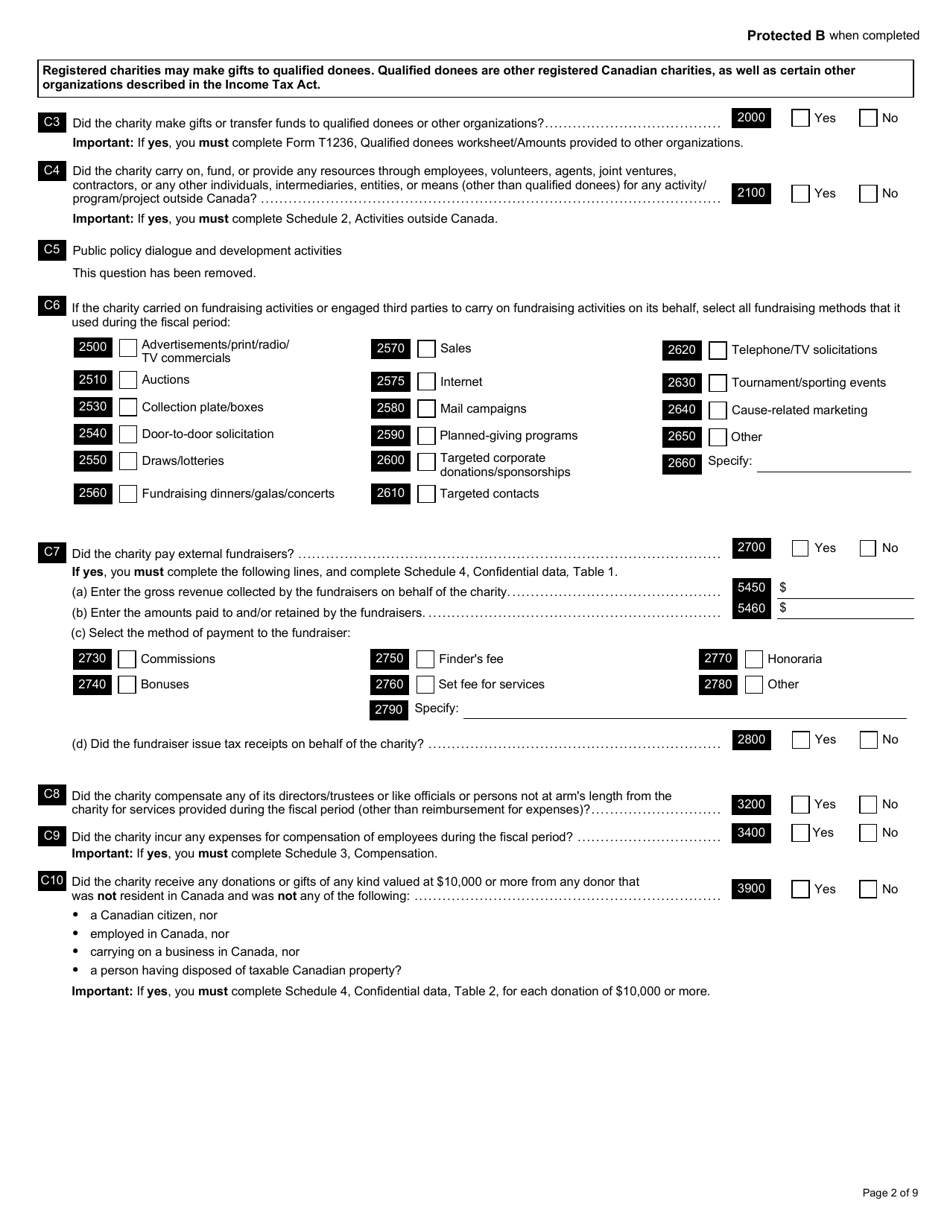

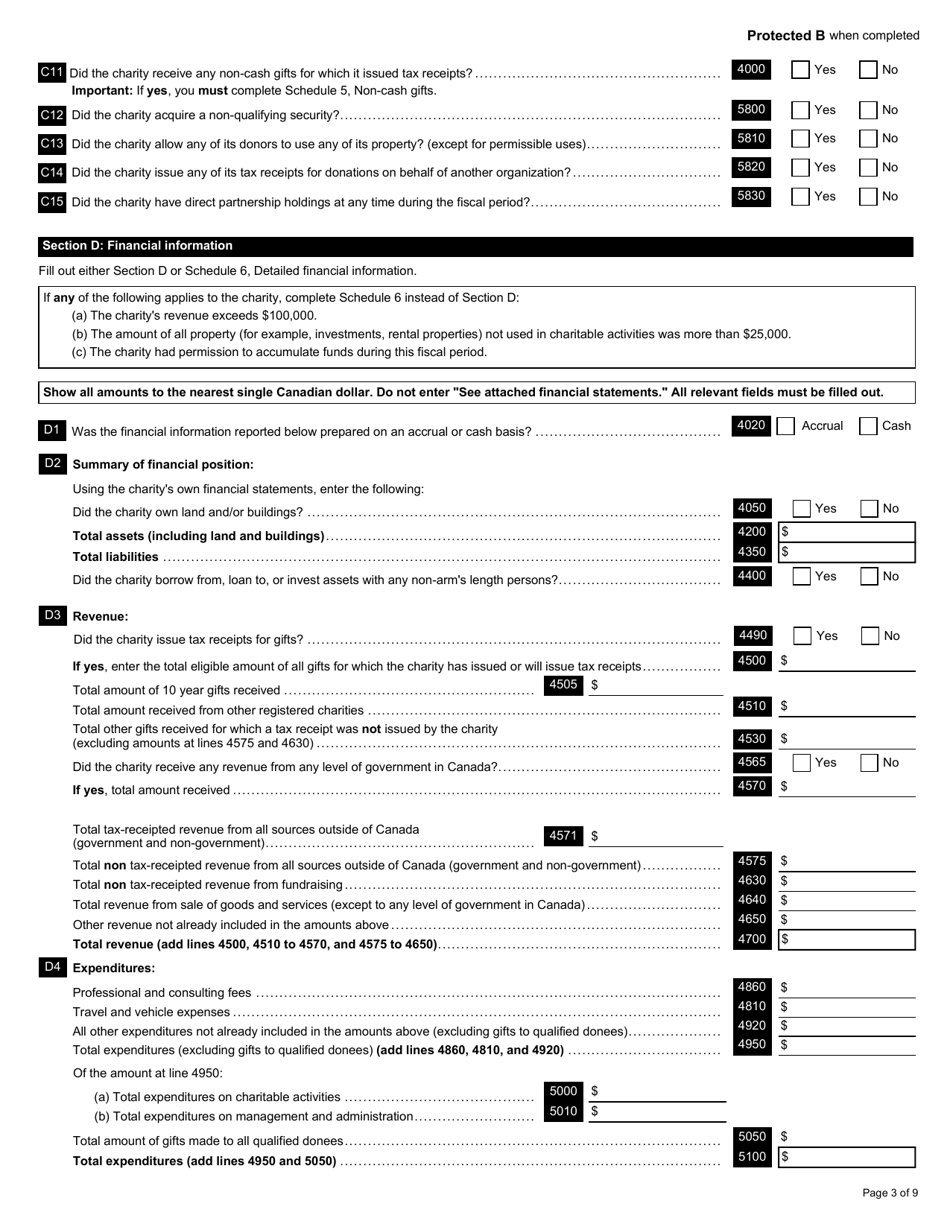

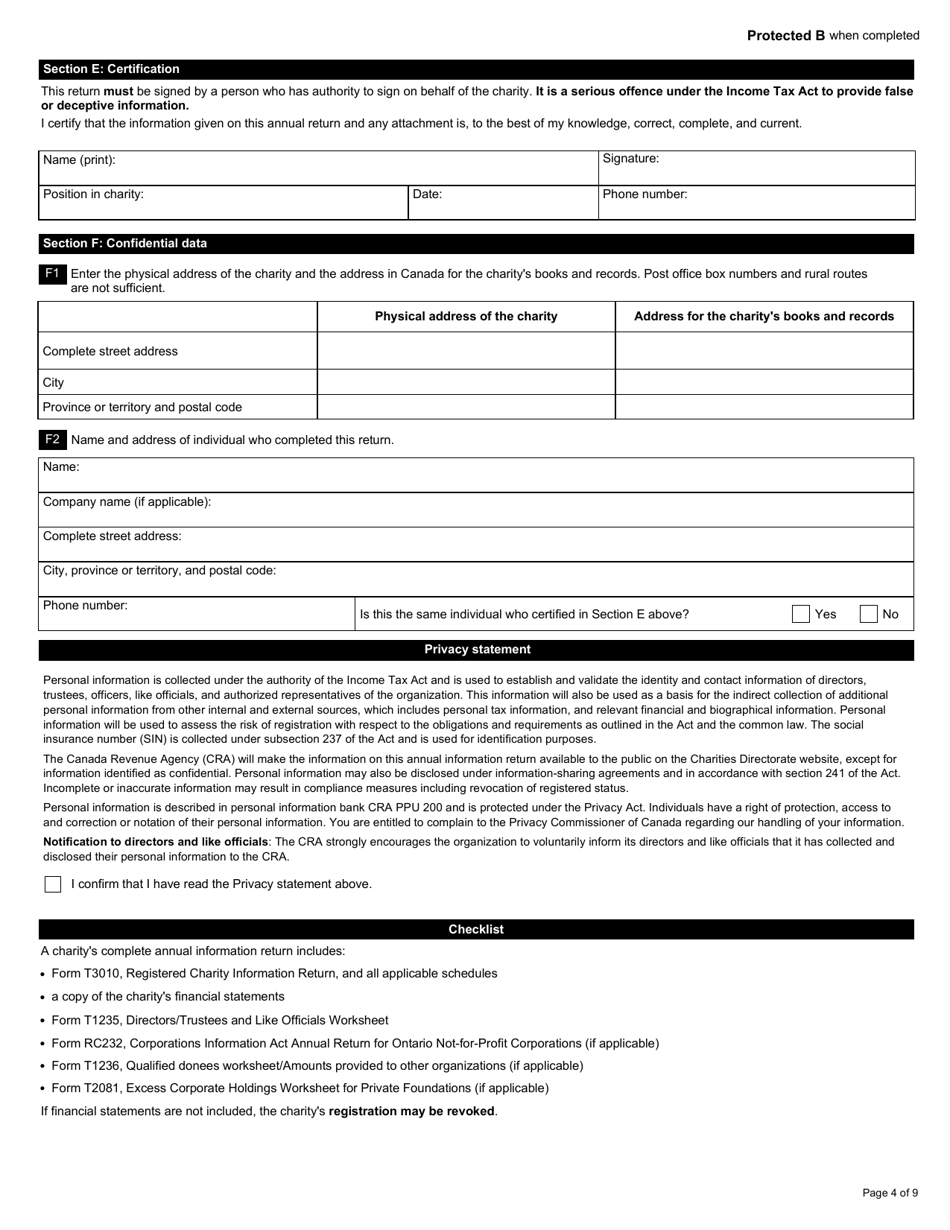

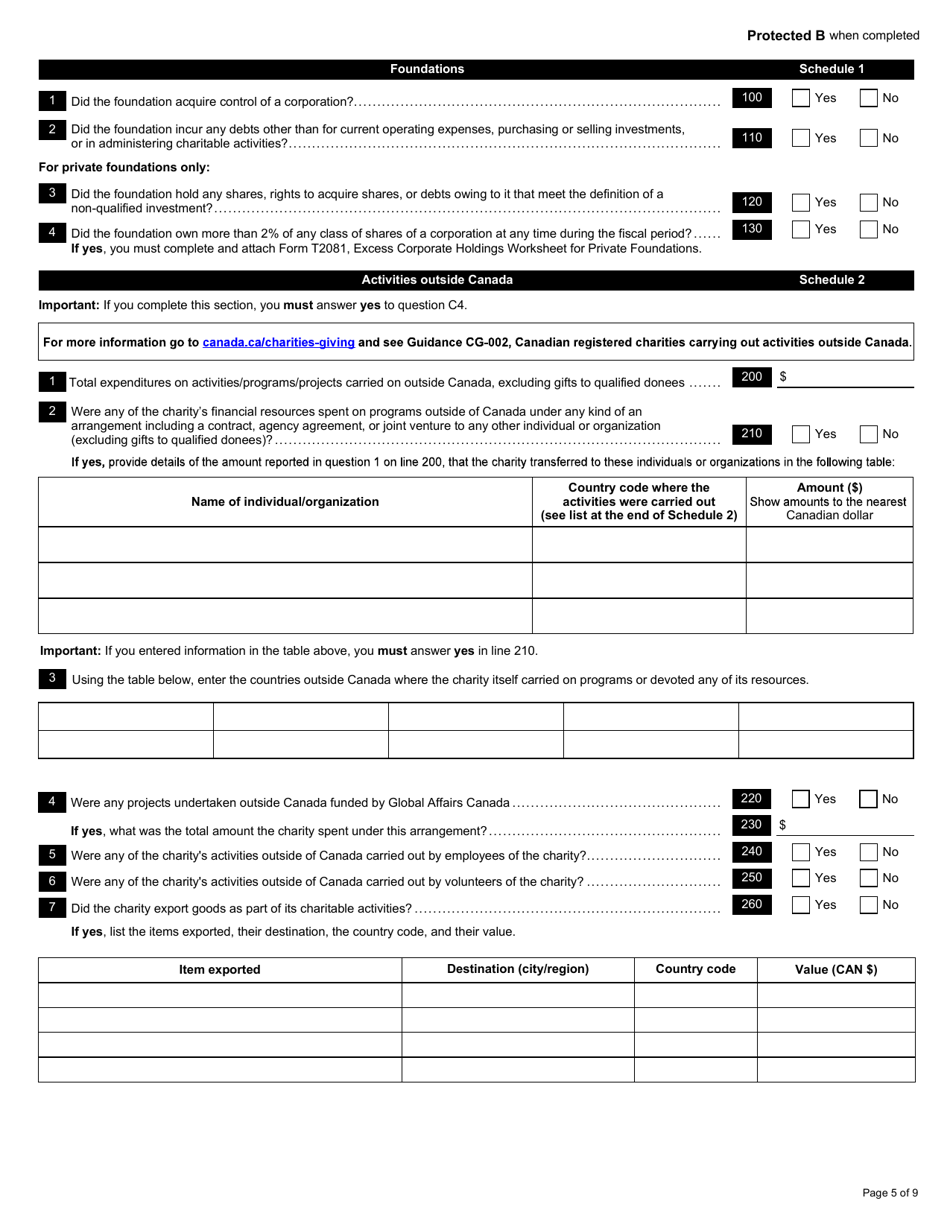

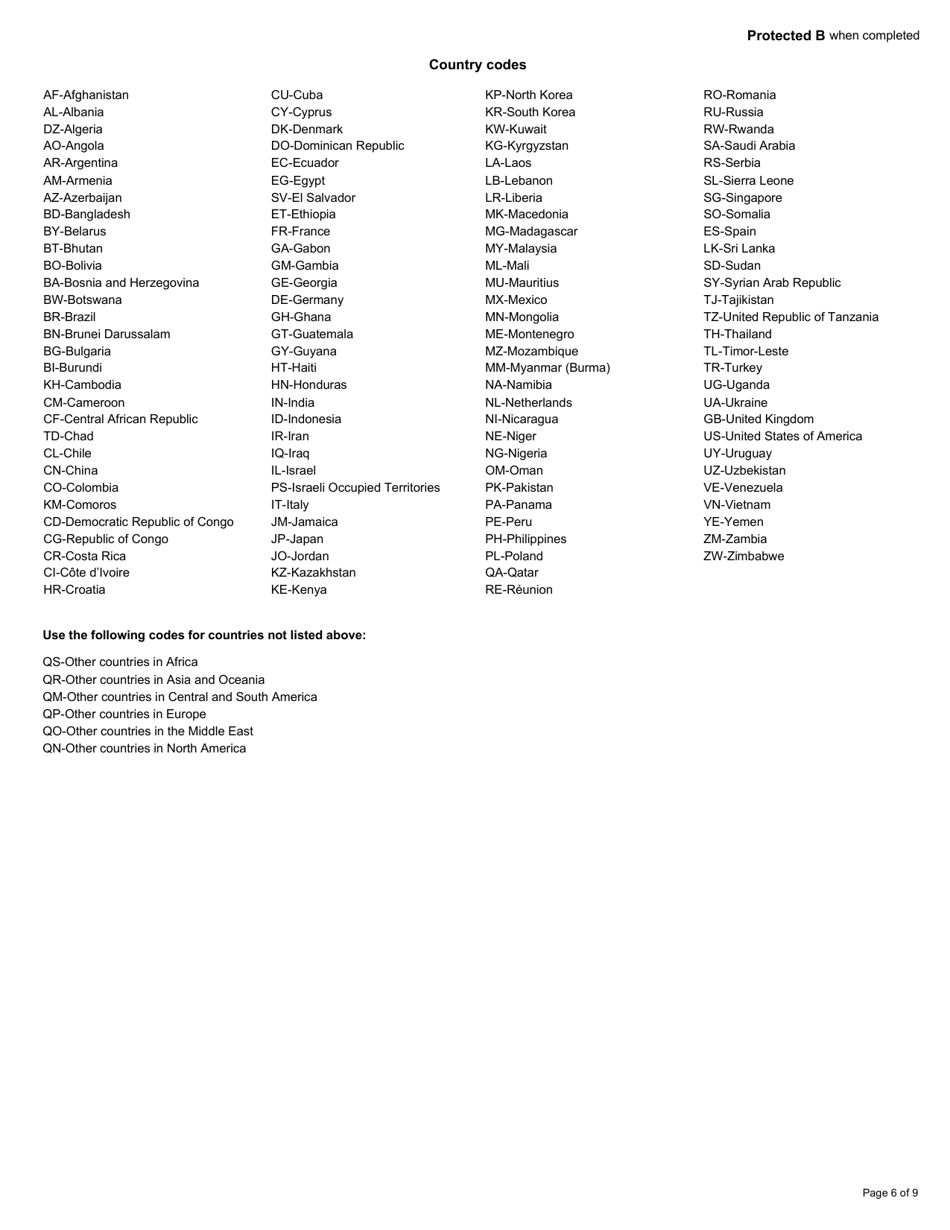

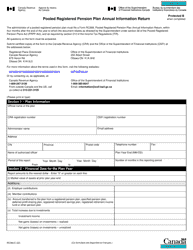

Form T3010 Registered Charity Information Return - Canada

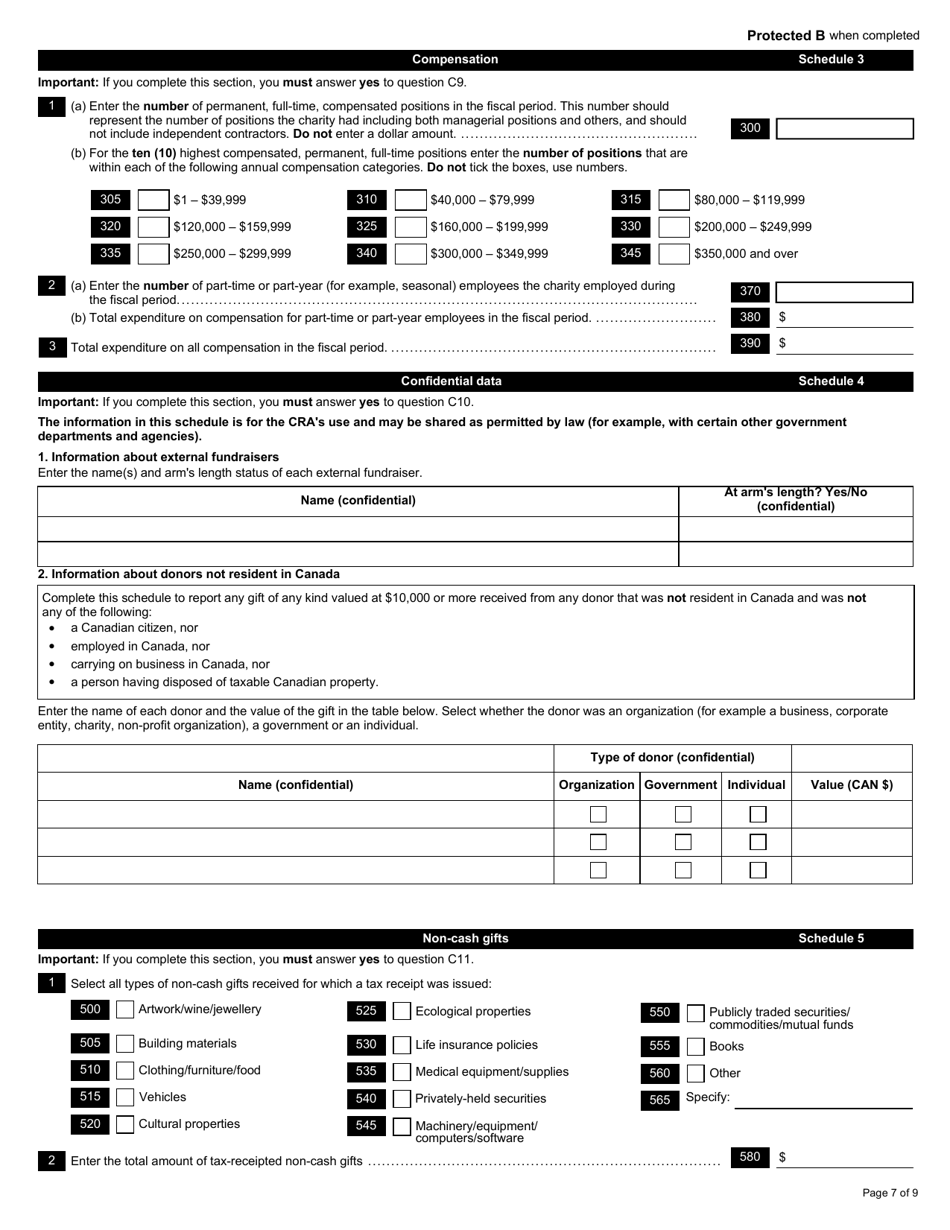

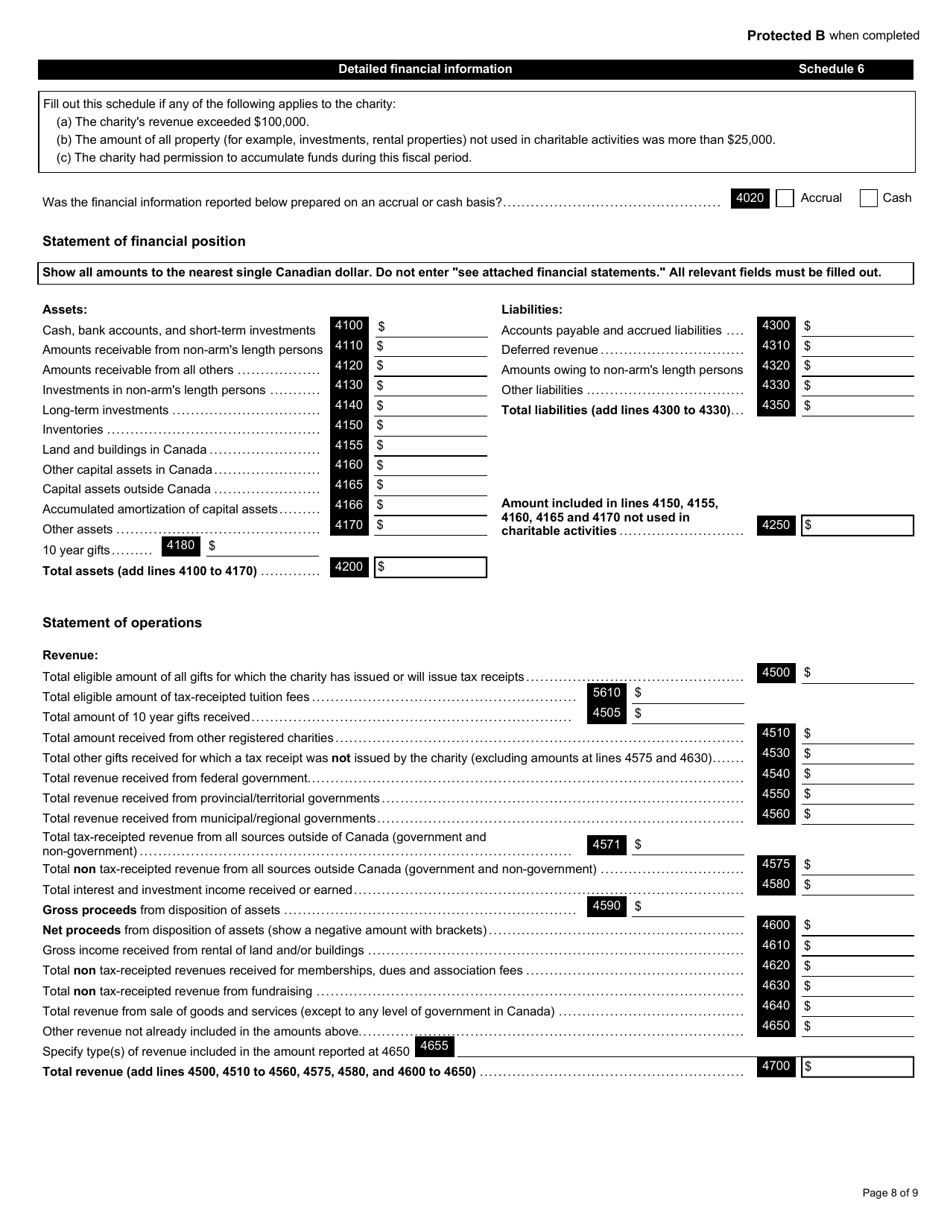

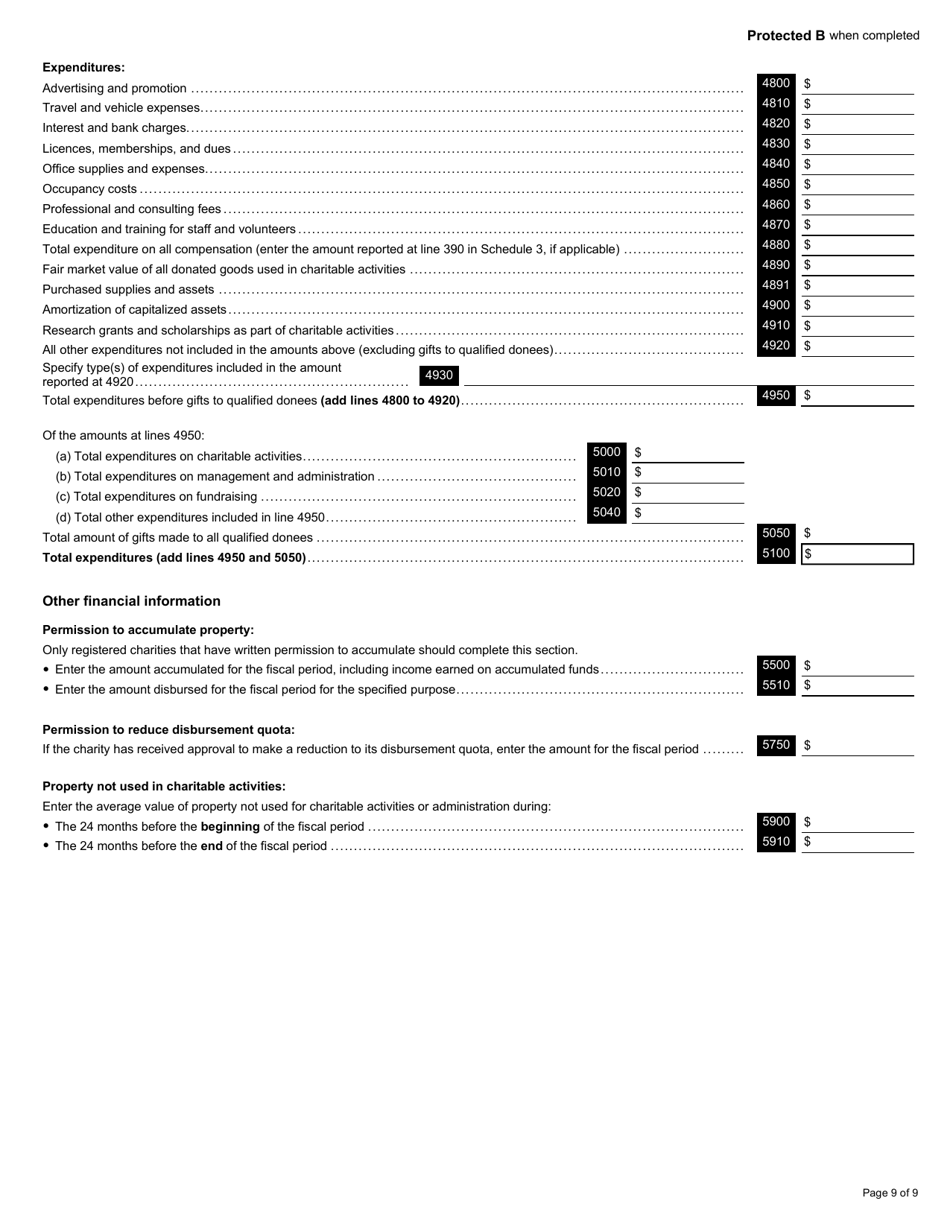

Form T3010 is the Registered Charity Information Return in Canada. It is used by Canadian registered charities to report their financial information and other important details to the Canada Revenue Agency (CRA). This form helps the CRA to monitor and ensure compliance with the rules and regulations governing charitable organizations in Canada.

The Form T3010 Registered Charity Information Return in Canada is filed by registered charities.

FAQ

Q: What is the T3010 Registered Charity Information Return?

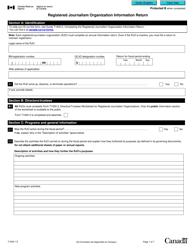

A: The T3010 Registered Charity Information Return is a form that registered charities in Canada are required to file with the Canada Revenue Agency (CRA) to provide detailed information about their activities, finances, and governance.

Q: Who needs to file the T3010 Registered Charity Information Return?

A: All registered charities in Canada must file the T3010 Registered Charity Information Return, regardless of their size or revenue.

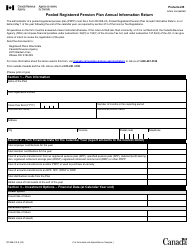

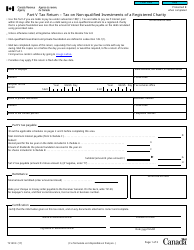

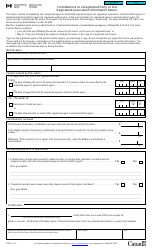

Q: What information is required in the T3010 Registered Charity Information Return?

A: The T3010 form requires charities to provide information about their charitable activities, financial statements, fundraising activities, board of directors, and other governance-related details.

Q: When is the deadline for filing the T3010 Registered Charity Information Return?

A: The deadline for filing the T3010 Registered Charity Information Return is within six months of the end of the charity's fiscal year. However, due to COVID-19, the CRA has provided temporary extensions for some charities.

Q: What happens if a registered charity fails to file the T3010 Registered Charity Information Return?

A: If a registered charity fails to file the T3010 Registered Charity Information Return, it may face penalties or even revocation of its charitable status by the CRA.

Q: Are there any fees associated with filing the T3010 Registered Charity Information Return?

A: No, there are no fees for filing the T3010 Registered Charity Information Return with the CRA.

Q: Can a registered charity request an extension to file the T3010 Registered Charity Information Return?

A: Yes, registered charities can request an extension to file the T3010 Registered Charity Information Return. They must submit a written request to the CRA explaining the reasons for the extension.

Q: Are there any resources available to help with completing the T3010 Registered Charity Information Return?

A: Yes, the CRA provides resources, such as guides and tutorials, to help registered charities complete the T3010 Registered Charity Information Return accurately.