This version of the form is not currently in use and is provided for reference only. Download this version of

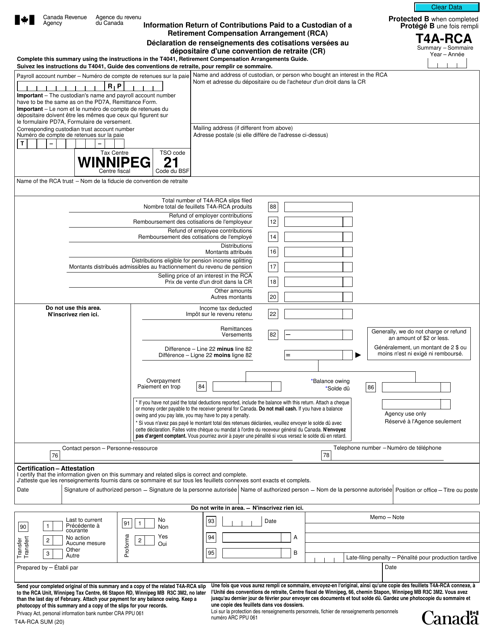

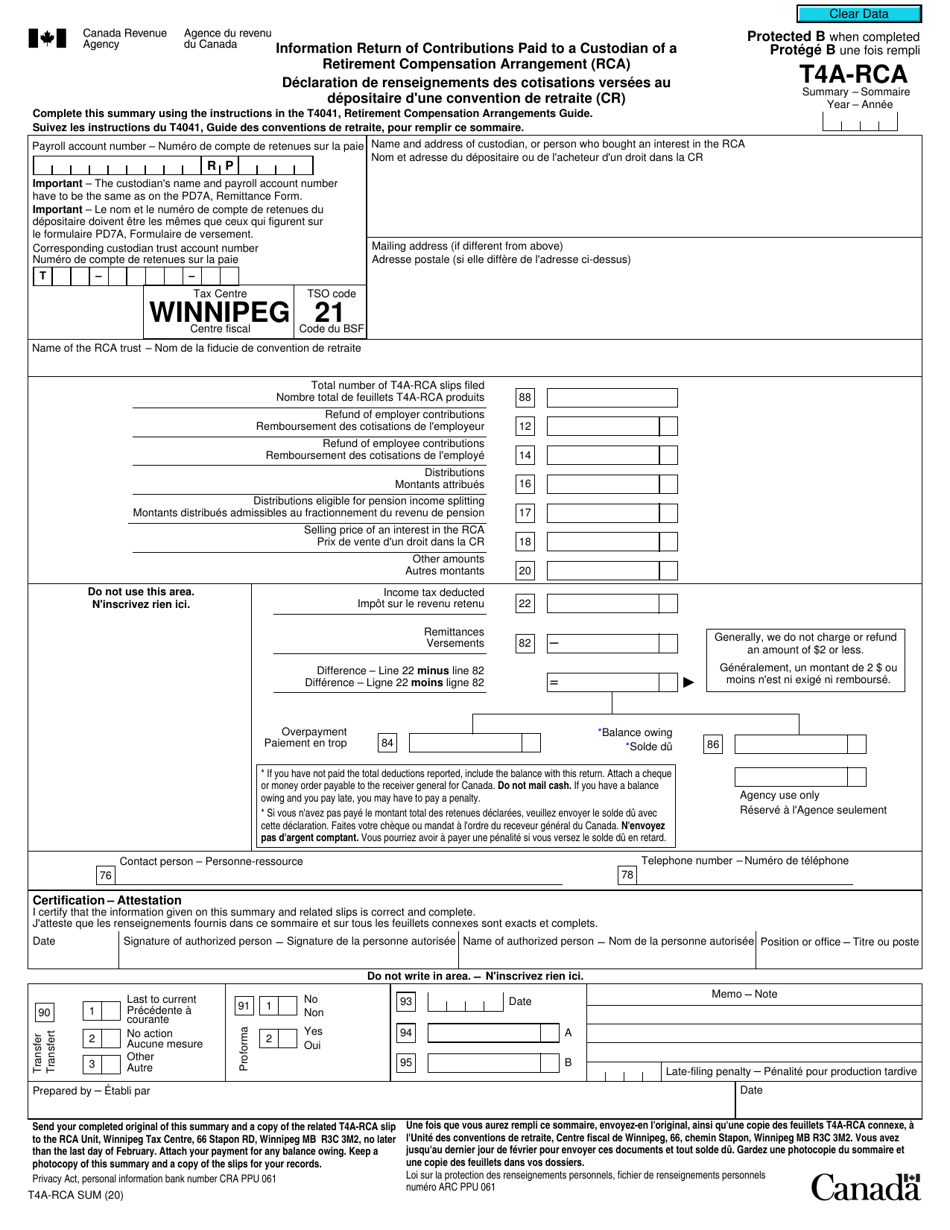

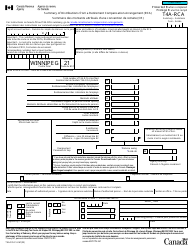

Form T4A-RCA-SUM

for the current year.

Form T4A-RCA-SUM Information Return of Distributions From a Retirement Compensation Arrangement (Rca) - Canada (English / French)

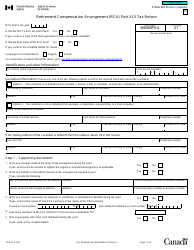

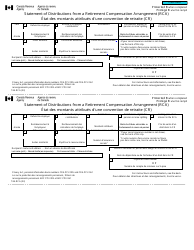

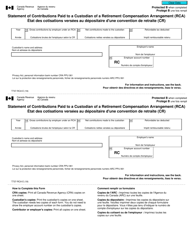

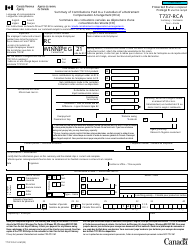

Form T4A-RCA-SUM is an information return used in Canada to report distributions made from a Retirement Compensation Arrangement (RCA). It is used to report these distributions to the Canada Revenue Agency (CRA) and provide the necessary information for tax purposes. The form is available in both English and French.

The Form T4A-RCA-SUM Information Return of Distributions from a Retirement Compensation Arrangement (RCA) in Canada can be filed by the person or entity responsible for making the distributions from the RCA.

FAQ

Q: What is Form T4A-RCA-SUM?

A: Form T4A-RCA-SUM is an information return for reporting distributions from a Retirement Compensation Arrangement (RCA) in Canada.

Q: What type of information does Form T4A-RCA-SUM include?

A: Form T4A-RCA-SUM includes information about the distributions made from a Retirement Compensation Arrangement (RCA), such as the recipient's name, social insurance number, and the amount of the distribution.

Q: Who needs to file Form T4A-RCA-SUM?

A: Employers or administrators of Retirement Compensation Arrangements (RCAs) in Canada need to file Form T4A-RCA-SUM to report the distributions made from the RCAs.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of retirement plan in Canada that provides retirement benefits to certain employees, such as key employees or highly paid employees.

Q: Is there a deadline for filing Form T4A-RCA-SUM?

A: Yes, the deadline for filing Form T4A-RCA-SUM is the last day of February following the calendar year in which the distributions were made.

Q: Is Form T4A-RCA-SUM available in both English and French?

A: Yes, Form T4A-RCA-SUM is available in both English and French.

Q: Do I need to send Form T4A-RCA-SUM to the recipients of the distributions?

A: Yes, you need to provide a copy of Form T4A-RCA-SUM to the recipients of the distributions.

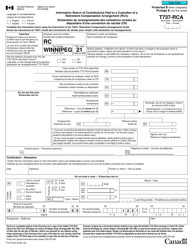

Q: Can I file Form T4A-RCA-SUM electronically?

A: Yes, you can file Form T4A-RCA-SUM electronically through the CRA's Internet File Transfer (XML) service or by using certified tax software.

Q: What should I do if there are errors or changes in the information reported on Form T4A-RCA-SUM?

A: If there are errors or changes in the information reported on Form T4A-RCA-SUM, you need to correct and refile the form as soon as possible.