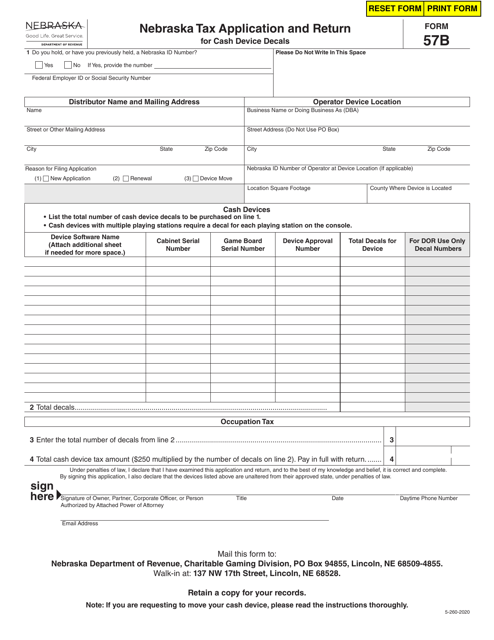

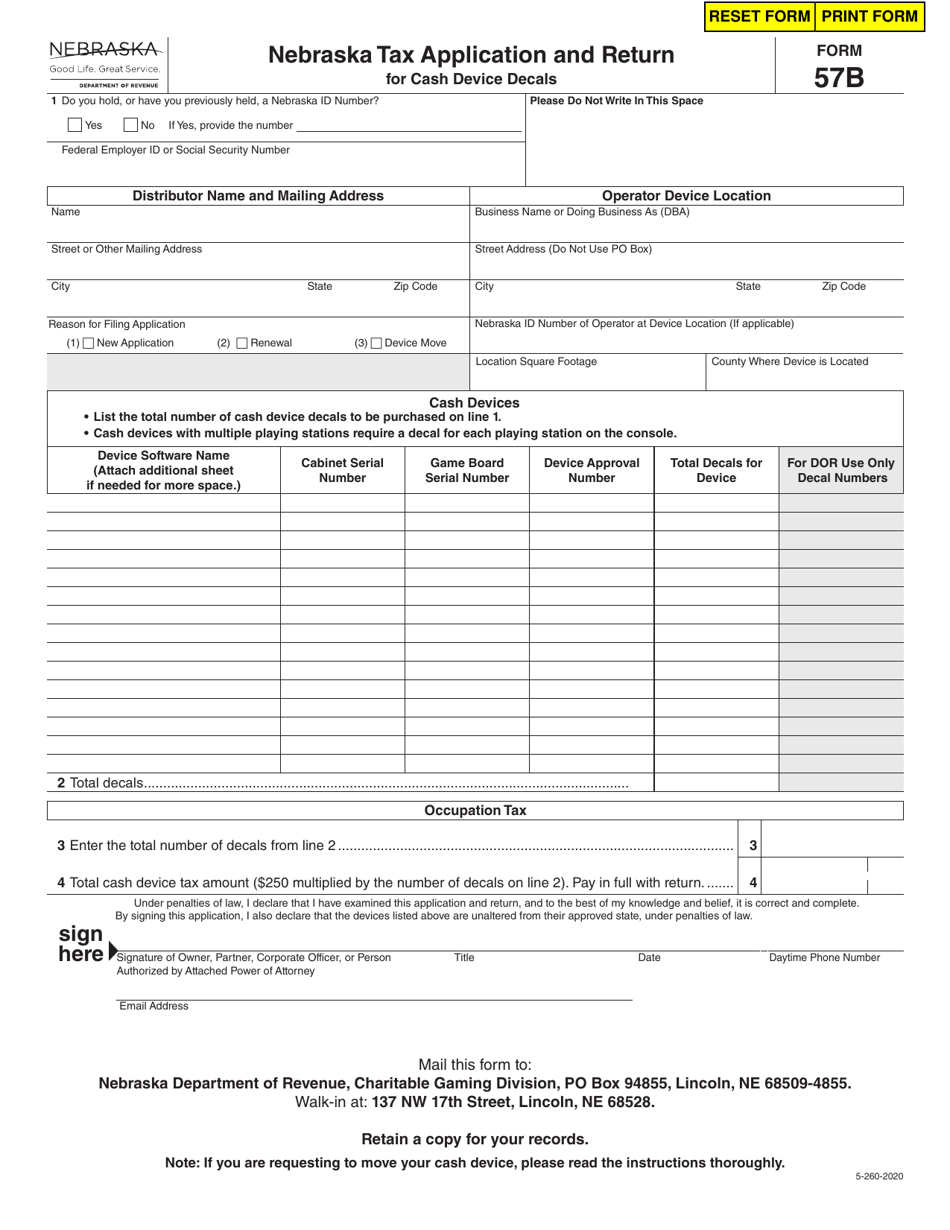

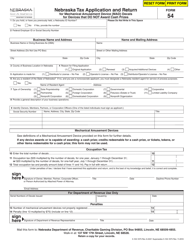

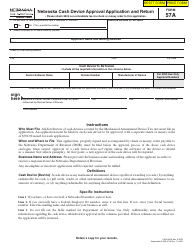

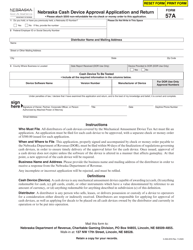

Form 57B (5-260-2020) Nebraska Tax Application and Return for Cash Device Decals - Nebraska

What Is Form 57B (5-260-2020)?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57B?

A: Form 57B is the Nebraska Tax Application and Return for Cash Device Decals.

Q: What is the purpose of Form 57B?

A: The purpose of Form 57B is to apply for and report taxes related to cash device decals in Nebraska.

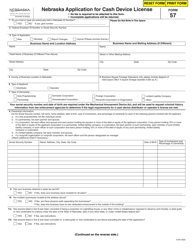

Q: Who needs to file Form 57B?

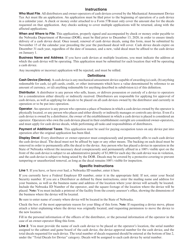

A: Anyone who operates cash devices in Nebraska, such as vending machines or coin-operated amusement devices, needs to file Form 57B.

Q: What is the deadline to file Form 57B?

A: The deadline for filing Form 57B is the last day of the month following the end of the calendar quarter.

Q: Do I need to pay a fee for the cash device decals?

A: Yes, there is a fee for each cash device decal, and the amount varies depending on the type of device.

Q: What happens if I don't file Form 57B?

A: Failure to file Form 57B or pay the required taxes can result in penalties and interest charges.

Q: Are there any exemptions or credits available?

A: Yes, there are certain exemptions and credits available for specific types of devices. Check the instructions on Form 57B for more information.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 57B (5-260-2020) by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.