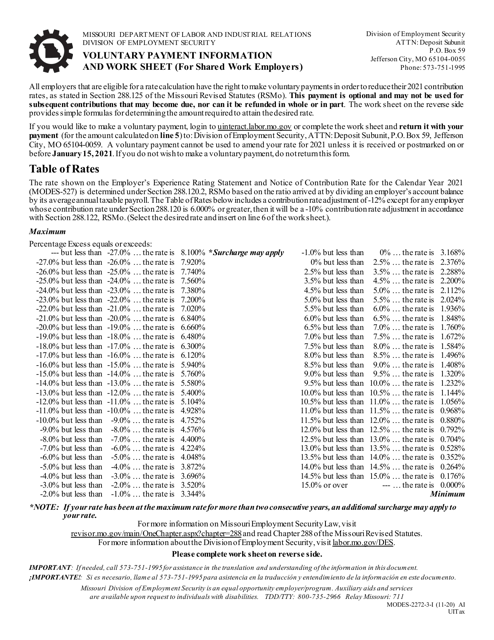

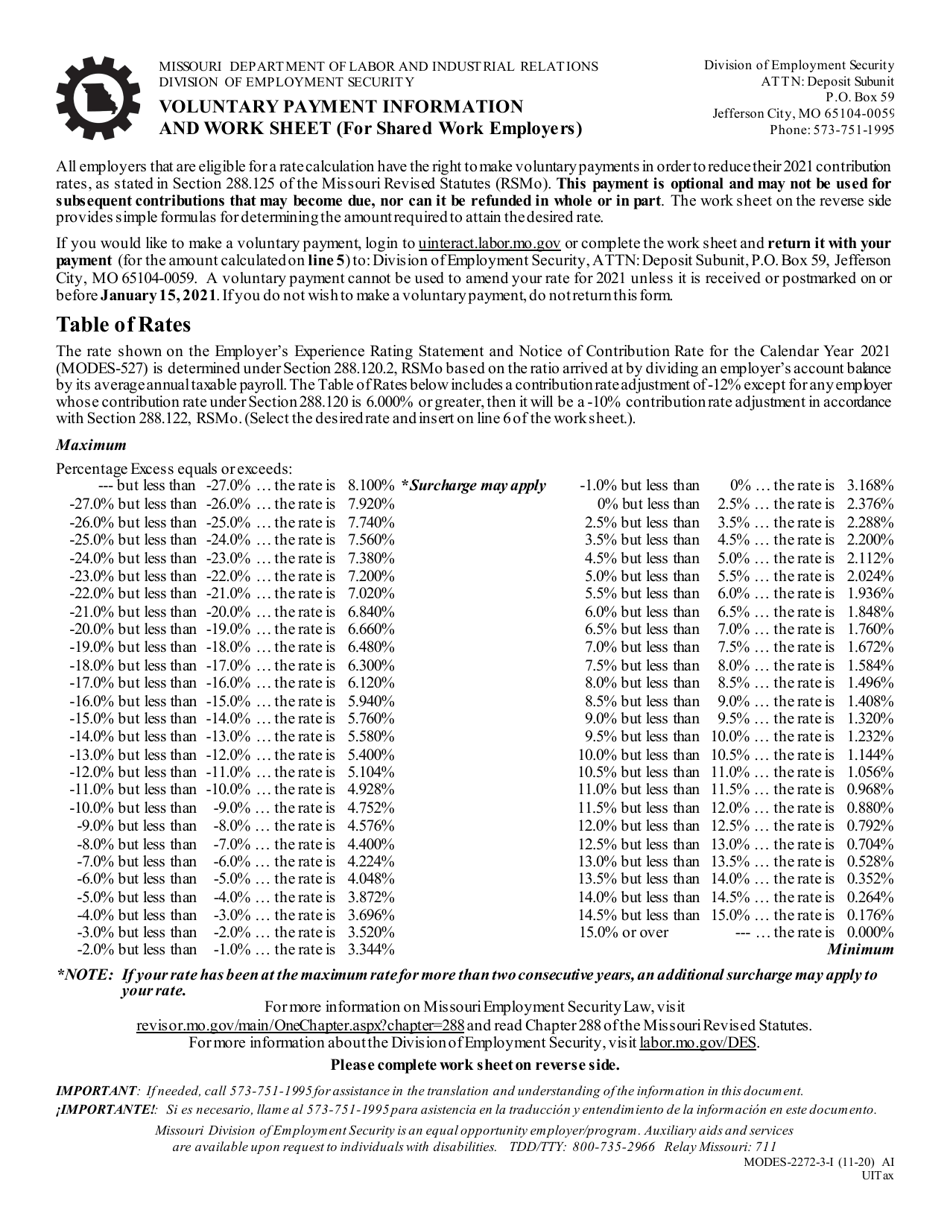

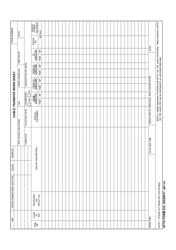

Form MODES-2272-3-I Voluntary Payment Work Sheet (For Shared Work Employers) - Missouri

What Is Form MODES-2272-3-I?

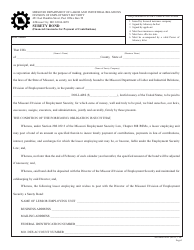

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

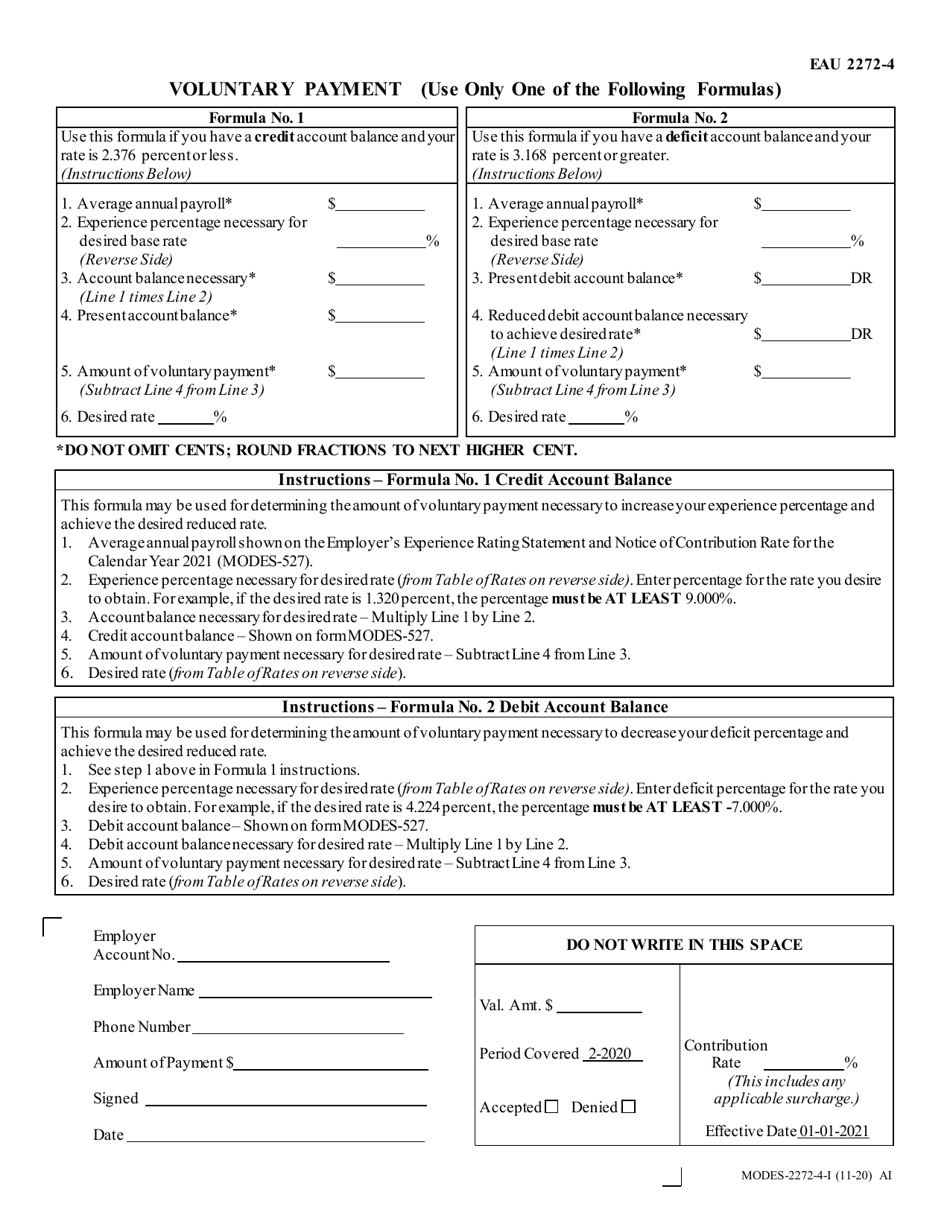

Q: What is Form MODES-2272-3-I?

A: Form MODES-2272-3-I is a Voluntary Payment Work Sheet specifically designed for Shared Work Employers in Missouri.

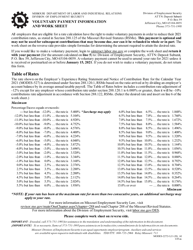

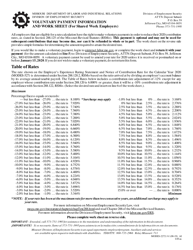

Q: What is the purpose of Form MODES-2272-3-I?

A: The purpose of Form MODES-2272-3-I is to help shared work employers calculate and make voluntary payments towards their shared work plan.

Q: Who needs to use Form MODES-2272-3-I?

A: Shared work employers in Missouri who want to make voluntary payments towards their shared work plan should use Form MODES-2272-3-I.

Q: What is a shared work plan?

A: A shared work plan is an alternative to layoffs, where employers reduce work hours for a group of employees and the employees receive partial unemployment benefits to supplement their reduced wages.

Q: Are shared work plans mandatory in Missouri?

A: Shared work plans are voluntary in Missouri. Employers can choose whether or not to participate in the shared work program.

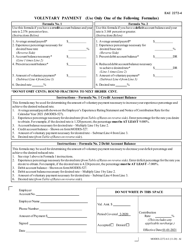

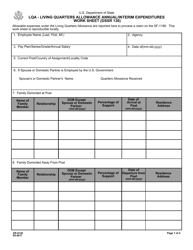

Q: What information is required on Form MODES-2272-3-I?

A: Form MODES-2272-3-I requires information such as the employer's name, address, tax identification number, and the amount of voluntary payment being made.

Q: Are there any deadlines for submitting Form MODES-2272-3-I?

A: The specific deadlines for submitting Form MODES-2272-3-I may vary. It is recommended to refer to the instructions on the form or contact the Missouri Division of Employment Security for deadline information.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-2272-3-I by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.