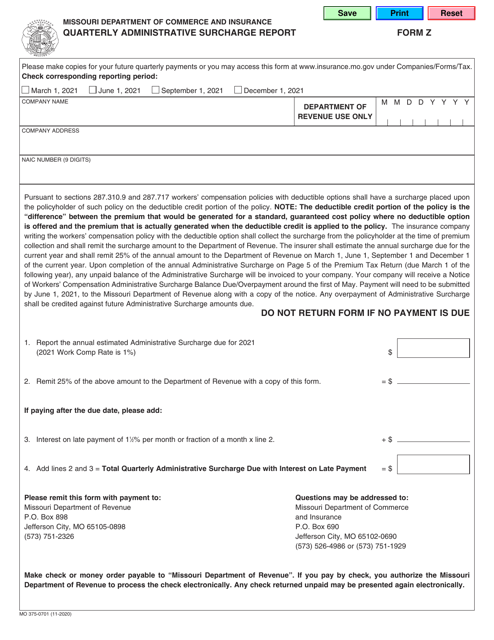

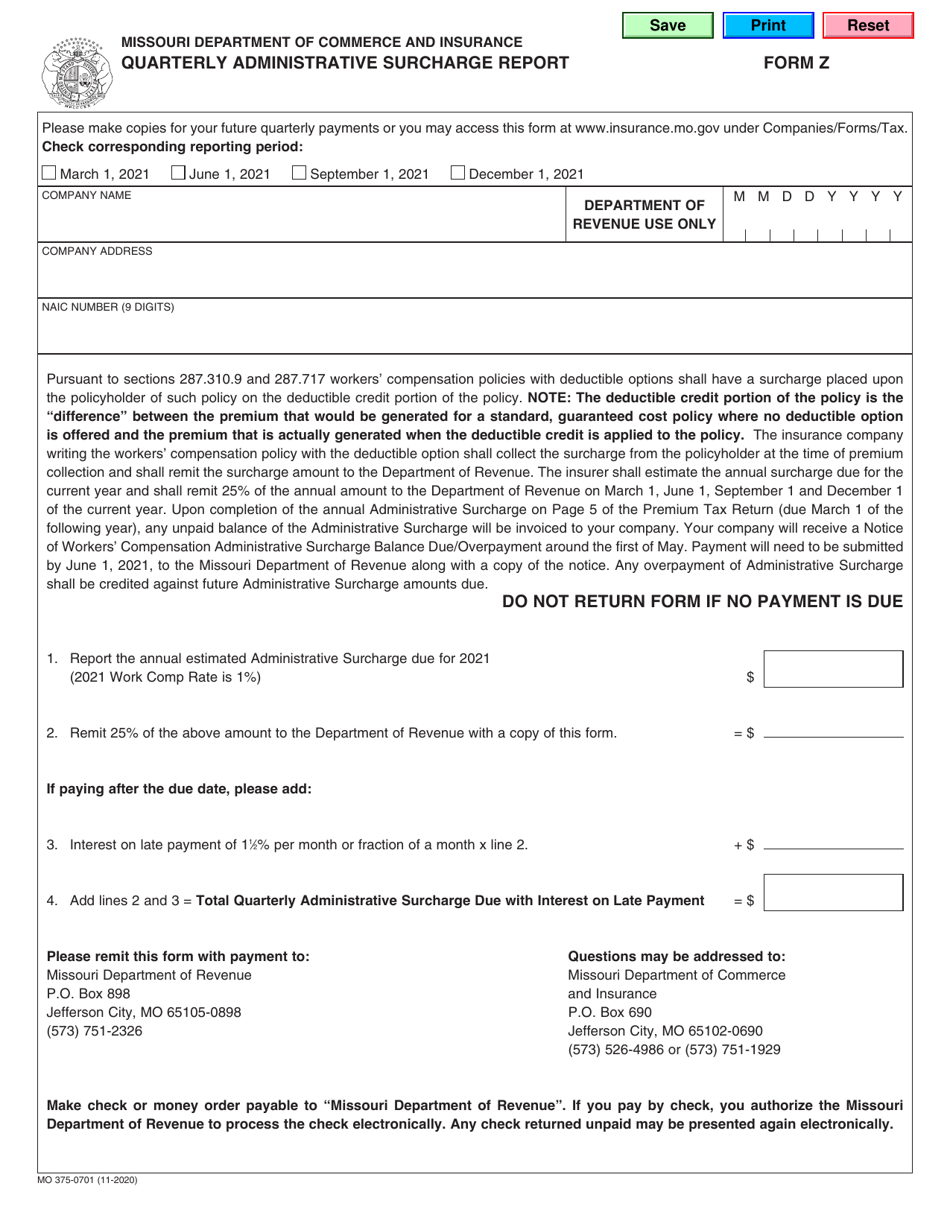

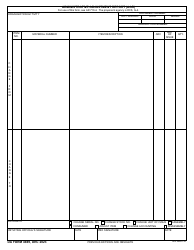

This version of the form is not currently in use and is provided for reference only. Download this version of

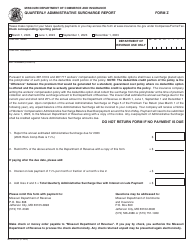

Form MO375-0701 (Z)

for the current year.

Form MO375-0701 (Z) Quarterly Administrative Surcharge Report - Missouri

What Is Form MO375-0701 (Z)?

This is a legal form that was released by the Missouri Department of Commerce and Insurance - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO375-0701?

A: Form MO375-0701 is the Quarterly Administrative Surcharge Report for Missouri.

Q: What is the purpose of Form MO375-0701?

A: The purpose of Form MO375-0701 is to report and pay the quarterly administrative surcharge for businesses in Missouri.

Q: Who needs to file Form MO375-0701?

A: Businesses in Missouri that are subject to the administrative surcharge need to file Form MO375-0701.

Q: When is Form MO375-0701 due?

A: Form MO375-0701 is due quarterly on the last day of the month following the end of the quarter.

Q: Is there a fee for filing Form MO375-0701?

A: Yes, there is an administrative surcharge fee that needs to be paid along with the form.

Q: What happens if I don't file Form MO375-0701?

A: Failure to file Form MO375-0701 or pay the administrative surcharge can result in penalties and interest.

Q: Do I need to include any supporting documentation with Form MO375-0701?

A: No, you do not need to include any supporting documentation with Form MO375-0701 unless specifically requested by the Missouri Department of Revenue.

Q: Who can I contact for more information about Form MO375-0701?

A: You can contact the Missouri Department of Revenue for more information about Form MO375-0701.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Missouri Department of Commerce and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO375-0701 (Z) by clicking the link below or browse more documents and templates provided by the Missouri Department of Commerce and Insurance.