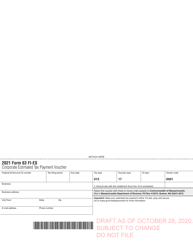

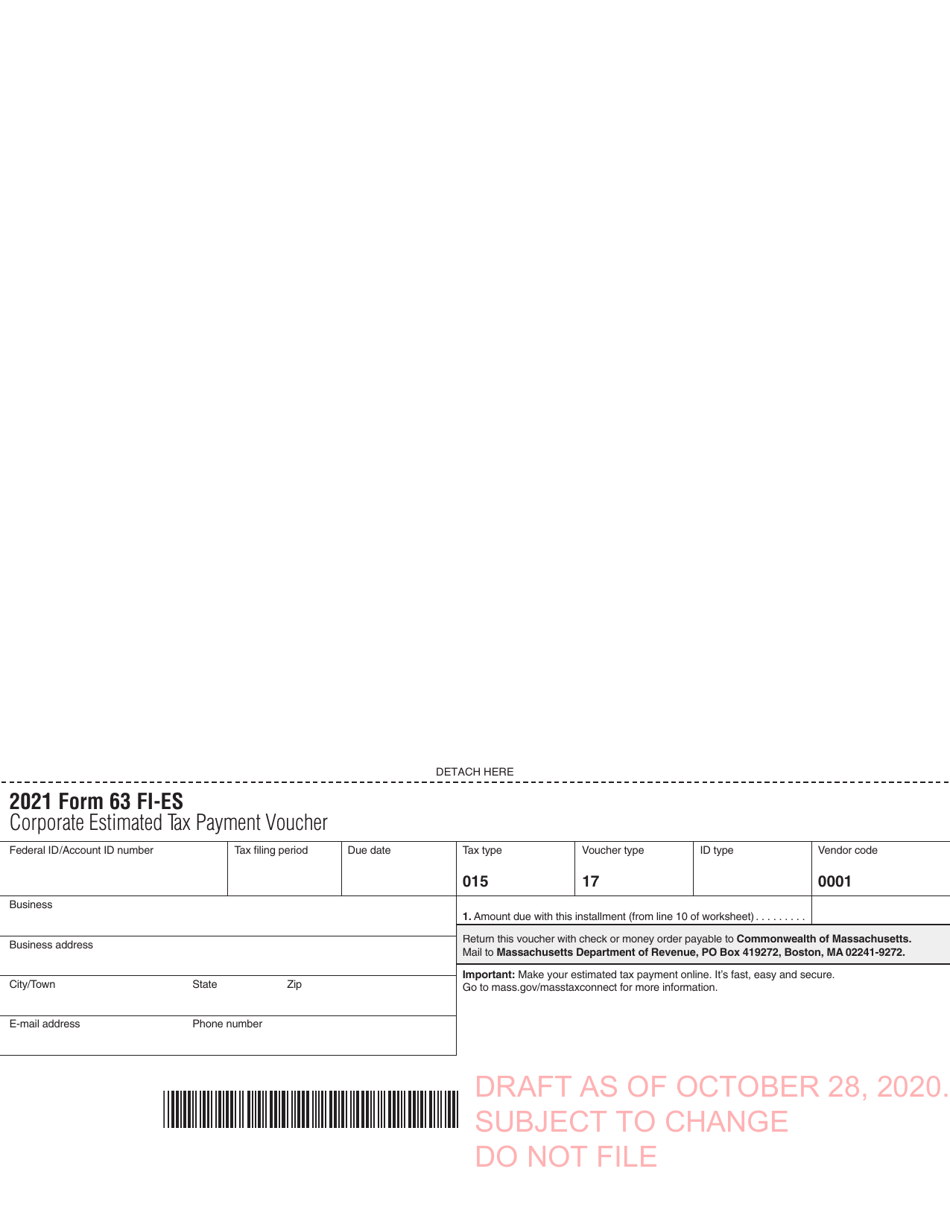

Form 63 FI-ES Corporate Estimated Tax Payment Voucher - Draft - Massachusetts

What Is Form 63 FI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 63 FI-ES?

A: Form 63 FI-ES is a voucher used for making corporate estimated tax payments in Massachusetts.

Q: What is the purpose of Form 63 FI-ES?

A: The purpose of Form 63 FI-ES is to submit estimated tax payments for corporate entities in Massachusetts.

Q: Who needs to use Form 63 FI-ES?

A: Corporate entities in Massachusetts that are required to make estimated tax payments should use Form 63 FI-ES.

Q: How often are estimated tax payments made using Form 63 FI-ES?

A: Projected income and tax liability should be paid in installments on a quarterly basis.

Q: Is Form 63 FI-ES required for all corporate entities in Massachusetts?

A: Yes, all corporate entities subject to Massachusetts income tax are required to make estimated tax payments using Form 63 FI-ES.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63 FI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.