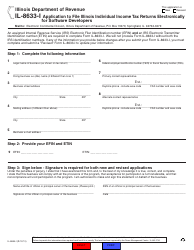

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IL-8453

for the current year.

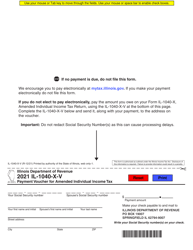

Form IL-8453 Illinois Individual Income Tax Electronic Filing Declaration - Illinois

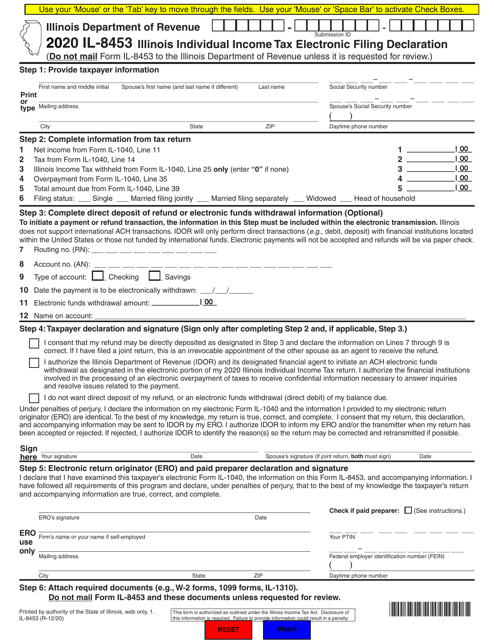

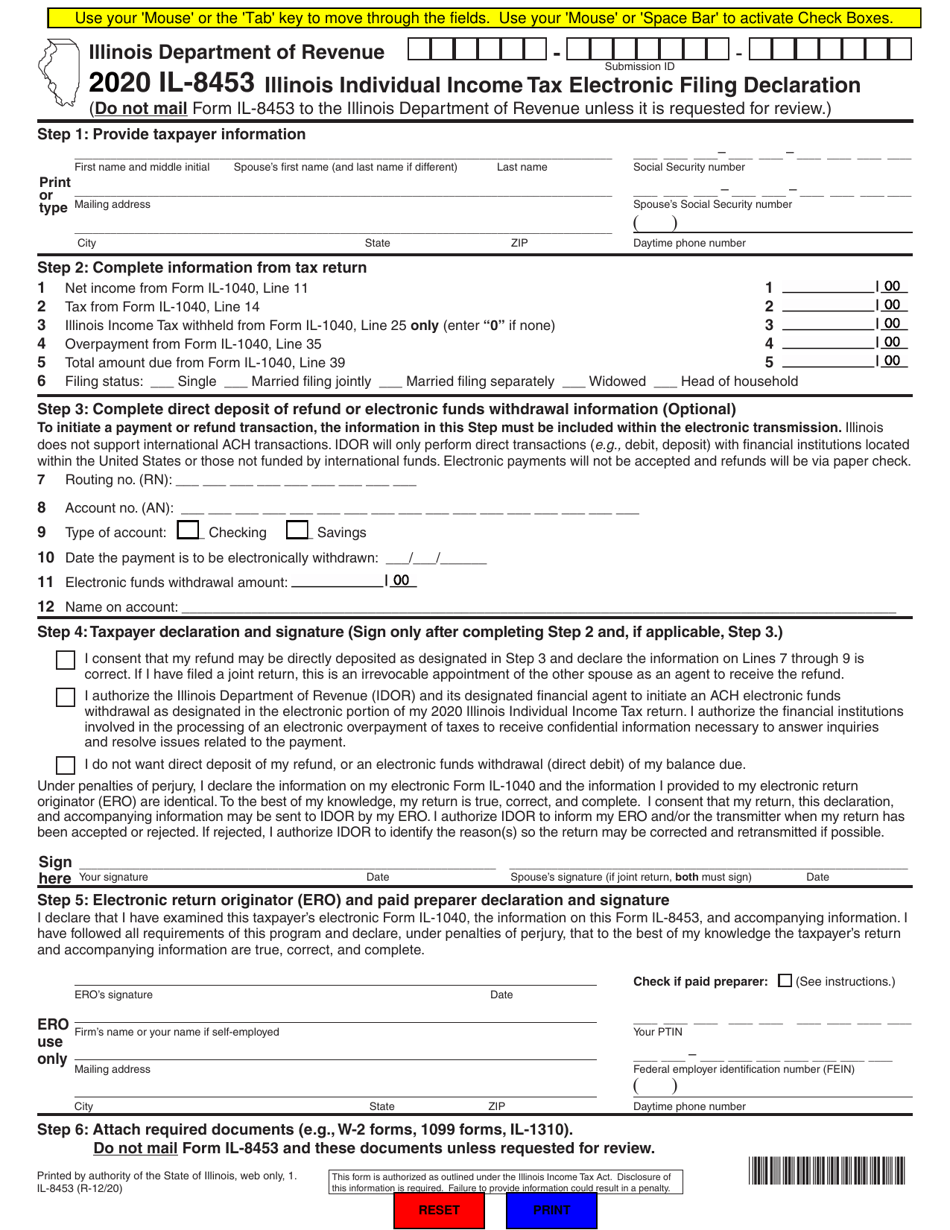

What Is Form IL-8453?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-8453?

A: Form IL-8453 is the Illinois Individual Income Tax Electronic Filing Declaration.

Q: Who needs to file Form IL-8453?

A: Residents of Illinois who are filing their individual income tax electronically need to file Form IL-8453.

Q: What is the purpose of Form IL-8453?

A: Form IL-8453 is used to declare and authorize the electronic filing of an individual's income tax return in Illinois.

Q: Can I file my Illinois income tax return electronically without filing Form IL-8453?

A: No, Form IL-8453 is required when filing your Illinois income tax return electronically.

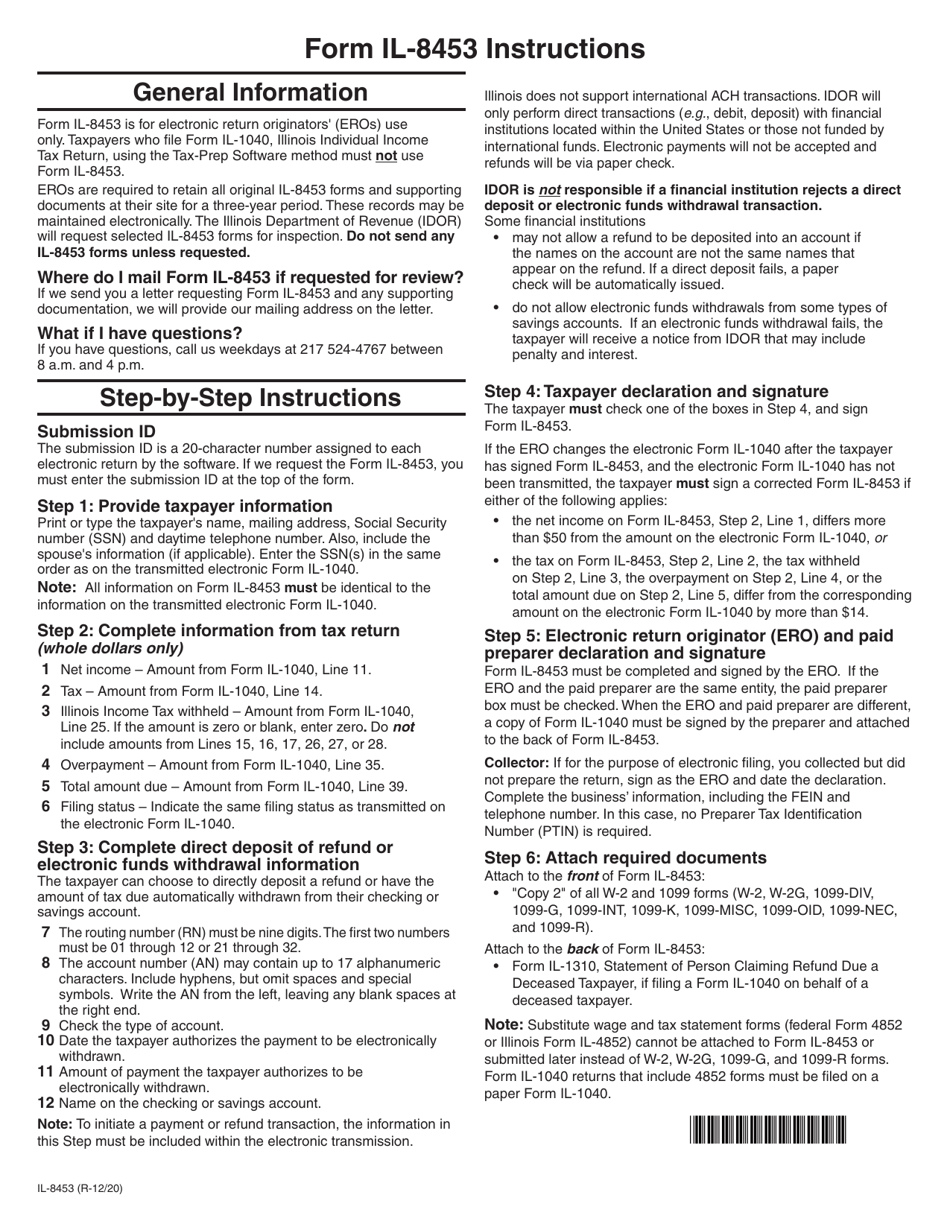

Q: How do I fill out Form IL-8453?

A: You need to enter your name, Social Security number, tax year, and sign the form to authorize the electronic filing of your Illinois income tax return.

Q: Is there a deadline for submitting Form IL-8453?

A: Yes, Form IL-8453 must be submitted by the due date of your Illinois income tax return, which is usually April 15th.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-8453 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.